SSDI Policy Changes Ahead in 2026 will introduce higher monthly payments for Social Security Disability Insurance recipients while adjusting work limits and administrative practices that govern eligibility and access. The updates, driven largely by inflation indexing and long-standing federal rules, are expected to affect more than eight million disabled workers nationwide beginning in January.

SSDI Policy Changes

| Key Fact | Detail |

|---|---|

| Benefit increase | Annual cost-of-living adjustment applied |

| Work limits | Higher earnings thresholds for SSDI recipients |

| Eligibility rules | No major statutory overhaul finalized |

| Access to services | Continued shift toward remote services |

As 2026 approaches, SSDI recipients can expect modestly higher payments, updated work thresholds, and continued reliance on remote services. While long-term reform discussions persist, the core structure of Social Security Disability Insurance remains intact, offering stability to millions who depend on it.

Cost-of-Living Adjustment Raises SSDI Payments

The most immediate and widely felt change under SSDI Policy Changes Ahead in 2026 is the annual cost-of-living adjustment (COLA) applied to disability benefits. The COLA is calculated using a federal inflation index and is intended to ensure that SSDI payments do not lose purchasing power as consumer prices rise.

Beginning in January, all SSDI recipients will see an automatic increase in their monthly payments. The adjustment applies uniformly and does not require beneficiaries to take action. New applicants approved in 2026 will also have their initial benefit amounts calculated using the updated figures.

Although the increase is smaller than those seen during periods of high inflation, it reflects a return to more typical economic conditions. Analysts note that COLAs are mechanical rather than discretionary, meaning they are not influenced by political negotiations or legislative votes.

For beneficiaries, the increase can help offset higher costs for housing, utilities, food, and transportation. However, experts caution that inflation adjustments rarely cover all household expenses equally, particularly for individuals with medical or accessibility-related costs.

Earnings Limits Adjusted for Working Beneficiaries

Another central component of Social Security Disability Insurance updates in 2026 involves changes to how much beneficiaries can earn while still receiving benefits. These rules are critical for recipients who are able to work part-time or test a return to employment.

Two key thresholds are adjusted annually:

- Substantial Gainful Activity (SGA): The monthly earnings level above which a beneficiary may be considered capable of competitive employment and risk losing SSDI eligibility.

- Trial Work Period (TWP): A program that allows beneficiaries to work for a limited number of months without immediate loss of benefits, regardless of earnings.

Under SSDI eligibility rules 2026, both thresholds will rise to reflect overall wage growth. This means beneficiaries can earn more before triggering reviews or benefit suspensions.

Disability policy specialists emphasize that these provisions are designed to reduce fear around work attempts. “The system recognizes that capacity can change over time,” said one former SSA adviser. “Higher thresholds reduce the risk of beneficiaries being penalized for trying to improve their financial independence.”

Still, advocates stress the importance of accurate reporting. Exceeding earnings limits without proper documentation can result in overpayments, which the SSA may later seek to recover.

No Major Eligibility Overhaul Finalized

Despite recurring debate over tightening disability standards, SSDI Policy Changes Ahead in 2026 do not include a major overhaul of eligibility criteria.

In recent years, policymakers explored updating the medical and occupational data used in disability determinations. Proponents argued that modernization could reflect changes in the labor market. Critics warned that stricter criteria could exclude older workers, people with multiple impairments, or those in physically demanding jobs.

Ultimately, no sweeping regulatory changes were finalized for 2026. Existing evaluation frameworks, including medical listings and vocational considerations, remain in place.

This outcome reflects a broader policy caution. Disability determinations are complex, and even small changes can affect large numbers of applicants. Maintaining stability, officials argue, helps ensure fairness and consistency in decision-making.

Administrative Changes May Affect Access

While benefit formulas and eligibility standards remain largely stable, SSDI Policy Changes Ahead in 2026 continue a longer-term shift in how beneficiaries interact with the Social Security Administration.

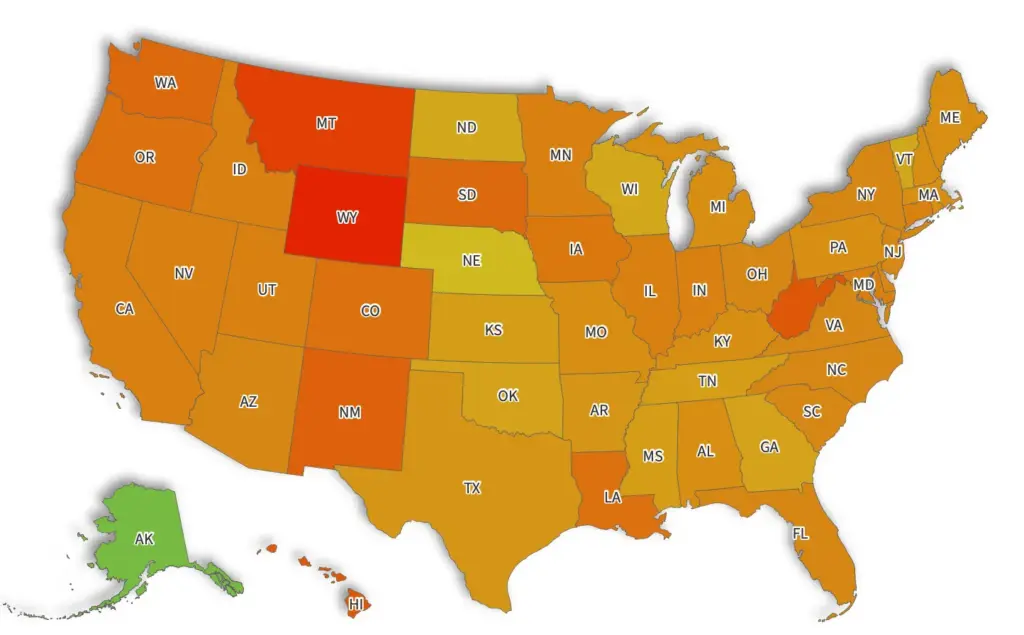

The agency has increasingly emphasized online portals, telephone services, and mailed documentation to manage workloads and staffing pressures. In-person field offices remain operational, but appointments may be more limited in some regions.

Supporters of digital services say they improve efficiency and reduce wait times. Critics counter that remote systems can disadvantage people with disabilities, limited digital literacy, or unreliable internet access.

Advocacy organizations have urged the SSA to preserve in-person options, particularly for complex cases involving appeals, overpayments, or medical evidence disputes.

How Medicare Costs Interact With SSDI Payments

One factor often overlooked in discussions of the SSDI benefit increase 2026 is the interaction between SSDI and Medicare.

Most SSDI recipients become eligible for Medicare after receiving disability benefits for 24 months. Once enrolled, Medicare Part B premiums are typically deducted directly from SSDI payments.

As healthcare costs rise, premium increases can partially offset COLA-related gains. For some beneficiaries, this means their net monthly payment increases only slightly, or remains nearly flat, despite a higher gross benefit.

Policy analysts note that this interaction is structural rather than new. However, it remains a key issue for recipients on fixed incomes, especially those with significant out-of-pocket medical expenses.

Long-Term Financing and Program Stability

Beyond immediate changes, SSDI Policy Changes Ahead in 2026 take place against a backdrop of broader concerns about the long-term financing of Social Security programs.

SSDI is funded through payroll taxes and operates as part of the broader Social Security trust fund structure. While near-term payments are considered secure, long-term projections show financial pressures as the population ages and workforce growth slows.

Experts widely agree that any major reforms would require congressional action and would likely be phased in gradually. Abrupt benefit cuts for current recipients are generally viewed as politically and socially unlikely.

For now, policymakers have focused on incremental adjustments rather than structural changes.

Impact on New Applicants vs. Current Beneficiaries

The 2026 changes affect different groups in different ways.

- Current beneficiaries will primarily experience higher payments and adjusted work thresholds.

- New applicants will have their benefits calculated using updated wage and inflation data, which can influence initial award amounts.

- Applicants in appeals will see no procedural overhaul, though administrative backlogs remain an ongoing concern.

Disability advocates emphasize that application success still depends heavily on medical documentation, work history, and consistency in records.

What Beneficiaries Should Do to Prepare

Although most changes are automatic, experts recommend that SSDI recipients take several proactive steps:

- Review annual benefit notices carefully.

- Report earnings accurately and promptly.

- Monitor Medicare premium deductions.

- Keep medical records updated in case of continuing disability reviews.

Financial counselors also advise beneficiaries to reassess household budgets each year, especially when COLAs coincide with rising costs in housing or healthcare.

SNAP Update: 18 States Plan to Limit Junk Food Purchases Starting in 2026

Broader Context: Stability Amid Ongoing Debate

Overall, SSDI Policy Changes Ahead in 2026 reflect continuity rather than disruption. The program continues to rely on established formulas and administrative practices while adapting gradually to economic conditions and service demands.

Disability policy remains an area of active debate, balancing fiscal sustainability with the needs of vulnerable populations. For now, the emphasis remains on predictability and gradual adjustment.

FAQs About SSDI Policy Changes

Will SSDI payments increase in 2026?

Yes. A cost-of-living adjustment will raise monthly benefits beginning in January.

Are SSDI eligibility rules changing in 2026?

No major eligibility changes are scheduled.

Can beneficiaries earn more while on SSDI?

Yes. Earnings thresholds will increase, allowing more income before benefits are affected.

Will Social Security offices still offer in-person services?

Yes, though remote services will continue to play a larger role.