Millions of retirees receiving the Social Security $1850 benefit level are watching inflation data closely as the formula that determines the 2026 cost-of-living adjustment begins to take shape. While no official increase has been announced, early economic indicators suggest modest changes that could affect monthly checks starting next January, at a time when household costs remain elevated for older Americans.

Social Security $1850 Benefit Level

| Key Fact | Detail |

|---|---|

| Average Monthly Benefit | ~$1,850 for many retired workers |

| 2026 COLA Status | Not yet announced |

| Inflation Measure Used | CPI-W (Consumer Price Index for Urban Wage Earners and Clerical Workers) |

| Decision Timeline | Official COLA announced October 2025 |

| Official Website | Social Security Administration |

How the Social Security $1850 Benefit Level Is Adjusted

The annual Social Security adjustment is designed to protect beneficiaries from inflation, not to increase purchasing power. The mechanism is rooted in federal law and has been in place for decades, forming one of the core protections for retirees and disabled Americans.

Each year, the Social Security Administration compares third-quarter inflation data from the current year with the same period a year earlier. The calculation relies on the Consumer Price Index for Urban Wage Earners and Clerical Workers, or CPI-W, which tracks price changes for goods and services such as food, housing, transportation, and medical care.

If the CPI-W shows inflation, benefits rise by the same percentage. If prices remain flat or fall, benefits stay the same.

“The cost-of-living adjustment reflects changes in consumer prices, not individual household expenses,” the Social Security Administration explains in its public guidance.

For recipients at the Social Security $1850 benefit level, the adjustment can result in changes ranging from a few dollars to several dozen dollars per month, depending on inflation trends.

Why Inflation Still Matters Even When It Slows

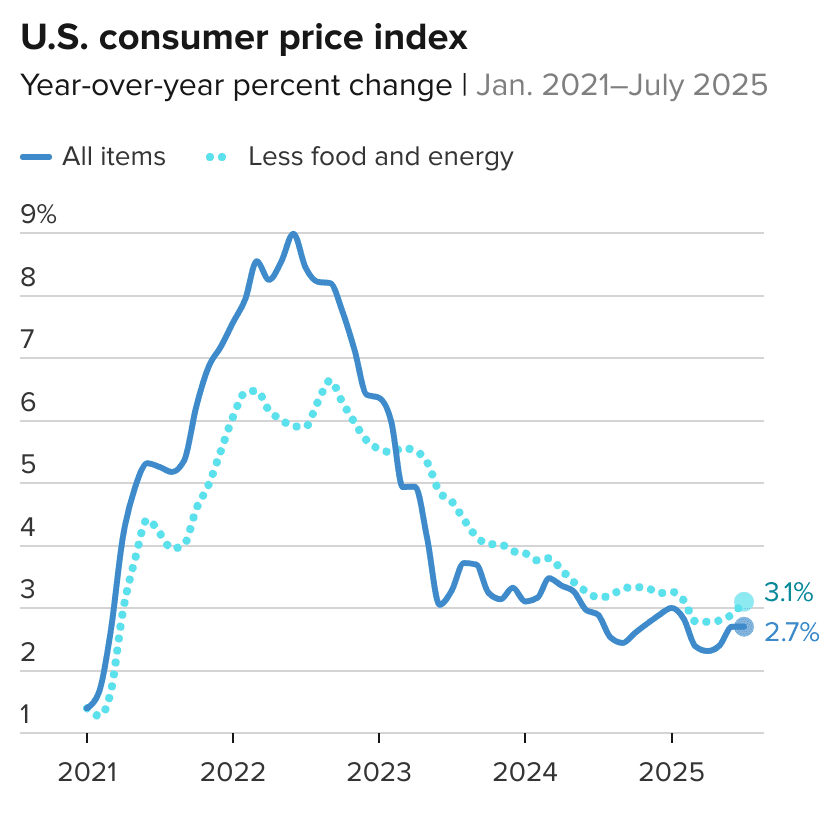

Although inflation has moderated from the peaks seen earlier in the decade, economists caution that slower inflation does not mean lower prices. Instead, it reflects prices rising at a slower pace, leaving many households still managing higher baseline costs.

Housing, utilities, insurance, and health-related expenses have risen faster than overall inflation in recent years, according to federal data. For retirees who rely heavily on Social Security, these categories often represent a larger share of monthly spending than for younger workers.

“Even modest inflation can have an outsized impact on retirees who live on fixed incomes,” said Alicia Munnell, director of the Center for Retirement Research at Boston College, in prior commentary on Social Security adequacy. “That is why the COLA, even when small, remains critically important.”

What Is Known — and Unknown — About the 2026 Adjustment

As of now, the Social Security Administration has not announced the 2026 COLA, and it will not do so until inflation data for July, August, and September 2025 are finalized and reviewed.

That announcement typically comes in mid-October, giving beneficiaries several months’ notice before changes take effect in January.

Economists caution against assuming outcomes too early, particularly in a period marked by global economic uncertainty, geopolitical tensions, and shifting energy and housing markets.

“Inflation has cooled compared with recent years, but it remains uneven across essential categories such as housing, medical care, and insurance,” said Mary Johnson, a Social Security policy analyst at The Senior Citizens League, during a recent policy briefing.

If inflation remains moderate, the 2026 adjustment is expected to be smaller than the historically large increases seen earlier in the decade. Even so, a modest adjustment could still raise a $1,850 monthly benefit by several hundred dollars over the course of a year.

Historical Context: How Recent COLAs Compare

Understanding the 2026 outlook requires context. In the early 2020s, Social Security recipients experienced some of the largest COLAs in program history, driven by sharp inflation increases following the pandemic.

Those larger adjustments provided short-term relief but did not necessarily restore lost purchasing power for many retirees, according to independent analyses. Rising Medicare premiums, rent increases, and food costs offset much of the gain.

Historically, COLAs have averaged between 2% and 3% annually over long periods. Years with no increase at all, such as during low-inflation periods in the 2010s, also remain part of the program’s history.

That variability underscores why many retirees track COLA announcements closely, even when expectations point to modest changes.

The Role of Medicare and Net Monthly Payments

While gross Social Security benefits may increase, net payments often depend on other factors, particularly Medicare Part B premiums. These premiums are typically deducted automatically from monthly Social Security checks.

In years when Medicare premiums rise sharply, some beneficiaries see little or no increase in their take-home amount, despite a positive COLA. Federal law includes a “hold harmless” provision that protects many beneficiaries from net reductions, but it does not apply universally.

According to the Centers for Medicare & Medicaid Services, premium announcements for 2026 will arrive later this year, adding another layer of uncertainty for retirees budgeting on fixed incomes.

Health policy experts note that even modest premium increases can significantly affect lower- and middle-income retirees, particularly those near the Social Security $1850 benefit level.

Why the Social Security $1850 Benefit Level Matters

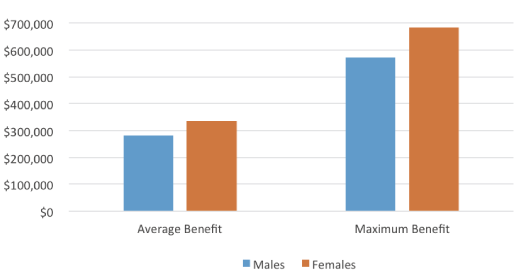

A monthly benefit of roughly $1,850 sits close to the national average for retired workers, making it a useful benchmark for assessing retirement security across the country.

For millions of households, Social Security provides the majority of retirement income. For some, it is the only reliable source. Advocacy groups have long argued that the current benefit structure struggles to keep pace with modern living costs, especially for seniors living alone or managing chronic health conditions.

Critics also point to the CPI-W itself, arguing that it does not accurately reflect seniors’ spending patterns, which place greater emphasis on medical care and housing. Alternative measures, such as the Consumer Price Index for the Elderly (CPI-E), have been proposed but not adopted into law.

Until such changes occur, beneficiaries remain tied to the existing formula.

Policy Debate and Long-Term Considerations

Beyond annual adjustments, the future of Social Security remains a subject of ongoing debate in Washington. Lawmakers face long-term funding challenges as the population ages and the ratio of workers to beneficiaries declines.

While the trust fund remains solvent in the near term, projections from the Social Security trustees indicate that changes will eventually be needed to ensure full benefit payments beyond the next decade.

Proposals range from adjusting payroll taxes to modifying benefit formulas or increasing the retirement age. None of these measures are directly tied to the 2026 COLA, but they form the broader policy backdrop against which annual adjustments occur.

For current retirees, however, the immediate concern remains the size and timing of the next adjustment.

Practical Planning for Beneficiaries

Financial advisors generally recommend that retirees avoid budgeting based on assumed COLA increases. Instead, they suggest treating any adjustment as supplemental income rather than guaranteed growth.

“COLAs are important, but they are unpredictable,” said one certified financial planner interviewed by public retirement advocacy groups. “It is safer to plan conservatively and adjust spending once official numbers are confirmed.”

Beneficiaries are encouraged to monitor official announcements from the Social Security Administration and review annual benefit statements carefully when they arrive.

Trump $2,000 Tariff Dividend Check Update – Where the Proposal Stands as 2025 Wraps Up

Looking Ahead

The official 2026 adjustment will be announced in October, once federal inflation data are finalized. Until then, recipients at the Social Security $1850 benefit level are advised to plan conservatively and watch for updates from the Social Security Administration and Medicare officials.

As Johnson observed, “Even small percentage changes matter when Social Security is the primary source of income.”

FAQs About Social Security $1850 Benefit Level

When will the 2026 COLA be announced?

The Social Security Administration typically announces the adjustment in mid-October, after reviewing third-quarter inflation data.

Will everyone receive the same percentage increase?

Yes. The COLA applies uniformly, though the dollar amount varies based on individual benefit levels.

Can benefits ever go down because of inflation?

Benefits are not reduced due to COLA calculations, even if inflation is negative.

Does the COLA account for regional cost differences?

No. The adjustment is national and does not vary by location.