The U.S. Social Security Cost-of-Living Adjustment (COLA) for 2026 will rise by 2.8%, according to the Social Security Administration (SSA). But economists and advocates warn the increase may not be enough to keep pace with what seniors actually buy, as healthcare, housing, and insurance costs rise faster than the inflation gauge used to calculate the adjustment.

2.8% Social Security COLA

| Key Fact | Detail / Statistic |

|---|---|

| 2026 COLA increase | 2.8% |

| Average monthly benefit (retired worker) | $2,071 (up from $2,015) |

| CPI-W inflation measure (used for COLA) | Based on Q3 2025 data |

| Inflation in senior spending categories | 4–6% |

| Medicare Part B premium increase | 6.2% (projected for 2026) |

| Official Website | Social Security Administration |

What the 2.8% COLA Means for Retirees

The COLA is meant to ensure that Social Security benefits maintain their purchasing power amid inflation. For 2026, beneficiaries will see a 2.8% increase, the second year below 3%, reflecting what officials describe as moderating consumer inflation.

However, the adjustment is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) — a metric many economists say does not reflect the spending realities of older Americans.

“The CPI-W focuses on working households, not retirees,” said Mary Johnson, a policy analyst at The Senior Citizens League. “Seniors spend disproportionately on healthcare and housing, which have risen much faster than 2.8%.”

Rising Costs in Everyday Living

While broad inflation has eased from pandemic-era peaks, key expenses for seniors have continued to climb.

According to the Bureau of Labor Statistics, healthcare costs rose 5.6% in 2025, while homeowners’ insurance premiums jumped 8.4%. Utility bills and housing increased by 4.1%, further tightening budgets.

These increases often outpace income growth from Social Security, especially when paired with Medicare premiums. The Centers for Medicare & Medicaid Services (CMS) expects Part B premiums to rise by 6.2% in 2026 — consuming much of the COLA for millions of retirees.

“My Social Security check went up about $50 last year,” said Angela Ruiz, a 74-year-old retiree from Arizona. “But my insurance went up $80 a month. It’s hard to keep up.”

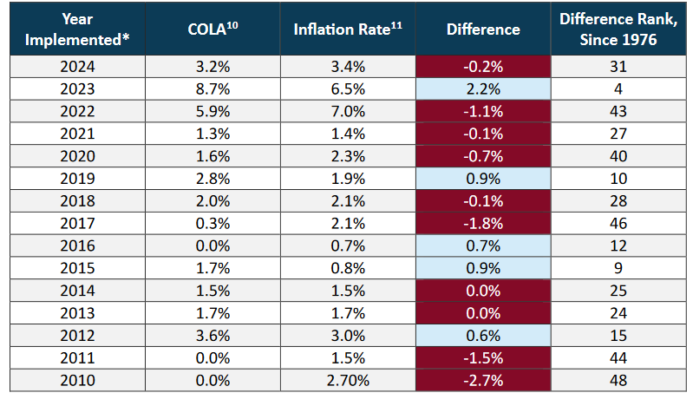

A Decade of Shrinking Buying Power

Since 2000, Social Security benefits have lost roughly one-third of their purchasing power, according to a 2025 study by The Senior Citizens League. Over that period, cumulative price increases in medical services, rent, and food have consistently exceeded average COLA adjustments.

| Year | COLA (%) | Senior Inflation Estimate (%) | Gap |

|---|---|---|---|

| 2010 | 0.0 | 2.5 | -2.5 |

| 2015 | 1.7 | 3.0 | -1.3 |

| 2020 | 1.6 | 2.3 | -0.7 |

| 2023 | 8.7 | 9.1 | -0.4 |

| 2026 | 2.8 | 4.8 (est.) | -2.0 |

Economists say this gap underscores a structural mismatch between the CPI-W and seniors’ true cost of living.

“Even small annual shortfalls accumulate,” said Dr. Alicia Monroe of the Brookings Institution. “Over 20 years, it can mean thousands in lost purchasing power.”

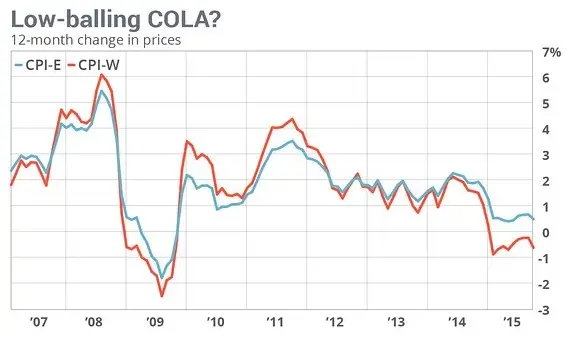

Why the CPI-W Misses the Mark

The CPI-W measures price changes based on the spending patterns of working-age Americans. Retirees, however, tend to spend less on transportation and more on medical care, housing, and energy.

The Consumer Price Index for the Elderly (CPI-E), which specifically tracks older consumers, has averaged about 0.3 percentage points higher inflation per year than CPI-W, according to the Congressional Research Service (CRS).

If CPI-E had been used in 2026, the COLA would have been roughly 3.1%, not 2.8%.

“The CPI-E isn’t perfect, but it’s closer to reflecting real conditions for older Americans,” said Dr. Monroe. “The current method is simply outdated.”

Policy Debate: Reforming the COLA Formula

Efforts to update the COLA formula have gained renewed attention. Several lawmakers, including members of the Senate Special Committee on Aging, have proposed switching to the CPI-E for Social Security adjustments.

Supporters argue the change would more accurately reflect retirees’ costs. Opponents warn it could add billions to annual outlays and accelerate the depletion of trust funds.

“Adjusting to CPI-E could improve benefit adequacy but worsen fiscal sustainability,” said Douglas Elmendorf, former Congressional Budget Office (CBO) director. “It’s a tradeoff Congress will need to weigh carefully.”

A 2024 Brookings Institution analysis estimated that using CPI-E would increase lifetime benefits for the average retiree by about $14,000, but shorten the program’s solvency by two years without new revenue.

Global Comparison: How Other Countries Handle Inflation

Other advanced economies use similar cost-of-living mechanisms but often adjust them more dynamically.

In Canada, pension benefits are indexed quarterly to the Consumer Price Index, allowing faster responses to inflation spikes.

The United Kingdom ties its State Pension increases to the “triple lock” — the highest of inflation, wage growth, or 2.5%.

“The U.S. system’s annual lag makes it slower to respond to changing prices,” said Dr. Karen Dynan of Harvard University. “That delay can have real effects on seniors living month to month.”

Human Impact: The Realities of Fixed Incomes

For many retirees, COLA increases are their only income growth each year. Roughly 40% of Social Security recipients rely on the program for at least 90% of their income, according to the SSA.

In interviews and surveys, retirees describe tightening budgets and difficult trade-offs. Some are deferring medical care, reducing grocery spending, or taking part-time jobs to offset rising bills.

“I’ve gone back to substitute teaching twice a week,” said Samuel Larkin, a 68-year-old from Ohio. “My benefit increase doesn’t cover utilities anymore, and heating costs are brutal in winter.”

Economic Forecast: What Comes Next

Inflation forecasts for 2026–2027 suggest modest easing, but economists warn that key categories like healthcare and insurance may remain stubbornly high.

The Federal Reserve projects core inflation around 2.4%, but healthcare inflation closer to 4.5%, creating ongoing pressure on senior budgets.

The SSA is expected to issue its next COLA projection in mid-2026. Analysts at the Committee for a Responsible Federal Budget say that unless inflation drops significantly, another modest increase near 2.5–3% is likely.

“Even with moderate inflation, retirees are in a bind,” said Nancy Altman, president of Social Security Works. “Without reform, each ‘raise’ just maintains a shrinking standard of living.”

Looking Forward

The 2026 COLA provides modest relief but underscores a deeper policy question: how to ensure that Social Security, the cornerstone of American retirement security, keeps pace with the real cost of aging.

“The adjustment helps, but it’s not enough,” said Johnson of The Senior Citizens League. “We need a formula that matches how seniors actually live — not how the average worker spends.”