Millions of Americans who rely on Supplemental Security Income (SSI) will receive a rare double Social Security payment in December due to a scheduling adjustment connected to the New Year’s Day federal holiday. The change affects beneficiaries nationwide and highlights how federal timing rules shape annual income patterns for some of the country’s most financially vulnerable residents.

Rare Double Social Security Payment

| Key Fact | Detail |

|---|---|

| December SSI Payment | Issued December 1 |

| January SSI Payment (Early) | Issued December 31 |

| 2025 Maximum Monthly Benefit | $967 for individuals; $1,450 for couples |

| Number of Recipients | Approx. 7.5 million |

| Official Website | Social Security Administration |

Why a Double Payment Is Happening

The Social Security Administration pays SSI benefits on the first day of each month unless that day is a weekend or a federal holiday. When it is, the agency distributes benefits on the preceding business day.

In 2025, January 1 falls on a federal holiday, triggering an early release of the January 2026 SSI payment on December 31, 2025. This shift does not increase a household’s annual income; rather, it reorganizes the timing.

An SSA spokesperson noted in a written statement that the agency makes “early payments to maintain uninterrupted benefit access while ensuring compliance with federal law.”

Historical Frequency of Double Payments

While the December-January shift is the most widely known example, early SSI payments occur whenever the first of a month cannot be processed.

Past Double-Payment Years

Examples from SSA payment calendars include:

- 2017 – June and December

- 2018 – September and December

- 2022 – April, September, and December

- 2023 – September and December

- 2024 – May, August, and November

These double-payment months occur two to three times per decade, depending on how weekends and holidays fall.

Who Receives the Rare Double Social Security Payment

SSI supports individuals who have limited income and resources, including older adults, blind individuals, and people with disabilities. According to the SSA’s latest report, about 7.5 million people receive SSI in the United States.

Primary Groups Affected

- Low-income seniors

- Adults with disabilities

- Children with qualifying disabilities

- Married couples receiving joint SSI

- People who receive both SSI and Social Security retirement or disability benefits

Households that receive both SSI and traditional Social Security benefits may even see three deposits in December:

- Regular Social Security retirement/disability payment

- December SSI payment

- Early January SSI payment

These multiple disbursements can cause confusion, especially for beneficiaries with irregular income.

How Much Recipients Will Receive

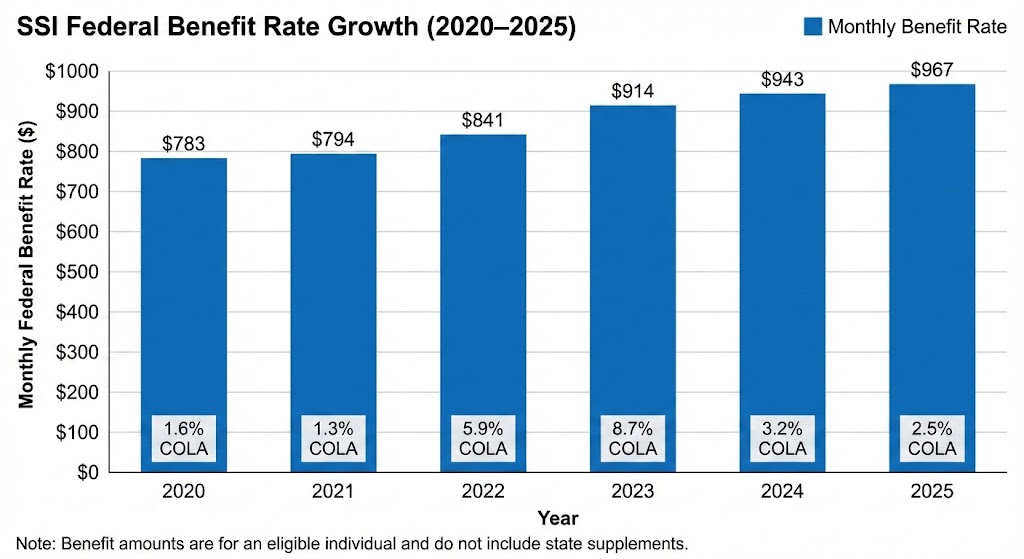

SSI payments are based on the federal benefit rate (FBR), which increases annually through the Cost-of-Living Adjustment (COLA).

2025 Federal Benefit Rate

- $967 for individuals

- $1,450 for couples

These changes follow inflation adjustments reported by the U.S. Bureau of Labor Statistics (BLS).

Dr. Carla Mendes, an economist at the Urban Institute, said that while the double payment might look like a bonus, “it is simply a timing shift, and families must plan for January carefully, because no additional payment will arrive until February.”

Impact on Household Budgeting

Advocates warn that the double payment may disrupt budgeting for beneficiaries living paycheck-to-paycheck.

Potential Budget Risks

- Overspending in December by treating the early payment as extra

- Cash shortages in early January

- Difficulty covering rent or utilities due in the first week of January

The National Council on Aging (NCOA) advises households to plan for January expenses early and avoid assuming the double deposit represents additional income.

“Treat the December 31 payment as January’s check,” the organization said in a public advisory.

How Beneficiaries Should Prepare for Rare Double Social Security Payment

Experts recommend several steps to prevent financial gaps.

1. Mark Both Dates Clearly

- December 1 – Regular December payment

- December 31 – January’s payment

2. Create a January Spending Plan

List essential expenses due between January 1–15, including:

- Rent

- Utilities

- Transportation

- Medicine

- Groceries

3. Avoid Treating the Early Payment as Holiday Cash

The December 31 payment often arrives during a high-spending time of year.

4. Use Budgeting Tools

Nonprofits suggest simple methods such as:

- Envelope budgeting

- Setting aside January’s portion in a separate account

- Automatic bill scheduling when possible

Regional and Demographic Impact Snapshot

According to SSA regional reports, SSI dependency varies widely across the country. High-reliance states typically include:

- West Virginia

- Kentucky

- Mississippi

- New Mexico

- Louisiana

In these regions, more than 5% of households receive SSI, compared with less than 2% in many western and upper-midwestern states.

Demographically, SSI recipients include:

- Older Americans living alone

- Children with disabilities (over 1 million)

- Working-age adults unable to maintain full-time employment

These groups often experience the most volatility when payments shift.

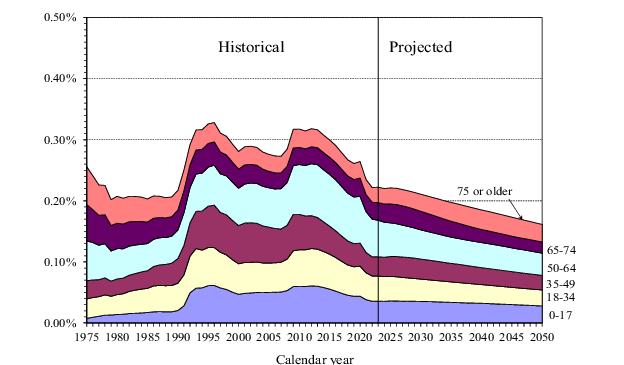

How Social Security Funding Enters This Conversation

Although the double payment is administrative rather than financial, it occurs against the backdrop of widespread debate about Social Security solvency.

According to the 2024 Social Security Trustees Report, the trust fund for Social Security retirement benefits may face depletion in the mid-2030s unless Congress acts. SSI, however, is funded through general federal revenue, not the trust fund.

Dr. James Hollister, a policy analyst at the Brookings Institution, said, “SSI is stable because it is not tied to the Social Security trust fund, but the households receiving these payments are still among the most economically fragile.”

Payment Schedule Comparisons

Understanding how payments differ helps beneficiaries avoid confusion.

| Payment Type | Schedule | Impact of Holidays |

|---|---|---|

| SSI | First of each month | Paid early if the 1st is a weekend/holiday |

| Social Security Retirement | 2nd, 3rd, or 4th Wednesday | No early payment; paid on scheduled weekday |

| SSDI | Varies by birthday | No early payment for holidays |

| Survivors Benefits | Same as retirement schedule | No early payment |

This distinction matters because many recipients receive both SSI and Social Security, but only SSI is paid early.

Historical Context: Why SSI Has This Rule

SSI began in 1974, replacing state-run disability and elderly support programs. Congress required payments to arrive on the first of the month to ensure predictable income. Federal law prohibits SSA from issuing payments on holidays, and Treasury regulations prevent processing on weekends.

This framework created the early-payment rule that continues today.

$967 Social Security Check Hits Accounts December 1 — Are You on the List?

Expert Analysis: Does a Double Payment Help or Harm?

Opinions among economists and social service groups vary.

Potential Benefits

- Helps families cover holiday costs

- Allows early payment of rent due January 1

- Reduces the chance of payment delays from bank closures

Potential Drawbacks

- Encourages overspending

- Causes confusion about benefit timing

- Difficult for households without stable financial planning

Dr. Mendes summarized the tension: “Double payments benefit those with stable budgets but can harm families living week to week.”

FAQs About Rare Double Social Security Payment

1. Is the double payment extra money?

No. It is an early release of January’s payment.

2. Will I get another payment in January?

No. The December 31 deposit is your January payment.

3. Does this affect Social Security retirement benefits?

No. Only SSI follows this early-payment rule.

4. Do I need to apply for the early payment?

No. It is automatic for all eligible SSI recipients.

5. Can this happen again next year?

Yes, depending on the calendar. Early payments occur whenever the 1st falls on a weekend or federal holiday.

Looking Ahead

The Social Security Administration will publish updated payment calendars in early 2026. As policymakers continue debating long-term Social Security reform, experts anticipate increased focus on ensuring predictable income for SSI recipients, who often face the highest economic risks.

For now, advocates urge households to plan ahead, use the early payment carefully, and treat December’s second deposit as income for the month of January.