In recent months, a $2000 stimulus payment has captured public attention, particularly after claims that it would be delivered as a form of tariff revenue dividend. However, as new details emerge, experts suggest that this “stimulus” may be more about repackaging older tax cuts than offering entirely new financial relief. This article breaks down the facts, the confusion, and the context behind the $2000 promise.

$2000 Stimulus Lie

| Key Fact | Detail/Statistic |

|---|---|

| The $2000 payment claim | Announced as a potential stimulus check funded by tariffs |

| Actual source of funding | Potentially drawn from tax cuts and tariff revenues |

| Concerns over tariff revenue shortfall | The tariffs may not generate enough revenue for direct payments |

| No formal payment plan yet | No approved bill or program guarantees the $2000 check |

While the prospect of a $2000 stimulus payment is certainly appealing, the details behind this proposal suggest that it may not be the new financial relief it appears to be. As the political and economic debate around the distribution of aid continues, American citizens will need to stay informed about the true nature of any forthcoming payments and tax cuts.

The $2000 Stimulus Payment: What’s Really Happening?

In a highly publicized announcement, former President Donald Trump proposed that the U.S. government would distribute $2000 stimulus payments to American citizens. The idea was presented as a “dividend” funded by tariff revenue, generated from taxes on imports, specifically targeting goods from countries like China.

However, the suggestion that this could be a new stimulus check generated confusion. Initially, it was unclear whether this was simply an old plan rebranded as something new or if it truly reflected fresh funding from tariff proceeds. Financial experts quickly pointed out that the math behind this $2,000 promise didn’t fully add up.

Tariff Revenue vs. Actual Payments: The Math Behind the Claim

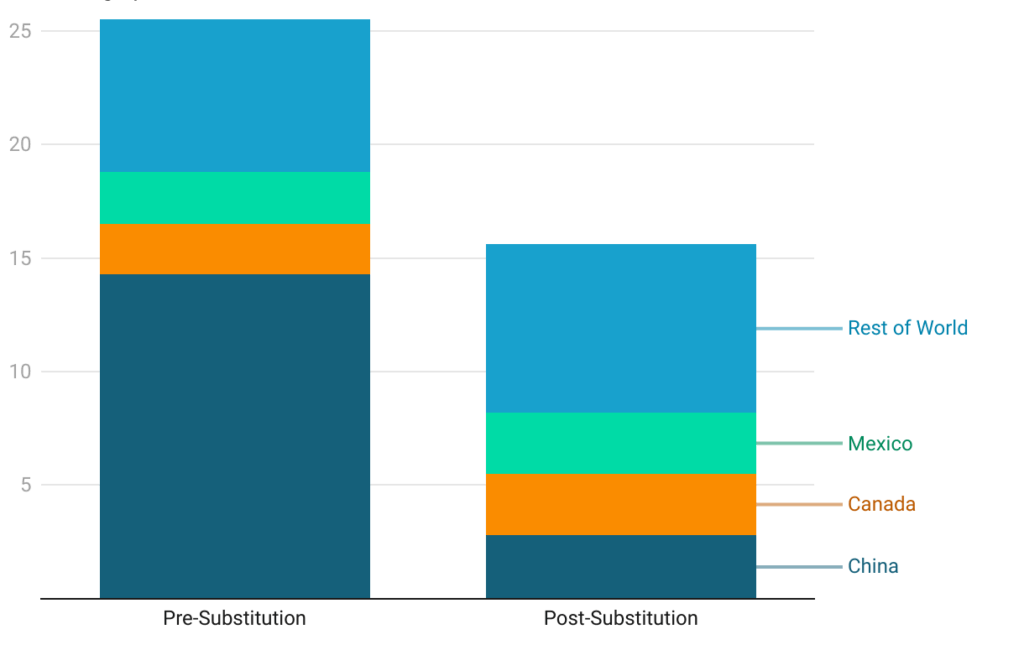

The promise of a $2000 payment was tied to the revenues raised by tariffs—taxes imposed on imports—which had been increased during the Trump administration. However, the total revenue from these tariffs has been far lower than what would be needed to fund such a payment to every eligible American citizen.

According to experts, the total amount that tariffs would generate—roughly $90 billion in 2023—is significantly less than the $300 billion it would take to distribute $2000 each to 150 million adult Americans. This shortfall raises important questions about how the funds would actually be distributed and whether the promised relief would be as immediate or widespread as initially suggested.

The $2000 Relief: Repackaged Tax Cuts

As more details have emerged, it seems that the $2000 stimulus is less about direct payments and more about rebranding tax relief measures that were already on the table. For example, Scott Bessent, a Treasury Department official, recently clarified that much of the relief would come from changes to existing tax rules rather than new payments.

These tax cuts, already implemented or planned in various forms, would result in individuals paying less in taxes over time, including exemptions for overtime pay, tips, and Social Security earnings. Rather than a lump sum payment, these changes may result in smaller, more gradual benefits, depending on an individual’s tax situation.

This shift in focus—from direct financial aid to tax relief—has led some critics to accuse the government of misleading the public by presenting already-existing policy changes as a new form of emergency support.

Historical Context: Stimulus Measures in the U.S.

The idea of a stimulus payment is not new. The U.S. government has provided similar relief in the past, most notably during the 2008 financial crisis and the COVID-19 pandemic.

In 2008, the U.S. issued a series of economic stimulus checks, providing Americans with tax rebates of up to $600. During the COVID-19 pandemic, the U.S. government distributed direct payments to citizens through the CARES Act, the American Rescue Plan, and other packages. The amounts ranged from $1,200 to $2,000 per individual, with the goal of bolstering economic recovery.

The $2,000 stimulus proposal has drawn parallels to these previous efforts. However, unlike the direct cash payments of 2020, which were funded through emergency relief packages, the proposed $2,000 is being marketed as a dividend from tariffs. This change in the source of funding and the focus on tax cuts rather than direct payments marks a significant shift in the U.S. government’s approach to economic relief.

Expert Opinions: Economic Experts Weigh In

Dr. Carla Jensen, a senior economist at the Brookings Institution, noted that “the fundamental issue with this proposal is its reliance on tariff revenue, which has fluctuated significantly in recent years.” She continued, “Tariffs may not be a reliable source of revenue to support a broad-based payment program. Instead, we should focus on more sustainable and equitable methods of providing relief to those who need it most.”

On the other hand, Dr. Gregory Wilson, an economist at the Heritage Foundation, suggested that tax cuts could provide a more long-term solution. “By reducing the tax burden on individuals, we create an environment where people can keep more of their income, which is a better way to stimulate the economy than one-time payments,” Wilson argued.

Both experts agree, however, that clear communication from the government is essential to avoid confusion and ensure that the public understands the nature of any relief measures.

Public Reaction: Confusion and Skepticism

The public’s reaction to the $2000 stimulus proposal has been mixed. Many Americans are eager for financial relief, especially after the disruptions caused by the COVID-19 pandemic and rising living costs. However, some have expressed frustration over the lack of clarity about whether this proposal will result in actual payments or merely be a repackaged version of previous tax cuts.

“I was hoping for a direct check, but now I’m not sure what to expect,” said Sarah Miller, a New York resident. “It seems like they’re just calling old tax breaks a stimulus to make it sound like they’re doing something new.”

Others argue that any form of relief is welcome, even if it comes in the form of tax reductions. “At this point, I just need some financial relief, whatever form it takes,” said Jason Clark, a small business owner in Texas.

Economic Impact of Tariffs: How Do Tariffs Affect the U.S. Economy?

While the tariff revenue idea is central to this proposal, it’s important to understand how tariffs impact the broader U.S. economy. Tariffs are taxes on imported goods, which are typically passed on to consumers in the form of higher prices. While tariffs can provide short-term revenue for the government, they can also lead to price increases for everyday items, putting pressure on American consumers.

The trade war with China, for example, led to increased costs for many American manufacturers and consumers. Experts argue that using tariffs as a long-term source of stimulus funding could have unintended consequences, including higher consumer prices and potential retaliation from trading partners.

Legislative Challenges: The Path to Approval

For any stimulus proposal to become a reality, it must pass through Congress. In recent years, partisan divides have made it difficult for lawmakers to agree on comprehensive relief packages. The $2,000 stimulus proposal, if it moves forward, will likely face significant hurdles in Congress.

“The idea of using tariffs to fund direct payments is a non-starter for many lawmakers, especially those from trade-heavy states or those who oppose further tariffs,” said Representative James Tucker (R-TX), a member of the House Ways and Means Committee. “If we’re serious about relief, we need to focus on policies that don’t risk harming our economy.”

Despite these challenges, some lawmakers are hopeful that the proposal could gain traction as part of a broader economic package.

International Comparison: How Other Countries Have Handled Stimulus

The U.S. is not alone in its efforts to provide financial relief to citizens during times of crisis. Other countries, including Canada, the United Kingdom, and Germany, have implemented direct cash payments or tax cuts to support their economies.

Canada, for example, provided direct payments to its citizens through the Canada Emergency Response Benefit (CERB) during the pandemic, while the U.K. introduced a furlough scheme to support workers. Both countries’ approaches focused on direct financial aid, a model that many Americans hoped the U.S. government would follow.

Max Out Your Social Security: The Government’s Newly Uncovered 3-Step Trick to Hit $5,251 Monthly

In contrast, countries like Japan have relied more heavily on tax relief measures, including deductions for household spending and temporary reductions in the consumption tax. While these measures helped stimulate the economy, they were less visible to the public compared to direct cash payments.

FAQ About The $2000 Stimulus Lie

1. Will I receive a $2000 check from the government?

Currently, there is no formal plan for a direct $2000 payment. What has been suggested may involve changes to existing tax policies, which could result in gradual tax relief.

2. How is the $2000 stimulus funded?

The proposed $2000 stimulus is based on revenues from tariffs. However, experts have pointed out that these funds may not be enough to cover the cost of direct payments.

3. Why is there confusion about the $2000 stimulus?

The confusion stems from the fact that what is being presented as a new relief payment might actually be an extension or rebranding of already existing tax cuts. This has led to public uncertainty over whether the promise will translate into direct payments.