In 2026, millions of U.S. retirees will see a 2.8% increase in their Social Security benefits, as part of the annual Cost-of-Living Adjustment (COLA). While this increase is a positive development for seniors nationwide, certain states are set to see more substantial gains. This article delves into which states will benefit the most from this change, examining both the financial implications and the broader impact on the retirement landscape.

Social Security Just Changed

| Key Fact | Detail/Statistic |

|---|---|

| 2026 COLA Increase | 2.8% increase in Social Security benefits |

| Average Monthly Increase | Approximately $56 for the average retiree |

| States with Largest Increases | Delaware, Indiana, Arizona, Utah, South Carolina |

The 2026 2.8% Social Security COLA increase is a critical development for millions of retirees across the United States. While it provides relief for many, its effects will vary depending on location, healthcare costs, and individual financial situations. As policymakers work toward ensuring the program’s future viability, retirees are advised to stay informed about changes to Social Security and continue planning for a financially secure future.

Social Security’s 2026 Boost: Understanding the Changes

Social Security’s 2.8% Cost-of-Living Adjustment (COLA) for 2026 represents a critical financial boost for millions of American retirees. Each year, the Social Security Administration (SSA) adjusts benefits to account for inflation, ensuring that the purchasing power of seniors is preserved amidst rising costs. For retirees who rely heavily on Social Security as their primary income source, this increase is significant.

While the increase may seem modest to some, it represents an important safeguard against inflation, which has outpaced wage growth in recent years. According to AP News, the average $56 increase will help offset the impact of rising costs for essentials such as healthcare, housing, and utilities.

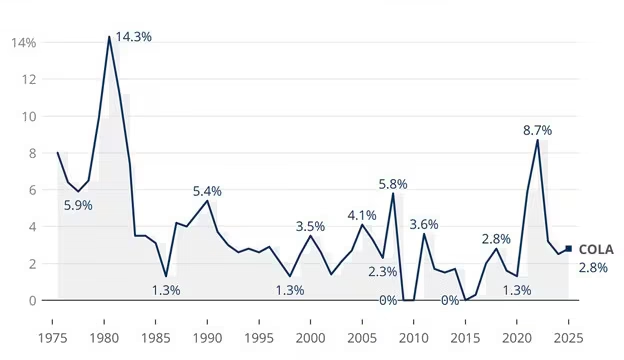

Historical Context

Over the years, Social Security’s COLA adjustments have fluctuated significantly. In some years, such as 2010 to 2013, there was no increase at all due to low inflation. In other years, the increase has been as high as 3.6%. The 2026 increase of 2.8% is the highest since 2019 when retirees received a 2.8% increase as well.

Despite its importance, the COLA increase is often viewed as insufficient by many seniors, particularly those with limited additional retirement savings. According to the National Council on Aging, a significant portion of U.S. retirees rely solely on Social Security for their income, underscoring the importance of this adjustment.

States with the Biggest Gains: Where Will Retirees Benefit Most?

While all Social Security recipients will benefit from the 2.8% increase, retirees in certain states will see larger dollar gains due to higher average benefits. These states, often characterized by lower cost-of-living expenses, provide a unique environment where the COLA boost will be especially impactful.

Delaware: A Top State for Retirees

Delaware has earned its place among the states with the biggest benefit increases for retirees. Due to its relatively high average benefits and the fact that many retirees in the state depend on Social Security as their primary income, Delaware’s retirees will see their COLA adjustments stretch further.

According to Pew Research Center, Delaware retirees enjoy some of the highest benefits in the country, and the 2.8% increase will add an average of $1,700 per year to their incomes. With no state sales tax and favorable tax policies for seniors, Delaware remains a popular choice for retirees looking to make the most of their Social Security benefits.

Indiana: A Hidden Gem for Retirees

Despite its low cost of living, Indiana has become one of the most attractive states for retirees. Many seniors in Indiana rely on Social Security benefits to cover their expenses, and the 2.8% increase will go a long way in helping them maintain financial stability.

Additionally, Indiana’s affordable housing and healthcare costs make it an ideal place for seniors on fixed incomes. For instance, retirees in Indiana spend less on housing and healthcare compared to their peers in states with more expensive urban areas, like New York or California.

Arizona and Utah: The Sun Belt Advantage

Arizona and Utah are two states that consistently rank high on lists of retirement-friendly destinations. With their warm climates, lower taxes, and affordable living costs, these states offer retirees a significant advantage.

In Arizona, the COLA boost will help cover rising healthcare costs, which are particularly high in states with large senior populations. Arizona’s attractive cost of living and tax policies provide a good balance for retirees relying on Social Security.

Similarly, Utah offers lower-than-average housing costs and healthcare expenses, making it an appealing state for retirees on a fixed income. These factors, combined with the COLA increase, ensure that seniors in Utah will feel a significant benefit.

South Carolina: Affordable Living for Retirees

In South Carolina, the combination of low property taxes and favorable retirement benefits policies make it a haven for retirees. Social Security benefits are exempt from state income tax, allowing retirees to keep more of their monthly income. This, coupled with the 2.8% COLA increase, will have a significant financial impact on those living in South Carolina.

Retirees in this state typically face lower living costs compared to many other regions of the country, meaning that the 2.8% increase will go further. In fact, many South Carolina retirees rely entirely on Social Security, which underscores the importance of this boost.

The Broader Impact of the COLA Increase

While the 2.8% increase may seem like a positive development, its impact will be felt differently depending on the individual and their specific financial situation. For many low-income retirees, Social Security is their primary source of income, and increases in benefits like the 2.8% boost can provide essential relief. However, rising costs in other areas, particularly healthcare and housing, may offset some of the positive effects.

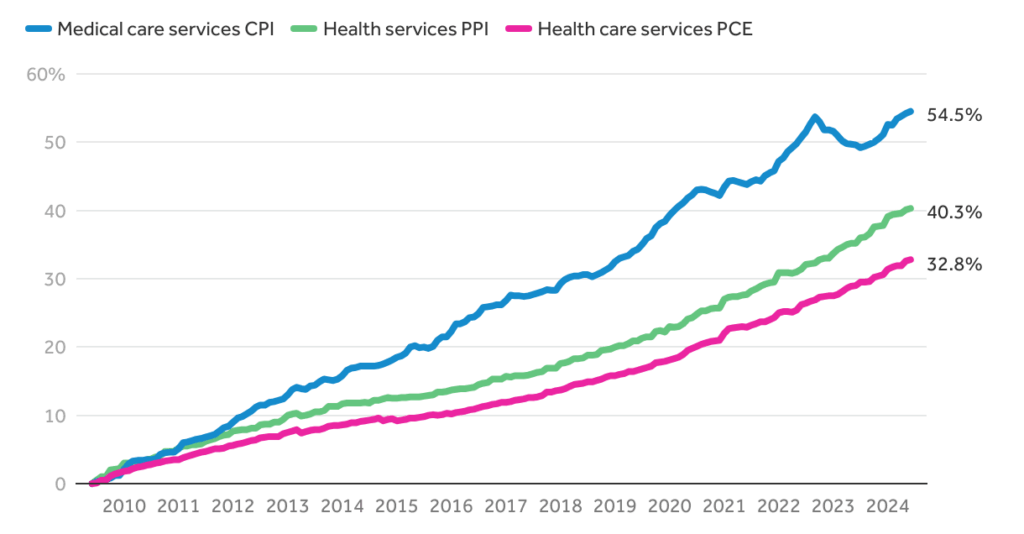

According to Dr. Andrea Lee, an economist at the Brookings Institution, “While the COLA increase is important, retirees must also plan for rising healthcare costs, which often outpace inflation. This is why many seniors find themselves in a difficult position, despite receiving a higher Social Security check.”

The Challenge of Healthcare Costs

One of the primary concerns for retirees is the rising cost of healthcare, particularly with Medicare premiums increasing each year. Although the COLA increase may alleviate some of the strain, many retirees will find their healthcare premiums consuming much of the additional funds. The Medicare Part B premium, which covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items, has historically increased each year, often outpacing the COLA increase.

The $2000 Stimulus Lie? How the Government Is Rebranding Old Tax Cuts as New Relief

Supplementing Social Security: Other Retirement Savings Strategies

For many retirees, Social Security is only one part of their financial plan. Experts emphasize the importance of diversifying income sources in retirement. In addition to Social Security, retirees should consider supplementing their income with personal savings, 401(k) or IRA accounts, and other investment vehicles.

As financial expert David Simpson notes, “Social Security was never designed to be a retiree’s only income. It’s a safety net, but retirees need to make sure they’re saving and investing in other ways, especially if they plan to rely on it long-term.”

Long-Term Sustainability of Social Security

The COLA increases, including the 2026 adjustment, raise important questions about the long-term sustainability of the Social Security program. Experts predict that the Social Security trust fund will face significant shortfalls in the coming decades, which could impact future benefit increases. As the population ages and the number of retirees increases, it will become more difficult to fund the program at its current levels.

According to the Social Security Administration’s (SSA) 2025 annual report, the OASI (Old-Age and Survivors Insurance) Trust Fund will be depleted by 2033, unless changes are made. This looming financial challenge underscores the need for policy reforms to ensure the program’s sustainability for future generations.