The Social Security Payments for November 2025 will follow the U.S. Social Security Administration’s (SSA) standard Wednesday rotation, affecting millions of retirees, disabled workers, and survivors across the United States. Payments are scheduled for November 12, 19, and 26, depending on the recipient’s date of birth, while early filers and Supplemental Security Income (SSI) beneficiaries follow separate timelines.

Social Security Payments

| Key Fact | Detail |

|---|---|

| Payment rotation dates | November 12 / 19 / 26 |

| Birth date range for each rotation | 1–10 → Nov 12; 11–20 → Nov 19; 21–31 → Nov 26 |

| Early & SSI recipients | Pre-May 1997 → Nov 3; SSI → Oct 31 |

| 2025 COLA increase | 3.2% |

| Official Website | SSA.gov |

How the November 2025 Payment Schedule Works

The SSA issues monthly benefits based on a staggered rotation system introduced in 1997 to manage its large beneficiary base more efficiently. Rather than sending all payments at once, the agency spreads disbursements over three Wednesdays each month, aligning with recipients’ birth dates.

Beneficiaries born 1st–10th receive payments on the second Wednesday (November 12), those born 11th–20th on the third Wednesday (November 19), and those born 21st–31st on the fourth Wednesday (November 26).

Those who started collecting Social Security before May 1997, or who receive both Social Security and SSI, continue to receive their benefits on the third day of each month, which in November 2025 falls on Monday, November 3.

Because November 1 lands on a weekend, SSI recipients—typically low-income seniors and individuals with disabilities—will receive their November payments Friday, October 31.

According to SSA data, more than 71 million Americans depend on these payments, which collectively represent the single largest source of retirement income in the United States.

The Origins and Purpose of the Wednesday Rotation

Before 1997, all Social Security benefits were issued on the third day of the month. This practice caused logistical bottlenecks for banks and the U.S. Postal Service. To streamline the process and reduce fraud risk, the SSA implemented the Wednesday rotation system, which divides recipients by birth date and spreads payments evenly across the month.

According to a 2023 SSA operations report, this scheduling structure has reduced payment delays by over 40 percent and improved processing efficiency for direct deposits and electronic funds transfers.

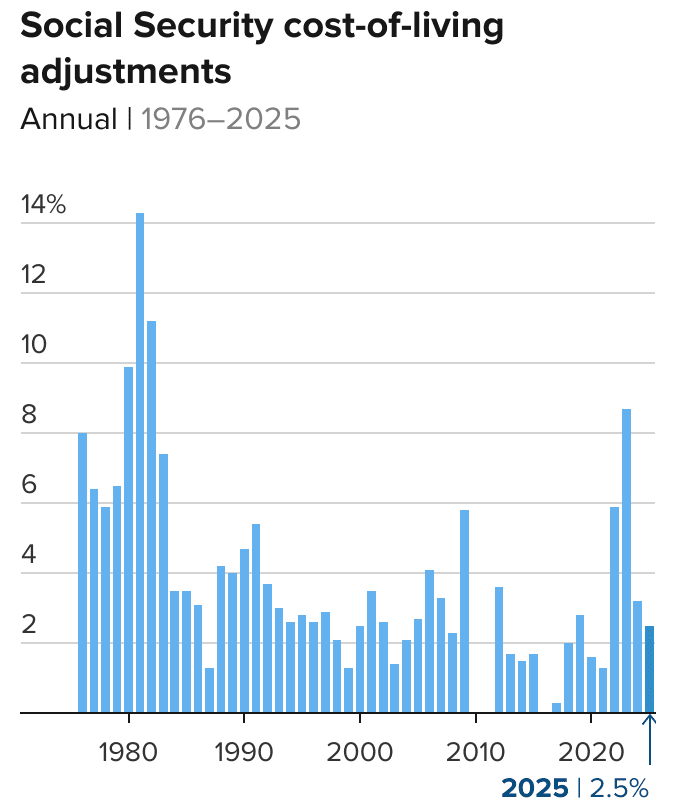

Understanding Cost-of-Living Adjustments (COLA)

The Cost-of-Living Adjustment (COLA) ensures that Social Security Payments keep pace with inflation. For 2025, benefits rose 3.2 percent, reflecting changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter of 2023 to the third quarter of 2024.

This adjustment increased the average monthly retirement benefit by approximately $59, bringing the average payment to $1,907, according to the SSA’s October 2024 data release.

“COLA is designed to preserve beneficiaries’ purchasing power in times of inflation,” said Andrew Biggs, senior fellow at the American Enterprise Institute, in an interview with Reuters. “While modest, this year’s adjustment helps offset cost pressures in healthcare and housing.”

How COLA Is Calculated

The annual COLA is determined by comparing the average CPI-W for July, August, and September of the current year with the same period in the previous year. If inflation increases, benefits rise proportionally.

For example, if the CPI-W rises by 3 percent, Social Security benefits increase by roughly the same amount. However, if prices remain stable or decline, there is no COLA increase for that year.

Economists note that while COLA helps maintain purchasing power, it does not always fully capture seniors’ cost burdens. Housing, food, and medical care often rise faster than the general inflation rate.

Direct Deposit, Paper Checks, and Payment Timing

Nearly 99 percent of beneficiaries receive their Social Security Payments via direct deposit, typically credited to bank accounts before 9 a.m. local time on the scheduled date. Paper checks are still available for a small percentage of beneficiaries but can take up to three business days longer to arrive.

The SSA advises waiting three mailing days before reporting a missing payment. Beneficiaries can check their deposit status through the My Social Security online portal or by calling their local SSA office.

The Economic Importance of Social Security Payments

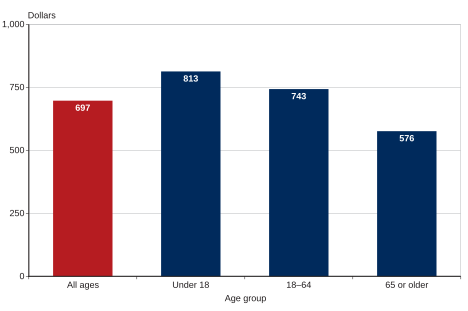

Social Security is more than a monthly check—it’s a foundational part of the U.S. retirement system. According to the Center on Budget and Policy Priorities (CBPP), Social Security lifts nearly 22 million Americans out of poverty each year, including over 15 million older adults.

For nearly two-thirds of retired workers, Social Security provides at least half of their income. For one in four, it’s their only income source.

“Without Social Security, the poverty rate among older Americans would be four times higher,” said Kathleen Romig, director of Social Security and Disability Policy at the CBPP. “It remains the nation’s most effective anti-poverty program.”

Funding and Sustainability Concerns

The Social Security trust funds are financed primarily through payroll taxes under the Federal Insurance Contributions Act (FICA). Workers and employers each contribute 6.2 percent of wages, up to a taxable income cap of $174,000 in 2025, while self-employed individuals pay the full 12.4 percent.

According to the 2024 Trustees Report, the combined Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) trust funds are projected to remain solvent until 2035. After that, the program would still pay roughly 83 percent of scheduled benefits if no reforms are enacted.

“Congress will need to act in the next decade to strengthen Social Security’s long-term finances,” said Stephen Goss, the SSA’s chief actuary, during a briefing earlier this year. “But beneficiaries should know their payments are secure for the foreseeable future.”

Policy Debate: Options on the Table

Policy experts have proposed various solutions to address Social Security’s future funding gap, including raising the payroll tax cap, increasing the full retirement age, or revising benefit formulas for high-income earners.

A Pew Research Center survey in 2024 found that 78 percent of Americans oppose benefit cuts but support higher income limits for payroll tax contributions.

Lawmakers from both parties agree that inaction would lead to automatic benefit reductions once reserves are depleted. However, no major reform package has yet gained bipartisan traction.

Who Receives Payments Early?

Beneficiaries who began collecting Social Security before May 1997—or who receive both SSI and Social Security—are paid on the third of each month, regardless of their birth date. In November 2025, that means Monday, November 3.

SSI recipients will receive their payment on October 31 because November 1 falls on a Saturday. This ensures beneficiaries don’t experience a delay due to weekends or holidays.

What to Do If a Payment Is Missing

If a payment does not arrive on the scheduled date, the SSA recommends checking the My Social Security account first to confirm processing. If the payment still hasn’t appeared after three business days, beneficiaries should contact their bank or local SSA office.

It’s also important to ensure banking information is current, as incorrect or outdated account details are the most common cause of delays.

Looking Ahead: COLA, Inflation, and Economic Outlook

With inflation moderating and interest rates stabilizing, analysts expect the 2026 COLA to fall below 3 percent, marking the smallest adjustment since 2021. However, the SSA will not announce the official figure until October 2026, when CPI-W data becomes available.

“The schedule remains stable,” said Jeffrey Nesbit, SSA spokesperson, in a statement to the Associated Press. “All benefits will be paid on time, and the agency continues to encourage direct deposit enrollment for faster, more secure delivery.”

FAQ

1. What if my payment date falls on a federal holiday?

If a scheduled payment falls on a holiday, the SSA issues it on the preceding business day.

2. Can I change my payment method from check to direct deposit?

Yes. You can enroll or update direct deposit details via your My Social Security account or by contacting the SSA.

3. Does COLA affect my Medicare premiums?

Yes, indirectly. Higher benefits can increase income thresholds, which may affect Medicare Part B premiums for some beneficiaries.

4. What should I do if my bank is closed on my payment day?

Funds are typically available the next business day once banks reopen.

The Broader Picture

Social Security remains the backbone of the U.S. retirement system, ensuring a measure of financial security for tens of millions of Americans. While policymakers continue to debate its future, the program’s reliability has endured for nearly nine decades.

The SSA has reaffirmed that all Social Security Payments for November 2025—and beyond—remain on schedule, supported by robust infrastructure and automatic funding mechanisms.