Millions of Americans will see a 2.8 percent benefit increase under the 2026 Social Security cost-of-living adjustment, but rising Medicare premiums and deductibles threaten to absorb much of that gain. The update reflects stubborn healthcare inflation and growing pressure on the nation’s aging-support systems.

Social Security & Medicare Changes for 2026

| Key Fact | 2026 Update |

|---|---|

| Social Security COLA | +2.8% (approx. +$56/month for average retiree) |

| Medicare Part B Monthly Premium | $202.90 (up $17.90 from 2025) |

| Medicare Part B Deductible | $283 (up from $257) |

| Payroll Tax Wage Base | Increased to $184,500 |

| Estimated Net Benefit Increase for Many Retirees | ~1.8–2.0% after Medicare deductions |

| Official Website | Social Security Administration |

The 2026 updates to Social Security and Medicare highlight the fragile balance between inflation relief and rising healthcare expenses. While the COLA provides a modest boost, Medicare’s growing costs will likely offset much of the benefit. Policymakers continue to debate long-term solutions, but for now, retirees must navigate another year of complex financial trade-offs.

What’s Changing for Social Security in 2026

A Modest COLA Driven by Slowing Inflation Trends

The Social Security Administration (SSA) set the 2026 cost-of-living adjustment (COLA) at 2.8 percent, reflecting a year of moderating nationwide inflation. The figure is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), the standard inflation measure used in federal law.

For the average retired worker, whose benefit was approximately $2,015 per month in 2025, the adjustment translates to an increase of about $56 per month before deductions. More than 71 million Social Security beneficiaries and 7.5 million Supplemental Security Income (SSI) recipients are affected.

Why COLA Matters More Than Ever

Economists note that even modest percentage changes can significantly affect older adults, many of whom rely on Social Security for most or all of their income. According to SSA data, about 40 percent of retirees depend on Social Security for at least half of their total income, and roughly 14 percent rely on it for 90 percent or more. Rising rent, utilities, and medical costs continue to outpace general inflation, making COLA adjustments crucial for maintaining purchasing power.

Changes to Social Security Earnings Limits and Payroll Taxes

In addition to the COLA, several structural adjustments take effect:

- Maximum taxable earnings increase to $184,500.

Workers will pay Social Security payroll taxes on income up to this threshold, up from $176,200 in 2025. - Earnings limits for working beneficiaries rise.

- For early retirees (below full retirement age): $24,480.

- For those reaching full retirement age in 2026: $65,160.

These limits affect how much beneficiaries may earn before receiving temporary reductions in their monthly payments.

Medicare Costs Rise in 2026 — Pressuring Retiree Budgets

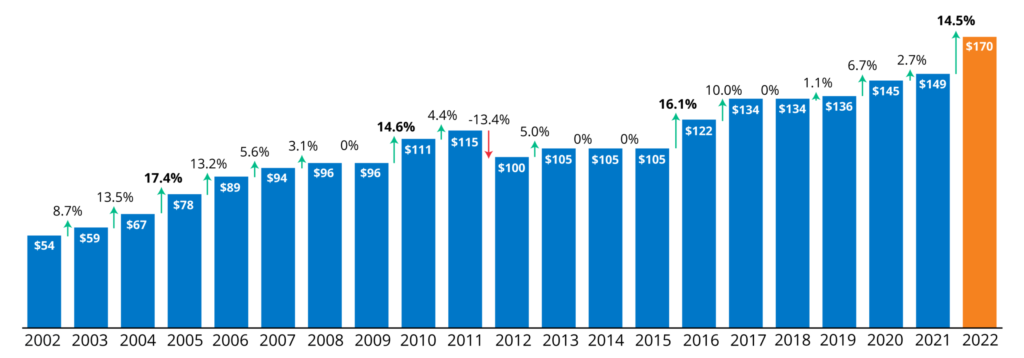

Part B Premiums and Deductibles Increase Sharply

The Medicare Part B standard premium rises to $202.90 per month, marking one of the largest single-year increases in recent history. Part B covers outpatient care, physician visits, durable medical equipment, and preventive services.

The annual Part B deductible also climbs from $257 to $283, further raising out-of-pocket healthcare spending.

CMS attributed the increases to:

- Rising costs of physician-administered drugs

- Greater use of outpatient services

- Broader demographic pressures as more Americans enter Medicare each year

Part A Hospital Costs Also Climb

Most beneficiaries continue to receive Part A premium-free. However, cost sharing increases:

- Inpatient hospital deductible: $1,736

- Coinsurance for extended hospital stays: Higher daily rates

- Skilled nursing facility coinsurance: Slightly increased for days beyond the initial coverage window

Why Many Seniors Will See Smaller-Than-Expected Net Gains

Medicare Deduction Shrinks Actual Benefit Increases

Because Medicare premiums are deducted automatically from many Social Security checks, the practical impact of COLA is often less than the headline figure. Analysts estimate that the effective increase for many retirees may fall to around 1.8 to 2.0 percent, once premium increases are accounted for.

Retirees with below-average monthly benefits may see even less of a practical increase. Higher-income enrollees subject to income-related monthly adjustment amounts (IRMAA) could face significantly larger Medicare charges, reducing their net benefit further.

Why the CPI-W May Underestimate Senior Costs

The CPI-W is designed around the spending habits of urban wage workers, not retirees. Seniors generally spend a larger share of income on:

- Prescription drugs

- Medical procedures

- Housing and utilities

- Long-term care support

- Insurance premiums

Many of these categories have inflation rates higher than the CPI-W average. Senior-advocacy organizations have long pushed for legislative change to adopt an alternative measure, such as the Consumer Price Index for the Elderly (CPI-E), which more closely reflects senior spending patterns.

How 2026 Fits Into a Decade of Volatility

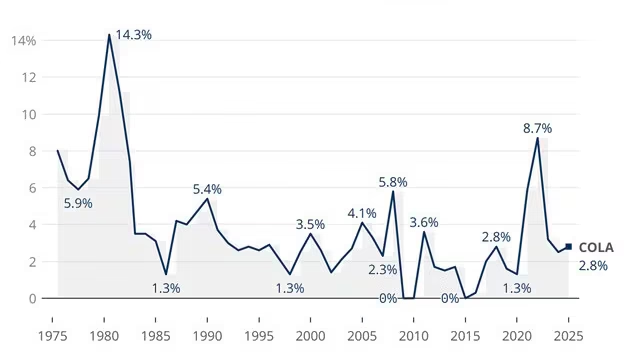

COLA adjustments have fluctuated sharply over the past 10 years:

- 2021: 1.3%

- 2022: 5.9%

- 2023: 8.7% (highest in more than 40 years)

- 2024: 3.2%

- 2025: 2.6%

- 2026: 2.8%

Inflation spikes in the early 2020s created significant financial strain for older adults, and although inflation has since eased, many costs — particularly healthcare — remain high.

Strains on the Social Security and Medicare Trust Funds

Demographic Pressures

The United States is experiencing significant demographic change. By 2034, adults over age 65 will outnumber children for the first time in American history. This shift places growing strain on Social Security and Medicare financing.

Key pressures include:

- Slowing workforce growth

- Rising life expectancy

- Increasing medical costs

- Higher retiree-to-worker ratio

The Social Security Trustees Report has repeatedly warned that the Old-Age and Survivors Insurance (OASI) Trust Fund may face depletion within the next decade, absent congressional action. Medicare’s Hospital Insurance Trust Fund faces similar pressures.

Policy Debates Are Intensifying

Lawmakers continue to debate proposals including:

- Adjusting payroll-tax caps

- Modifying full retirement age

- Introducing alternative COLA formulas

- Increasing Medicare negotiation authority for prescription drugs

- Raising revenue through new taxes or economic reforms

While no major bipartisan agreement has been reached, the 2026 updates highlight the need for long-term planning.

Impact Across Different Groups of Beneficiaries

Retirees on Fixed Income

Those relying almost entirely on Social Security may experience only marginal improvements in monthly income. Rising housing prices, insurance premiums, and medical bills continue to pose challenges.

Working Beneficiaries

Beneficiaries under full retirement age may welcome higher earnings limits, providing more flexibility to supplement income without facing immediate benefit reductions.

High-Income Medicare Beneficiaries

IRMAA adjustments mean affluent seniors could face much steeper premium increases. This group may see the smallest net COLA benefits of all.

SSI Recipients

SSI payments will rise in line with COLA, but recipients — many of whom face economic hardship — may still struggle with rising healthcare or disability-related costs.

December Social Security & SSI Guide: Payment Dates, Double Checks, and Next Year’s COLA

What Analysts and Advocates Are Saying

Policy researchers emphasize that the 2.8 percent adjustment provides relief but does not fully address structural challenges.

Several economic think tanks note that:

- Healthcare inflation remains higher than broader inflation

- Seniors face increased housing insecurity

- Trust fund depletion timelines create uncertainty

- COLA formulas remain outdated for an aging population

Advocacy groups argue that without broader reform, millions of Americans will continue to lose purchasing power.

Practical Steps Beneficiaries Should Consider for 2026

Retirement experts recommend that seniors:

- Review their updated SSA benefits letter and check for any discrepancies.

- Reevaluate monthly budgets to account for higher Medicare premiums and deductibles.

- Consider Medicare Advantage and Part D options during open enrollment to manage rising costs.

- Assess supplemental insurance policies to offset hospital or outpatient expenses.

- Consult a financial planner or benefits counselor for personalized guidance.