The 2026 Social Security notice will reach households across the United States beginning in early December, outlining new monthly benefit amounts, earnings limits, and Medicare-related deductions for more than 72 million people. The Social Security Administration (SSA) said the annual update reflects inflation trends, wage data, and healthcare program adjustments that will take effect on January 1, 2026.

Your 2026 Social Security Notice Is Coming Soon

| Key Fact | Detail / Statistic |

|---|---|

| COLA 2026 Increase | 2.8% |

| Average Retirement Benefit | About $2,071/month |

| Maximum Taxable Earnings | $184,500 |

| Expected Medicare Part B Increase | Moderately higher; may offset COLA |

| Number of Recipients | ~72 million |

| Official Website | Social Security Administration |

The 2026 Social Security notice will continue rolling out through December, offering the most comprehensive snapshot of next year’s benefits. While the increase provides modest relief, many households will feel continued pressure from healthcare costs and broader economic uncertainty. Analysts say future adjustments will depend heavily on inflation trends and legislative decisions in Washington.

What’s Inside the 2026 Social Security Notice

The 2026 Social Security notice includes several updates that affect retirees, disabled workers, survivors, and individuals receiving Supplemental Security Income (SSI). SSA spokesperson Jeff Nesbit said the annual notice “reflects the agency’s commitment to accuracy, transparency, and timely communication for all beneficiaries.”

The most significant updates involve the cost-of-living adjustment (COLA), earnings limits, disability thresholds, and Medicare deductions.

COLA 2026 Raises Benefits by 2.8%

The COLA 2026 increase of 2.8% is based on inflation data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a measure calculated by the U.S. Bureau of Labor Statistics.

How the Increase Affects Monthly Payments

- The average retired worker’s monthly payment will rise from about $2,015 to $2,071.

- A retired couple both receiving benefits will see an average increase to roughly $3,208.

- Disabled workers will see benefits rise by approximately $44 per month on average.

- SSI federal payments will increase slightly for low-income seniors and disabled adults.

Economist Dr. Alicia Munnell, director of the Center for Retirement Research at Boston College, said the increase “is modest compared to the unusually high COLAs seen earlier in the decade but remains important for households dealing with persistent housing and healthcare costs.”

Earnings Limits and Tax Thresholds Are Increasing

The Social Security changes for 2026 include increases to earnings limits for beneficiaries who work while receiving benefits.

Key Earnings Changes

According to the SSA:

- The annual earnings limit for people younger than full retirement age rises to $24,480.

- The limit for those reaching full retirement age in 2026 increases to $65,160.

- The maximum taxable earnings subject to payroll taxes will climb to $184,500.

Labor economist Dr. Kathryn Edwards, formerly of the RAND Corporation, explained that the higher limits “reflect stronger wage growth in some sectors, particularly health care and professional services, even as overall economic momentum stabilizes.”

Medicare Premiums Expected to Reduce Net Gains

While gross benefits will increase, the 2026 Social Security notice warns that higher Medicare Part B premiums could significantly reduce net payments.

The Centers for Medicare & Medicaid Services (CMS) has not released final 2026 Part B premiums, but budget estimates suggest higher costs due to rising medical service demand and prescription drug spending.

“Many people will find that their COLA increase is mostly or entirely absorbed by healthcare premiums,” said Juliette Cubanski, deputy director of Medicare policy at the Kaiser Family Foundation.

In recent years, Medicare premiums have risen faster than Social Security benefits, a trend that concerns both advocacy groups and budget analysts.

Impact on Different Groups of Beneficiaries of 2026 Social Security Notice

The 2026 updates affect different groups in different ways.

Retirees

Most retirees will see a small increase in their monthly payments, though higher Medicare costs may limit net gains.

Disabled Workers

Disability Insurance (SSDI) recipients will benefit from higher monthly averages and updated Substantial Gainful Activity (SGA) thresholds.

Survivors

Surviving spouses and children will also see modest increases tied directly to COLA 2026.

SSI Recipients

Low-income elderly and disabled adults will see slight increases, although many rely on state supplements that vary nationwide.

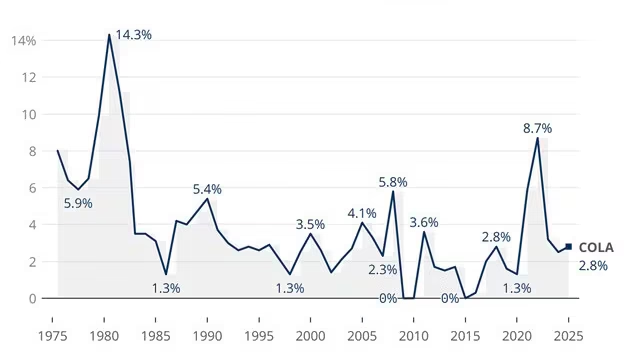

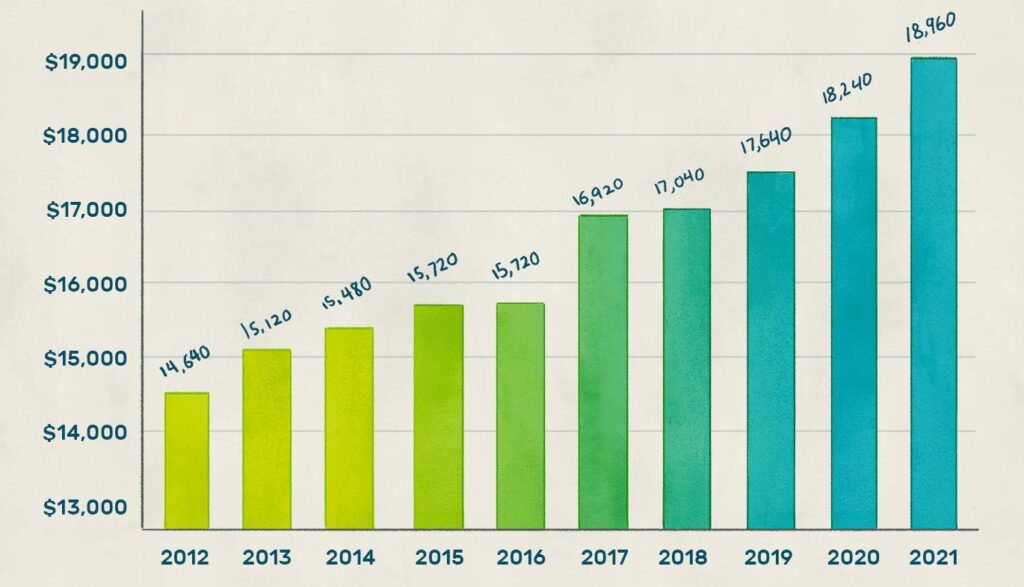

Historical Context and Comparison to Recent Years

The 2.8% COLA is smaller than increases seen in 2022 and 2023, when inflation reached a 40-year high. Those years saw two of the largest increases in decades:

- 2022: 5.9%

- 2023: 8.7%

- 2024: 3.2%

- 2025: 2.5%

- 2026: 2.8%

Financial historian Peter Cohn, author of America’s Retirement Landscape, said the 2026 adjustment “signals a return to more typical inflation patterns after the volatility of the early 2020s.”

Budgetary Implications and Long-Term Concerns

The Social Security trust funds continue to face long-term financial pressure. According to the most recent Social Security Trustees Report, the combined funds may face depletion in the mid-2030s if Congress does not act.

The Committee for a Responsible Federal Budget warned that incremental COLAs and rising taxable wages increase annual payouts, adding strain to the system.

Meanwhile, the AARP has called for Congress to strengthen Social Security without reducing benefits, arguing that most retirees rely on their payments for a significant share of income.

How to Read and Verify Your 2026 Social Security Notice

The notice includes several sections beneficiaries should review:

1. New Benefit Amount

Shows gross monthly payment with the COLA 2026 adjustment.

2. Medicare Deductions

Lists Part B, Part D, and any income-related premium adjustments.

3. Net Benefit Payment

Indicates the deposit amount scheduled for January.

4. Tax Withholding

Reflects changes in optional federal tax withholding.

5. Work and Income Rules

Explains updated earnings limits and reporting requirements.

Financial advisor Ed Slott recommends comparing the 2026 notice with last year’s benefit statement. “Beneficiaries should confirm that name spellings, benefit amounts, and Medicare deductions match expectations. Small errors can have long-term implications.”

Practical Guidance for Recipients

How to Check Benefits Online

- Log into my Social Security at SSA.gov.

- Review benefit verification letters and payment history.

- Update direct deposit information.

- Report wage changes if working.

What to Do If You Spot an Error

- Call SSA at 1-800-772-1213.

- Visit a local SSA office.

- File an appeal through your online account.

Avoiding Scams

The SSA warns that scammers often target beneficiaries during notice season.

Officials stress that the agency never calls to demand payment or personal data.

SSI Payments Arriving Early This Month — Key Dates Every Recipient Should Check

Public Reaction and Outlook for 2027

Many beneficiaries say they welcome the increase but worry it will not keep pace with rising costs.

“Every dollar helps, but groceries and utilities have climbed far faster,” said Karen Phillips, a 74-year-old retiree in Ohio.

Looking ahead, analysts predict a similar or slightly lower COLA in 2027 unless inflation surprises.