The Two Payments in December that millions of Supplemental Security Income (SSI) recipients will receive this year are the result of a scheduling rule triggered when the first day of a month falls on a federal holiday. The Social Security Administration (SSA) confirmed that New Year’s Day closures will move the January benefit to December 31, creating two deposits in the same month. Officials emphasize that this is not a bonus, but an early release of next month’s income.

Two Payments in December

| Key Fact | Detail |

|---|---|

| Why two payments occur | SSA moves payments when the first of the month is a weekend or federal holiday |

| When payments arrive | December benefit on Dec. 1; January benefit on Dec. 31 |

| January impact | No SSI payment will be issued in January due to early December disbursement |

| Who receives SSI | Low-income seniors, adults with disabilities, and qualifying children |

| Average SSI benefit | $699 per month in 2024 |

| Official Website | Social Security Administration |

SSI recipients will continue to see occasional early payments when the federal calendar requires adjustments. While the appearance of Two Payments in December may cause initial confusion, officials say the scheduling rule ensures timely benefit delivery and supports the financial stability of millions of Americans who depend on the program.

Why SSI Recipients Will Receive Two Payments in December

The Social Security Administration typically deposits Supplemental Security Income on the first day of each month. When the first day falls on a weekend or a federal holiday, federal law requires the payment to be issued on the closest prior business day. Because New Year’s Day 2026 falls on a federal holiday, January’s SSI benefit will be deposited on December 31. This creates the appearance of a double payment in December.

An SSA spokesperson told the Associated Press that the payment shift “ensures timely access to essential benefits during federal holidays and prevents disruption for vulnerable households.”

Advocacy groups emphasize that this pattern is normal and does not reflect an increase in benefits. It is simply an administrative requirement based on federal scheduling rules.

This Is Not a Bonus or Extra Benefit

Although recipients will see two payments in December, analysts stress that this does not represent additional income. The second payment is January’s benefit issued early, and no payment will be made in January.

“Households should view the second payment as income for the following month,” said Dr. Elena Foster, a senior policy analyst at the Center on Budget and Policy Priorities. “It is a routine scheduling adjustment and not a supplement to existing benefits.”

Financial experts warn that confusion over the timing can lead to budgeting challenges, especially for households reliant on SSI for essential expenses.

How the Double December Payment Affects Beneficiaries

The early release of January’s payment may complicate financial planning for the 7.4 million Americans receiving SSI. Many beneficiaries rely on predictable monthly deposits to cover rent, groceries, utilities, and medical expenses.

Potential Budget Strain

Financial counselors caution that the early payment can cause a long gap in January if beneficiaries treat both December deposits as same-month income.

“People living on low incomes tend to budget month to month,” said Michelle Carter, director of the Benefits Access Project. “When two deposits arrive in December, recipients may not realize they must stretch the second payment through January.”

The SSA encourages recipients to verify payment dates through their online accounts or by contacting local offices.

Who Qualifies for SSI Two Payments in December and Why This Matters

Understanding who receives SSI helps clarify why payment schedule changes can have significant consequences. SSI is a needs-based benefit funded by general tax revenue, not by payroll taxes like Social Security retirement benefits.

Eligibility includes:

- Adults aged 65 or older with limited income and resources

- Adults with disabilities

- Children with significant disabilities

- U.S. citizens or certain qualified non-citizens

- Individuals with countable resources below $2,000 ($3,000 for couples)

Because recipients often have limited income and few financial reserves, unexpected payment timing can create confusion or hardship.

Does an Early Payment Affect Other Benefits?

Many beneficiaries worry that receiving two deposits in December might affect eligibility for other income-based support programs.

Here is what agencies say:

- SNAP (food stamps): USDA classifies the December 31 payment as January income, so it should not reduce December benefits.

- Medicaid: Most states follow SSA accounting and do not treat early payments as duplicate income.

- Housing assistance: HUD programs generally average income over longer periods and are not affected by the early payment.

Experts still recommend reporting income exactly as received and contacting caseworkers if discrepancies occur.

Historical Examples of Advance Payments

Early January SSI payments have occurred many times, including:

- 2022: January payment issued December 30, 2021

- 2023: January payment issued December 30, 2022

- 2024: January payment issued December 29, 2023

In all these cases, two December payments were followed by no January payment. The SSA publishes these schedules annually, but experts say many recipients remain unaware until deposits appear.

Impact on Disability Advocates and Policy Debates

The recurring confusion has led disability rights groups to call for improved communication from the SSA. The National Disability Rights Network stated that better outreach “helps prevent misinterpretations that could affect budgeting or eligibility for other programs.”

Some policy researchers argue that the issue reflects broader challenges within SSI, including outdated asset limits and complex reporting rules. Congress has considered modernizing SSI, but no major reforms have passed in more than 30 years.

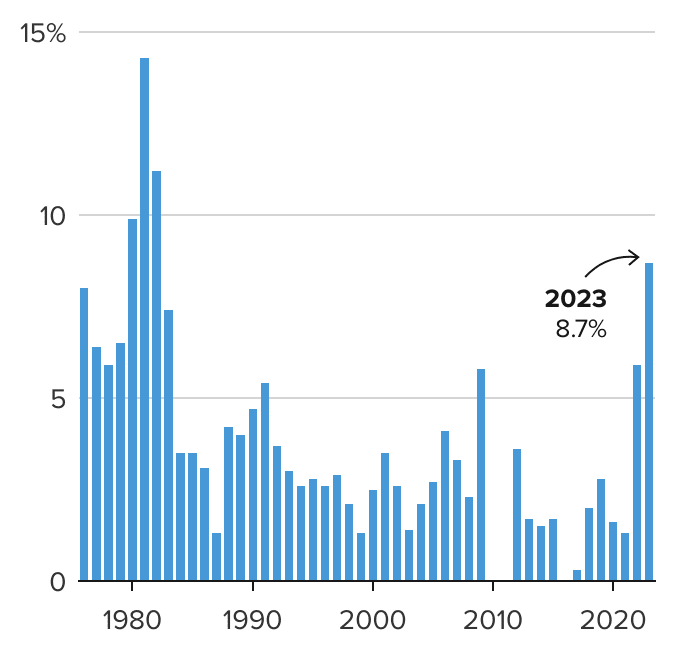

Looking Ahead: COLA and Future Payment Schedules

The Cost-of-Living Adjustment (COLA), applied each January, reflects inflation measured by the Consumer Price Index. Even though January’s payment arrives in December, the COLA still applies.

SSA officials note that “the date of deposit does not change the effective month of benefit increases.”

This means beneficiaries may see higher payments on December 31 if a new COLA is approved for the upcoming year.

2026 SSI Payment Schedule Overview

To help beneficiaries plan ahead, here is the simplified 2026 SSI payment schedule:

- January: Paid early on December 31, 2025

- February: February 1

- March: March 1

- April: April 1

- May: May 1

- June: June 1

- July: July 1

- August: August 1

- September: September 1

- October: October 1

- November: November 1

- December: December 1

No additional early payments are scheduled for 2026 unless new federal holidays are added.

How SSI Differs From Social Security Retirement Benefits

Many individuals confuse SSI with Social Security retirement or disability benefits, but they differ significantly.

Key differences include:

- SSI is funded by general taxes, while Social Security is funded by payroll taxes.

- SSI eligibility is based on financial need; Social Security requires work history.

- SSI benefits are generally lower than Social Security retirement payments.

- SSI payments follow the first-of-month rule, while Social Security retirement payments depend on birthdate.

Understanding these distinctions helps prevent misunderstandings about payment timing and eligibility.

Why Some Social Security Recipients Will Receive Three Payments in December – Check Details

How Recipients Can Verify Their Payment Dates

The SSA recommends several methods to confirm payment schedules:

- Use a my Social Security online account

- Call the SSA helpline at 1-800-772-1213

- Visit a local SSA field office

- Check the SSA.gov payment calendar

Advocacy groups recommend checking payment information especially around holidays to avoid confusion.

FAQs About Two Payments in December

Will this happen again next year?

It depends on the calendar. If January 1 falls on a weekend or holiday, the payment will shift again.

Does this affect my taxes?

SSI is not taxable income, so payment timing does not affect tax filings.

Will Social Security retirement beneficiaries also receive two payments?

No. They follow a different schedule.

Does my representative payee manage the change?

Yes. Payees receive notifications and must budget accordingly.