Millions of Americans are scheduled to receive their Social Security payments on November 26, 2025, marking the final disbursement of the month under the Social Security Administration’s (SSA) birth-date-based schedule. The agency confirms that the payment will be delivered on time to retirees, disability beneficiaries, and survivors with late-month birthdays, even as inflation pressures and holiday expenses weigh heavily on fixed-income households.

Social Security Payments for Nov. 26, 2025

| Key Fact | Detail / Statistic |

|---|---|

| Final November SSA Payment | Nov. 26, 2025 |

| Eligible Group | Birthdays 21st–31st |

| SSI Note | November SSI paid early on Oct. 31 |

| Beneficiaries Nationwide | ~71 million |

| Share Using Direct Deposit | >99% |

| Official Website | SSA |

The November 26 payment marks the final Social Security disbursement of the month and arrives during a period of financial strain for households facing rising seasonal costs. With inflation moderating and future COLA adjustments on the horizon, beneficiaries continue navigating a complex economic landscape while relying on the stability of one of the nation’s most significant federal programs.

Who Receives Social Security Payments on Nov. 26, 2025?

SSA’s Birth-Date Model Explained

The Social Security Administration (SSA) distributes monthly benefits through a staggered system introduced in the late 1990s. This approach reduces processing congestion and helps deliver payments more efficiently. Individuals with birthdays between the 21st and 31st of any month receive payments on the fourth Wednesday, which this year falls on November 26.

An SSA spokesperson, speaking in a recent public briefing, said the agency’s “priority is predictable, uninterrupted service for retirees, disability beneficiaries, and survivors who depend on these payments for everyday expenses.”

Who Exactly Is Included?

The November 26 disbursement covers:

- Retired workers receiving monthly retirement benefits

- Social Security Disability Insurance (SSDI) beneficiaries

- Survivors, including widows, widowers, and dependents

- Spouses or dependents entitled to auxiliary benefits

The group is among the largest within the SSA payment system, with analysts estimating that roughly one-third of all beneficiaries fall into the late-month cycle.

Understanding the Broader November Payment Schedule

Early November Payments

Under SSA rules, earlier distributions occurred on:

- November 12, 2025 – Birthdays on the 1st–10th

- November 19, 2025 – Birthdays on the 11th–20th

In addition, beneficiaries who qualified before May 1997 were paid on November 3, following long-standing exceptions for older or mixed-benefit households.

SSI Payments Arrived Early

Supplemental Security Income (SSI) operates on a different timeline. Because November 1, 2025, falls on a weekend, the SSA moved SSI payments to October 31. This happens several times a year, producing months with two payments and others with none.

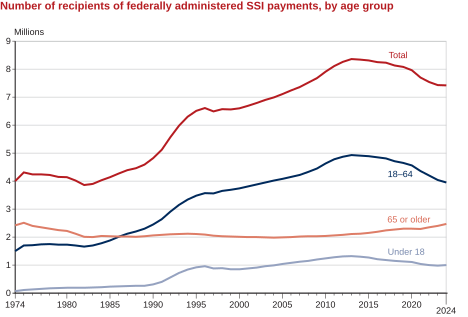

According to the Center on Budget and Policy Priorities (CBPP), about 8 million SSI recipients nationwide rely heavily on the precise timing of these deposits, which often support essential needs such as rent, food, and utilities.

Economic Context: Inflation, Living Costs, and the Holiday Season

Rising Costs Pressure Fixed-Income Households

The payment’s timing just before Thanksgiving offers temporary relief during a period when many Americans face higher expenses. Data from the Bureau of Labor Statistics (BLS) shows that while inflation cooled in mid-2025, the cost of essentials — including groceries, energy, and housing — continues to rise faster than Social Security benefits.

Dr. Melissa Turner, an economist at the University of Michigan, noted that “households relying primarily on Social Security payments remain vulnerable to swings in food and housing costs, even with recent stabilization in broader inflation indicators.”

Social Security’s Role in Household Budgets

According to the SSA’s Office of Retirement and Disability Policy, about 40% of retirees rely on Social Security for half or more of their income. Among low-income seniors, the program often serves as the primary or only source of financial support.

Why Social Security Payments Continue During Shutdowns

Mandatory Funding Ensures Continuity

Social Security is funded through the Federal Insurance Contributions Act (FICA) payroll taxes, classified as mandatory spending. As a result, payments continue unaffected by political disputes or government shutdowns.

During previous shutdowns, including the prolonged 2018–2019 lapse, Social Security benefits were delivered on schedule. While some SSA administrative operations faced staffing reductions, core benefit payments remained uninterrupted.

James Walker, a senior policy advisor at the Congressional Research Service (CRS), explained in a 2024 report that “Social Security operates independently of annual appropriations, making it one of the most stable components of the federal safety net.”

COLA: What Beneficiaries Can Expect in 2026

How COLA Is Calculated

The annual Cost-of-Living Adjustment (COLA) is based on average third-quarter inflation data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The SSA announces the new adjustment each October.

2026 COLA Projections

Analysts from the Committee for a Responsible Federal Budget (CRFB) estimate that the 2026 COLA will remain “modest,” likely between 2.2% and 2.8%, following a period of slowing consumer prices but rising service costs.

Such increases directly affect payments beginning January 2026, not the November 2025 cycle.

Demographic and Social Impact of the Nov. 26 Payment

A Lifeline for Seniors and Disabled Americans

Social Security remains the largest federal benefit program, supporting more than 71 million people across retirement, disability, and survivor categories. Older adults—particularly those living on fixed incomes—often adjust their monthly budgets around SSA’s predictable cycle.

A 2025 study published by the National Institute on Retirement Security (NIRS) found that nearly one in four older Americans has no retirement savings beyond Social Security.

Holiday Timing Adds Additional Pressure

With the final November payment arriving just before Thanksgiving, the timing can influence spending patterns. Nonprofit senior advocates note increases in calls for assistance during holiday months, largely due to food and utility costs.

“Many recipients prioritize essentials, stretching every dollar until the next deposit,” said Angela Ruiz, director of the nonprofit Senior Support Alliance. “Holiday expenses often add stress, even with timely Social Security payments.”

Tools, Resources, and Fraud Warnings

How Beneficiaries Can Prepare

The SSA recommends that beneficiaries:

- Use direct deposit to avoid mail delays

- Create an online mySocialSecurity account to verify payment amounts

- Report address or bank changes promptly

Growing Threats: Scam Prevention

The Federal Trade Commission (FTC) continues to warn about rising Social Security-related phone and email scams.

In 2024, fraud reports linked to Social Security impersonation totaled over $126 million in losses. The FTC instructs recipients to avoid sharing personal information over the phone and to verify any communication directly with the SSA.

Trump’s $2000 Tariff Rebate: Will 2025 Bring a Surprise Cash Windfall for American Families?

Looking Ahead: December Payments and 2026 Adjustments

The final SSA disbursement of the year will follow a similar pattern in December 2025, with no anticipated schedule changes. As the SSA transitions into 2026, both beneficiaries and policymakers are preparing for ongoing debates about long-term trust fund stability.

The Social Security Trustees Report continues to project that trust fund reserves will require long-term legislative action within the next decade. Several proposals are under consideration, though no major reforms are expected before 2026.