The Social Security Fairness Act, signed into law by President Joe Biden in January 2025, marks one of the most significant changes to America’s retirement system in decades. The legislation repeals two controversial provisions — the Windfall Elimination Provision and the Government Pension Offset — that reduced Social Security benefits for millions of public-sector retirees. For many working retirees, this long-awaited reform translates into larger monthly payments and, in many cases, retroactive compensation.

Social Security Upgrade

| Key Fact | Detail / Statistic |

|---|---|

| Law enactment date | January 5, 2025 |

| Provisions repealed | Windfall Elimination Provision (WEP), Government Pension Offset (GPO) |

| Estimated beneficiaries | More than 2.8 million public-sector retirees |

| Average monthly increase | $300 – $800 depending on benefit type |

| Estimated retroactive payments | About $17 billion nationwide by mid-2025 |

| Official Website | Social Security Administration |

What the Social Security Fairness Act Does

The Social Security Fairness Act directly addresses two long-criticized rules that had been in place for more than 40 years.

The first, the Windfall Elimination Provision (WEP), reduced the Social Security retirement benefit of individuals who also received a pension from employment not covered by Social Security taxes. The second, the Government Pension Offset (GPO), reduced or eliminated spousal and survivor benefits for people with non-covered government pensions.

Both provisions were introduced decades ago to prevent what lawmakers then viewed as “double dipping” — receiving full Social Security benefits in addition to a separate government pension. However, over time these measures disproportionately hurt workers who had split careers between public and private employment.

By repealing WEP and GPO, the Social Security Fairness Act ensures that eligible retirees now receive their full benefit as calculated by the standard formula. The repeal took effect for benefits payable beginning January 2024, meaning millions of retirees will receive both adjusted monthly payments and retroactive compensation for the past year.

Who Gains the Most

Public-Sector Employees

The largest beneficiaries of the Social Security Fairness Act are public-sector workers such as teachers, police officers, firefighters, and state and local government employees who were part of retirement systems not coordinated with Social Security. Many of these workers spent part of their careers in Social Security-covered employment — for example, in the private sector — and later in non-covered government jobs.

Under the old rules, these workers often discovered that their Social Security checks were hundreds of dollars smaller than expected. Some spouses and widows even lost access to benefits entirely. The new law restores those amounts, often raising payments by $300 to $800 per month depending on prior income and pension type.

Mixed-Career Workers

The change also benefits individuals who worked in both the United States and abroad or who transitioned between covered and non-covered roles during their careers. Teachers who taught both in private schools and in public districts, or military members who later took civilian government jobs, are among those seeing meaningful increases.

How Much the Change Is Worth

The impact of the Social Security Fairness Act varies widely. The SSA estimates that, in 2025, 2.8 million people will see higher monthly benefits, with an average increase of roughly $400 per month. For some surviving spouses previously affected by the GPO, the gain may exceed $1,000 per month.

In addition to ongoing increases, the Treasury Department began issuing retroactive payments in mid-2025, covering the period back to January 2024. The total cost of these payments is expected to surpass $17 billion nationwide.

Financial planners say that, beyond the immediate boost, the change can significantly improve lifetime income for public-sector retirees who often rely on modest pensions. The removal of WEP and GPO will also help retirees qualify for higher spousal or survivor benefits — a factor especially relevant to women, who make up a majority of surviving spouses affected by the offset rules.

Why the Change Was Made

A Long Campaign for Fairness

Efforts to repeal WEP and GPO date back nearly two decades. Teachers’ associations, firefighter unions, and retiree advocacy groups argued that the provisions unfairly penalized career public servants. Critics maintained that the formulas used to adjust benefits were overly broad, punishing workers with even minimal public-sector service.

Over time, bipartisan support for repeal grew. Lawmakers cited cases in which retirees lost as much as half of their expected benefits, despite having paid into the system for years. The Social Security Fairness Act finally passed Congress in late 2024 with strong cross-party support and was signed by President Biden in early 2025.

Economic and Demographic Context

The reform arrives as the nation’s aging population puts new pressure on the Social Security system. With more Americans working later in life and holding multiple careers, the number of people affected by mixed-coverage rules has grown steadily. Policymakers concluded that simplifying the benefit structure would improve transparency and fairness — even if it increases short-term program costs.

Financial and Fiscal Implications

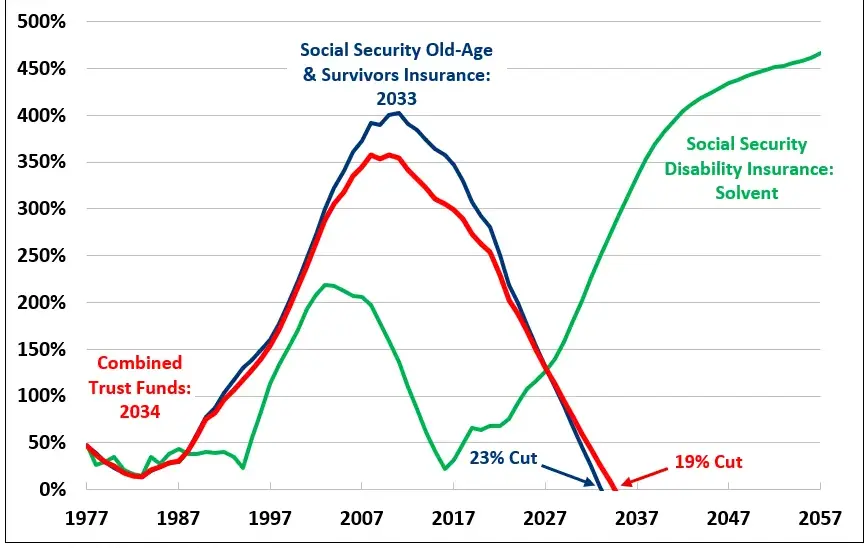

Repealing WEP and GPO will inevitably increase expenditures. Analysts from the Congressional Budget Office estimate that the change will cost around $180 billion over ten years. While this is modest relative to the total size of the Social Security program, it could advance the projected date of trust-fund depletion by several months.

Supporters argue that the fairness of the reform outweighs its fiscal impact, emphasizing that the cost remains small compared with overall retirement spending. Opponents caution that adding new obligations without new funding could complicate broader Social Security reform efforts already under debate in Congress.

For now, officials maintain that the program’s solvency remains intact through at least 2034, giving lawmakers time to address broader financing issues.

Working While Retired: What Stays the Same

The Social Security Fairness Act changes benefit calculations for certain retirees but does not alter other Social Security rules.

- The earnings test still applies to beneficiaries who work while collecting benefits before reaching full retirement age. In 2025, retirees under that age can earn up to $23,400 annually without reducing their benefits; amounts above that threshold temporarily withhold $1 for every $2 earned.

- Once retirees reach full retirement age, they can work without any earnings penalty.

- The taxation of Social Security benefits remains unchanged, with up to 85% of benefits taxable for higher-income households.

- The cost-of-living adjustment (COLA) formula, based on the Consumer Price Index, continues as before.

In other words, the “upgrade” is narrowly targeted: it eliminates the unfair offsets while keeping the broader structure of Social Security intact.

Steps for Retirees to Take

1. Confirm Eligibility

Retirees should review their employment histories to determine whether they had any non-covered work, meaning jobs where Social Security taxes were not withheld. Those who also worked in covered positions are likely eligible for increased payments.

2. Check Online Accounts

The SSA recommends that all beneficiaries log into their My Social Security accounts to verify that their contact information and bank details are current. Doing so ensures timely delivery of any retroactive payments.

3. Watch for Notices

The SSA is sending two separate mailings to affected beneficiaries — one confirming the adjustment to remove the offset, and another specifying the new payment amount.

4. Reapply if You Were Denied Before

Individuals who were previously denied spousal or survivor benefits because of the GPO can now reapply. The repeal removes the barrier that eliminated or reduced those payments.

5. Seek Professional Advice

Financial planners advise retirees to reassess their retirement-income strategies. The additional Social Security income could affect tax liabilities, Medicare premiums, or eligibility for income-based programs.

Broader Social and Economic Effects

Gender Equity

Women are expected to benefit disproportionately from the repeal of the GPO, as they represent the majority of surviving spouses affected by the offset. In many cases, widows who lost access to their late spouse’s benefit will now see their Social Security restored in full. Advocates view the reform as an important step toward addressing gender disparities in retirement income.

Public-Sector Recruitment and Retention

Observers also note potential long-term benefits for public-sector employment. Removing the WEP and GPO makes government careers more attractive by aligning pension and Social Security benefits with private-sector norms. This may help state and local governments recruit and retain workers in education, law enforcement, and emergency services.

Administrative Simplification

From an operational standpoint, repealing two complex provisions reduces administrative workload for the SSA. Officials say the simplification will make benefit calculations more transparent and easier for retirees to understand, reducing the number of appeals and corrections processed each year.

Criticisms and Remaining Questions

Despite broad support, some economists remain concerned about the fiscal impact. They argue that increasing benefits without identifying new revenue sources could undermine efforts to strengthen Social Security’s long-term finances.

Others note that while fairness is improved for public-sector retirees, millions of Americans with modest private-sector earnings still face challenges such as inadequate savings, rising health-care costs, and the gradual erosion of purchasing power.

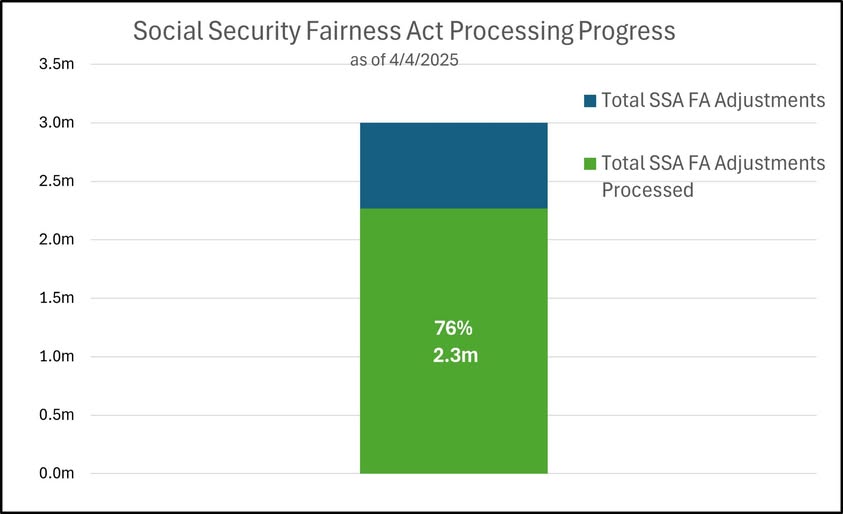

There are also logistical challenges: processing millions of recalculated benefits has placed heavy demands on the SSA, which faces staffing shortages. Officials acknowledge that some cases involving multiple pensions or foreign employment may take until 2026 to resolve fully.

2 New Social Security Changes Just Announced—Here’s How to Get More Money Starting This Month

Looking Ahead

The Social Security Fairness Act represents both a symbolic and practical victory for fairness in retirement policy. For the millions of teachers, police officers, and civil servants affected, it corrects a perceived inequity that lingered for generations.

At the same time, the change underscores the delicate balance policymakers must strike between fairness and fiscal sustainability. Broader Social Security reform remains on the horizon, with debates continuing over raising the payroll-tax cap, adjusting the retirement age, or revising benefit formulas.

For now, working retirees can expect higher payments, fewer penalties, and a clearer path toward financial stability in their later years.