The U.S. government will introduce significant Social Security changes in 2026, reshaping how benefits are calculated, taxed, and distributed. Starting in January 2026, millions of retirees, workers, and families will experience adjustments to their cost-of-living benefits, retirement eligibility, and taxable wage limits.

According to the Social Security Administration (SSA), these updates are designed to maintain the program’s financial stability amid rising costs and demographic shifts.

Social Security Is Changing in January 2026

| Key Fact | Detail / Statistic |

|---|---|

| Cost-of-Living Adjustment (COLA) | 2.8% increase; about $56 more per month for average retiree |

| Full Retirement Age (FRA) | 66 years, 10 months for 1959 births; 67 for 1960 or later |

| Wage Base Limit | Expected to exceed $175,000 in 2026 |

| Trust Fund Depletion | Projected by 2033 without legislative action |

| Official Website | SSA |

The Social Security changes 2026 aim to preserve retirees’ purchasing power and keep the system financially viable. Yet the updates also underscore deeper fiscal and demographic challenges.

As lawmakers debate the program’s future, one fact remains clear: Social Security continues to serve as the bedrock of retirement security for tens of millions of Americans—and its endurance will depend on timely, bipartisan reform.

A Brief History: Social Security’s Evolving Promise

Established in 1935, Social Security was created to provide income security for older Americans after the Great Depression. Funded through payroll taxes, it expanded over decades to include disability and survivor benefits.

Today, more than 70 million Americans receive payments from the program each month.

The 2026 changes continue a pattern of incremental adjustments that have occurred periodically since the 1980s, when Congress last overhauled the system to stabilize its finances. The gradual increase in the full retirement age to 67 was one such reform.

“Social Security remains the cornerstone of retirement for most Americans,” said Dr. Olivia Kent, policy analyst at the Brookings Institution. “But the program’s original structure was designed for a very different demographic reality—fewer retirees and longer careers.”

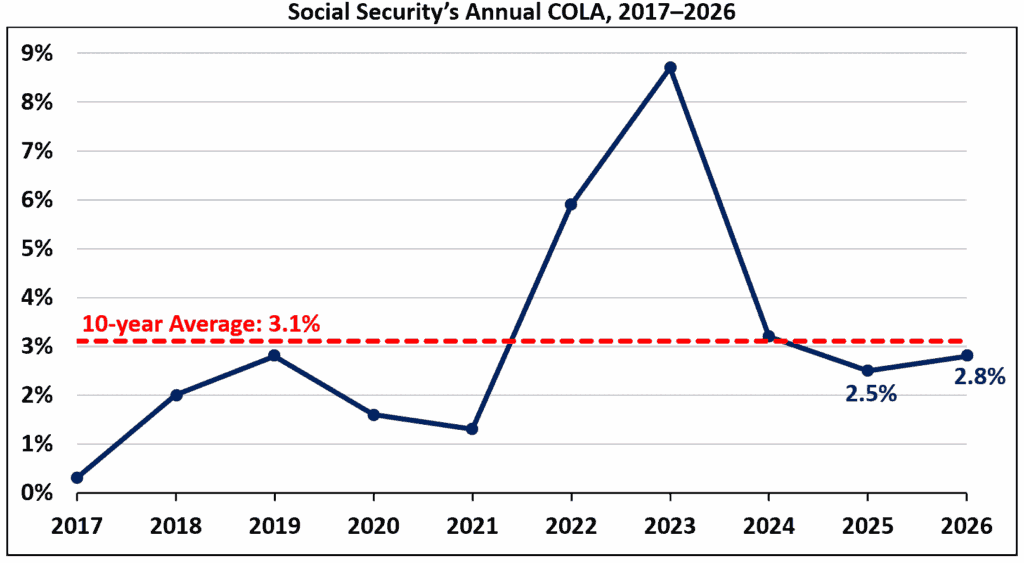

COLA Increase: A Modest Boost in an Inflationary Era

The most visible of the Social Security changes 2026 is the 2.8% cost-of-living adjustment (COLA), which takes effect in January. The SSA bases this figure on inflation measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

That means the average retiree will receive about $56 more per month in benefits. The goal is to preserve purchasing power as prices for essentials like food, rent, and medical care continue to rise.

However, many retirees will see only a partial benefit because Medicare Part B premiums—which are deducted from Social Security payments—are also expected to increase.

“The COLA helps offset inflation, but many seniors are still struggling to keep up with healthcare and housing costs,” said Nancy LeaMond, Executive Vice President of the AARP. “For fixed-income households, even small changes can have an outsized impact.”

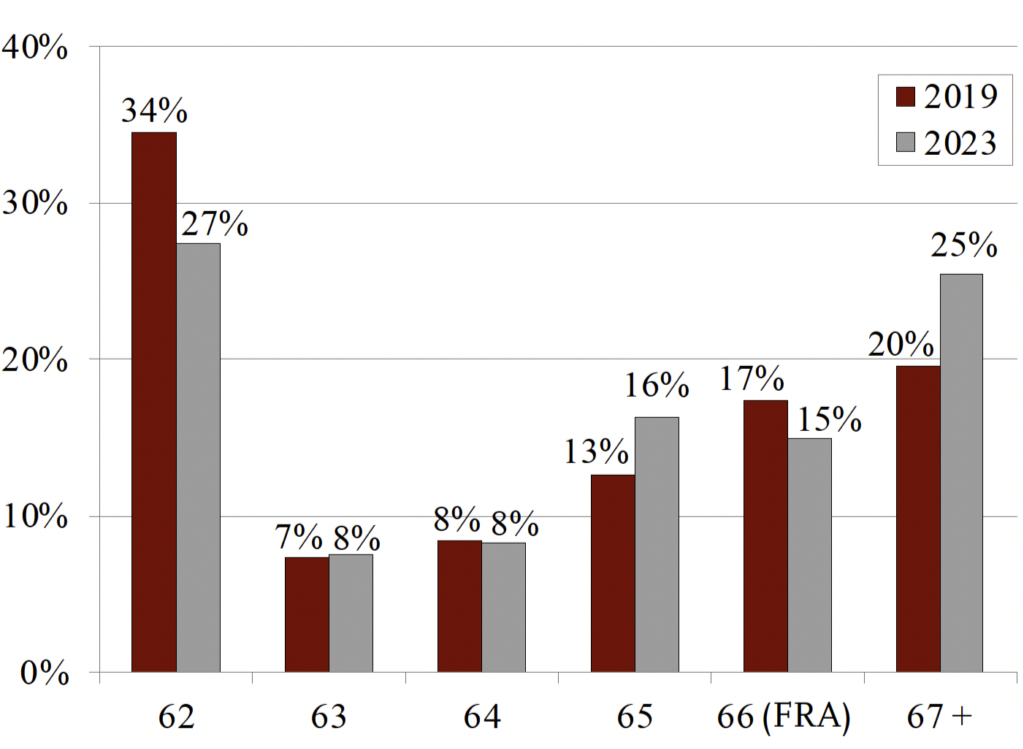

Retirement Age Rises Again

In 2026, the full retirement age (FRA) will increase to 66 years and 10 months for Americans born in 1959. For those born in 1960 or later, FRA will reach 67, completing a decades-long transition.

This change has long-term implications for how and when Americans choose to retire. Those who claim benefits early—at age 62—will continue to face a permanent reduction of up to 30% in monthly payments. Conversely, delaying until age 70 increases monthly benefits by 8% per year beyond FRA.

“Timing is everything,” explained Andrew Biggs, senior fellow at the American Enterprise Institute. “For some, delaying benefits even two years can mean tens of thousands more over a lifetime.”

Taxable Income and Earnings Limits Expand

The SSA will raise the maximum taxable earnings limit, or “wage base,” above the 2025 level of $168,600—likely exceeding $175,000. Both employees and employers pay a 6.2% payroll tax on earnings up to that cap.

High earners will therefore contribute more to Social Security in 2026. Additionally, the amount needed to earn one Social Security credit—a key metric for future eligibility—will increase slightly, reflecting overall wage growth.

Workers who continue earning income after claiming benefits should also note that the earnings limit—the threshold above which benefits are temporarily withheld—will adjust upward. In 2025, it stood at $22,320; analysts predict a similar increase next year.

These changes are intended to ensure continued funding for the system, though some economists argue they fall short of addressing structural shortfalls. “The adjustments are necessary but not sufficient,” said Dr. Steven Pressman, visiting professor of economics at the New School for Social Research. “Demographic pressures are outpacing payroll growth.”

How the Changes Affect Different Americans

The impact of these reforms varies sharply by demographic:

- Retirees on Fixed Incomes: A 2.8% COLA will help modestly but may not fully cover increases in rent, property taxes, or healthcare.

- Middle-Class Workers: Those earning near or above the taxable wage base will see slightly higher deductions from their paychecks.

- Younger Workers: Millennials and Gen Z employees face the longest wait for full benefits and the greatest uncertainty about future solvency.

For example, Linda Perez, a 63-year-old nurse in Texas, plans to delay retirement until 67 to avoid benefit reductions. “I’ve worked my whole life,” she said. “If waiting a few more years means I can live more comfortably, it’s worth it.”

Economic and Policy Implications

The 2026 updates reflect a delicate balancing act between supporting retirees and maintaining fiscal sustainability.

The Congressional Budget Office (CBO) estimates that by 2030, the ratio of workers to beneficiaries will fall below 2.3 to 1, down from 5 to 1 in 1960. That means fewer workers are funding benefits for more retirees.

Some policymakers have proposed reforms to preserve the system’s solvency:

- Raising the payroll tax rate from 6.2% to around 7%.

- Lifting the wage cap to include more high-income earners.

- Gradually increasing FRA beyond 67.

- Means-testing benefits, reducing payments to the wealthiest retirees.

While these proposals remain politically divisive, most economists agree that action will be needed before 2033, when the OASI Trust Fund is projected to run short.

Comparing Social Security Internationally

The U.S. is not alone in facing pension challenges.

In Canada, the Canada Pension Plan (CPP) recently increased contribution rates to preserve funding.

In the United Kingdom, the State Pension age will rise to 67 by 2028.

Germany has linked its retirement age to life expectancy, ensuring gradual adjustments.

“Global aging is forcing every developed country to confront similar questions,” noted Dr. Anna Müller, a senior researcher at the OECD. “The key is balancing fairness, affordability, and adequacy.”

What Beneficiaries Should Do Now

Financial experts urge Americans to plan proactively:

- Check your SSA account to verify earnings records and projected benefits.

- Estimate your break-even age—when delayed benefits outweigh early payouts.

- Coordinate with Medicare to understand how premium increases affect net income.

- Diversify retirement income through savings, employer plans, or annuities.

“Social Security was never meant to be the sole source of retirement income,” said Karen Lopez, a certified financial planner in Chicago. “It should complement personal savings and employer-sponsored plans.”

SNAP Cuts Incoming? USDA Pulls Back Emergency Funding as Budget Crisis Deepens

US Work Visas and Permanent Residency After Graduation Explained by Duke University

FAQ

Q1. When will the 2026 COLA take effect?

A: The new benefit amounts begin with January 2026 payments, typically distributed starting the second week of the month.

Q2. Will Medicare premiums offset my increase?

A: Possibly. If Medicare Part B premiums rise—as projected—some or all of the COLA increase could be absorbed.

Q3. How do I find my full retirement age?

A: You can check the SSA’s online FRA calculator. For 1959 births, it’s 66 years and 10 months; for 1960 or later, it’s 67.

Q4. Will Social Security run out of money?

A: The program won’t “run out,” but without reform, it will only be able to pay around 77% of scheduled benefits by 2033.