The $620 penalty for claiming Social Security benefits before full retirement age (FRA) can significantly reduce monthly payments. This reduction applies to individuals who claim early and continue working, resulting in deductions based on earned income. Understanding this penalty is crucial for those considering early Social Security claims, as it can impact both short- and long-term financial planning.

$620 Monthly Penalty

| Key Fact | Detail/Statistic |

|---|---|

| Full Retirement Age (FRA) | Varies by birth year; for those born after 1960, FRA is 67. |

| Early Claim Penalty | Claiming benefits before FRA can reduce monthly payments by up to 30%. |

| Earnings Test Penalty | $1 is deducted for every $2 earned over the earnings limit until FRA. |

| Average Monthly Benefit Difference | The average difference between claiming at 62 and 67 is $588/month. |

| Projected Impact of Cost-of-Living Adjustments | Penalty gap could increase to $620/month due to COLA adjustments. |

| Official Website | Social Security Administration |

The $620 monthly penalty for claiming Social Security before FRA illustrates the financial consequences of early claims, especially when combined with the earnings test. By understanding the impact of early claims and the potential adjustments to benefits, individuals can make more informed choices that align with their long-term financial goals.

The Early Social Security Claiming Penalty: A Detailed Look

When deciding whether to claim Social Security benefits before reaching full retirement age (FRA), many individuals face the prospect of significant reductions in their monthly payouts. The $620 penalty, often discussed in media reports, is tied to a variety of factors, including the age at which benefits are claimed and whether the recipient is still working. This penalty is not a fixed monthly fee but rather reflects the long-term impact of claiming early.

Understanding Full Retirement Age (FRA) and the Social Security Penalty

The concept of FRA is central to understanding the penalties associated with early Social Security claims. For individuals born in 1960 or later, FRA is 67. Those who claim benefits before this age face a reduction in their monthly payments. The earlier a person claims, the larger the reduction.

For example, if someone claims at 62, their benefits could be reduced by as much as 30%. This reduction is permanent; once you opt to claim early, you will receive a lower monthly amount for the rest of your life. According to the Social Security Administration (SSA), this is designed to account for the additional years of benefit payments, spreading the total amount over a longer period.

The Earnings Test: How Work Impacts Early Social Security Claims

A significant component of the penalty for early claims is the Retirement Earnings Test. This test affects individuals who claim Social Security before FRA and continue to work. If you earn more than the annual earnings limit, the SSA will deduct $1 from your monthly benefits for every $2 you earn above that limit.

In the year that you reach FRA, the penalty changes. For months leading up to your FRA, the SSA deducts $1 for every $3 earned over a higher threshold. These deductions are not permanent; once you reach FRA, the amounts withheld due to excess earnings are added back to your monthly benefit, increasing it.

The thresholds for this earnings test change annually. For example, in 2024, the limit for individuals under FRA is $21,240 per year. After reaching FRA, the limit increases significantly.

The $620 Penalty Explained

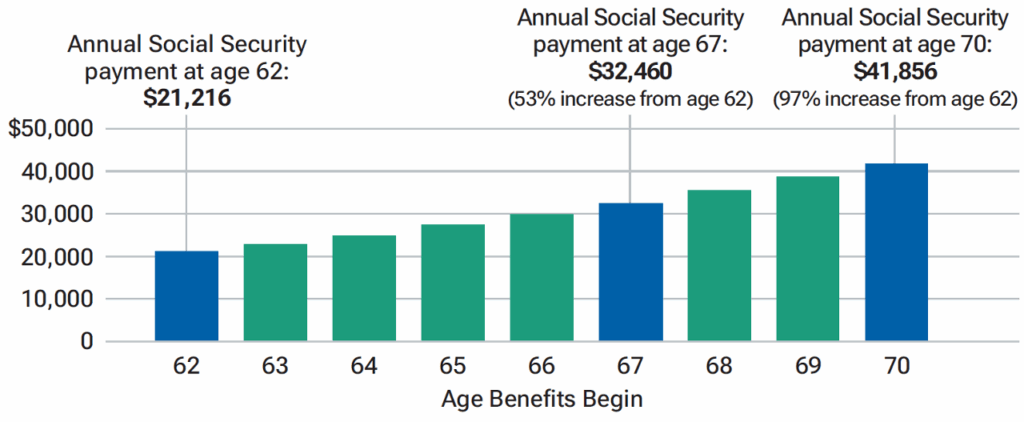

The figure of $620 often mentioned in discussions of Social Security penalties is based on the difference in monthly benefits between those who claim at age 62 versus those who wait until FRA. In 2024, the average monthly benefit for someone claiming at age 62 is $1,342, while the average benefit for those claiming at FRA is approximately $1,930. This creates a gap of about $588 per month.

With future Cost-of-Living Adjustments (COLAs), which are intended to keep Social Security payments in line with inflation, this gap could increase to approximately $620 per month, according to estimates. This gap represents the reduction in benefits for those who start claiming early and highlights the long-term financial impact of such a decision.

Strategies to Maximize Social Security Benefits

While claiming Social Security early can be tempting for many, especially those in need of immediate income, it’s crucial to understand the full financial picture. There are several strategies that can help maximize lifetime Social Security benefits.

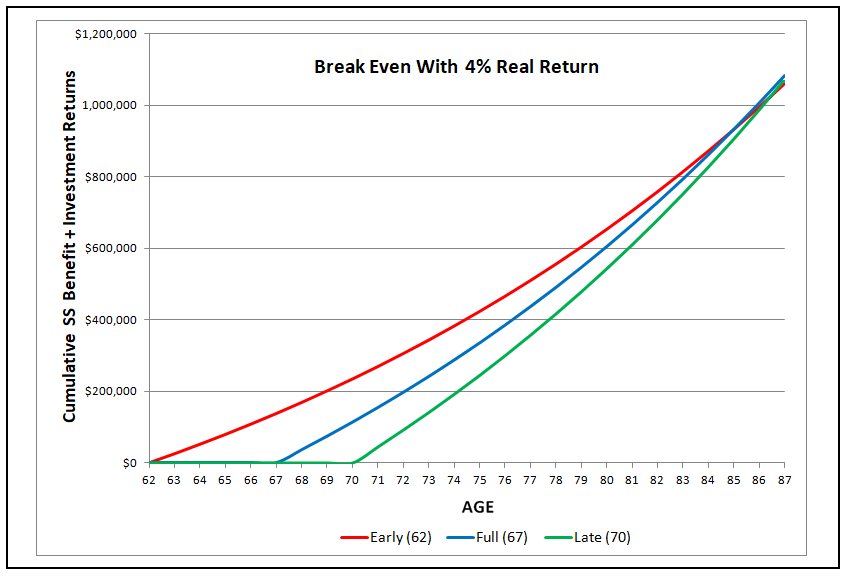

1. Delaying Benefits for a Larger Monthly Payment

One of the most effective ways to increase Social Security benefits is by delaying claims past FRA. For every year you delay claiming until age 70, your monthly benefits increase by approximately 8%. This is a strategy often recommended for those in good health who can afford to wait.

2. Spousal Benefits

For married couples, spousal benefits provide a unique opportunity to maximize Social Security. A spouse can claim up to 50% of the other spouse’s benefit at FRA, even if they have never worked or have lower lifetime earnings. Planning for spousal benefits can significantly increase overall household income.

3. Strategic Claiming with a Financial Advisor

Consulting with a financial planner can provide tailored advice on the best strategy for claiming Social Security. Financial experts recommend taking into account factors like health, other sources of retirement income, tax implications, and life expectancy when deciding the optimal time to start receiving benefits.

Personal Stories: How Early Claims Can Affect Retirees

Case Study 1: Early Claiming to Meet Immediate Financial Needs

Margaret, 62, worked as a teacher for 30 years. After a recent health scare, she decided to claim Social Security early. While this choice provided her with immediate financial relief, Margaret will face a permanent reduction in her monthly benefits. Had she waited until 67, her benefits would have been higher, but the immediate need outweighed the future financial sacrifice.

Case Study 2: Delaying Claims for a Larger Monthly Benefit

John, 65, is in good health and has additional retirement savings. He plans to wait until age 70 to claim his Social Security benefits. By doing so, his monthly payments will increase by 8% each year, which will result in a significantly higher income during his later years. John’s strategy focuses on securing a more comfortable retirement in his 70s and beyond.

Historical Context: How Social Security Has Evolved

Social Security has been a cornerstone of the U.S. retirement system since it was introduced in 1935. Initially designed to provide income for elderly Americans, the system has undergone various changes over the decades. In recent years, concerns about the sustainability of Social Security have led to discussions about reforms.

Historically, the full retirement age was 65 for individuals born before 1937. It was gradually raised to 66 and then to 67 to reflect longer life expectancies. These changes highlight the evolving nature of the program, which aims to balance benefits with the country’s economic realities.

Impact on Future Generations

The Social Security system faces significant financial challenges due to an aging population and the increasing number of retirees. While the system is currently solvent, experts warn that the trust fund could run out of money by the mid-2030s unless Congress takes action. Younger generations may find that their benefits are smaller or subject to more restrictions, making it important to start planning for retirement well in advance.

Comparing Social Security with Other Retirement Plans

While Social Security is an essential part of retirement planning, it is unlikely to provide the full income that most retirees will need. Additional retirement savings through 401(k) plans, IRAs, and personal investments are crucial for a well-rounded financial strategy.

Social Security is designed to replace only a portion of pre-retirement income, with the average benefit typically replacing about 40% of an individual’s working wages. To achieve a more comfortable retirement, it’s important to explore other investment options and savings plans that can supplement Social Security income.Navigating Your Social Security Benefits: A Personal Approach

Before making a decision about claiming Social Security, it’s essential to consult the SSA or use their online tools to calculate your expected benefits at various ages. This allows you to better understand the trade-offs involved in claiming early versus waiting.

In addition, seeking advice from a financial planner or retirement expert can help you make the most informed decision based on your unique situation. For some, claiming early might make sense, but for others, delaying benefits could significantly improve their financial outlook over time.