The Social Security Administration (SSA) has officially confirmed that approximately 75 million Americans will see a 2.8% increase in their monthly benefits beginning in January 2026. This annual cost-of-living adjustment (COLA) is designed to help retirees, survivors, and those with disabilities maintain their purchasing power as the costs of essential goods and services continue to shift within the United States economy.

For a beneficiary currently receiving a Social Security monthly payment of $1,950, the 2026 adjustment will result in a gross increase of approximately $54.60 per month. This raises the total monthly check to $2,004.60 before any deductions for taxes or healthcare. Over the course of the 2026 calendar year, this adjustment provides an additional $655.20 in gross annual income.

Social Security Check of $1,950

The following data summarizes the most critical financial shifts for beneficiaries in the coming year, based on current federal announcements.

| Key Metric | 2025 Value | 2026 Value (Confirmed) |

| COLA Percentage | 2.5% | 2.8% |

| Avg. Retired Worker Benefit | $2,015 | $2,071 |

| Standard Medicare Part B Premium | $185.00 | $202.90 |

| Maximum Taxable Earnings | $176,100 | $184,500 |

| SSI Maximum (Individual) | $967 | $994 |

Detailed Breakdown: The Real Value of the 2026 Increase

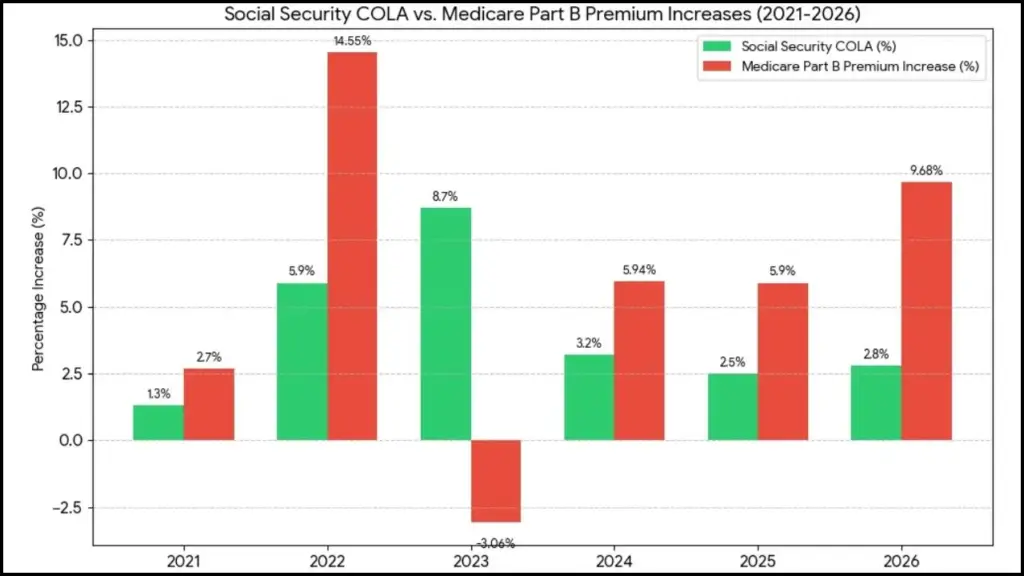

While a 2.8% increase is slightly higher than the 2.5% adjustment implemented in 2025, it represents a stabilizing trend compared to the 8.7% spike recorded in 2023. The SSA utilizes the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) to calculate these annual changes, specifically measuring inflation during the third quarter of the prior year.

The Impact of Medicare Deductions

For the vast majority of retirees, the Social Security check they see in their bank account is the “net” amount after Medicare Part B premiums are deducted. For 2026, the Centers for Medicare & Medicaid Services (CMS) announced a significant increase in the standard Part B premium, raising it from $185.00 to $202.90.

This $17.90 monthly increase in healthcare costs acts as a direct offset to the COLA. For an individual receiving the Social Security amount of $1,950, the $54.60 gross raise is reduced by the higher Medicare premium, leaving a net increase of roughly $36.70.

Changes to Earnings Limits for Working Retirees

Many beneficiaries choose to work while receiving benefits. For 2026, the SSA has adjusted the earnings test limits, allowing retirees to earn more before their benefits are temporarily withheld.

Younger Than Full Retirement Age (FRA)

If you are under your FRA for the entire year of 2026, the earnings limit is $24,480. If you earn more than this amount, the SSA will withhold $1 in benefits for every $2 you earn over the limit. This is an increase from the $23,400 limit in 2025, providing an additional $1,080 in “earning room.”

Reaching FRA in 2026

For those who will reach their full retirement age during 2026, the rules are more lenient. You can earn up to $65,160 in the months leading up to your birthday month. Above this threshold, the SSA withholds $1 for every $3 earned. Once you reach your FRA, there is no limit on how much you can earn while receiving your full Social Security benefit.

The Maximum Social Security Benefit in 2026

For high earners who have consistently paid the maximum into the system for at least 35 years, the maximum possible benefit is also rising.

- Claiming at age 62: $2,969 per month.

- Claiming at Full Retirement Age: $4,207 per month.

- Claiming at age 70: $5,251 per month.

To achieve the top-tier payment of $5,251, a worker must have earned at or above the taxable maximum (which will be $184,500 in 2026) for 35 years and delayed their claim until age 70.

Supplemental Security Income (SSI) Adjustments

Low-income individuals and those with disabilities who receive Supplemental Security Income (SSI) will also see their federal payment amounts increase by 2.8%.

- Individuals: The maximum monthly federal payment will rise to $994.

- Couples: Both members of an eligible couple will share a maximum of $1,491.

- Essential Persons: Those who provide essential care to an SSI recipient will receive up to $498.

Unlike regular Social Security, SSI payments for January 2026 will actually be delivered on December 31, 2025, because January 1 is a federal holiday.

January 2026 Social Security Payment Dates: Check Exact Dates When Payments Will Be Sent

FAQs About Social Security Check of $1,950

1. When will I receive my official notice of the new benefit amount?

The SSA began sending COLA notices in late November 2025. Most beneficiaries can view their personalized “COLA Notice” online by signing into their my Social Security account. Paper notices are typically mailed throughout December.

2. Does the “Hold Harmless” provision apply to me in 2026?

The “Hold Harmless” rule prevents a person’s Social Security check from decreasing due to a Medicare Part B premium increase. Because the 2.8% COLA for 2026 ($54.60 for a $1,950 check) is larger than the $17.90 Medicare premium increase, most people will see a net gain, meaning the provision will only protect a very small number of people with exceptionally low benefits.

3. Will the 2026 COLA increase my taxes?

It might. If your “combined income” (adjusted gross income + tax-exempt interest + half of your Social Security benefits) exceeds $25,000 as an individual or $32,000 as a couple filing jointly, you may owe federal income tax on a portion of your benefits.

4. How is the 2.8% figure determined?

The SSA compares the average CPI-W from the third quarter (July, August, September) of 2025 to the same period in 2024. The percentage difference between these two averages becomes the COLA for the following year.

5. What is the taxable maximum for workers in 2026?

For those still in the workforce, the maximum amount of earnings subject to the Social Security tax will increase to $184,500. Any earnings above this amount are not taxed for Social Security, nor are they used to calculate future benefit amounts.