The Social Security Administration has released its annual SSA Year-End Report, outlining the most significant developments in Social Security benefits, policy adjustments, staffing, and long-term financial pressures for the coming year. The report highlights updates for 2025, including the cost-of-living adjustment, administrative improvements, and the challenges facing the system as America’s population continues to age.

SSA Year-End Report

| Key Fact | Detail |

|---|---|

| COLA increase | 2.5% benefit increase for 2025 |

| Maximum taxable earnings | Maximum wage base increases to $176,100 |

| Trust fund outlook | Retirement trust fund projected to face depletion around 2033 without legislative action |

The SSA Year-End Report signals both progress and warning. While the agency has improved service delivery and increased benefits modestly for 2025, the long-term financial challenges remain serious. The broader message is clear: the system is stable in the short term, but future solvency will require legislative action. Beneficiaries and workers alike are encouraged to plan with flexibility as debates about Social Security’s future continue.

SSA Year-End Report

The annual report provides a broad overview of the agency’s performance, upcoming changes, administrative workload, beneficiary demographics, and long-term financial projections. It reviews the Old-Age and Survivors Insurance program, the Disability Insurance program, Supplemental Security Income, and service delivery operations across the nation.

The agency reports progress in service delivery, highlighting reduced wait times on telephone lines and in field offices. Increased use of digital tools also played a major role in easing pressure on staff. More beneficiaries are now applying online or using digital portals to manage their accounts.

Major Policy Changes

Cost-of-Living Adjustment (COLA)

A 2.5 percent cost-of-living adjustment will be applied to monthly benefits beginning in January 2025. This increase reflects moderate inflation and results in slightly higher Social Security payments for retirees, disabled individuals, and survivors.

The average monthly retirement benefit is expected to rise modestly, offering some financial relief but falling short of covering the full increase in essential living expenses for many households, especially in healthcare and housing.

Eligibility, Earnings, and Tax Parameters

Several technical parameters will adjust in 2025:

- The maximum amount of earnings subject to Social Security payroll tax will rise to $176,100.

- Workers need to earn $1,810 in wages or self-employment income to receive one Social Security credit.

- Individuals who work while collecting benefits will face updated earnings-test limits before benefits are temporarily withheld.

These adjustments reflect wage growth and inflation trends and influence how future benefits are calculated for millions of workers.

Financial Outlook and Long-term Risk

Projected Trust-Fund Depletion

A major focus of the report is the continued projection that the retirement trust fund could be depleted around 2033 if no legislative changes are made. After that point, the system would only be able to pay a portion of scheduled benefits through incoming payroll taxes alone.

Current estimates suggest that without intervention, benefits could be reduced by roughly a fifth. This long-term imbalance is driven primarily by demographic changes, such as the retirement of baby boomers, longer life expectancies, and fewer workers supporting each beneficiary compared to previous decades.

Why the Shortfall Exists

Three major structural issues contribute to the funding gap:

- Fewer workers per retiree as the population ages.

- Wages forming a smaller share of total compensation over time, reducing payroll tax revenue.

- Beneficiaries collecting benefits for longer periods due to increased life expectancy.

The report emphasizes that these forces have been building for many years, meaning that adjustments to the system become more difficult the longer Congress waits to act.

Service Delivery, Staffing, And Digital Modernization

Improved Service Times

The SSA reports noticeable improvements in service wait times. The agency reduced phone wait times, cut delays for disability decisions, and handled more cases digitally. These enhancements are critical, as millions of people rely on timely assistance every year.

Modernization Efforts

The year-end review highlights major steps in updating digital systems. More beneficiaries than ever before used online services to apply for benefits, check eligibility, or manage their accounts. The agency continues to identify internal reforms to reduce administrative costs and streamline operations.

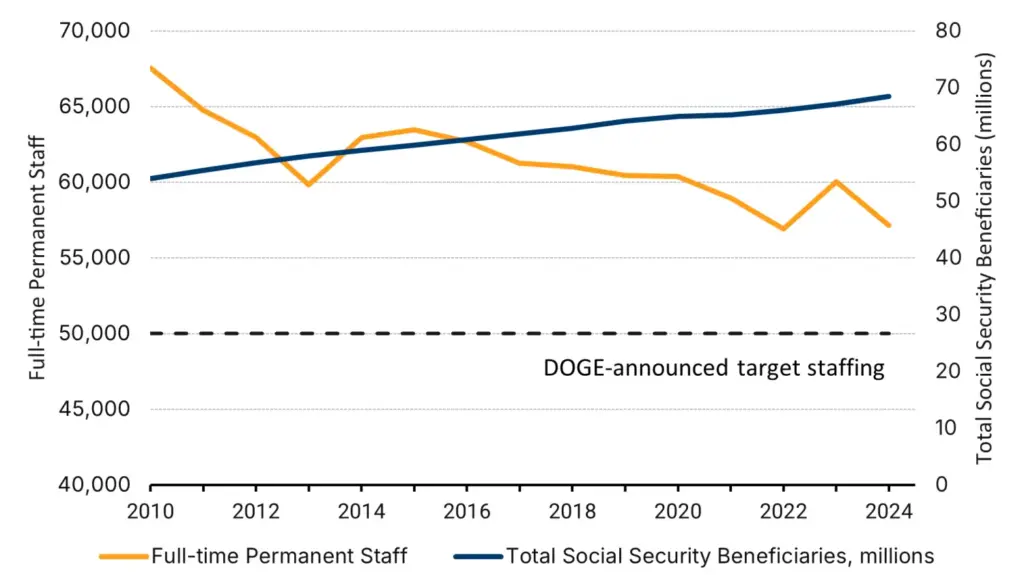

While progress has been made, the report notes that technology and staffing challenges persist. Disability claim backlogs, older computer systems, and heavy workloads continue to affect service delivery in many regions.

What This Means For Americans

Impact on Current Beneficiaries

For retirees and other beneficiaries already receiving Social Security payments, the 2.5 percent COLA offers modest support. But rising prices in housing, healthcare, and utilities continue to outpace general inflation for many older Americans, meaning the adjustment may feel limited in practical terms.

Impact on Future Retirees

For younger workers, the SSA Year-End Report underscores a growing reality: future benefits are subject to legislative changes that may reduce growth rates or adjust eligibility. The trust-fund projections are especially significant for workers in their 20s, 30s, and 40s, who may see different rules by the time they retire.

Financial planners often emphasize the importance of diversification and early retirement planning given the system’s long-term uncertainty.

Expert Perspective

Many retirement policy researchers warn that waiting to enact reforms increases the eventual cost and complexity of the solution. Measures such as tax adjustments, eligibility changes, or benefit formula modifications become more challenging the longer they are delayed.

Social Security Tax Guide — Income Limits That Determine Whether Your Benefits Are Taxed

Broader Context: Economic And Demographic Pressures

Economic Assumptions

The report stresses that economic downturns, slower wage growth, or increased disability claims could place additional pressure on Social Security’s finances. Conversely, stronger productivity, higher employment levels, or increased immigration would improve the system’s outlook.

Changing Demographics

The American population continues to age. Lower birth rates, longer lives, and slower workforce growth all create long-term funding stresses. These demographic realities are central to the projections and underscore the need for thoughtful policy changes in the coming years.

Case Studies: How Changes Affect Real People

A retired worker earning the maximum benefit in 2025 will see a modest increase from the COLA adjustment, but may still face higher healthcare premiums and rising living costs. The report notes that fixed-income households remain especially vulnerable to inflation that exceeds the COLA formula.

A worker in their early 60s, earning near the taxable earnings ceiling, will pay payroll taxes on a larger portion of income due to the increased wage base. While this raises future benefits, it also underscores the importance of planning for potential reforms affecting their eventual payouts.

These cases show how the same Social Security changes can affect people differently depending on age, income, and retirement status.