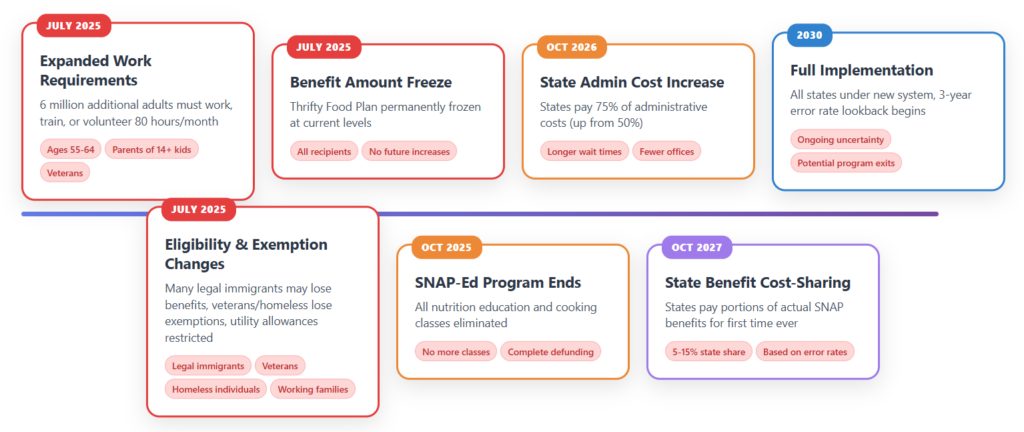

The SNAP Rules for 2026 will shape how millions of low-income Americans qualify for and keep food assistance as expanded federal work requirements reach full implementation and states continue adjusting program oversight. Rooted in recent budget legislation, the changes affect eligibility, compliance obligations, and, in some cases, how food stamp benefits are administered across the United States.

SNAP Rules for 2026

| Key Fact | Detail / Statistic |

|---|---|

| Program name | Supplemental Nutrition Assistance Program (SNAP) |

| Affected age group | Many adults ages 18–54 without qualifying exemptions |

| Monthly requirement | 80 hours of work or approved activity |

| Benefit limit without compliance | 3 months in a 36-month period |

| Administration | Federally funded, state administered |

The Policy Background Behind SNAP Rules for 2026

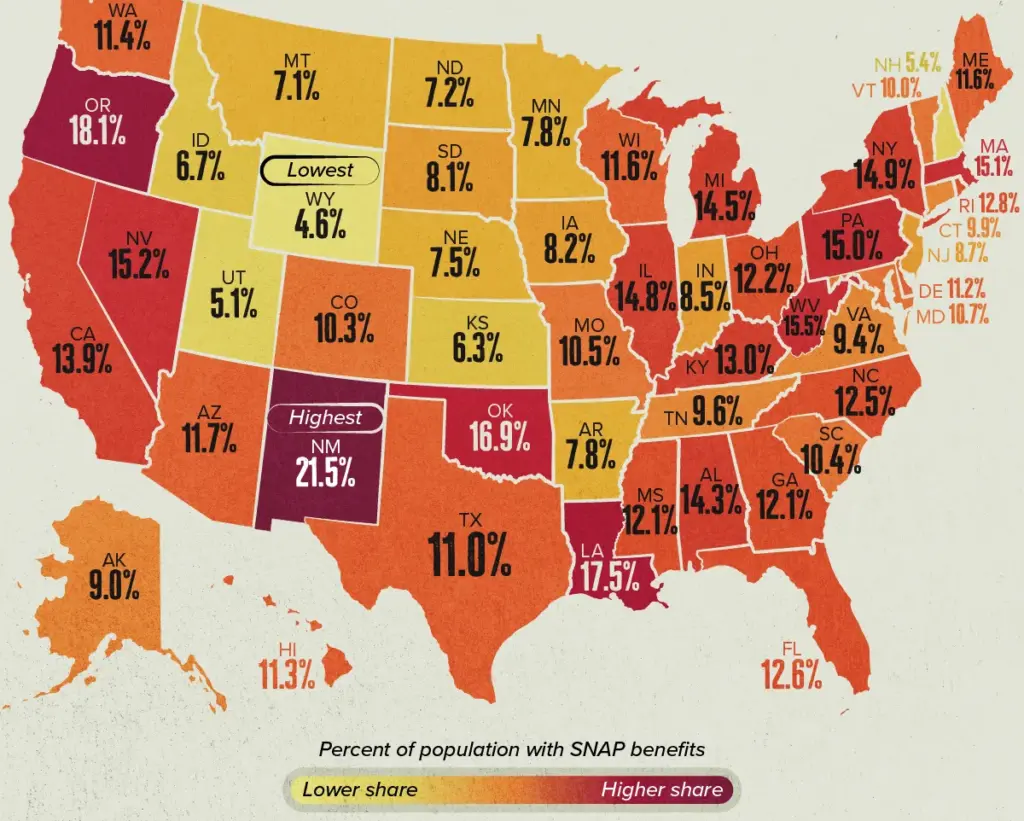

The Supplemental Nutrition Assistance Program, commonly known as SNAP, is the largest federal nutrition assistance program in the United States. According to the U.S. Department of Agriculture (USDA), it serves tens of millions of Americans each month, including working families, seniors, people with disabilities, and children.

The SNAP Rules for 2026 reflect the final phase of policy changes enacted under the Fiscal Responsibility Act of 2023, a bipartisan law passed to suspend the federal debt ceiling while curbing long-term spending growth. One of its most consequential provisions expanded SNAP work requirements, reviving a decades-old debate over the role of employment conditions in public assistance programs.

“These rules represent the most significant change to SNAP eligibility enforcement in a generation,” said Pamela Herd, a professor of public policy at Georgetown University. “While the law was framed as a budget measure, its effects are fundamentally social.”

Historically, SNAP work requirements have fluctuated in response to economic conditions. During recessions, Congress has often loosened requirements to stabilize household food access. During periods of low unemployment, lawmakers have tended to tighten them, arguing that work incentives are more effective when jobs are available.

Expanded Work Requirements in SNAP Rules for 2026 to Take Full Effect

Who Must Meet the Requirement

Under the SNAP Rules for 2026, most able-bodied adults ages 18 to 54 without dependent children must meet monthly work or participation thresholds to receive benefits beyond a short-term period. Federal policy refers to this group as able-bodied adults without dependents, or ABAWDs.

To remain eligible, affected individuals must complete at least 80 hours per month of one or more of the following:

- Paid employment

- Participation in approved job training or education programs

- State-approved workfare or volunteer activities

- A combination of these activities totaling the required hours

Those who do not comply generally face a limit of three months of SNAP benefits within a 36-month period, a restriction commonly called the “time limit.”

USDA officials say the policy is intended to encourage labor force participation while preserving assistance for those who cannot work.

“Congress set these parameters, and our role is to administer them consistently,” a USDA spokesperson said. “The law includes clear standards and exemptions.”

Exemptions Still Apply

Despite the expanded scope, the SNAP Rules for 2026 do not apply universally. Federal law maintains exemptions for individuals who are:

- Medically certified as physically or mentally unable to work

- Pregnant

- Caring for a dependent child or incapacitated adult

- Enrolled in certain qualifying education or treatment programs

States also retain limited authority to request geographic waivers in areas with persistently high unemployment, though the Fiscal Responsibility Act narrowed the availability of such waivers.

Anti-hunger organizations stress that exemptions exist on paper but can be difficult to navigate in practice.

“Eligibility often hinges on documentation, not just circumstances,” said Dottie Rosenbaum, director of SNAP policy at the Center on Budget and Policy Priorities. “That administrative barrier is where many people lose access.”

Income and Asset Rules Remain Central

While work conditions dominate the policy discussion, SNAP eligibility changes tied to income and household resources remain central to determining who qualifies for assistance.

Most households must have gross monthly income below 130% of the federal poverty level, with net income limits applied after deductions for housing, child care, and medical expenses. These thresholds adjust annually and vary by household size.

Some states have adopted broader eligibility options that raise or eliminate asset limits, while others continue to assess savings and other resources when determining eligibility.

“Work requirements shape duration, but income rules shape access,” said Elaine Waxman, a senior fellow at the Urban Institute. “Both matter, especially during periods of economic volatility.”

State-Level Variations and Food Purchase Rules

Although SNAP is federally funded, states play a central role in administration, resulting in variation in outreach, enforcement, and participant experience.

Under the SNAP Rules for 2026, states remain responsible for:

- Verifying work participation

- Granting exemptions

- Managing Employment and Training (E&T) programs

- Communicating changes to recipients

Some states have also explored pilot programs affecting allowable purchases, though the USDA has historically approved such demonstrations sparingly. Public health advocates argue restrictions could encourage healthier diets, while critics warn they risk stigmatizing recipients and complicating program delivery.

As of early 2026, USDA officials say no nationwide restrictions on specific foods have been implemented, and SNAP benefits continue to be usable for most grocery items intended for home consumption.

Administrative Burden and Reporting Requirements

For recipients subject to SNAP work requirements, compliance often depends on accurate and timely reporting. States may require monthly or periodic proof of employment, training attendance, or exemption status.

Research from policy institutes shows that administrative complexity can significantly affect participation rates, even among eligible households. Missed paperwork deadlines, limited access to technology, and inconsistent communication are common challenges.

“From a policy perspective, the rule is only as effective as its implementation,” said Herd. “Administrative hurdles can function as de facto eligibility barriers.”

State officials counter that verification is necessary to ensure program integrity and comply with federal law.

Political Debate and Economic Context

The SNAP Rules for 2026 sit at the intersection of economic policy and social welfare, making them a recurring subject of political debate.

Supporters of expanded work requirements argue they reflect current labor market conditions, which, as of recent years, have featured relatively low unemployment and high job openings. They say tying benefits to work reinforces the program’s original intent as temporary assistance.

Opponents point to studies showing that past SNAP work requirements produced limited long-term employment gains while increasing food insecurity among affected adults.

According to the Congressional Budget Office, the changes reduce federal SNAP spending but also result in lower participation, including among some individuals who remain eligible but fail to meet reporting requirements.

Practical Implications for Households

For households navigating the SNAP Rules for 2026, the practical impact often comes down to awareness and access to support services.

Experts recommend that recipients:

- Respond promptly to state notices

- Report work or training hours accurately

- Seek exemptions if circumstances change

- Contact local SNAP offices or legal aid organizations for assistance

Community organizations warn that confusion around rules can deter eligible individuals from applying for or retaining food stamp benefits, particularly among populations with unstable employment.

$1000 December Deposits: Which Americans Are Scheduled to Be Paid on the 18th

What Comes Next After SNAP Rules Changing for 2026

Looking ahead, the SNAP Rules for 2026 are expected to remain in place unless Congress acts to amend federal law. However, enforcement practices, court rulings, and administrative guidance could still shape how the rules affect households on the ground.

USDA officials say they will continue monitoring outcomes, including employment effects and food access indicators, as states adjust to the fully implemented framework.

“SNAP remains a cornerstone of the nation’s food security system,” the agency said in a recent statement. “Our responsibility is to administer the law while ensuring eligible Americans can access nutrition assistance.”

FAQs About SNAP Rules for 2026

Q: Does everyone receiving SNAP have to work in 2026?

No. Only certain adults without qualifying exemptions are subject to work requirements.

Q: How many hours must affected recipients work?

Most must complete at least 80 hours per month of work or approved activities.

Q: Are states allowed to change SNAP rules?

States administer SNAP but must follow federal eligibility and benefit standards.