The Social Security Administration (SSA) has confirmed a 2.8% COLA increase for 2026, raising monthly benefits for more than 70 million Americans beginning in January. The adjustment, intended to help recipients keep pace with inflation, automatically applies to Social Security and Supplemental Security Income (SSI). However, the early arrival of the January SSI payment on December 31, due to the federal calendar, has prompted fresh attention to year-end documentation and account updates.

New 2.8% COLA

| Key Fact | Detail |

|---|---|

| COLA Rate | 2.8% increase for 2026 |

| Average Monthly Benefit Rise | Approximately $54 for retired workers |

| Early Payment Date | January 2026 SSI payment issued December 31, 2025 |

| Number of People Affected | More than 70 million Social Security & SSI beneficiaries |

| Inflation Basis | Calculated using CPI-W for July–September |

| Official Website | Social Security Administration |

The SSA will continue monitoring inflation trends throughout 2026 ahead of the next COLA determination. Lawmakers and policy analysts are expected to intensify debates over Social Security’s long-term sustainability, while retirees navigate rising expenses with modest increases in benefits.

For now, the 2.8% COLA increase offers modest relief but underscores the ongoing financial pressures facing millions of older Americans and those living with disabilities.

Understanding the 2.8% COLA Increase

The 2.8% COLA increase reflects the annual formula tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a federal measurement of inflation. The Social Security Act mandates that benefits rise when inflation pushes living costs higher, ensuring the real value of payments does not erode over time.

SSA officials stated that the 2026 increase aims to protect retirees’ purchasing power following several years of elevated inflation pressure across housing, healthcare, food, and energy sectors.

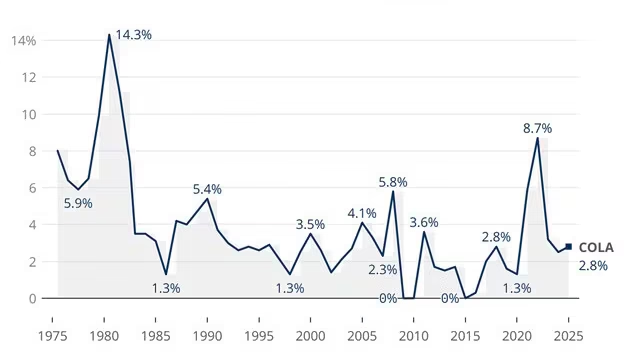

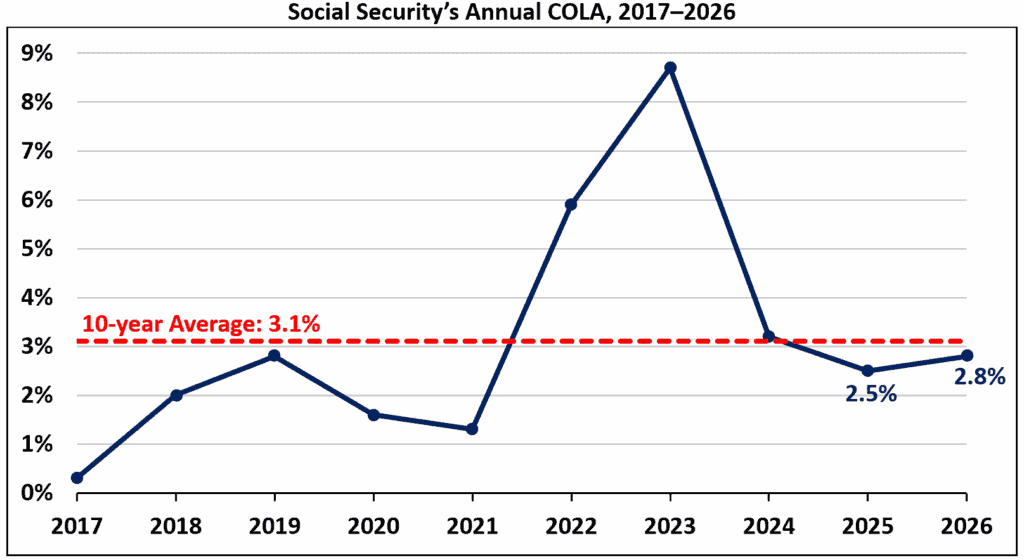

Historical Context

The 2.8% adjustment is modest compared with recent years:

- 2023: 8.7% (highest in four decades)

- 2024: 3.2%

- 2025: 3.0%

The 2026 rate reflects a cooling but still significant inflation trend.

Why December 31 Matters — and Why It Isn’t a Hard Deadline

Some news coverage has framed December 31 as a “deadline,” but the SSA has not issued any requirement that beneficiaries must take action by this date to receive the COLA. The confusion stems from payment timing:

- SSI beneficiaries will receive their January 2026 payment on December 31, 2025.

- This occurs because federal rules prohibit payments on weekends and holidays.

- The December 31 payment does not count as an extra benefit; it is simply delivered early.

Advocacy groups say beneficiaries should use the end of the year to verify their information, especially if they rely on mailed notices or have recently moved.

Who Benefits from the 2.8% COLA Increase?

Retired Workers

The average retired worker will see their monthly Social Security payment rise by about $54, according to preliminary SSA projections.

For many, this increase helps cover prescription costs, utility bills, and rising insurance premiums. Yet experts caution that actual household expenses may still outpace the COLA.

Disabled Workers

Disabled beneficiaries under Social Security Disability Insurance (SSDI) also receive the increase. For those living on fixed incomes, even small adjustments can significantly impact monthly budgeting.

Survivors

Widows, widowers, and dependent children receiving survivor benefits also see proportional increases under the COLA formula.

Low-Income Households Receiving SSI

SSI beneficiaries, who represent some of the nation’s most financially vulnerable adults and children, will see their maximum federal payment increase. The early December 31 payment is particularly important for those managing month-to-month income.

Expert Perspectives on the Impact

Economists and policy analysts say the COLA offers relief but does not fully bridge the gap between benefit levels and rising living costs.

“COLA adjustments preserve the baseline stability of Social Security payments, but they don’t fully address the growing costs of healthcare, long-term care, and rent,” said one retirement-policy researcher at the Center for Budget and Policy Priorities.

A senior economist at a major U.S. university added:

“Retirees are experiencing sustained inflation in essential goods. A 2.8% increase helps, but ongoing expenses—particularly medical—continue to rise faster than overall inflation.”

How the SSA Calculates COLA

The COLA formula uses the CPI-W index from the third quarter (July–September) of one year compared with the same period of the previous year. If prices increase, benefits increase proportionally.

The SSA does not have discretion over the figure; it is a mechanical calculation defined by federal law. This protects the program from political influence while ensuring year-to-year consistency.

Administrative Steps Beneficiaries Should Consider

Although no mandatory actions are required to receive the COLA increase, experts recommend beneficiaries take the following steps before year-end:

1. Update Contact Information

Ensure mailing addresses, email addresses, and phone numbers are current with the SSA.

2. Review Direct Deposit Information

Incorrect or outdated deposit details are among the leading causes of payment delays.

3. Check My Social Security Accounts

Online accounts allow beneficiaries to:

- View payment schedules

- Access COLA notices

- Review earnings histories

- Monitor for fraud or unusual changes

4. Watch for COLA Notices

Most beneficiaries will receive updated benefit notices electronically or by mail in early December.

Impact on Federal and Military Retirees

Federal Employees Retirement System (FERS) beneficiaries often receive a reduced COLA due to program rules. For example:

- If the COLA is between 2% and 3%, FERS retirees receive 2%.

- If the COLA exceeds 3%, they receive 1% below the official COLA.

Military retirees, governed by the Department of Defense, typically receive the full COLA amount unless otherwise specified by annual legislation.

These differences can create disparities between groups of retirees with similar cost-of-living needs.

Program Sustainability and Long-Term Considerations

The COLA debate intersects with broader discussions about Social Security’s long-term financing. According to the most recent Social Security Trustees Report:

- The program’s trust funds face depletion in the 2030s if Congress does not act.

- At that point, benefits could be reduced by about 20% unless lawmakers extend funding.

Economists emphasize that COLA increases do not contribute meaningfully to shortfalls; structural factors include demographic changes and slower workforce growth.

Retiree Case Examples

A retired teacher in Ohio

A 72-year-old retired educator reports that rising insurance premiums and grocery bills continue to strain her budget.

“Every increase is helpful, but my expenses feel like they grow faster than the COLA,” she said.

A disabled worker in Arizona

A 45-year-old SSDI recipient explains that the increase will “cover two additional weeks of transportation costs” needed for medical appointments.

A widower in Texas

A 78-year-old widower receiving survivor benefits notes that “medication costs remain the biggest challenge,” despite the adjustment.

These perspectives highlight the variability in how beneficiaries experience inflation.

Social Security Deadline Set for December 7 — What Every Retiree Must Do Before Then

Economic Outlook: Will the COLA Be Enough?

Inflation has moderated since the peaks of 2022–2023 but remains elevated in key sectors. Economists predict:

- Healthcare inflation may exceed the COLA

- Rental markets remain tight in many states

- Energy costs may fluctuate due to global market conditions

Financial planners encourage retirees to evaluate budgets early in 2026 and to consider whether supplemental savings, part-time work, or state assistance programs might help stabilize income.