Millions of older Americans will see a modest income boost in January as Social Security’s annual cost-of-living adjustment (COLA) raises average benefits by $56 per month. The increase, driven by cooling but persistent inflation, is welcome news for many on fixed incomes. Yet analysts warn that failing to plan for rising health-care expenses — the one costly mistake that could wipe it out — may leave retirees no better off than before.

Retirees Celebrate $56 COLA

| Key Fact | Detail / Statistic |

|---|---|

| 2026 COLA Increase | 2.8% rise, about $56 per month for the average retired worker |

| Medicare Premium Pressure | Part B premiums expected to rise about 10% in 2026 |

| Retiree Concerns | 77% of older Americans say COLA does not match rising costs |

| Inflation Impact | Food, housing, and health-care prices rising faster than CPI-W |

As retirees welcome the $56 monthly increase, economists caution that rising health-care and insurance costs may absorb much of the gain. The coming months will reveal how sharply Medicare premiums rise, and whether seniors can maintain their financial footing amid ongoing economic uncertainty.

What the $56 COLA Means for Retirees in 2026

The 2026 cost-of-living adjustment increases Social Security benefits by 2.8%, which translates to the widely reported $56 average monthly increase. According to the Social Security Administration, the adjustment is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a federal measure tracking price changes in consumer goods and services.

The boost lifts the average monthly retirement benefit to about $2,071, up from roughly $2,015 in 2025. While the increase provides short-term relief, many retirees say it falls short of covering essential expenses such as housing, utilities, medical needs, and groceries.

“Seniors are grateful for any increase, but the reality is that costs in retirement are rising faster than the COLA,” said Richard Johnson, senior fellow at the Urban Institute.

The One Costly Mistake That Could Wipe It Out

The primary risk facing retirees is the assumption that the extra $56 represents additional discretionary income. Financial planners say this is the single most costly mistake retirees can make.

Rising Medicare Premiums Are a Major Threat

Medicare Part B premiums are projected to increase by about 10% in 2026, according to early estimates from the Centers for Medicare & Medicaid Services (CMS). This could raise the standard premium by approximately $18 per month, immediately consuming nearly one-third of the COLA increase.

For retirees with higher incomes, premiums under the Income-Related Monthly Adjustment Amount (IRMAA) could rise even more sharply, potentially erasing the benefit entirely.

“If retirees spend the COLA as if it’s extra cash, many will be caught off guard,” said Mary Johnson, an independent Medicare and Social Security analyst. “Premiums and health-care costs alone will absorb a large portion of the increase.”

Why Health-Care Costs Threaten to Outrun the $56 COLA

Health-care inflation continues to rise faster than general inflation. According to federal data:

- Hospital services increased more than 7% year-over-year.

- Prescription drug prices rose 5.3%.

- Long-term care facilities reported double-digit price increases.

Retirees spend twice as much on health care as younger households, according to the Bureau of Labor Statistics. This means increases in medical costs have a disproportionate impact on older Americans.

Out-of-Pocket Expenses Are Climbing

Even with Medicare, retirees pay an average of:

- $7,000 per year in out-of-pocket medical costs

- Plus premiums for Part B, Part D, and supplemental plans

These numbers continue to climb, making the $56 COLA insufficient to cover additional medical needs.

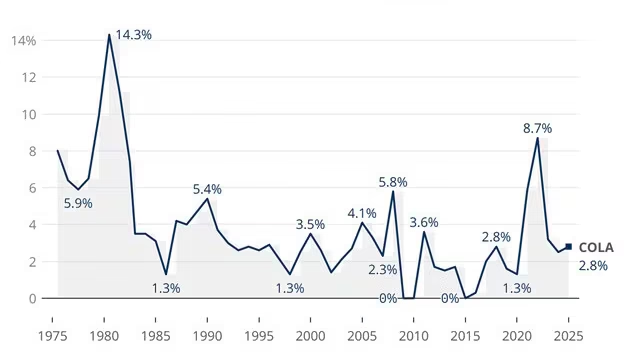

Historical Perspective — How Does the $56 COLA Compare?

To understand the significance of the increase, it helps to look at recent COLA history:

| Year | COLA % | Avg Monthly Increase |

|---|---|---|

| 2022 | 5.9% | ~$92 |

| 2023 | 8.7% | ~$146 |

| 2024 | 3.2% | ~$59 |

| 2025 | 2.5% | ~$50 |

| 2026 | 2.8% | ~$56 |

The current adjustment is far lower than the inflation-driven increases seen earlier in the decade. While inflation has cooled, prices remain high, which continues to strain retiree budgets.

Why Retirees Feel the COLA Is Not Enough

In surveys conducted by AARP and Pew Research Center, 77% of Americans aged 50 and older believe the COLA does not accurately reflect their cost of living.

There are several reasons:

1. CPI-W Doesn’t Reflect Senior Spending

The CPI-W inflation index reflects working-age Americans, not retirees. Seniors spend a larger share on:

- Health care

- Medications

- Long-term care

- Housing and utilities

These costs often rise faster than the broader CPI-W basket.

2. Essential Goods Have Outpaced Inflation for Years

Housing and medical services have grown more expensive each year, even as overall inflation has stabilized. Retirees cannot easily downsize or reenter the workforce, making them vulnerable to price increases.

3. Social Security Provides the Majority of Income for Many Seniors

According to the SSA, Social Security provides at least 50% of income for more than half of retirees. For one in four seniors, it supplies 90% or more of their income.

This makes small COLA changes disproportionately important.

How the COLA Is Calculated — and Why It’s Controversial

The cost-of-living adjustment is based on the third-quarter CPI-W each year. Critics argue that CPI-W fails to capture the financial pressures retirees face, especially health-care inflation.

Some lawmakers advocate replacing CPI-W with the Consumer Price Index for the Elderly (CPI-E), which better reflects senior spending patterns and typically results in higher adjustments.

However, shifting to CPI-E would increase long-term Social Security costs, raising concerns about trust fund solvency.

Policy Debate — What Lawmakers Are Saying

Washington remains divided on how to strengthen Social Security.

- Some members of Congress support raising the payroll tax cap to increase revenue.

- Others propose adjusting the retirement age, which would reduce long-term benefit obligations.

- A bipartisan group has suggested using CPI-E—an index tailored for seniors—but acknowledges the change would require additional funding to maintain trust fund health.

“Social Security is the bedrock of financial security for older Americans,” said Sen. Sherrod Brown, chair of the Senate Finance Subcommittee on Social Security. “We must ensure benefits keep up with rising costs.”

Opponents argue structural reforms must accompany any benefit enhancement to prevent future insolvency.

How Retirees Can Avoid the “Costly Mistake”

Financial advisers recommend several practical steps:

1. Treat the COLA as a Cost-Offset, Not Extra Cash

Allocate the $56 increase toward:

- Medicare premiums

- Prescription drugs

- Utilities or insurance premiums

2. Review Medicare Plan Options During Open Enrollment

Medication formularies and premiums change annually. Switching plans can save hundreds of dollars per year.

3. Track Inflation in Essentials

Monitoring rising costs can help retirees adjust their budgets before expenses outpace income.

4. Build Supplemental Income Sources

Part-time work, small business activity, or passive income can improve financial resilience.

5. Plan for Long-Term Care Early

Long-term care remains one of the fastest-growing expenses in retirement.

Looking Ahead — What Retirees Should Expect

Economists expect moderate inflation in 2026, but warn that essential goods and services — especially medical care — will continue to rise faster than general inflation. Medicare premium announcements later this year will reveal how much of the COLA retirees will ultimately retain.

Regardless of the outcome, analysts emphasize planning and budgeting as the best defenses against shrinking purchasing power.