WASHINGTON — As the 2025 calendar year draws to a close, millions of Baby Boomers are facing a critical window to optimize their retirement benefits and avoid permanent financial penalties. Experts from the Social Security Administration (SSA) and independent financial institutions warn that missing key year-end deadlines or failing to adjust for new 2026 regulations could result in thousands of dollars in lost lifetime income.

The transition into 2026 brings updated cost-of-living adjustments (COLA), higher earnings limits for those still in the workforce, and shifting age requirements for full retirement eligibility.

Three Social Security Steps Baby Boomers Should Review Now

| Key Fact | 2025 Status | 2026 Status (Official) |

| Cost-of-Living Adjustment (COLA) | 2.5% | 2.8% |

| Earnings Limit (Under FRA) | $23,400 | $24,480 |

| Earnings Limit (Year of FRA) | $62,160 | $65,160 |

| Full Retirement Age (FRA) | 66 yrs, 10 mos (born 1959) | 67 years (born 1960+) |

| Medicare Part B Premium | $185.00 | $202.90 |

The landscape of American retirement is shifting as the 2026 regulations take effect. By taking these three steps—verifying net COLA, adjusting for earnings limits, and confirming FRA milestones—Baby Boomers can enter the new year with a secure and predictable financial strategy.

1. Verify Your 2026 Benefit Increase and Medicare Offset

The first essential step for any beneficiary is to review the COLA notice. The SSA officially announced on October 24, 2025, that benefits for nearly 75 million Americans will increase by 2.8% starting in January 2026. This adjustment follows a 2.5% increase in 2025 and aims to help seniors manage inflation-driven expenses in housing and food.

For the average retired worker, this translates to an increase of approximately $56 per month, raising the typical check from $2,015 to $2,071. However, retirees must look closely at their net pay. The Centers for Medicare & Medicaid Services (CMS) recently confirmed that the standard monthly Medicare Part B premium will rise by $17.90, reaching $202.90 in 2026. Because these premiums are deducted directly from Social Security checks, the actual “take-home” raise for many will be closer to $38 per month.

2. Navigate the New 2026 “Earnings Test” Thresholds

Baby Boomers who have claimed Social Security but continue to work must monitor their annual income before the December 31 deadline. The SSA applies an Earnings Test to those who have not yet reached their Full Retirement Age (FRA).

In 2026, the earnings limit for workers younger than FRA will increase to $24,480. For every $2 earned above this limit, the SSA will withhold $1 in benefits. For those reaching their FRA in 2026, the limit is much higher at $65,160, with only $1 withheld for every $3 earned above the threshold until the month they reach full age.

It is vital to report estimated earnings accurately before the year ends. If a beneficiary earns significantly more than they projected in 2025, they may face an overpayment notice in 2026, requiring them to pay back thousands in benefits. Conversely, if earnings were lower than expected, the SSA may owe the beneficiary a retroactive payment.

3. Account for the Shifting Full Retirement Age (FRA)

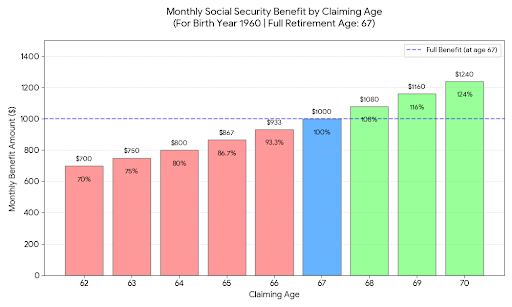

For the final wave of the Baby Boomer generation, 2025 and 2026 represent a historic milestone. Those born in 1960 will turn 65 in 2025, but for the first time in the program’s modern history, their FRA is officially 67 years.

This shift marks the end of a decades-long phase-in resulting from the 1983 Social Security Amendments. Claiming benefits at age 65 for this group results in a permanent reduction of roughly 13.3% compared to waiting until age 67. If an individual born in 1960 claims at the earliest possible age of 62, their benefit is slashed by 30%.

Experts suggest that Boomers should use the final weeks of 2025 to run a “break-even” analysis. While claiming early provides immediate cash flow, waiting until age 70 can increase the monthly benefit to 124% of the FRA amount.

Year-End Tax and RMD Considerations

Beyond the SSA, Boomers must manage their Required Minimum Distributions (RMDs) from 401(k)s and IRAs. The current age to begin RMDs is 73. Failing to take the full distribution by December 31 can trigger a 25% excise tax on the amount not withdrawn.

Furthermore, these distributions can trigger the “tax torpedo.” If “provisional income” (adjusted gross income + tax-exempt interest + 50% of Social Security) exceeds $34,000 for individuals or $44,000 for couples, up to 85% of Social Security benefits become subject to federal income tax. Taking a large RMD at the end of the year could inadvertently push a retiree into a higher tax bracket for their benefits.

2026 Social Security Increase Updates: What a $56 Monthly Increase Looks Like in Real Terms

FAQs About 2026 Social Security payment

1. When will I receive my first 2026 Social Security payment with the 2.8% COLA?

Most beneficiaries will see the increase in January 2026. However, Supplemental Security Income (SSI) recipients will receive their first increased payment on December 31, 2025, because January 1 is a federal holiday.

2. Is there a limit on how much I can earn if I am over my Full Retirement Age?

No. Once you reach your Full Retirement Age (66 and 10 months for those born in 1959, or 67 for those born in 1960), the earnings test no longer applies. You can earn any amount of wages without any withholding from your Social Security benefits.

3. Does the 2.8% COLA apply to disability and survivor benefits too?

Yes. The COLA is applied to all Social Security programs, including Social Security Disability Insurance (SSDI) and survivor benefits. The average survivor benefit for an aged widow(er) is expected to rise from $1,867 to $1,919 in 2026.

4. How does the “Hold Harmless” rule work with the Medicare premium hike?

The “Hold Harmless” provision prevents your Social Security check from decreasing due to Medicare premium increases. However, with a 2.8% COLA, the average $56 increase easily covers the $17.90 premium hike. Only those with very low monthly benefits (under $639) might be protected by this rule in 2026.

5. What counts as “earnings” for the Social Security earnings test?

Only earned income (wages from a job or net profit from self-employment) counts toward the limit. Passive income, such as pensions, 401(k) withdrawals, IRAs, capital gains, and interest, does not count toward the $24,480 limit.