The Social Security Fairness Act changes are reshaping retirement income for millions of Americans, ending decades-old benefit reductions and triggering retroactive payments dating back more than a year. The law, implemented in 2025, alters how monthly benefits are calculated for many public-sector retirees and their families, prompting one of the most significant recalculations of Social Security benefits in a generation.

Social Security Fairness Act Changes

| Key Fact | Detail |

|---|---|

| Law enacted | January 2025 |

| Retroactive period | Back to January 2024 |

| Who is affected | Retirees impacted by WEP and GPO |

| Monthly increase | Varies by earnings and pension history |

| Official Website | Social Security Administration |

What the Social Security Fairness Act Changes Do

The Social Security Fairness Act eliminates two provisions that for decades reduced benefits for certain retirees: the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO). These rules primarily affected public-sector workers—including teachers, police officers, firefighters, and municipal employees—whose primary pensions came from jobs not covered by Social Security payroll taxes.

Under WEP, a worker’s own Social Security retirement benefit could be reduced if they also received a non-covered pension. Under GPO, spousal and survivor benefits were reduced—often eliminated entirely—by two-thirds of the recipient’s government pension.

According to the Social Security Administration, these provisions were originally enacted in the 1980s to prevent what lawmakers then viewed as “double dipping.” Over time, however, critics argued they disproportionately penalized workers with mixed careers who paid into Social Security for years but still saw sharply reduced benefits.

“This legislation corrects a structural inequity that affected millions of public servants,” the SSA said in a statement following implementation. “Many beneficiaries were receiving significantly less than what their work history would otherwise entitle them to.”

Support for repeal grew steadily over the past decade, driven by advocacy from retiree groups and bipartisan lawmakers representing districts with large numbers of public employees. Opponents had long raised concerns about cost, but the final legislation passed with broad cross-party support after years of stalled efforts.

Historical Context: Why WEP and GPO Were Controversial

The Windfall Elimination Provision and Government Pension Offset were introduced in 1983, during a period when Congress was attempting to shore up Social Security’s finances. At the time, lawmakers feared that workers who spent part of their careers outside the system could appear to be low-income earners under Social Security’s progressive benefit formula, thus receiving higher replacement rates.

Over time, researchers and policy analysts argued that the provisions often overshot their target. Teachers or firefighters who worked summer jobs, second careers, or early private-sector roles frequently paid Social Security taxes for years, only to see those contributions yield sharply reduced returns.

A 2020 report from the Congressional Research Service noted that WEP reductions did not consistently align with actual “windfall” benefits and varied widely among similarly situated workers. That finding helped fuel renewed legislative momentum.

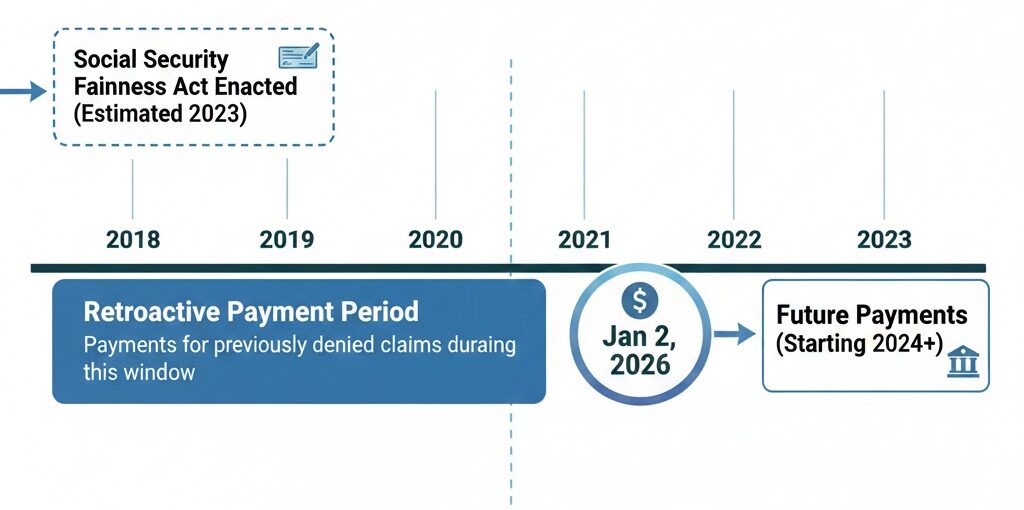

When Retroactive Payments Begin

Retroactive payments are among the most closely watched aspects of the Social Security Fairness Act changes. The law applies benefit recalculations back to January 2024, meaning eligible beneficiaries are owed back payments for months in which WEP or GPO should no longer have applied.

The Social Security Administration began issuing lump-sum retroactive payments in late February 2025, with deposits and paper checks continuing through the spring and summer. The agency said most straightforward cases were processed first, while more complex files—such as survivor benefits or cases involving multiple pensions—required additional review.

“These retroactive payments are automatic,” the SSA said, emphasizing that beneficiaries do not need to submit new applications if their banking and mailing information is current. However, officials acknowledged that delays are possible due to staffing constraints and the sheer volume of recalculations.

For many recipients, the lump-sum payments amount to several thousand dollars, depending on the size of the original reduction and the number of months involved.

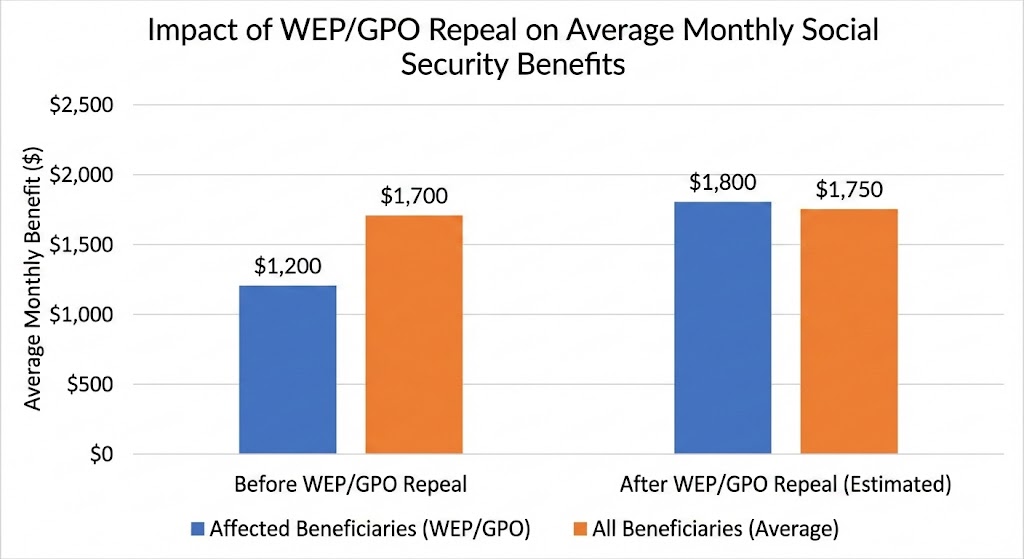

How Monthly Benefits Are Shifting

Beyond the one-time retroactive payments, the most consequential impact of the Social Security Fairness Act changes lies in permanent monthly benefit increases. Updated benefit amounts began appearing in April 2025, reflecting payments earned for March.

The size of the increase varies significantly. Some retirees see modest gains under $100 per month, while others experience increases of $500 or more. Those with longer Social Security-covered work histories alongside public pensions tend to see larger adjustments.

Retirement experts say the change improves predictability for households that had struggled to plan around uncertain benefit reductions. “For many families, this stabilizes retirement income in a meaningful way,” said a former SSA policy official now advising public-sector unions.

Importantly, future cost-of-living adjustments will now apply to the higher base amount, compounding the long-term effect of the change.

Real-World Impact: Retirees and Survivors

For surviving spouses, the repeal of GPO is particularly significant. Under prior law, some widows and widowers received little or no survivor benefit, even when their spouse paid into Social Security for decades.

Advocacy groups say the change brings relief to older Americans who were among the most financially vulnerable. “This is not a windfall,” said one retiree advocate. “It’s restoring benefits people already earned.”

Who Benefits—and Who Does Not

Despite its broad impact, the Social Security Fairness Act changes do not affect all retirees. Only individuals whose benefits were reduced by WEP or GPO qualify for adjustments.

Most state and local government employees already work in jobs covered by Social Security and were never subject to these offsets. Their benefit calculations remain unchanged.

Policy analysts stress this distinction to manage expectations. “This law targets a specific inequity,” said a retirement economist. “It does not expand Social Security benefits universally.”

Administrative and Implementation Challenges

Implementing the law has required the Social Security Administration to recalculate millions of records, some dating back decades. The agency has faced ongoing staffing shortages and rising service demands, raising concerns about processing delays.

SSA officials say automation has helped, but some cases still require manual review. Beneficiaries are advised to review mailed notices carefully and report discrepancies promptly.

Fiscal and Policy Implications

The repeal of WEP and GPO carries long-term cost implications for Social Security’s finances. The Congressional Budget Office previously estimated that eliminating the provisions would increase program outlays by tens of billions of dollars over the next decade.

Supporters argue the cost reflects benefits that workers were always entitled to receive. Critics warn that rising expenditures underscore the urgency of broader Social Security reform as the trust fund faces projected shortfalls in the 2030s.

The Social Security Administration has said it will provide Congress with regular implementation updates and fiscal impact assessments.

Political Reaction and Broader Debate

The law’s passage marked a rare moment of bipartisan consensus on Social Security policy. Lawmakers from both parties cited fairness to public servants as a driving factor, even as disagreements persist over the program’s long-term sustainability.

Some fiscal conservatives cautioned that the change could complicate future reform efforts, while progressives framed it as a necessary correction to an outdated system.

$2,500 Data Breach Settlement Deadline – Why Claims Close Soon for These Six Insurers

Looking Ahead

As payments continue to be processed, SSA officials urge beneficiaries to ensure their contact information remains current. The agency expects most recalculations to be completed by the end of 2025, though some complex cases may extend beyond that timeframe.

For retirees affected by the change, the law represents both financial relief and symbolic recognition of years of public service—closing a chapter on a debate that has spanned more than four decades.

FAQs About Social Security Fairness Act Changes

Do I need to apply for retroactive payments?

No. Payments are automatic if the SSA has your correct information.

Are survivor benefits included?

Yes. Survivors previously affected by the Government Pension Offset may see restored benefits.

Will future cost-of-living adjustments apply?

Yes. All future COLAs will be calculated using the new benefit amount.

What if my payment seems incorrect?

SSA advises contacting the agency directly and retaining all notices for reference.