The Winter 2025 Social Security payments will bring modest increases for more than 52 million retired Americans, according to the Social Security Administration (SSA). Federal officials say the seasonal adjustment reflects recent inflation data and precedes the larger 2.8 percent cost-of-living increase taking effect in January 2026. Economists warn, however, that rising Medicare premiums may limit how much retirees actually gain.

Winter 2025 Social Security Payments

| Key Fact | Detail |

|---|---|

| Average retired worker benefit entering winter 2025 | ~$2,008 per month |

| Projected average benefit for December 2025 | ~$2,018 per month |

| COLA increase taking effect January 2026 | 2.8% |

| Early January SSI payment date | December 31, 2025 |

| Medicare Part B premiums rising in 2026 | Amount to be finalized |

| Official Website | SSA.gov |

Understanding the Winter 2025 Payment Adjustments

The SSA reports that the average monthly payment for retired workers was just over $2,008 heading into late 2025. Forecasters interviewed by Reuters project that December payments may rise modestly—about $10 on average—due to regular indexing adjustments and demographic changes among new beneficiaries.

The larger increase arrives in January, when the Social Security COLA 2026 takes effect. The 2.8 percent adjustment was announced in October 2025 based on national inflation readings collected by the U.S. Bureau of Labor Statistics.

Why Benefits Are Rising Only Slightly This Winter

According to the U.S. Department of Labor, inflation slowed significantly throughout 2024 and 2025, easing pressure on federal cost adjustments. In a statement, Dr. Michael Alvarez, a senior economist at the Pew Research Center, said the winter payments “align closely with a cooling inflation environment that has stabilized living costs for many Americans.”

Economists point out that while general inflation is easing, the costs most relevant to older adults—medical care, prescription drugs, and rent—have continued to rise. These increases often outpace Social Security benefit adjustments.

Impact of Rising Medicare Costs on Net Benefits

Benefit increases are offset by rising health-care costs for many retirees. The Centers for Medicare & Medicaid Services (CMS) has signaled that the standard Part B premium will rise again in 2026 due to higher spending on outpatient care and new medical technologies.

Sarah Thompson, policy director at the National Council on Aging, said the upcoming premium increases “will reduce the real-world purchasing power of many older adults, particularly those relying solely on Social Security.

Understanding the January 2026 COLA Increase

The annual cost-of-living adjustment is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The SSA compares average CPI-W readings in July, August, and September against the same period from the previous year.

The 2.8 percent increase for 2026 indicates moderate inflation, lower than the historically high 8.7 percent COLA in 2023 but still significant compared to past decades.

Historical Context: How COLA Has Changed Over Time

When Social Security was created in 1935, benefits did not adjust automatically for inflation. Congress began approving periodic increases in the 1950s, and automatic COLA indexing started in 1975. In the past 50 years:

- The average COLA has been 3.8 percent.

- There have been three years with zero COLA (2009, 2010, 2015).

- The largest COLA ever was 14.3 percent in 1980.

This long history underscores how inflation and economic conditions shape retiree benefits across generations.

How the SSI Payment Schedule Will Shift in December

The SSI payment schedule moves the January payment to December 31, 2025, because January 1 is a federal holiday. This affects 7.4 million individuals who receive Supplemental Security Income.

Thompson said the early payout “helps recipients avoid delayed access during the holiday period, but it can create confusion if people mistake the December 31 deposit for a second monthly benefit.”

Payment Dates for Winter 2025 Social Security Payments

Retirement Benefits

The SSA pays based on the beneficiary’s date of birth:

- Birthdays on the 1st–10th → Second Wednesday

- Birthdays on the 11th–20th → Third Wednesday

- Birthdays on the 21st–31st → Fourth Wednesday

SSI Payments

- December 1, 2025 (December SSI)

- December 31, 2025 (January 2026 SSI)

Behind the Numbers: How Social Security Is Funded

The Social Security program is financed primarily through payroll taxes collected under the Federal Insurance Contributions Act (FICA). Workers and employers each pay 6.2 percent on wages up to the annual taxable maximum.

According to the Congressional Budget Office, the system paid out $1.4 trillion in benefits last year, making it one of the largest federal programs.

The 2025 Trustees Report warns that the trust fund could face depletion by 2033 if Congress does not adjust revenue levels or benefit formulas. Lawmakers continue to debate options, including:

- Raising the payroll tax cap

- Increasing the payroll tax rate

- Modifying future benefit formulas

- Adjusting eligibility ages

No major changes are expected in 2025, but analysts say reform discussions will intensify as the trust fund deadline approaches.

Different Beneficiary Groups Will See Different Effects

Social Security serves multiple categories of recipients. This winter:

Retirement Beneficiaries

Will see modest increases until the COLA arrives in January.

Disability Beneficiaries (SSDI)

SSDI payments increase alongside retirement benefits and follow the same COLA rules.

Survivor Benefits

Widows, widowers, and dependent children will also receive higher payments beginning January.

SSI Beneficiaries

SSI increases will appear on December 31, due to the holiday payment rule.

Regional Cost-of-Living Differences

Social Security payments do not vary by state, but the purchasing power of benefits differs significantly across regions.

According to cost-of-living analysis from the Bureau of Economic Analysis:

- The lowest purchasing power is found in California, New York, and Hawaii.

- The highest purchasing power is in Mississippi, Arkansas, and West Virginia.

These disparities affect how far retirees’ winter payments will stretch for housing, utilities, and groceries.

The Growing Role of Social Security in Older Americans’ Economic Security

Data from the National Institute on Retirement Security shows:

- Social Security provides at least 50% of income for half of U.S. retirees.

- For one in four retirees, it provides 90% or more.

- Nearly 10% of older Americans live below the federal poverty line.

The winter payments, while small, are particularly important for low-income households facing rising heating, prescription, and housing costs.

Common Misconceptions About Social Security

Myth 1: Social Security is “going bankrupt.”

Fact: Even if the trust fund is depleted, ongoing payroll taxes could still fund about 77% of scheduled benefits, according to the SSA.

Myth 2: Congress has “stolen” the trust fund.

Fact: Trust fund assets are invested in U.S. Treasury bonds, which earn interest and remain backed by the federal government.

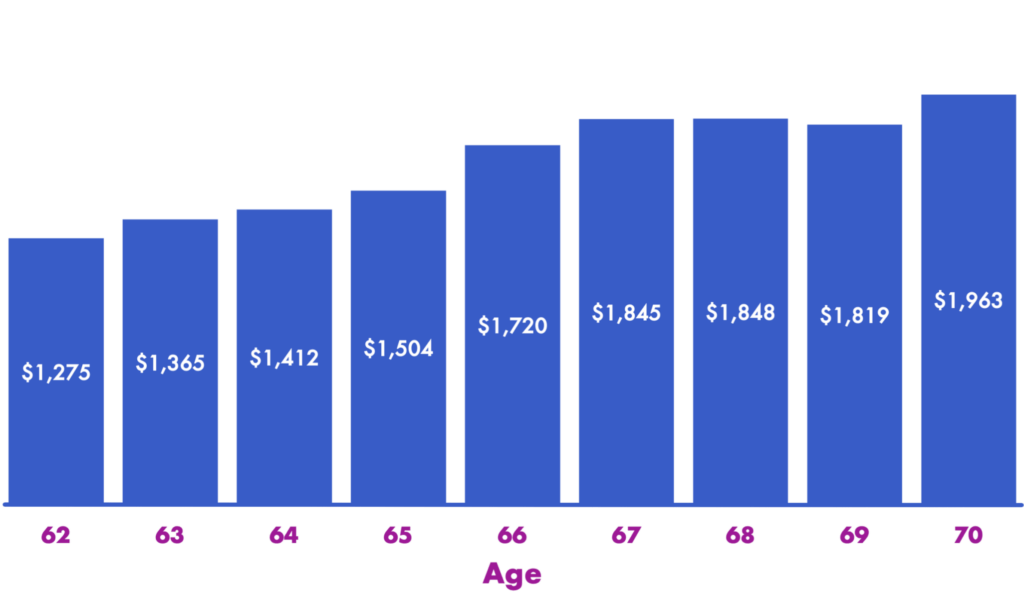

Myth 3: Everyone gets the same amount.

Fact: Benefits are based on lifetime earnings, age of claiming, and work credits.

Winter 2025: Fraud Warnings and Scam Prevention

The SSA Office of the Inspector General reports rising cases of impersonation scams, particularly around payment changes. Officials warn:

- SSA will never call to ask for bank details.

- SSA does not threaten arrests or legal action.

- Beneficiaries should verify communications through ssa.gov/myaccount.

International Comparison: How U.S. Benefits Stack Up

Retirement experts at the OECD say the U.S. Social Security system provides a replacement rate—the percentage of pre-retirement income replaced—of around 50% for average earners.

By comparison:

- Italy: ~80%

- Spain: ~74%

- Canada: ~53%

- United Kingdom: ~29%

The U.S. ranks in the middle among advanced economies.

What Retirees Can Do to Prepare for Winter 2025

Experts recommend several steps:

- Review your my Social Security account to confirm payment dates.

- Check Medicare open enrollment options.

- Evaluate heating assistance programs such as LIHEAP.

- Scrutinize bank activity for unusual transactions.

- Update contact information with SSA.

Gov’t Confirms Most Social Security Checks Cap at $2000 — Here’s Why It Matters

Looking Ahead

The SSA is expected to release updated beneficiary data in early 2026. Economists say the combination of moderate COLA growth and rising health costs will remain a central concern for older Americans. Retiree groups continue to urge Congress to address long-term solvency challenges before the 2033 trust-fund deadline.