The SSI payments arriving early this month follow a scheduled adjustment by the Social Security Administration (SSA), which will deposit January’s benefit one day early because of the New Year’s Day federal holiday. The shift affects millions of low-income older adults, disabled individuals, and children nationwide, creating a month with two payments that some households may mistakenly view as extra income.

SSI Payments Arriving Early

| Key Fact | Detail |

|---|---|

| Early Payment | January’s SSI benefit will be deposited on Dec. 31, not Jan. 1 |

| Regular Payment | December’s benefit arrives Dec. 1 |

| Reason for Change | Jan. 1 is a federal holiday; benefits are paid on the prior business day |

| Who Is Affected | All SSI recipients, including disabled adults, older adults, and eligible children |

| Impact | December receives two deposits; February receives none |

| Official website | SSA |

Why SSI Payments Are Arriving Early This Month

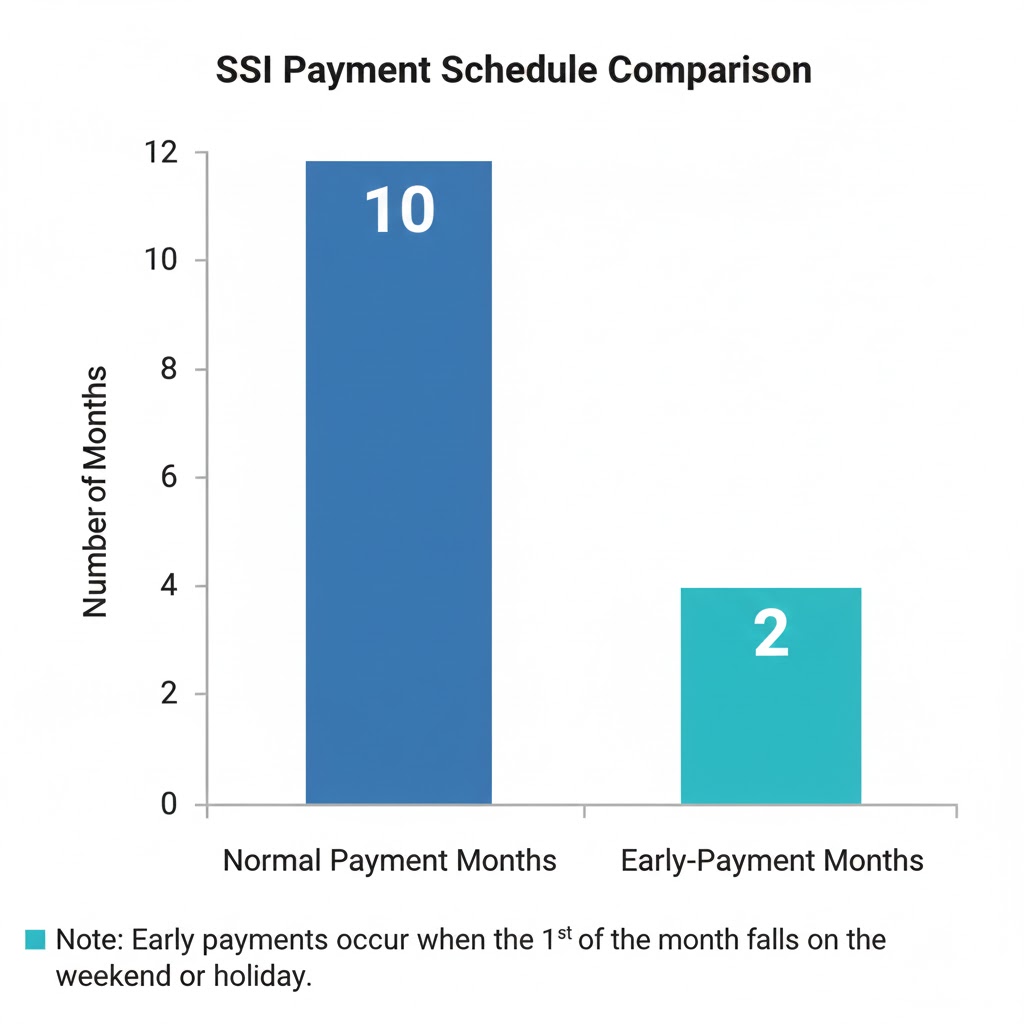

The Supplemental Security Income (SSI) program pays benefits on the first day of each month. But when that date falls on a weekend or federal holiday, the SSA moves the deposit to the nearest preceding business day.

Next month’s regularly scheduled date—January 1, 2026—falls on a holiday, prompting the SSA to deliver the payment on December 31, 2025 instead.

“Ensuring uninterrupted benefit access is a core responsibility of our agency,” an SSA representative said in a publicly released statement. “Holiday and weekend adjustments are routine and do not affect benefit eligibility or amounts.”

Dr. Melissa Han, a public policy specialist at the Urban Institute, said the adjustment “often causes confusion among recipients, especially those living on fixed incomes who may assume the extra deposit is a bonus. It is not.”

How the Social Security Schedule Works

The Social Security schedule depends on the type of benefit an individual receives. SSI operates on a fixed monthly schedule, while Social Security Disability Insurance (SSDI) and retirement or survivor benefits are paid based on the beneficiary’s birth date.

SSI Payment Rules

- Paid on the 1st of the month

- Advanced when the 1st falls on:

- A Saturday

- A Sunday

- A federal holiday

This creates a rare situation where two payments may fall within the same calendar month. However, the annual total remains unchanged.

Other Social Security Programs

Programs such as SSDI, retirement benefits, and survivor benefits follow mid-month schedules based on the recipient’s birth date.

Birth-date–based schedule:

- 1st–10th: Second Wednesday

- 11th–20th: Third Wednesday

- 21st–31st: Fourth Wednesday

This system is designed to spread payment processing across the month and reduce administrative strain.

Two SSI Payments: Who Will Receive Them and Why It Matters

This month, nearly 7.5 million SSI recipients, including more than 1 million children, will receive two deposits:

- December benefit: Dec. 1

- January benefit (early): Dec. 31

Important: This is not additional money. It is simply January’s payment issued one day early.

Why This Matters

Some recipients—particularly those managing disability-related expenses, rising rental costs, or medical bills not covered by Medicaid—may face financial strain in February, which has no SSI payment.

“Households should treat the December 31 deposit as income for January, not as money available for holiday spending,” said Louise Carter, a senior analyst at the Center on Budget and Policy Priorities.

How Early SSI Payments Affect Budgeting

Experts warn that two deposits in one month can create budget gaps later.

Key Financial Planning Challenges

- Longer gap between payments:

- December 31 to March 1 is the longest period without a new deposit for SSI recipients.

- Holiday spending pressure:

Some households may spend January’s income during late December. - Rent timing:

Many renters pay January rent before the end of December, increasing the likelihood of using two SSI payments at once.

Financial Guidance from Economists

Dr. Robert Martinez, professor of public finance at Georgetown University, said early deposits “can create a cash-flow imbalance, especially for low-income households without savings cushions.”

He recommends households:

- Label the Dec. 31 deposit as “January Funds”

- Set aside money for medications and utilities

- Avoid using the payment for holiday expenses

Nonprofit organizations such as United Way and local community service agencies also advise beneficiaries to review their budgets before early-payment months.

Who Qualifies for SSI Benefits?

Understanding who receives SSI helps explain why early payments can significantly impact household stability.

SSI Eligibility Includes

- Adults aged 65 or older with limited income

- Adults with disabilities meeting SSA criteria

- Children with qualifying disabilities

- Individuals with limited assets

Unlike Social Security retirement benefits, SSI is not based on a person’s work history. It is funded through general federal tax revenue, not the Social Security Trust Fund.

In 2025, the maximum federal SSI benefit is approximately:

- $943 for individuals

- $1,415 for couples

Some states supplement the federal amount, which leads to varying total benefit levels across the U.S.

Why This Issue Matters Now

The early SSI payment comes at a time when essential costs remain high for low-income Americans.

Cost Pressures Affecting SSI Recipients

- Rising rent in most U.S. cities

- Persistent inflation in groceries

- Higher energy bills during winter months

- Increased medical costs and prescription prices

According to a 2025 analysis from the Bureau of Labor Statistics (BLS), households reliant on fixed benefits are more exposed to inflation than higher-income households.

Dr. Serena Patel, an economist with Boston University, said, “Any disruption or shift in benefit timing—no matter how routine—has the potential to strain low-income families already managing tight budgets.”

Understanding the 2026 COLA Adjustment

Although this month’s early payment is not tied to the annual cost-of-living adjustment (COLA), the upcoming increase affects January’s benefit amount.

COLA Overview

Each year, the SSA adjusts benefits based on inflation as measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

The 2026 COLA is expected to raise SSI payments modestly, though official figures depend on final CPI-W data released in autumn.

Recipients will see the increased amount in the January benefit, which is delivered early—December 31.

December Social Security Payouts: The Updated Calendar Every Retiree Should Check

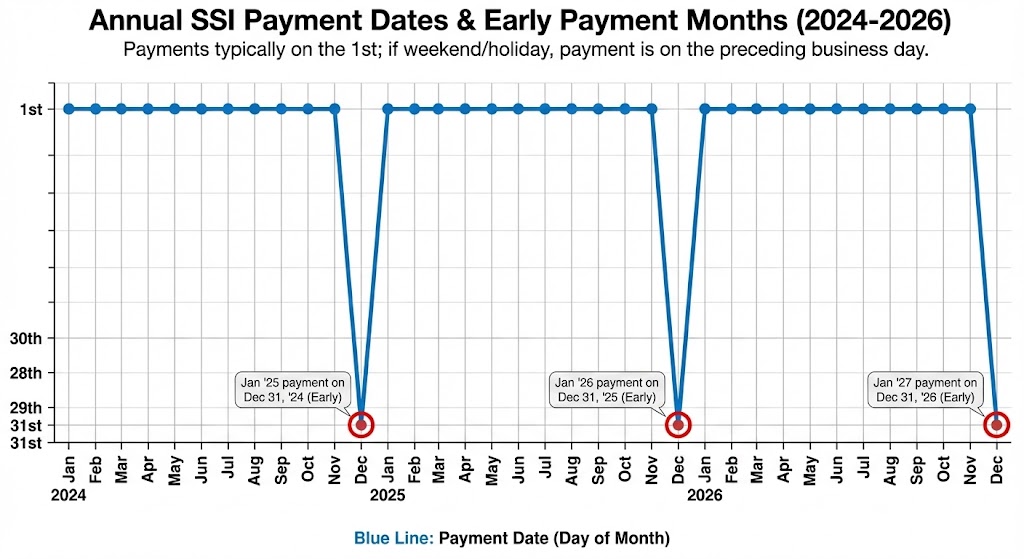

Full Payment Timeline for December, January, and February

SSI Payments

- December 1, 2025 – Regular December payment

- December 31, 2025 – Early January 2026 payment

- February 1, 2026 – No payment (since January’s benefit arrived early)

- March 1, 2026 – Next regularly scheduled payment

This cycle repeats annually whenever holidays fall on scheduled payment dates.

SSDI & Retirement Benefits

These follow the birthday-based schedule and will not experience a date shift in January.

Looking Ahead

The SSA will release the full 2026 payment schedule later this year, allowing beneficiaries and financial counselors to plan for months with adjusted deposit dates. Economists say early awareness is key, especially for families relying heavily on SSI for basic needs.

“Predictability is essential for low-income households,” said Dr. Martinez. “Any transparency the SSA provides can help families prepare and avoid unexpected financial stress.”