WASHINGTON — The Social Security Administration (SSA) has finalized the official payment calendar for 2026, revealing a scheduling quirk that will force millions of retirees to wait longer than usual for their first checks of the year. While benefits are increasing due to a 2.8% Cost-of-Living Adjustment (COLA), the way January’s Wednesdays fall on the calendar means most recipients will not see their funds until the second half of the month.

2026 Social Security Schedule

| Key Fact | Detail/Statistic |

| 2026 COLA Increase | 2.8% boost to monthly benefits |

| First General Payment | Wednesday, January 14, 2026 |

| SSI Early Delivery | December 31, 2025 (due to Jan 1 holiday) |

| Average Retiree Increase | Approximately $56 per month |

| Medicare Part B Premium | Rising to $202.90 per month |

The January “Wait”: Understanding the SSA’s 2026 Payment Schedule

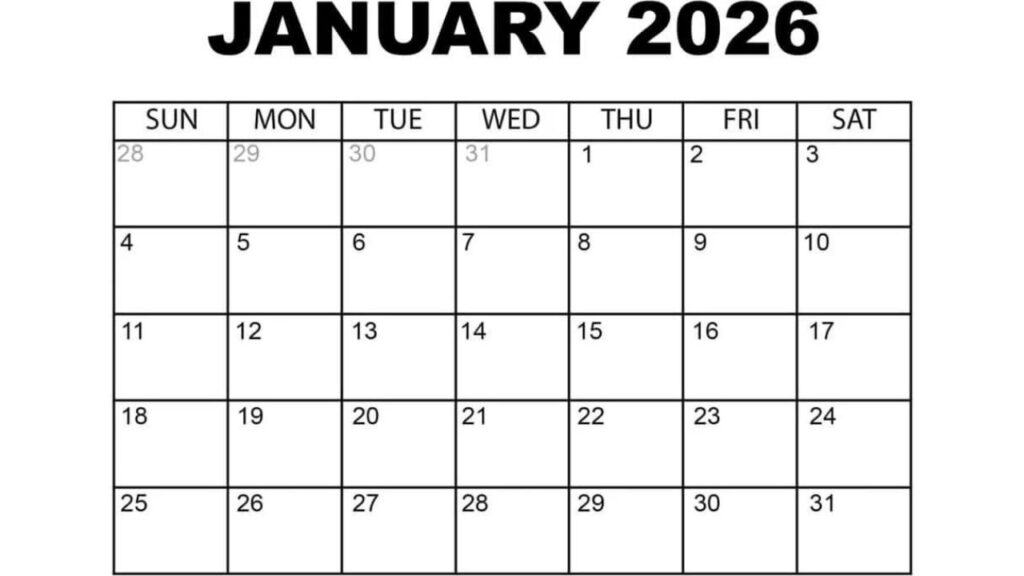

For the 70 million Americans relying on federal benefits, the SSA’s 2026 Payment Schedule dictates exactly when inflation-adjusted funds arrive. In 2026, January begins on a Thursday. Because the SSA distributes the bulk of its payments on the second, third, and fourth Wednesdays of the month, the “second Wednesday” falls as late as possible—January 14.

This creates a significant gap for those who received their final 2025 payment in mid-December. For many, this three-to-four-week interval requires careful holiday budgeting to ensure essential costs are covered before the new year’s first deposit hits.

Birth Date Groups and Payment Dates

The agency follows a rigid system based on the recipient’s day of birth to manage the volume of transactions. This system remains unchanged for 2026, though the calendar dates shift:

- Birthdays 1st – 10th: Paid on the second Wednesday (Jan. 14, 2026).

- Birthdays 11th – 20th: Paid on the third Wednesday (Jan. 21, 2026).

- Birthdays 21st – 31st: Paid on the fourth Wednesday (Jan. 28, 2026).

Exceptions: Who Receives Payments Early?

While most retirees must wait until mid-month, certain groups will receive their COLA-adjusted benefits sooner. Under federal law, if a payment date falls on a weekend or a federal holiday, the SSA must move the deposit to the preceding business day.

Supplemental Security Income (SSI) Timing

Since January 1 is a federal holiday, Supplemental Security Income (SSI) recipients will receive their January payment on Wednesday, December 31, 2025. This results in a “double payment” in December. Federal officials emphasize that this is not a bonus check but an advance of the January funds. Recipients are encouraged to budget accordingly, as no further SSI payments will be issued in the month of January.

Pre-1997 Beneficiaries

Those who began receiving benefits before May 1997, or who receive both Social Security and SSI, are typically paid on the third of each month. In January 2026, the third falls on a Saturday. Consequently, these checks will be issued on Friday, January 2, 2026.

The Impact of the 2.8% COLA Increase

The 2026 adjustment is designed to help seniors keep pace with inflationary pressures on items like groceries and utilities. According to data from the Bureau of Labor Statistics (BLS), the increase is tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

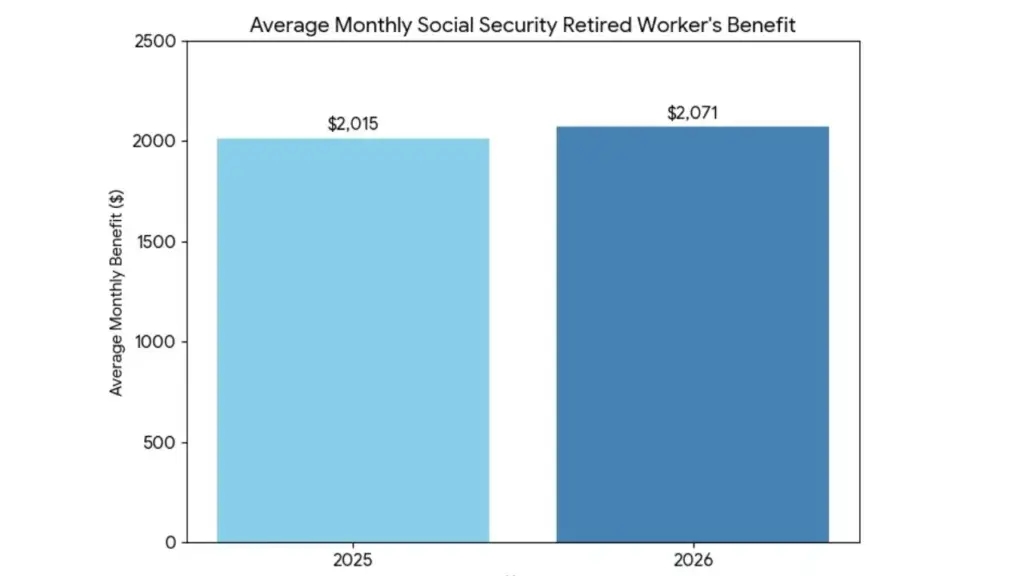

- Average Retiree: Monthly checks will rise by roughly $56, reaching an average of $2,071.

- Couples: A retired couple both receiving benefits can expect an average of $3,208.

- Maximum Benefit: For those retiring at full retirement age, the maximum monthly check rises to $4,152.

However, the “net” gain for many seniors will be lower than the headline percentage. The Centers for Medicare & Medicaid Services (CMS) confirmed that Medicare Part B premiums will rise to $202.90 in 2026. This $17.90 increase will be deducted directly from most Social Security checks, effectively consuming a portion of the COLA raise.

Administrative Changes and Improved Service

The SSA enters 2026 following significant upgrades to its customer service infrastructure. Data released by the agency indicates that average wait times on the national 800-number decreased from 30 minutes in early 2025 to roughly seven minutes by the end of the year. This improvement comes as the agency handled approximately 68 million calls, a 65% increase in volume over the previous fiscal period.

Furthermore, the agency has expanded its digital offerings. Most beneficiaries can now access their COLA notices via the “my Social Security” portal. This electronic access is designed to reduce reliance on physical mail, which often faces seasonal delays during the December and January period.

Managing the Transition to 2026

Financial experts suggest that beneficiaries should review their January bank statements carefully. The combination of the late-January schedule for most and the rising Medicare premiums means the first check of the year may differ from previous expectations.

The agency maintains that electronic transfer remains the most reliable method of delivery. For the small percentage of beneficiaries still receiving paper checks, the SSA warns that mail processing times during the holiday season could add additional days to the already late January schedule. If a payment does not arrive by the scheduled date, the SSA advises waiting three additional mailing days before contacting a local office.

Looking Ahead to 2026: How the Social Security COLA Could Affect Medicare Costs

FAQs About 2026 Social Security Schedule

1. Why is my January 2026 Social Security check “delayed”?

Technically, it is not delayed but scheduled according to a calendar shift. Since January 1, 2026, is a Thursday, the “second Wednesday” of the month (the first payment date for most) doesn’t occur until January 14. This is the latest possible date for that first payment cycle.

2. How much will my Social Security check increase in 2026?

Most beneficiaries will see a 2.8% increase. On average, this amounts to roughly $56 more per month for a retired worker.

3. Will the 2026 Medicare premium increase affect my COLA?

Yes. The standard Medicare Part B premium is rising to $202.90. Since this is usually deducted from Social Security checks, it will offset some of your 2.8% raise.

4. Why did SSI recipients get two checks in December 2025?

Because January 1 is a holiday, the SSA moves the January 1 payment to the nearest business day, which is December 31. This is an advance, not an extra payment.

5. How can I see my exact 2026 benefit amount before my check arrives?

You can log into your “my Social Security” account online. COLA notices are typically uploaded to the Message Center starting in early December.