In a move marking a significant Social Security Reversal, the U.S. government has eased its plan to end paper checks for benefit payments, acknowledging persistent gaps in banking access and digital infrastructure. The Social Security Administration confirmed it will continue issuing paper checks for Americans without viable electronic options, reversing a previously announced “final” deadline set for September 30, 2025.

Social Security Reversal

| Key Fact | Detail |

|---|---|

| Paper checks were set to end September 30, 2025 | Reversal allows limited exemptions |

| Less than 1% of recipients still use paper checks | About 600,000 nationwide |

| Paper checks cost three times more to issue | $100M annual savings possible |

| Policy softened after public and bipartisan pushback | Concerns over access for unbanked Americans |

Government Walks Back “Final” Deadline

The Social Security Administration (SSA) has reversed its plan to end paper check payments after September 30, 2025, acknowledging that not all beneficiaries can transition to digital payments.

The change comes amid widespread criticism that the move risked excluding elderly, disabled, and unbanked Americans from receiving their monthly benefits.

“Where a beneficiary has no other means to receive payment, we will continue to issue paper checks,” the SSA said in a statement quoted by The Washington Post.

The reversal, quietly confirmed in October, reflects a growing recognition that technology adoption gaps persist across age, geography, and income levels.

The Push for Modernization

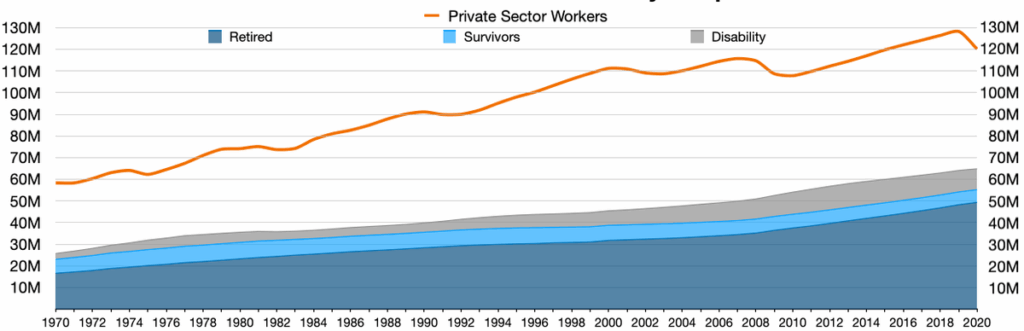

Federal officials have long sought to phase out paper checks for Social Security and other benefit programs. The effort began in the 1990s, with a major push in 2011, when the Treasury required most new beneficiaries to enroll in direct deposit or the government’s Direct Express Debit Card.

By 2025, more than 99 percent of the SSA’s 72 million monthly payments were already digital.

“This is one of the most successful modernization campaigns in federal financial history,” said Timothy Grady, spokesperson for the Bureau of the Fiscal Service, the Treasury branch managing payments.

Electronic payments, he added, are faster, cheaper, and far less prone to theft or misdelivery.

Why the Deadline Was Reconsidered

Despite overwhelming digital adoption, the remaining 1 percent represents hundreds of thousands of people—mostly seniors, residents in rural areas, and individuals with disabilities.

According to the Federal Deposit Insurance Corporation (FDIC), about 5 million U.S. households remain unbanked. These households are disproportionately low-income, minority, or elderly.

“It’s not just about convenience; it’s about access,” said Dr. Maria Hernandez, senior policy fellow at the Brookings Institution. “A fully digital system risks leaving behind those who already face barriers to participation in the economy.”

Economic Considerations

The Treasury estimates that paper checks cost roughly three times more to issue than electronic payments—about 50 cents per check compared with 15 cents per direct deposit.

Eliminating paper checks could save taxpayers over $100 million per year, but officials admit cost savings alone cannot justify policies that risk excluding vulnerable populations.

“We have a fiscal responsibility to modernize,” said Deputy Treasury Secretary Linda Porter, in a September briefing. “But we also have a moral responsibility to ensure every American can safely access their benefits.”

The Human Impact

For recipients like Doris Mitchell, an 82-year-old retiree from rural Mississippi, paper checks remain essential. Her small town lacks a local bank, and her prepaid debit card was once lost in the mail.

“When my check comes in the mail, I can hold it in my hand and walk it to the store,” she told CBS News. “That’s how I know it’s real.”

Advocacy groups like AARP and the National Council on Aging have applauded the SSA’s flexibility. They argue that ending paper checks abruptly could leave thousands of seniors temporarily without income.

“This adjustment ensures continuity,” said Nancy LeaMond, AARP’s chief advocacy officer. “No one should have to choose between food, rent, and figuring out online banking.”

A History of Payment Transitions

The shift away from paper checks isn’t new. The Electronic Funds Transfer Act of 1996 first directed federal agencies to deliver payments electronically. In 2011, the Treasury launched GoDirect.gov, a national campaign urging recipients to switch.

Between 2011 and 2020, the share of paper checks dropped from 15 percent to under 2 percent. However, the last fraction—primarily rural or elderly recipients—proved resistant.

“Every major payment transition meets its final 1 percent problem,” said Dr. Anya Sharma, economist at the University of Michigan’s Center for Financial Inclusion. “The final group is always the hardest to reach.”

Fraud and Security Concerns

Electronic payments have dramatically reduced check fraud and mail theft, which cost the government tens of millions annually.

The U.S. Postal Inspection Service reported a 35 percent decline in benefit-related mail theft since 2015.

However, cybersecurity risks remain a concern for seniors navigating online portals.

“We need to replace one set of vulnerabilities with genuine security, not new digital threats,” said Robert Jenkins, a cybersecurity policy adviser at the RAND Corporation.

How Other Countries Handle It

Other developed nations have already made similar transitions.

- In the United Kingdom, all pensions and welfare payments have been electronic since 2013.

- Canada ended its federal paper checks in 2016 but allowed exemptions for individuals over 80 and those living in remote communities.

- The European Union mandates digital transfers for all cross-border payments.

Experts say the U.S. reversal mirrors Canada’s experience, which balanced modernization with inclusion.

“No major democracy has achieved 100 percent digitization without exceptions,” said Dr. Fiona Clarke, a social policy researcher at the London School of Economics.

Government’s Next Steps

The SSA and Treasury now plan to expand outreach programs to help seniors and rural residents adopt digital options safely.

That includes financial literacy workshops, partnerships with community banks and credit unions, and enhancements to the Direct Express Debit Card.

Officials also announced plans to test mobile verification features and new accessibility tools for individuals with visual or cognitive impairments.

Expert Perspectives: Balancing Efficiency and Equity

Policy experts say the Social Security Reversal underscores a broader tension in U.S. governance: balancing efficiency with equity.

“Digital transformation is inevitable, but public trust is fragile,” said Dr. Gerald Tan, senior fellow at the Council on Foreign Relations. “Policies must evolve at the pace of people, not just technology.”

Economists agree that long-term savings will depend on helping the last group of paper check recipients transition smoothly—without leaving them behind.

“If modernization alienates even a small fraction of vulnerable citizens, it’s not progress,” Tan added.

Public Reaction

The reversal has drawn bipartisan support in Congress and widespread approval from advocacy organizations.

Financial inclusion advocates have praised the decision as “a rare example of responsive governance.”

Still, watchdog groups have urged the SSA to publish clear criteria for exemptions to avoid confusion or inconsistent enforcement.

“The exemption process must be transparent,” said Elena Morris, director of the nonprofit PayFair America. “People deserve to know whether they qualify before deadlines loom again.”

Looking Ahead

While the Social Security Reversal preserves paper checks for now, the federal government’s long-term trajectory remains firmly digital.

Officials have not announced a new cutoff date but reaffirm their goal of a “fully electronic, universally accessible” payment system.

For millions of beneficiaries, the debate reflects something larger than payment methods—it’s about the government’s obligation to balance innovation with inclusion.

“Modernization should never mean marginalization,” AARP’s LeaMond said. “This decision shows that progress and compassion can coexist.”

FAQ About Social Security Reversal

Will paper checks stop entirely in 2025?

No. The SSA confirmed that paper checks will continue for individuals who cannot access electronic payments.

Why does the government prefer electronic payments?

They’re faster, more secure, and cheaper to process, according to the Treasury Department.

How can beneficiaries switch?

Recipients can enroll in direct deposit or use the Direct Express Debit Card via GoDirect.gov.