The Social Security Schedule for December will shift due to the federal holiday calendar, prompting early payments for millions of Supplemental Security Income (SSI) recipients and creating adjusted timelines for some Social Security beneficiaries. The Social Security Administration (SSA) said the changes follow long-standing protocols designed to ensure uninterrupted benefit access when standard payment dates fall on weekends or federal holidays.

Why December’s Social Security Schedule Is Changing

| Key Fact | Detail / Statistic |

|---|---|

| Early SSI Payment | January 2026 benefits arrive on December 31 |

| Social Security Wednesday Schedule Unchanged | Payments issued on December 10, 17, 24 |

| Reason for Shift | January 1 federal holiday |

| Number of Affected SSI Recipients | 7.4 million Americans |

| Potential Budget Impact | No SSI payment will be issued in January |

| Official Website | SSA |

As December approaches, the SSA encourages beneficiaries to check their My Social Security accounts for official notices. Early payments may influence personal budgeting, but the agency emphasizes that benefit totals remain unchanged for the year.

December’s Social Security Schedule Adjustments Explained

The December’s Social Security Schedule changes stem from an SSA rule preventing payments from being issued on federal holidays. When a payment date conflicts with a holiday, the agency moves the deposit to the nearest preceding business day. This year, January 1 falls on a Wednesday, triggering an adjustment for SSI benefits.

An SSA spokesperson said, “Our payment schedule remains consistent throughout the year, with adjustments made only when federal holidays require it. These changes protect beneficiaries from delays and ensure timely access to funds.”

The early payment will not increase monthly benefits, nor does it represent an additional check. Instead, the payment timing shifts between calendar months.

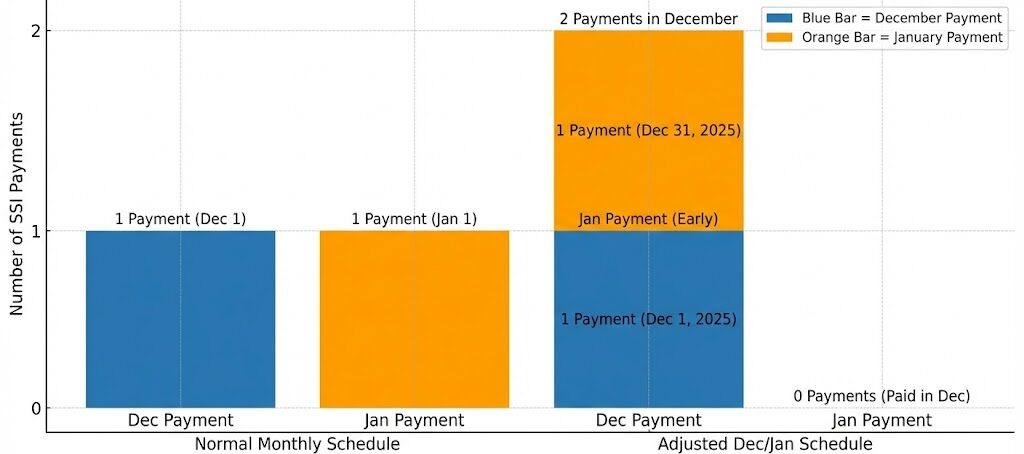

How the Social Security Schedule Is Changing for SSI Recipients

The Social Security Schedule Is Changing for SSI recipients due to the New Year’s Day federal holiday. As a result, the payment dates are:

- December 1 – Regular monthly SSI benefit

- December 31 – Early January 2026 SSI benefit

This means SSI beneficiaries will receive two payments in December but none in January.

Dr. Marla Stevenson, a senior policy analyst at the Urban Institute, said the shift can cause confusion. “Many households rely on a predictable rhythm of income. When two payments arrive in the same month, some assume they are receiving an increase, but the actual effect is a skipped payment in January.”

Stevenson added that early payments can strain budgets if households do not plan ahead. “Recipients may feel financially comfortable in late December but experience shortfalls at the end of January.”

Impact on Social Security Retirement, Disability, and Survivor Benefits

For beneficiaries enrolled in Old-Age, Survivors, and Disability Insurance (OASDI), payment timing follows the standard Wednesday formula based on birth dates. These dates remain intact:

- December 3: All beneficiaries who began receiving payments before May 1997

- December 10: Birthdays between the 1st and 10th

- December 17: Birthdays between the 11th and 20th

- December 24: Birthdays between the 21st and 31st

The SSA reiterated that these payments are not affected by holiday timing because none of the scheduled Wednesdays fall on federal holidays.

How Federal Holidays Shape the Social Security Schedule

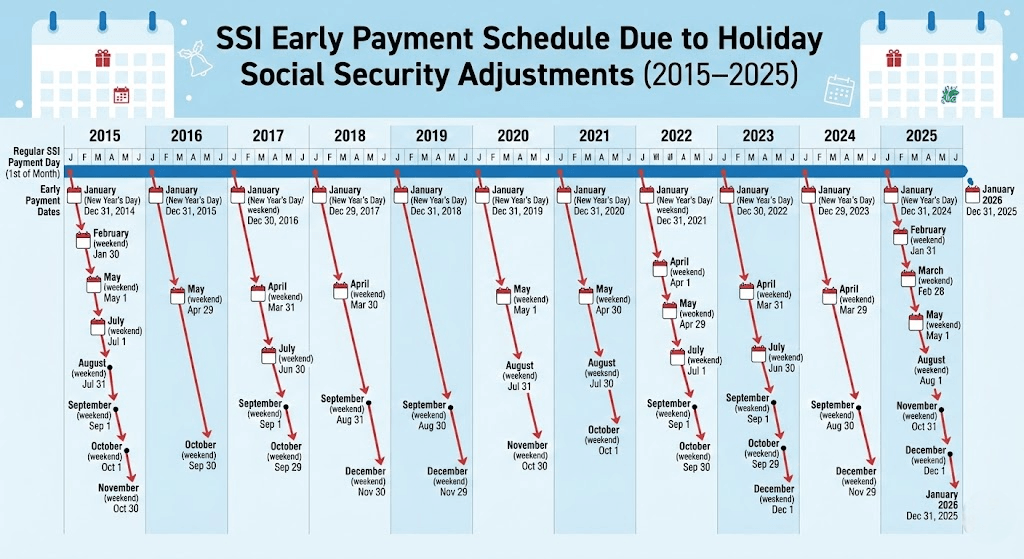

Holiday-related changes occur several times each decade. January 1 is one of the most frequent triggers because it always falls on a holiday and often lands on a weekend. This pattern causes early SSI payments in:

- 2017

- 2022

- 2023

- 2025

- 2026

According to retirement economist Dr. Henry Caldwell of Georgetown University, “Holiday-related payment adjustments are routine and pose no financial penalty to recipients. They simply shift cash flow across the calendar month.”

How Banks and Financial Institutions Handle Early Deposits

Most beneficiaries use direct deposit, which the U.S. Department of the Treasury recommends for faster and safer processing. Banks typically credit SSA payments immediately upon receipt, though processing times may vary.

Community banks and credit unions sometimes issue advisories during the holiday season due to reduced staffing. Beneficiaries should:

- Monitor account alerts

- Confirm deposit times for their institution

- Avoid cashing out payments too quickly during high-fraud periods

The American Bankers Association notes that scammers often target seniors when SSA schedules change.

What Beneficiaries Should Expect — Practical Guidance

Given the compressed payment structure, beneficiaries should take several steps:

1. Review direct deposit details

Incorrect account numbers can delay payments for weeks.

2. Adjust household budgets

January will have no SSI payment. Households should plan for:

- Rent or mortgage due January 1

- Utilities with early billing cycles

- Medical costs for the start of the year

3. Anticipate SSA service delays

Customer service lines see elevated call volume in late December.

4. Watch for fraud alerts

The SSA reports a seasonal rise in phone scams impersonating agency officials.

5. Track benefit letters

Cost-of-Living Adjustment (COLA) notices typically arrive in December, affecting next-year estimates.

Historical Background: Why the Early Payment System Exists

Congress established the early-payment rule decades ago to prevent beneficiaries from going without income when holidays disrupted federal operations. Before the rule was implemented, payment delays were common, creating hardship for seniors and people with disabilities.

The SSA now uses automated payment systems, but the original policy remains because federal offices cannot process payments on holidays. The long-standing process ensures predictability and limits administrative errors.

Veterans Could Receive Up to $4544 in Benefits This Month – But Time Is Running Out

Looking Ahead: What 2026 May Bring

The December 31 early payment is the final deposit before the 2026 Cost-of-Living Adjustment (COLA) takes effect. The SSA will release updated projections after the Bureau of Labor Statistics publishes the final inflation readings.

Policy experts are also monitoring potential changes in Congress related to:

- Benefit formula modernization

- Long-term trust fund solvency

- Adjustments to payment calendars

While none of these proposals currently have bipartisan support, analysts expect renewed debate as lawmakers review SSA funding levels next year.

FAQs About Why December’s Social Security Schedule Is Changing

1. Why is the Social Security Schedule changing in December?

The schedule is changing because January 1 is a federal holiday. When payment dates fall on holidays, the SSA issues payments on the preceding business day.

2. Will I receive an extra SSI payment in December?

No. The December 31 payment represents January’s SSI benefit. January will have no SSI deposit.

3. Do the changes affect Social Security retirement benefits?

No. Retirement, survivor, and disability benefits follow the Wednesday birth-date schedule, which is not impacted by this year’s holidays.

4. How can I confirm my payment date?

Beneficiaries can check the official SSA payment calendar or log into their My Social Security account for personalized information.

5. Will the payment schedule change again in 2026?

Yes. Because January 1, 2026, is also a federal holiday, the January SSI payment will again be issued early on December 31, 2025.