A Social Security payment of up to $4,018 is scheduled for December 10, according to the Social Security Administration’s (SSA) monthly calendar. The payment goes to retirement, survivor, and disability beneficiaries whose birthdays fall between the 1st and 10th of any month and who started receiving benefits after May 1997. The distribution is part of the nationwide cycle that governs when more than 70 million people receive their federal benefits each month.

Up to $4,018 in Social Security

| Key Fact | Detail / Statistic |

|---|---|

| Payment Date | December 10, 2025 |

| Maximum Benefit | $4,018 for retirees at full retirement age |

| Eligibility Window | Birthdays 1–10; claims after May 1997 |

| Official Website | Social Security Administration |

Who Receives the December 10 Social Security Payment

The December 10 distribution follows the agency’s three-tiered system implemented in the late 1990s. Beneficiaries are assigned to one of three payment windows tied to their birthdays:

- 1st–10th: Paid on the second Wednesday (Dec. 10)

- 11th–20th: Paid on the third Wednesday (Dec. 17)

- 21st–31st: Paid on the fourth Wednesday (Dec. 24)

Those who began collecting benefits before May 1997 follow an older schedule and receive payments on December 3 instead.

An SSA spokesperson previously explained that the staggered design “reduces administrative load and results in more predictable monthly distribution,” ensuring that the agency does not process tens of millions of payments on a single day.

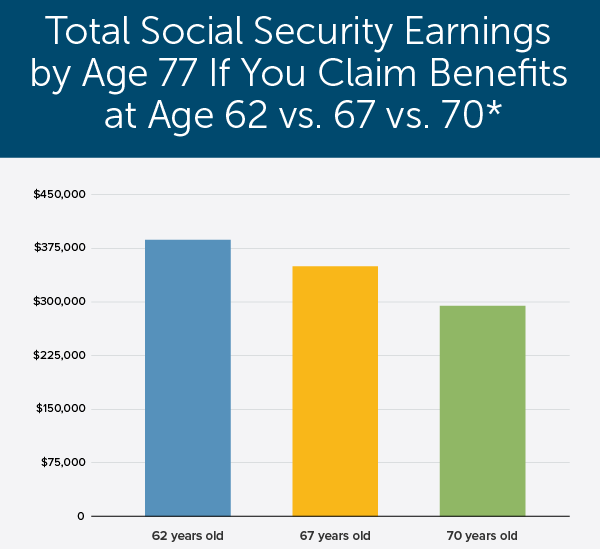

Understanding the Maximum Benefit of Up to $4,018 in Social Security

The $4,018 monthly maximum applies only under specific conditions. According to the SSA’s benefits formula, a claimant must:

- File at full retirement age (FRA), typically 66 or 67 depending on birth year.

- Earn at or above the maximum taxable wage base for approximately 35 years.

- Have consistent work history, because years with zero income lower the benefit calculation.

Most Americans receive far less. The average monthly benefit is about $1,900, according to the SSA’s most recent statistical update.

Dr. Alicia Munnell, director of the Center for Retirement Research at Boston College, said earlier this year that “very few retirees qualify for the top benefit tier, because it requires a lifetime of earnings at the highest taxable levels,” adding that the typical retiree’s experience is “substantially more modest.”

How the December Social Security Schedule Works

The SSA schedules retirement and disability payments based on a system adopted nearly three decades ago. This system spreads payments throughout the month to stabilize agency operations and help the U.S. Treasury manage outgoing cash flow.

December 2025 Payment Breakdown

- December 1: SSI beneficiaries

- December 3: Pre-May-1997 Social Security claimants

- December 10: Birthdays 1–10

- December 17: Birthdays 11–20

- December 24: Birthdays 21–31

- December 31: Early SSI payment for January 2026

The December 31 SSI payment is part of a long-standing rule: when the regular date falls on a weekend or holiday, payments shift to the nearest business day.

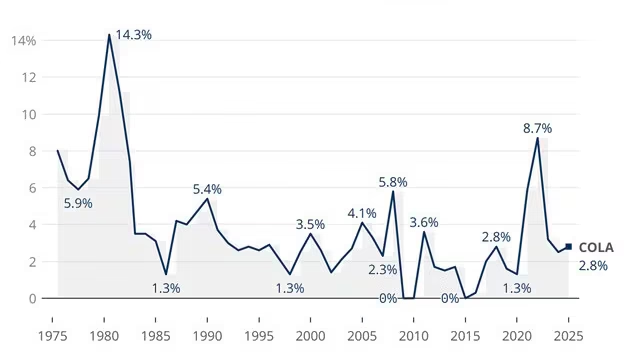

The Role of COLA and Economic Conditions

Social Security benefits do not remain static. They rise each year through a Cost-of-Living Adjustment (COLA), designed to keep payments aligned with inflation.

The 2025 benefit level reflected in the December payment does not yet include the upcoming 2026 COLA, which will take effect in January.

Economists at the Federal Reserve Bank of St. Louis note that inflation remains a key driver of benefit adequacy. While COLAs help, they seldom match rising medical and housing costs, two of the most significant expenses for retirees.

According to the Bureau of Labor Statistics, medical care inflation has outpaced overall inflation for much of the past decade. “Older households face a different inflation basket,” said Dr. Charles Blahous, a former public trustee for Social Security. “Rising healthcare costs mean that even positive COLAs can fall short of real needs.”

Why Social Security Matters to More Than 70 Million Americans

Social Security is the primary source of income for a significant share of retirees. According to the SSA:

- About 40% of older Americans rely on Social Security for half or more of their income.

- One in seven relies on it for nearly all household income.

- About 9 million disabled workers receive Social Security Disability Insurance (SSDI).

The benefits are also crucial for survivors: 5.8 million widows, widowers, and children receive monthly support.

“The program functions as the nation’s backbone for retirement income,” said Dr. Kathleen Romig, Director of Social Security and Disability Policy at the Center on Budget and Policy Priorities. “For many families, it is the difference between stability and poverty.”

Eligibility Clarifications: Who Does Not Receive the December 10 Payment

It is equally important to understand who does not qualify for the December 10 window:

- Beneficiaries with birthdays after the 10th

- Anyone who began collecting before May 1997 (paid Dec. 3)

- People who receive Supplemental Security Income (SSI) instead of Social Security

- Individuals whose records require unresolved verification (e.g., bank information updates)

The SSA recommends that beneficiaries maintain updated bank account information through their mySocialSecurity portal to avoid delays.

Fraud Prevention: What Beneficiaries Should Watch For

The rise in digital payments has brought higher risk of fraudulent impersonation. The Social Security Inspector General’s Office warns that scammers often target beneficiaries around payment dates.

Common red flags include:

- Unexpected calls claiming “payment problems”

- Requests for bank details

- Emails pretending to be SSA notices

- Threats of suspended benefits

“SSA will never threaten you, demand payment, or ask for personal information by phone,” Inspector General Gail Ennis said in a public advisory. Beneficiaries are encouraged to report suspicious contacts through the agency’s fraud portal.

Historical Perspective: How Social Security Payments Evolved

When Social Security began in the 1930s, benefits were issued quarterly. Monthly payments started in 1940, and for decades all beneficiaries were paid on the same date.

Key milestones include:

- 1972: Automatic COLA adjustments introduced

- 1997: Modern staggered payment schedule begins

- 2013: Shift toward direct deposit, reducing mailed checks

The move to electronic payments significantly reduced fraud and administrative costs. Today, more than 99% of beneficiaries receive direct deposits.

Policy Debates Surrounding Social Security’s Future

Lawmakers continue to discuss long-term solvency as demographic shifts strain the system. The Congressional Budget Office (CBO) projects that the Social Security Trust Fund could face depletion in the 2030s without legislative action.

Proposals under discussion include:

- Raising the payroll tax cap

- Adjusting the FRA (Full Retirement Age)

- Means-testing high-income beneficiaries

- Increasing payroll tax rates

- Modifying the benefit formula

While none of these proposals affect the December 10 payment, understanding the larger policy landscape helps explain why benefit adequacy remains a central national issue.

How Beneficiaries Can Confirm Their Payment

The SSA encourages beneficiaries to confirm payment status using:

- mySocialSecurity account

- Direct deposit notifications

- The Social Security Payments Calendar on SSA.gov

The agency also recommends checking bank deposits before contacting SSA, as bank processing times can vary.

CalFresh Update: More Than 5.5 Million Californians Receive Up to $1,789 This Week

What Comes Next

Following the December 10 payment, beneficiaries will see COLA-adjusted amounts beginning in January 2026. The SSA will release updated payment charts in December to help households anticipate changes.

Economists expect modest increases but warn that inflation pressures may persist. “Benefit adjustments will help, but purchasing power remains an ongoing challenge for seniors on fixed incomes,” said Richard Johnson, a senior fellow at the Urban Institute.