The decision to delay Social Security benefits until age 70 has long been promoted as a way to secure higher monthly payments. However, several retirement experts and economists say the strategy may not suit everyone, especially older workers with health issues, limited savings, or short life expectancies.

Why Waiting Until 70 for Social Security May Not Pay Off

| Key Fact | Detail / Statistic |

|---|---|

| Maximum Delayed Credit | Benefits increase about 8% for each year claimed after full retirement age until 70 |

| Median American Savings | Half of Americans over 55 have less than $50,000 saved for retirement |

| Average Life Expectancy at 65 | 18.3 years for men, 20.9 years for women |

Why Some Experts Question Delaying Social Security to 70

Several financial planners say the conventional advice to wait until 70 for maximum benefits does not align with the financial realities of many older Americans. Dr. Jason Fichtner, chief economist at the Bipartisan Policy Center, said in an interview that “delaying benefits is not the optimal choice for households with limited savings or poor health, even though it raises lifetime monthly income.”

According to a 2024 analysis from the Center for Retirement Research at Boston College, nearly half of lower-income workers are unlikely to benefit financially from waiting due to shorter life expectancy and the need for earlier cash flow.

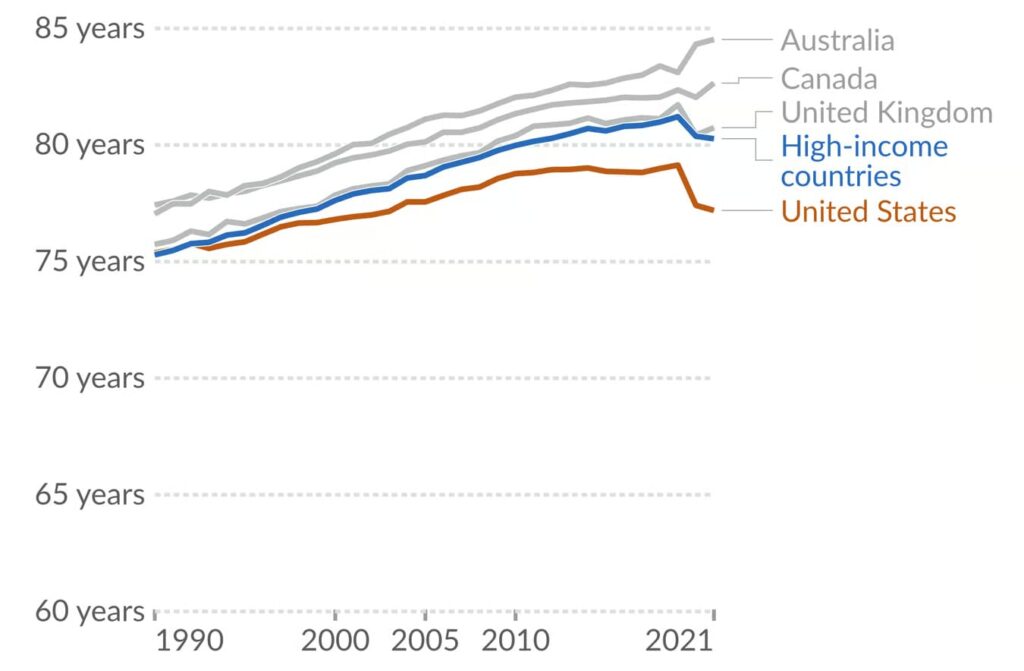

Health and Longevity Are Major Factors

Health remains one of the strongest predictors of the ideal claiming age. Older workers facing chronic illness often struggle to continue earning wages into their late 60s. Dr. Alicia Munnell, director of the Center for Retirement Research, noted that “benefit maximization assumes you can afford to delay, but many workers in physically demanding jobs cannot.”

The Centers for Disease Control and Prevention (CDC) reports wide gaps in life expectancy based on income and occupation, raising concerns that the “wait until 70” message disproportionately benefits higher-income Americans with longer expected lifespans.

Economic Pressures Are Changing Claiming Behavior

The majority of Americans do not wait until 70. According to the U.S. Social Security Administration (SSA), only about 10% of non-retired adults plan to delay benefits to age 70, a trend reinforced by rising living costs, limited savings, and medical expenses.

Sarah Foster, a senior analyst at Bankrate, said in a recent report that “inflation and declining real wages have pushed many older workers to claim earlier than planned.”

Researchers also note that claiming early may reduce pressure on retirement savings, allowing limited assets to last longer—especially important for those with 401(k) balances below the national median.

The Impact on Spousal and Survivor Benefits

Social Security’s rules complicate the decision further for married couples. Delaying a higher-earning spouse’s benefits can increase survivor benefits, but it may also reduce the amount a lower-earning spouse receives during their joint retirement years.

Mary Beth Franklin, a Social Security and Medicare expert and former contributing editor for InvestmentNews, said that couples often “overestimate the advantage of maximizing survivor benefits and underestimate the value of cash flow earlier in retirement.”

What Financial Planners Recommend Instead

Most experts agree that claiming decisions should be personalized. Financial planners often encourage retirees to:

- Assess their health status and longevity risk.

- Review household income needs and emergency savings.

- Consider spousal benefits and survivor planning.

- Evaluate whether working longer is feasible or healthy.

- Model outcomes with a certified planner or SSA tools.

The National Association of Personal Financial Advisors (NAPFA) warns against “one-size-fits-all” recommendations, especially among retirees facing economic insecurity.

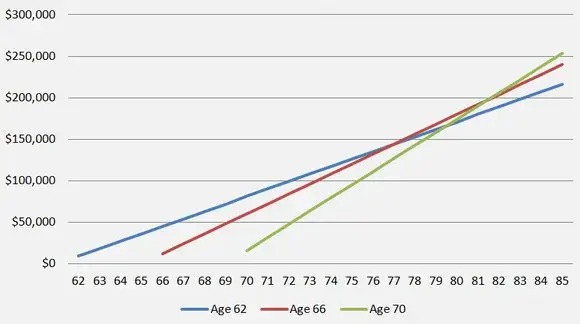

How the Break-Even Age Shapes the Debate

Financial planners often calculate a “break-even age” to help clients understand the trade-offs between claiming earlier and waiting until 70. This calculation identifies the age at which the higher delayed benefit overtakes the total early benefits collected over time.

For many workers, that age falls somewhere between 78 and 82. Retirees who do not expect to reach that age—because of chronic illness, hazardous career history, or family health patterns—may receive more total income by claiming earlier.

Dr. David Blanchett, a retirement researcher at Morningstar, explained that “longevity uncertainty complicates the decision. The breakeven math is simple, but the real world is not.”

Why Lower-Income Workers Often Benefit from Earlier Claims

Income is a strong predictor of both savings and longevity. Data from the Brookings Institution shows that higher-income Americans live nearly 10 years longer, on average, than those with the lowest incomes.

This discrepancy significantly impacts Social Security outcomes:

- Lower-income households rely more heavily on Social Security as their primary retirement income.

- They reach the break-even age less often.

- They often have jobs that cannot be sustained into their late 60s.

Kathleen Romig, director of Social Security and disability policy at the Center on Budget and Policy Priorities, said that “the advice to delay is least realistic for the very households that depend on these benefits the most.”

Rising Healthcare Costs Pressure Older Workers

Healthcare is one of the largest expenses retirees face. According to the Employee Benefit Research Institute (EBRI), a couple retiring in 2024 may need more than $300,000 to cover lifetime healthcare expenses, not including long-term care.

Workers experiencing medical issues before Medicare eligibility (age 65) often:

- reduce work hours

- retire early

- face high out-of-pocket costs

These pressures make delaying benefits more challenging.

How Changes to Social Security Could Influence Future Claiming Decisions

Experts warn that ongoing discussions about the future solvency of Social Security may influence how people weigh early benefits versus delayed credits. The SSA projects that the trust fund for retirement benefits could face shortfalls by 2033 if Congress does not act.

Policy proposals under debate include:

- Raising the full retirement age

- Adjusting payroll taxes

- Expanding taxes on high-income earners

- Modifying benefit calculations

Uncertainty about future reforms is causing some Americans to take benefits earlier, driven by concerns that waiting could mean reduced payouts later.

Psychological Factors Often Drive Claiming Decisions

Behavioral economists say the claiming decision is influenced as much by psychology as by math. The idea of receiving a guaranteed income stream—even if smaller—offers emotional security to retirees who have experienced financial instability.

A study from the Pew Research Center found that many older adults fear “leaving money on the table” if they delay and pass away earlier than expected. This emotional risk often outweighs the rational calculation of maximizing lifetime benefits.

Dr. Olivia Mitchell, professor of business economics at the Wharton School, explained that “people value certainty now more than potential gains later, especially in retirement.”

Case Studies Show How Circumstances Drive Better Outcomes

Financial planners often use case studies to illustrate how different variables change the optimal claiming age.

Case 1: Worker with limited savings and moderate health

A 64-year-old warehouse worker with joint issues and $40,000 in savings may be better served by claiming at 62 or 63 to reduce financial strain and avoid drawing down limited assets.

Case 2: Higher-income professional with strong health and long family longevity

A 67-year-old engineer with substantial savings and a family history of living into the 90s benefits more from delaying to 70, maximizing lifetime payouts.

Case 3: Married couple with mixed incomes

A couple might benefit from a “split strategy,” where the lower-earning spouse claims early for income support, while the higher earner delays to maximize survivor benefits.

These examples highlight the central message: context matters more than general rules.

More Tools Are Emerging to Help Retirees Decide

Growing awareness of the complexity has prompted new tools and resources, including:

- The SSA’s online claiming calculators

- Nonprofit tools from AARP

- University-affiliated research simulators

- Personalized planning models offered by certified financial planners

These tools incorporate factors like health, savings, expected longevity, income needs, and spousal benefits.

As the Population Ages, the Advice Landscape Is Evolving

More than 10,000 Americans turn 65 every day, according to the U.S. Census Bureau. This demographic shift is increasing the urgency of providing clearer and more personalized guidance for retirees.

Policy analysts expect that Social Security education will become an even more central part of retirement planning in the coming decade, especially as more Americans enter old age with insufficient savings and higher debt levels.

Retirees Get Ready — Here’s the Full December 2025 and January 2026 Social Security Timeline

FAQs About Why Waiting Until 70 for Social Security May Not Pay Off

1. Is waiting until 70 always the most profitable option?

No. While delaying increases monthly payments, individuals with health issues or limited savings may receive more lifetime income by claiming earlier.

2. Does early claiming reduce retirement benefits permanently?

Yes. Claiming before full retirement age results in a permanent reduction, though it may still be financially beneficial depending on circumstances.

3. How can spouses coordinate Social Security benefits?

Spouses should consider earnings histories, survivor benefits, and household income needs. Consulting a financial planner can provide tailored strategies.

4. Will Social Security still be available in the future?

Experts widely agree that Social Security will continue to exist, but Congress may need to make adjustments to maintain full benefit levels.