As the U.S. government rolls out new relief and recovery initiatives, stimulus scams 2025 are spreading faster and becoming more sophisticated than ever before. From AI-generated robocalls to fraudulent text messages impersonating federal agencies, criminals are using advanced technology to exploit public confusion and economic anxiety.

Authorities warn that these scams have caused hundreds of millions of dollars in losses this year alone—making them one of the fastest-growing forms of financial crime in the country.

Top 10 Stimulus Scams in 2025

| Key Fact | Detail | Source |

|---|---|---|

| Complaints filed in 2025 (Jan–June) | Over 80,000 reports of stimulus-related fraud | Federal Trade Commission (FTC) |

| Estimated consumer losses | More than $280 million since January 2025 | Federal Bureau of Investigation (FBI) |

| Most common scam type | Fake IRS text messages and phishing links | Internal Revenue Service (IRS) |

The Rise of Stimulus Fraud

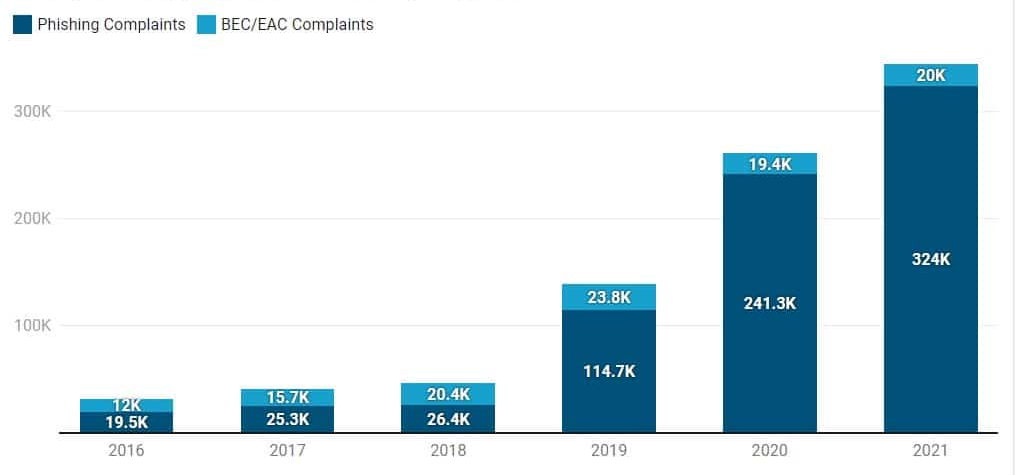

The term “stimulus scam” first entered mainstream awareness in 2020, when the COVID-19 pandemic prompted massive government relief programs. Criminals quickly adapted, building elaborate phishing networks to impersonate government websites and intercept payments.

Five years later, the pattern has intensified. According to the FTC’s Consumer Sentinel Network, reports of government-related fraud have tripled since 2022. “The combination of economic pressure and new digital tools has created ideal conditions for scammers,” said Samuel Levine, Director of the FTC’s Bureau of Consumer Protection.

While earlier scams relied on crude fake emails, 2025 has ushered in the era of hyper-personalized deception powered by artificial intelligence.

How Technology Changed the Game

AI has fundamentally altered the fraud landscape. Scammers can now generate authentic-sounding robocalls using voice-cloning software, create convincing fake websites with automated design tools, and even simulate government correspondence complete with realistic logos and formatting.

“The sophistication of these scams is unlike anything we’ve seen before,” said Prof. Hany Farid, a digital forensics expert at the University of California, Berkeley. “With generative AI, the line between legitimate and fraudulent communication is disappearing.”

In several recent cases investigated by the FBI Internet Crime Complaint Center (IC3), AI-generated voices were used to impersonate IRS officers demanding payment verification through cryptocurrency. Victims collectively lost millions of dollars before the calls were traced to offshore operations.

1. Fake Government Text Messages

Text-based scams remain the most common method of attack. Messages often read, “You’re eligible for a new federal stimulus benefit. Click here to confirm your details.”

“These texts are designed to create urgency,” said Lisa Plaggemier, Executive Director of the National Cybersecurity Alliance. “The moment you click the link, malware is installed, or your personal data is harvested.”

2. AI Robocalls and Deepfake Voices

AI-generated robocalls are now capable of mimicking human tone, pauses, and even background noise to appear legitimate. Victims have reported hearing what sounded like a real IRS employee or bank representative.

One Maryland resident, Diana Cooper, told investigators she lost $9,400 after receiving a call from what sounded like an official Treasury Department line. “It even used my full name and address,” she said. “I had no idea it wasn’t real until my bank froze my account.”

3. Phishing Relief Program Emails

Fraudulent emails continue to circulate with subjects like “Final Notice: Claim Your Federal Relief Payment.” Clicking the included links leads to imitation government portals requesting banking credentials.

According to Trend Micro’s 2025 Threat Landscape Report, at least 400 new domains were registered this year that mimic the IRS or the Department of the Treasury. Many were hosted overseas, complicating enforcement.

4. Fake Check Scams

Another classic tactic involves mailing counterfeit “advance stimulus checks.” Victims are told to deposit the check and send part of the money back for “verification.” When the check bounces, the victim is left responsible for the funds.

The U.S. Postal Inspection Service warns that scammers often use real names of Treasury officials and convincing watermarks. Public awareness, not technology, remains the best defense.

5. Identity Theft Through Fake Portals

Several fake IRS login pages have been discovered capturing usernames, Social Security numbers, and passwords. This stolen information is later used for large-scale identity theft, credit fraud, or false tax returns.

The Identity Theft Resource Center (ITRC) reported a 25% increase in complaints linked to stimulus-related phishing in 2025. Seniors and low-income families remain the most frequent targets.

6. “Update Account” or “Verification Required” Messages

Messages claiming “your stimulus payment is delayed” or “your eligibility will expire” have surged across text and email channels. Such language creates a false sense of urgency.

“Fear overrides critical thinking,” said Dr. Mary Aiken, cybersecurity psychologist at University College Dublin. “Scammers exploit that emotional reaction to get quick compliance.”

7–10. Other Common Schemes

• Fake Relief Apps that install spyware disguised as “stimulus trackers.”

• Social Media DMs promising “instant deposits” through unofficial portals.

• QR Code Flyers directing victims to counterfeit payment pages.

• Investment Relief Scams claiming to multiply stimulus funds through crypto platforms.

The Human Cost

Behind the statistics are thousands of ordinary citizens losing their savings.

“I felt stupid, but it was so believable,” said Juan Hernandez, a retired postal worker from Texas who fell victim to a fake IRS call. “They had my address, my last four digits, everything.”

Experts say stolen data from past breaches fuels these convincing schemes. “Hackers don’t need to guess anymore—they already have your personal details,” said Rachel Tobac, CEO of SocialProof Security. “AI just makes the con smoother.”

Global Perspective

Stimulus-related scams are not confined to the United States. In Canada, the Canadian Anti-Fraud Centre has reported fake messages about “GST relief deposits.” In the United Kingdom, fraudsters use “cost-of-living payment” claims to target citizens. Australia’s government recently warned of similar texts promising “energy rebate bonuses.”

“The cross-border nature of digital fraud means no country is immune,” said Dr. Mark Button, Director of the Centre for Counter Fraud Studies at the University of Portsmouth. “International cooperation is essential.”

Government and Industry Response

The FTC, IRS, and Department of Justice have intensified their coordination, running nationwide campaigns to remind citizens that legitimate government agencies never demand payment via text, cryptocurrency, or gift card.

Private companies are also stepping in. Google and Meta have launched automated systems that detect and block domains impersonating public institutions. Phone carriers like AT&T and Verizon have expanded AI-based call filtering to intercept suspicious robocalls before they reach users.

However, experts caution that scammers adapt rapidly. “This is an arms race,” said Prof. Farid. “For every new safeguard, criminals develop two new methods.”

Public Awareness and Education

Government agencies and nonprofit organizations are focusing on consumer education as a first line of defense. The AARP Fraud Watch Network offers free webinars teaching seniors how to identify fake calls. Schools and community centers are also including digital literacy lessons in their curriculums.

“We’re not just fighting technology—we’re fighting human psychology,” said Kathy Stokes, AARP’s Director of Fraud Prevention Programs. “The more people understand how scams work, the fewer will fall for them.”

Legislative and Technological Efforts

Lawmakers in Washington are pushing new legislation to enhance digital fraud tracking. A proposed AI Fraud Accountability Act would require transparency reports from companies that develop voice synthesis software.

Meanwhile, federal agencies are testing new detection tools that use machine learning to identify patterns in scam calls and websites. The FTC is piloting a nationwide alert system that could send verified warnings directly to mobile devices.

Broader Context: Economic Anxiety and Public Trust

Economists say the surge in fraud reflects both economic uncertainty and declining confidence in government communication channels.

“The modern scam thrives on distrust,” said Dr. Josephine Wolff, cybersecurity policy scholar at Tufts University. “People are unsure whom to believe—official messages or online chatter. Scammers exploit that confusion.”

Analysts also point to the blurred boundary between official and social media communications. Many people first learn about relief programs from social platforms, where misinformation spreads quickly.

The Road Ahead

Federal agencies are now exploring partnerships with AI firms to track synthetic voices and detect cloned websites. Experts say these tools could help prevent future outbreaks of mass fraud—but warn that public vigilance remains essential.

“Technology alone won’t stop scams,” said IRS spokesperson Eric Smith. “The best protection is skepticism. If something sounds too urgent or too good to be true, it probably is.”