A Social Security timing mistake involving early benefit claims and continued employment is placing many U.S. retirees at risk of losing their full $2,000 monthly payment. The problem stems from long-standing federal earnings limit rules that reduce Social Security benefits for individuals who work before reaching full retirement age. Officials and economists say the issue is often overlooked, despite its impact on millions of Americans entering retirement with insufficient savings.

Social Security Timing Mistake

| Key Fact | Detail / Statistic |

|---|---|

| Earnings limit for beneficiaries under full retirement age | $23,240 in 2025 |

| Withholding rate for excess earnings | $1 withheld for every $2 over the limit |

| Impact on $2,000 monthly benefit | Payment may be fully withheld |

| Official Website | Social Security Administration |

As more Americans work later in life, the earnings limit and the broader question of when to claim Social Security are becoming central to retirement planning. Officials say updated guidance will be released later this year to help future retirees make informed decisions and avoid costly mistakes.

Why the Social Security Timing Mistake Matters

A growing share of Americans are unintentionally triggering federal withholding rules by claiming benefits too early, according to the Social Security Administration (SSA). Many claim at 62, unaware that continuing to work—even part-time—can immediately put their benefits at risk.

Jeffrey Basner, an SSA spokesperson, said in a recent briefing that “many beneficiaries do not realize how quickly modest employment earnings can affect their benefits.” He added that benefit withholding is not a penalty but a requirement mandated by Congress to align early claiming with long-term program sustainability.

Retirement researchers say a misunderstanding of the earnings limit is now one of the most common errors made by soon-to-be retirees.

How the Earnings Limit Reduces Social Security Benefits

Key Mechanisms Explained

The federal earnings limit applies only to individuals who have not yet reached their full retirement age—typically 66 or 67 depending on birth year. The threshold represents the maximum a working beneficiary may earn without triggering withholding.

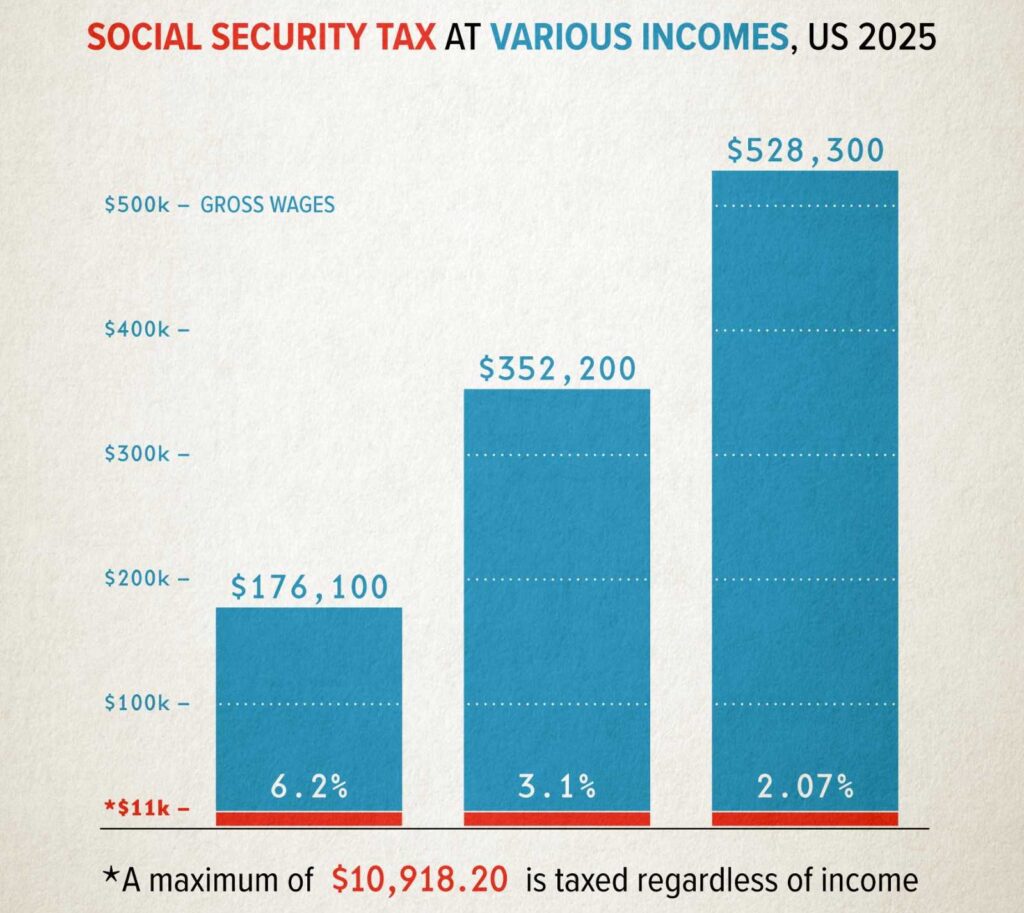

In 2025, the earnings limit is $23,240, according to SSA’s annual inflation adjustments. Workers exceeding that amount face a withholding rate of $1 for every $2 earned above the limit.

Financial analysts explain that even a small amount of additional income—holiday work, overtime, or a tax refund counted as earnings—can eliminate an entire monthly payment.

Early Claiming and Increased Vulnerability

The interaction between early claiming and the earnings test creates a financial challenge for households already struggling to prepare for retirement.

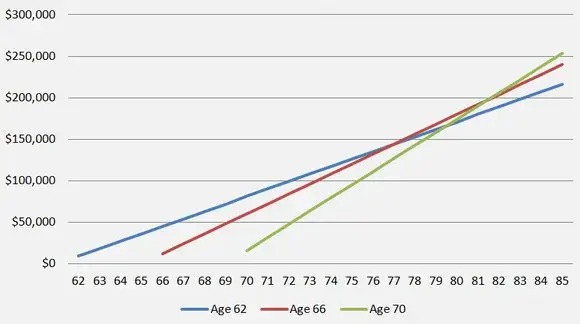

According to projections from the Congressional Budget Office (CBO), claiming benefits at age 62 results in a reduction of 25 to 30 percent in lifetime monthly payments. Workers who file early often do so because they need immediate income or because they misunderstand how the system functions.

“Retirees often underestimate how much modest employment can affect their benefits,” said Dr. Anya Moreno, a senior economist at the Urban Institute. “In many cases, people claim early because of financial pressure, and later discover that working even a few hours per week eliminates a significant portion of their monthly income.”

Historical Context: How the Earnings Limit Evolved

The earnings limit, often misunderstood as a penalty, has existed in some form since the Social Security Act became law in 1935. Originally designed to encourage older workers to permanently exit the workforce, the rule limited how much retirees could earn before losing benefits.

In the 1990s, Congress revised the policy, removing the earnings test for beneficiaries who had reached full retirement age. The test, however, was left in place for early filers, reflecting concerns about the long-term financial sustainability of the Social Security Trust Fund.

Economists note that the rule is unlikely to disappear soon, as the program continues to face structural funding challenges. The Trustees Report published by the U.S. Treasury indicates that the Old-Age and Survivors Insurance (OASI) fund may face shortfalls in the next decade without policy changes.

A Growing Challenge: Demographic Shifts and Workforce Trends

The earnings limit affects more people today due to demographic changes. Older Americans are working at higher rates than in past generations. According to data from the U.S. Bureau of Labor Statistics (BLS):

- Nearly 20 percent of people aged 65 and older remain in the labor force.

- Employment among adults aged 60–64 has grown steadily over the past decade.

These trends reflect rising life expectancy, limited retirement savings, and the shift away from employer-provided pensions. As a result, more workers find themselves navigating the complex relationship between wages and early Social Security benefits.

Real-World Impact of Social Security Timing Mistake: Who Is Most Affected?

Retirement experts say several groups are disproportionately impacted:

Workers in Seasonal or Variable-Income Jobs

Retail, agriculture, hospitality, and gig-economy workers often earn fluctuating wages. A short-term surge in earnings can unintentionally trigger benefit withholding.

Low- and Moderate-Income Households

These retirees are more likely to claim benefits early and continue working due to financial necessity.

Women and Caregivers

Women are more likely to have interrupted careers and lower lifetime earnings, making them more vulnerable to early claiming and subsequent withholding.

Divorced or Widowed Individuals

Those unaware of spousal or survivor benefits may claim early without realizing that they qualify for potentially higher alternative benefits.

Experts Urge Workers to Review Their Earnings and Claiming Strategy

Recommendations From Financial Planners

Financial planners recommend that individuals approaching retirement:

- Model their expected earnings for the next several years.

- Review their Social Security statement at least annually.

- Consult a certified financial planner or retirement specialist.

- Consider delaying benefits until full retirement age, or even age 70.

Mark Hensley, a certified financial planner interviewed by the Associated Press, said, “For workers who expect to remain employed, delaying benefits is often the most effective way to avoid the earnings limit entirely and secure higher payments later.”

Government Officials Stress Withholding Is Not Permanent

The SSA points out that withheld benefits are typically credited back once an individual reaches full retirement age. This adjustment results in slightly higher monthly checks moving forward. However, experts at the Brookings Institution caution that the “break-even” point varies, and some retirees may never fully recover the withheld amounts.

Limited Public Awareness Despite Federal Outreach

A 2024 survey by the Pew Research Center found that fewer than 40 percent of adults aged 55–64 understood how the earnings test functioned. Many respondents believed the test applied for life, not realizing that it ends at full retirement age.

Advocacy organizations argue that the SSA must expand public education, noting that many workers receive little guidance before making major retirement decisions.

Policy Debate: Should the Earnings Limit Be Reformed?

Economists and lawmakers continue to debate whether the earnings limit unfairly penalizes older workers or serves an important budgetary function.

Supporters of reform argue that:

- The rule discourages work at a time when labor shortages persist.

- Many retirees misunderstand the policy, leading to financial hardship.

- A simpler system would improve public trust in Social Security.

Others argue that:

- Removing the earning test could significantly increase program costs.

- Early claimers already receive reduced lifetime benefits; additional incentives may be unsustainable.

Congress has considered proposals to adjust or eliminate the earnings test several times, but no major changes are currently underway.

New Jersey Residents Could See Year-End Refunds — Are You Eligible for Extra Support for Seniors?

Practical Steps for Retirees to Avoid the Timing Mistake

Experts recommend the following steps:

- Calculate expected earnings before filing. Even minor income changes can trigger withholding.

- Verify all information on your SSA earnings record. Errors can affect benefit calculations.

- Consider coordinating claiming decisions with a spouse. Spousal benefits may provide higher income.

- Plan for year-end income sources such as bonuses, freelance work, or lump-sum payouts.

- Use SSA’s online calculators to estimate withholding under different earnings scenarios.

FAQs About Social Security Timing Mistake

How does the earnings limit affect my Social Security benefits?

It reduces early retirement benefits by withholding $1 for every $2 earned above the annual limit.

Can withheld benefits be recovered later?

Yes. The SSA recalculates benefits at full retirement age to account for withheld months.

Does the earnings limit apply after full retirement age?

No. The rule ends entirely once a beneficiary reaches full retirement age.