People planning to retire in 2026 are facing a narrowing window to stabilize their finances as advisers warn of rising volatility, potential tax changes, and shifting retirement timelines. Financial analysts say retirees should focus on three smart financial steps before year-end to protect income, reduce risk, and prepare for uncertain economic conditions. With inflation elevated and investment markets unpredictable, this period is considered one of the most important planning stages for near-retirees.

Planning to Retire in 2026

| Key Fact | Detail / Statistic |

|---|---|

| U.S. workers retiring in 2026 face higher living costs | Consumer prices up 3.4% year-over-year |

| Many households underestimate retirement spending needs | Most need 70%–90% of pre-retirement income |

| Experts urge action before year-end | Tax planning, debt reduction, and savings optimization are essential |

| Majority of adults over 65 need long-term care | 70% will require some form of long-term assistance |

Why Planning to Retire in 2026 Requires Early Action

Economists note that people planning to retire in 2026 face a more complicated financial landscape than earlier generations. Inflation has raised daily living costs, and interest rates have increased borrowing costs at a time when many near-retirees still carry mortgages or other debts.

According to the Federal Reserve, many workers over age 55 have less cash savings and higher debt than previous cohorts. This trend increases vulnerability during the transition into retirement.

“Retirement today demands more precise planning because the margin for error is smaller,” said Dr. Elaine Morris, a senior economist at the Pew Research Center. “Year-end is one of the most important checkpoints for shaping long-term financial outcomes.”

Three Smart Financial Steps Experts Recommend

1. Review Income Sources and Align Withdrawal Strategies

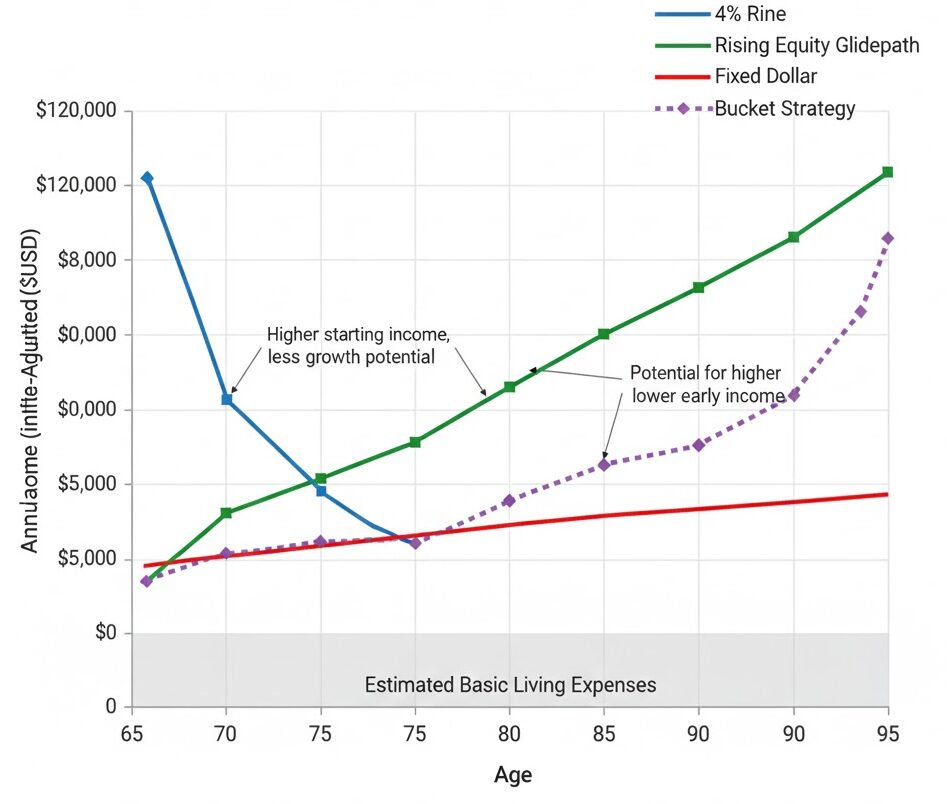

Financial advisers warn that new retirees often miscalculate the longevity and timing of income streams. Evaluating expected Social Security benefits, pensions, savings, and required minimum distributions is essential.

According to the Social Security Administration, claiming benefits before full retirement age permanently reduces monthly payments, while delaying benefits can increase them by up to 8% per year.

Experts recommend testing multiple income scenarios, including market downturns, to avoid early depletion of savings.

“Households should stress-test their withdrawal plans,” said Michael Grant, a financial strategist at the Wharton School. “Even a few years of poor market performance can dramatically affect long-term security.”

2. Consolidate Accounts, Eliminate High-Interest Debt, and Build Cash Reserves

Year-end is a strategic time to reduce financial clutter by consolidating retirement accounts. Advisers say this simplifies investment oversight and reduces the risk of mismanaging assets.

The Consumer Financial Protection Bureau warns that credit card debt, with interest rates exceeding 20% in many cases, can severely undermine retirement plans. Paying down high-interest balances before leaving the workforce is considered one of the most effective financial steps.

Building an emergency fund covering 12 to 24 months of essential expenses is also strongly recommended.

“Liquidity protects retirees from having to sell investments in down markets,” said Rachel Tan, a certified financial planner with the American College of Financial Services. She emphasized that cash reserves provide flexibility during unexpected medical or household expenses.

3. Evaluate Tax Strategies and Consider Year-End Opportunities

Tax professionals say individuals planning to retire in 2026 should conduct a year-end tax review to reduce future liabilities. Options include:

- Roth conversions

- Charitable deductions

- Maximizing catch-up contributions

- Capital gains harvesting

According to the Internal Revenue Service, those aged 50 or older can make larger annual contributions to retirement accounts, allowing them to boost savings before retirement.

“Tax policy is fluid, so planning early provides greater control,” said Lauren Shah, a senior fellow at the Urban-Brookings Tax Policy Center. She noted that lower-income years immediately after retirement often present opportunities for favorable tax strategies.

Broader Economic Context for 2026 Retirees

The U.S. economy is still adjusting to post-pandemic shifts, supply chain restructuring, and tight labor markets. Prices for food, energy, and housing remain significantly higher than they were five years ago.

Economists at the International Monetary Fund warn that inflation may remain above long-term averages, posing risks to retirees relying on fixed incomes.

“Even modest inflation compounds over a 20- to 30-year retirement,” said Jonathan Lee, a researcher with the Brookings Institution. “Failing to account for this can leave retirees underprepared.”

Common Financial Mistakes Pre-Retirees Make

Experts say several recurring mistakes can jeopardize retirement security:

Mistake 1: Underestimating healthcare expenses

Fidelity estimates that a 65-year-old couple may need more than $300,000 for medical costs in retirement, excluding long-term care.

Mistake 2: Inadequate diversification

Overreliance on employer stock or overly conservative portfolios can reduce long-term growth.

Mistake 3: Small or nonexistent emergency savings

Unexpected expenses often lead to premature withdrawals, increasing taxes and reducing investment growth.

Mistake 4: Neglecting inflation planning

Inflation-adjusted spending plans are necessary to maintain purchasing power.

Healthcare and Long-Term Care Planning: A Rising Priority

Healthcare becomes one of the largest expenses in retirement. People planning to retire in 2026 should review Medicare enrollment timelines, supplemental insurance options, and prescription drug coverage.

According to the U.S. Department of Health and Human Services, roughly 70% of adults over age 65 will require some form of long-term care, which Medicare does not fully cover.

“Healthcare decisions made before retirement can affect costs for decades,” said Dr. Andrew Collins, a healthcare policy expert at Johns Hopkins University.

Pre-retirees are advised to:

- Compare Medicare Advantage and Medigap plans

- Review employer-sponsored coverage options after retirement

- Evaluate whether long-term care insurance or hybrid plans are necessary

Lifestyle Planning and Housing Decisions

Retirement planning extends beyond finances. Housing, daily routines, and future mobility all influence long-term comfort and cost of living.

Experts recommend revisiting decisions such as:

- Downsizing to reduce housing expenses

- Relocating to a lower-cost state or closer to family support

- Modifying current homes for accessible living

- Evaluating transportation needs as driving habits change

Housing often represents retirees’ largest expense outside of healthcare, making early evaluation essential.

What Happens if People Delay These Steps?

Delaying preparation may increase tax liabilities, reduce investment flexibility, or force early withdrawals during market downturns. The National Institute on Retirement Security reports that many Americans retire earlier than planned due to health issues or employer changes.

Financial advisers call the years 2024 and 2025 a “critical window” for those targeting a 2026 retirement.

“This is when people can make the most meaningful adjustments,” Grant said. “If they wait too long, they may lose the opportunity to lower risk or build adequate savings.”

Thousands Set to Receive $500 Monthly Through 2026 – Check If You’re Secretly Eligible

Looking Ahead

The next year will be decisive for Americans planning to retire in 2026. While economic conditions remain uncertain, financial experts agree that disciplined preparation—especially during year-end—can strengthen long-term retirement security.

“Retirement success is rarely about one big decision,” Morris said. “It’s about taking the right steps at the right time.”

FAQs About Planning to Retire in 2026

Why is year-end planning important?

Year-end deadlines influence taxes, contributions, investment adjustments, and healthcare enrollment.

What income level should most retirees target?

Experts say 70 to 90 percent of pre-retirement income is typical for maintaining living standards.

Should retirees consider long-term care insurance?

Many do, as the majority of older adults require some form of care.

Are Roth conversions helpful?

Often, especially during low-income years right after retirement.