Millions of Americans receiving SSI checks will see their benefits arrive earlier than usual after the Social Security Administration (SSA) adjusted its payment schedule to accommodate federal holidays and banking rules. The shift affects beneficiaries whose deposits fall on non-business days, triggering a legally required early release. Officials say the long-standing policy prevents payment disruptions and supports households that depend on predictable monthly income.

SSI Checks Hitting Bank Accounts Early

| Key Fact | Detail / Statistic |

|---|---|

| Early SSI payments occur when the 1st falls on a weekend or federal holiday | Payment moves to the prior business day |

| Approximate SSI beneficiaries | 7.4 million nationwide |

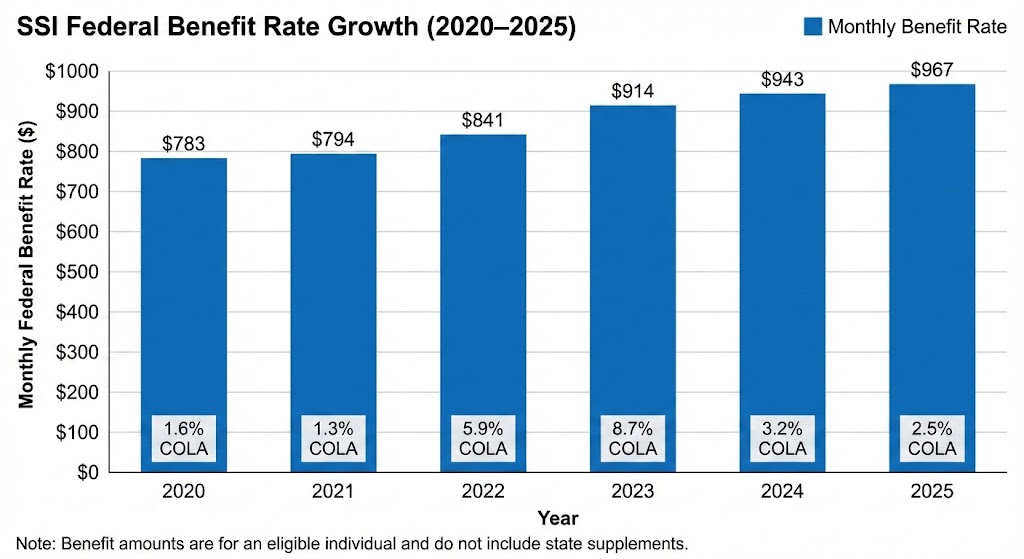

| 2024 Federal SSI payment | $943 per month for individuals |

| Official Website | SSA |

SSA officials say the agency will continue adjusting payment dates as required by federal guidelines, with several early-deposit months already scheduled in the fiscal calendar. Advocates urge beneficiaries to plan ahead and verify their deposit dates to maintain stable monthly budgets and avoid confusion when SSI checks appear early.

Why SSI Checks Are Arriving Early

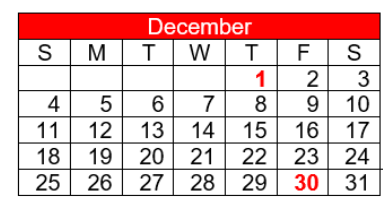

The early arrival of Supplemental Security Income (SSI) payments is a predictable result of the federal payment calendar. The Social Security Administration issues SSI benefits on the first day of each month. When that date falls on a weekend or federal holiday, the SSA releases the payment on the nearest earlier business day to ensure beneficiaries receive uninterrupted financial support.

Although the change often prompts confusion, the policy has been in place for decades, governed by federal guidelines that prohibit disbursements on days when the U.S. Treasury or commercial banks are closed.

The Three Criteria That Determine Early SSI Checks Deposit Eligibility

1. Enrollment in the Supplemental Security Income Program

Only individuals who receive Supplemental Security Income qualify for early deposits. SSI is designed for people with limited income and resources, including those aged 65 and older, individuals who are blind, and people with qualifying disabilities. The SSA reports that more than 7 million Americans rely on SSI for basic necessities such as housing, food, transportation, and healthcare.

2. Payment Date Falling on a Weekend or Federal Holiday

Calendar-based adjustments are the central reason SSI checks arrive early. If the first of the month coincides with a Saturday, Sunday, or recognized federal holiday, the SSA advances the payment to the previous business day. This shift prevents delays linked to the closure of the Treasury Department and financial institutions.

Historical data shows these adjustments typically occur four to six times per decade, although certain years—especially those with midweek holidays—can produce more frequent shifts.

3. Direct Deposit Participation

Most early payments affect beneficiaries enrolled in direct deposit, which provides faster access to funds compared with mailed paper checks. Financial institutions post deposits as soon as they receive the transfer from Treasury systems, though timing can vary slightly based on internal bank processing times.

How Often SSI Checks Arrive Early

Calendar-related changes are not new. A review of SSA archives shows that early SSI payments have occurred regularly since the program’s creation in 1972. During years when January 1 falls on a Monday or Tuesday, for example, the SSA often issues January benefits on the final business day of December—a shift that results in two payments within the same month.

Experts say these patterns are predictable and consistent with long-standing Treasury rules intended to maintain the financial stability of federal benefit recipients.

How Early Deposits Affect Monthly Budgets

Advocates for seniors and disabled Americans say early payments can create budgeting challenges. When two payments arrive in the same month, beneficiaries may mistakenly believe they have received an additional benefit. This misunderstanding can lead to cash shortages the following month, since the early payment simply replaces the upcoming check.

“An early deposit is not extra income,” said Dr. Karen Elliott, a senior fellow at the Urban Institute. “It is the next month’s benefit arriving early, and many households need help planning around the gap that follows.”

Organizations that work with low-income seniors encourage beneficiaries to mark early-payment months on their calendars to manage spending more effectively.

The Banking System’s Role in Early SSI Payments

Banks and credit unions play a key role in processing federal benefits. When the Treasury sends payments after business hours, many institutions automatically post them at midnight local time. Others require manual verification during early morning processing cycles.

A representative from the American Bankers Association said deposit timing depends on internal systems, though most institutions prioritize federal benefit payments for same-day access. Differences between banks explain why some recipients see deposits hours earlier than others.

Impact on People Using Mobile Banking and Payment Apps

For beneficiaries who use mobile banking platforms, early SSI checks may appear under “pending deposits” before officially clearing. Financial institutions increasingly rely on real-time payment systems, allowing some beneficiaries to view incoming funds up to 24 hours earlier.

However, experts caution that pending funds are not spendable until banks officially release them. Many mobile apps display expected deposit dates, but accuracy depends on the receiving bank’s policies.

Fraud Concerns and Scams Surrounding Early SSI Checks

Whenever SSI checks arrive early, fraud reports tend to increase. Scammers frequently target beneficiaries by impersonating SSA employees and claiming payment irregularities. According to the Federal Trade Commission (FTC), reports of Social Security-related fraud rise during months with modified payment schedules.

Typical scams include requests for personal information, threats of suspended benefits, or demands for “re-verification” fees.

SSA officials emphasize that the agency never calls beneficiaries to demand payment, threaten legal action, or request banking information. The agency urges recipients to hang up immediately if they receive suspicious calls.

What the Law Says About Early Payments

Federal regulations governing SSI payments are outlined in the Social Security Act and related Treasury guidelines. These rules restrict federal payments on days when government offices or banks are closed. To ensure compliance, the SSA must deliver payments before the closure.

Legal analysts note that this framework is unlikely to change unless Congress amends the statutory requirements. Lawmakers have introduced bills in recent years to streamline government payment systems, but none have significantly altered SSI payment timing.

Economic Implications of Early SSI Deposits

While early SSI payments do not affect federal spending totals, they can influence short-term cash flow among households living on limited income. Economists at the Center on Budget and Policy Priorities (CBPP) note that early deposits may cause temporary increases in consumer spending at the end of a month, followed by reduced activity in the month that follows.

Retail sectors servicing low-income consumers—such as discount grocery chains—often report slight fluctuations tied to federal benefit cycles.

However, because early deposits do not increase or decrease total annual benefits, economists say the broader macroeconomic impact remains limited.

What Beneficiaries Can Do to Prepare

Advocacy groups recommend several steps to minimize confusion:

1. Review the annual SSA calendar

The agency publishes a full year of payment dates, including all early-deposit months.

2. Keep written records

Noting which payment corresponds to which month helps prevent overspending.

3. Use the mySocialSecurity portal

This tool lets beneficiaries review upcoming payments, update direct deposit details, and track benefit history.

4. Confirm deposit timing with your bank

Most institutions provide deposit-availability details through online banking or customer service support.

December 18 Marks a New $1000 Direct Payment — Only One State Qualifies

Voices From the Community: How Early Payments Affect Households

Interviews with nonprofit organizations reveal a wide range of responses to the early deposits. Some beneficiaries appreciate having access to funds before holiday closures when expenses are higher. Others find the timing creates confusion, particularly if they forget that the next month’s payment will be delayed.

Maria Lopez, a 62-year-old SSI recipient in Arizona, said early deposits help her “catch up on utility bills before holiday office closures.”

But David Turner, a disability advocate in Ohio, said beneficiaries often “mistake two payments in one month for increased benefits,” leading to budgeting issues.

These perspectives underscore the importance of financial literacy programs for seniors and disabled individuals who rely on consistent monthly income.

SSA Response and Planned Improvements

The Social Security Administration says it is exploring digital tools that provide clearer alerts when payments are scheduled for early release. Officials say they aim to simplify communication, especially for beneficiaries who do not use online systems regularly.

A spokesperson said the agency is also studying ways to expand multilingual notifications to ensure that more beneficiaries understand payment timing.