The Social Security Administration (SSA) has announced a 2.8 percent cost-of-living adjustment (COLA) for 2026, a change that will increase benefits for more than 70 million Americans. For many retired couples receiving benefits, the adjustment will translate into more than $1,000 in additional annual income starting in January 2026, with Supplemental Security Income (SSI) recipients seeing the first increase on December 31, 2025.

Social Security Is Giving Couples Over $1000 More in 2026

| Key Fact | Detail |

|---|---|

| 2026 COLA | 2.8% |

| Average increase for retired worker | About $56 more per month |

| Average increase for aged couple | About $88 more per month |

| Effective dates | Jan. 2026 for most; Dec. 31, 2025 for SSI |

| Maximum taxable earnings in 2026 | $184,500 |

| Public sentiment | Majority believe increase helps but does not keep pace with costs |

| Official Website | SSA |

How the 2026 COLA Affects Retired Couples

The 2.8 percent COLA means that a typical retired couple, where both spouses receive Social Security benefits, will see their combined monthly payment increase by about $88. Over the course of a full year, this amounts to an additional $1,056 in gross income before taxes or Medicare deductions.

The SSA bases this estimate on the average benefit paid to retired couples nationwide. Actual individual increases vary, depending on each spouse’s earnings history, retirement age, and whether one or both receive auxiliary or spousal benefits.

Averages vs. real outcomes

While the estimated increase is helpful for planning, many couples will not see the exact average amount. Higher-earning beneficiaries will receive a larger dollar increase, while lower-earning retirees will see a smaller change. Those subject to Medicare deductions may also receive less in net monthly payment.

Why the COLA Matters for Retirees

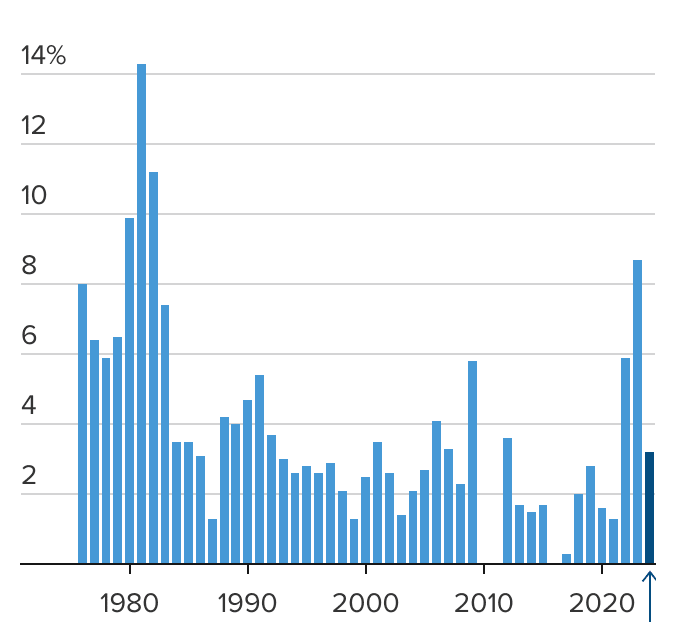

The cost-of-living adjustment aims to help Social Security benefits maintain purchasing power despite rising prices. The SSA calculates the annual COLA based on inflation readings from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

In recent years, retirees have faced rising prices for essentials such as:

- healthcare and prescription drugs,

- housing,

- utilities, and

- groceries.

For many older Americans, these categories consume a larger share of income than they do for the general population. As a result, even modest shifts in inflation can have a significant effect on a retiree’s financial security.

What seniors say

Surveys conducted by national senior organizations show that while many beneficiaries welcome the 2026 increase, a large portion believe it does not fully offset rising living costs. Healthcare expenses in particular have grown faster than overall inflation.

How the SSA Calculates the COLA

The COLA is not set by Congress or by political decision. Instead, it is determined by a formula written into federal law. The calculation compares the average CPI-W reading from July, August, and September of one year to the same period of the previous year. If prices rise, benefits rise. If prices fall or remain flat, there is no increase.

Why 2.8 percent in 2026?

The 2.8 percent figure reflects inflation measured during the third quarter of the previous year. This makes the adjustment an automatic response to price changes in the broader economy.

Is CPI-W accurate for seniors?

Some policy experts argue that CPI-W does not fully capture the spending patterns of retirees, who tend to spend more on healthcare than younger workers. These experts advocate for switching to a CPI designed for older Americans. Others argue that CPI-W has worked as intended and provides a consistent, predictable standard.

Other Important Social Security Changes in 2026

Along with the COLA, several other automatic adjustments take effect in 2026.

Taxable Maximum Earnings Increase

Workers who pay into Social Security will see the maximum taxable earnings rise to $184,500. Income above this amount is not subject to Social Security tax.

Higher Retirement Earnings Test Limits

For beneficiaries who continue working before reaching full retirement age, the earnings limit will also rise. Those who earn above the limit may temporarily have a portion of their benefits withheld until reaching full retirement age.

Maximum Benefit Rises

The highest possible benefit for someone retiring at full retirement age increases to reflect average wage growth in the national economy.

Expert Perspectives and Financial Planning Considerations

Financial analysts emphasize that while the 2026 COLA provides meaningful relief, couples should incorporate the increase into a broader financial strategy. A modest boost may not offset rising prices in all areas, especially healthcare.

Medicare premiums may reduce net benefit

Medicare Part B premiums typically rise each year. Although the final 2026 premiums will be announced later, many retirees can expect a portion of their COLA to be absorbed by higher healthcare costs.

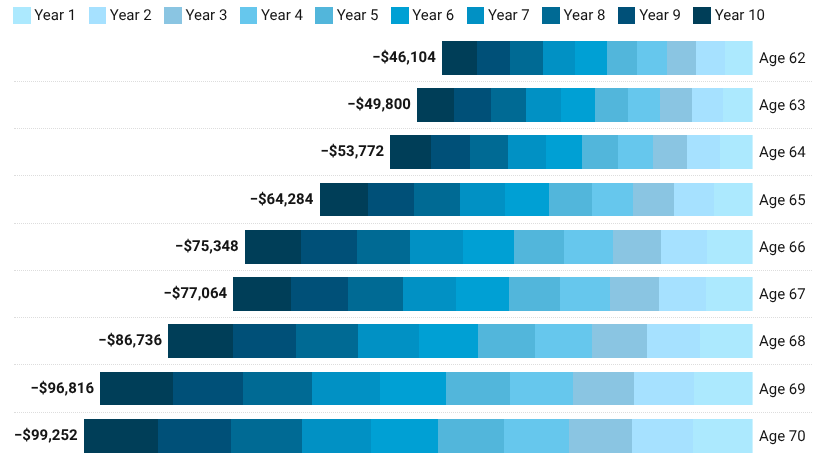

Delaying benefits still offers long-term rewards

Some financial planners recommend delaying Social Security benefits when possible. While the COLA applies regardless of claiming age, delaying can increase monthly payments by up to 8 percent per year until age 70.

A broader debate on Social Security’s long-term stability

The Social Security trust funds face demographic pressures as longer life expectancy and lower birthrates change the ratio of workers to retirees. Policymakers continue to debate options such as adjusting the taxable maximum, revising benefit formulas, or modifying the full retirement age.

November 19 Social Security Deposit — Who Qualifies for the Upcoming Payment

How the Increase Affects SSI, Disabled Workers, and Survivors

Although the average retired worker is the most discussed group, the 2026 COLA also applies to others receiving SSA benefits.

SSI Recipients

Federal SSI payments will increase for individuals and couples. The first 2026 payment is issued on December 31, 2025 due to calendar alignment.

Disabled Workers

Disabled workers will see their average benefits rise modestly, helping to cover essential expenses during periods of limited work capacity.

Widows, Widowers, and Survivors

Survivor beneficiaries will also receive larger monthly payments, with the exact amount depending on income history and family structure.

What Retired Couples Should Do Before January 2026

Experts recommend several steps to ensure households understand their updated benefits:

- Review the SSA benefit notice

Paper notices arrive in early December 2025, while online notices appear earlier for those with a mySSA account. - Check for Medicare premium changes

This helps determine the net amount deposited into your account. - Update your household budget

Consider how the additional income fits into your financial plan. - Evaluate withholding and taxation

Up to 85 percent of benefits may be taxable depending on combined income. - Consider long-term planning

The COLA is one part of a broader financial picture that may include savings, pensions, and investment income.

Looking Ahead

The 2026 COLA offers meaningful relief for millions of retirees, especially couples relying heavily on Social Security income. While the increase helps maintain purchasing power, many expenses continue to rise faster than benefits. As Americans prepare for 2026, the COLA serves both as financial support and a reminder of the ongoing discussion about the program’s long-term sustainability.