The NY Stimulus Check Update continues to draw statewide attention as New York officials confirm that inflation rebate payments authorized under the 2025–2026 state budget will continue to arrive through December. Authorities said the ongoing disbursements reflect routine processing, not a new federal stimulus program, amid widespread confusion fueled by misinformation on social media.

NY Stimulus Check Update

| Key Fact | Detail |

|---|---|

| Type of payment | New York inflation rebate |

| December distribution | Payments continue due to processing volume |

| Maximum amount | Up to $400 per household |

| Federal role | None — no new federal stimulus |

| Eligible households | Over 3 million New Yorkers |

Understanding the December Payment Cycle

State officials said this month that residents should expect some checks from the New York inflation rebate program to continue arriving through December because of processing delays, high mailing volumes, and address-related issues. The New York State Department of Taxation and Finance said in a written statement that the agency “is continuing to issue all remaining rebates as quickly as administrative systems allow.”

A spokesperson said that delays “do not reflect funding issues,” but instead “routine end-of-year processing.” Officials did not specify how many checks remain outstanding but emphasized that distribution is ongoing.

What the New York Inflation Rebate Includes

The rebate program, approved earlier this year, provides targeted aid to residents feeling the effects of elevated living costs. Payments range from $150 to $400, depending on filing status, adjusted gross income, and dependency status.

Eligibility Requirements

- Filed a 2023 New York State resident income tax return

- Met income thresholds defined in the fiscal 2025–2026 budget

- Not claimed as a dependent by another taxpayer

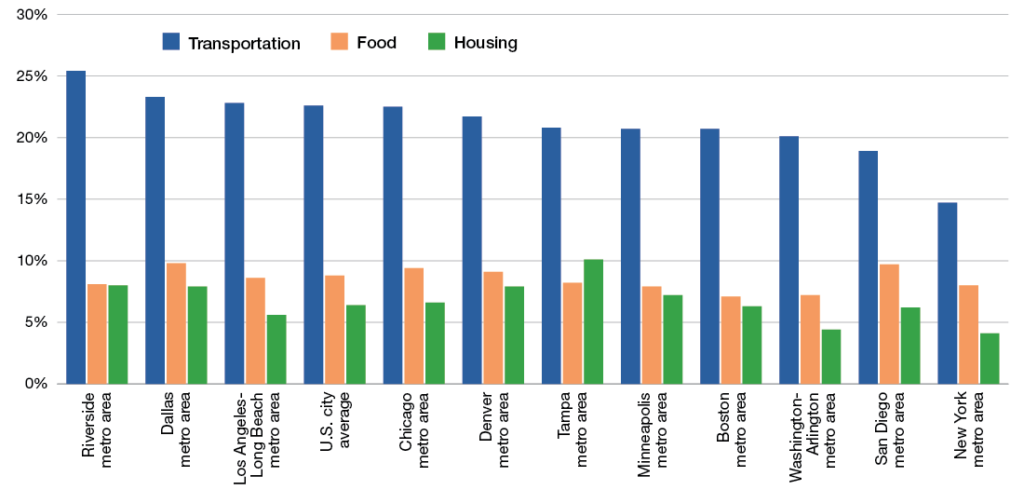

The program was designed to target low- and middle-income households with limited financial flexibility. According to a legislative budget analysis, families earning between $40,000 and $110,000 experienced the sharpest increases in transportation, food, and utility costs.

Dr. Elaine Murphy, an economist at Columbia University, said the rebate “represents a practical, short-term tool for easing financial pressure on working households,” but warned that “its scale cannot counter long-term affordability challenges facing the state.”

Legislative and Budget Background

The inflation rebate emerged after several months of negotiations during the state’s 2025–2026 budget process. Lawmakers debated whether to deliver aid as a direct rebate or as a temporary tax credit, ultimately choosing the former because it offered faster distribution and a clearer structure for middle-income households.

Assembly Budget Chair Michael Rivera said at the time that the rebate “reflects the Legislature’s commitment to providing immediate relief during a period of persistent inflation.”

Opposition lawmakers argued the program should have been larger, but fiscal analysts warned against overextending the state’s revenue outlook.

Funding for the rebate comes from a combination of budget surpluses and targeted reallocations, including higher-than-expected revenue from income and corporate tax receipts.

Why Confusion About a “December Stimulus” Spread

Rumors of a new federal stimulus check intensified in early November after misleading posts on social media claimed that the Internal Revenue Service would issue “holiday assistance payments.” The IRS publicly denied those claims, stating that no federal stimulus program is active.

A senior Treasury Department official told reporters earlier this year that “federal stimulus efforts ended after the 2021 Recovery Rebate Credit, and no additional rounds have been authorized by Congress.”

State officials said the timing of the New York inflation rebate unintentionally contributed to public misunderstanding, as payments arriving late in the year resembled the timeline of earlier federal stimulus disbursements.

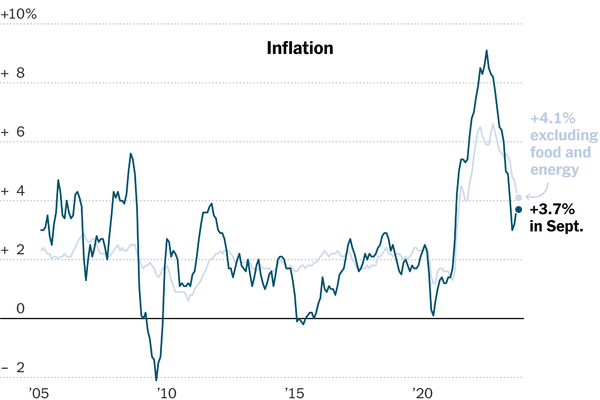

Economic Pressures Leading to the Rebate Program

The Federal Reserve Bank of New York reported that regional inflation exceeded national averages in several categories, including shelter, energy, and childcare costs. New York City, Buffalo, and Rochester all saw year-over-year rent increases above 6 percent in 2024, compared with a national average of 5.2 percent.

Dr. Marcus Klein, a senior analyst at the Brookings Institution, said the rebate reflects “a growing recognition that households are absorbing long-term cost pressures without the significant wage gains needed to offset them.”

He noted that the impact of rebating varies across regions. Urban residents often spend more on housing, while rural families face higher transportation and heating fuel expenses.

How New York Compares to Other States

New York is one of at least eight states that issued inflation-related rebates in 2024–2025, alongside California, Colorado, New Mexico, and Minnesota.

Unlike New York, some states delivered payments through refundable tax credits or energy rebates. Minnesota, for example, provided direct relief based on household size, while Colorado tied rebates to income thresholds similar to New York’s model.

Policy analysts say New York’s approach is notable because it combined broad eligibility with relatively modest payment amounts, prioritizing reach over depth.

Administrative Challenges: Mailing Delays and System Backlogs

The Department of Taxation and Finance acknowledged delays in October and November due to:

- Incorrect or outdated mailing addresses

- Returned mail requiring manual review

- Seasonal postal slowdowns

- System maintenance associated with end-of-year reporting

Postal issues were most common in Western New York and parts of Long Island, according to preliminary distribution data shared with legislative staff.

A Tax Department official, who was not authorized to speak publicly, said the agency increased staffing during the first week of December “to accelerate outstanding mail processing.”

How Residents Are Using Their Rebate

Interviews with residents across New York found that most plan to use their rebates for basic necessities.

Maria Lopez, a teacher from Syracuse, said the rebate “will go straight to energy bills,” which she expects to rise during the winter.

Eric Hamilton, a delivery driver from Queens, said his $400 rebate “covers about half of one month’s rent increase, but it’s something.”

Consumer behavior studies from the Pew Research Center show that households receiving small relief payments overwhelmingly spend them on utilities, groceries, transportation, or debt repayments.

What Happens If a Payment Is Missing?

State officials said residents who believe they should have received a rebate but have not must wait until mid-January before filing an inquiry. To protect taxpayer data, the state does not provide an online tracking system or phone-based verification for individual checks.

If a check is lost or damaged, residents may request a replacement after the mailing cycle ends. The process typically requires verification of identity and filing history.

2026 Refund Outlook: Many Households Could See an Extra $1,000 Next Tax Season

Outlook for 2026: Will More Payments Be Approved?

Budget analysts say it is too early to determine whether New York will issue inflation rebates in 2026. The Legislature is monitoring inflation trends, revenue projections, and cost-of-living indices ahead of the next budget cycle.

Dr. Murphy said lawmakers will face “a difficult balance between maintaining fiscal discipline and responding to ongoing affordability concerns.”

The governor’s office has not signaled plans for additional rounds but acknowledged that the issue will be revisited if economic conditions worsen.

FAQs About NY Stimulus Check

Is this the same as a federal stimulus check?

No. The payment is part of the New York inflation rebate, funded entirely by the state.

How do I know if I’m eligible?

Eligibility is based on your 2023 state income tax return. The state automatically determines qualification.

Will I owe taxes on the rebate?

State officials say the payment is not taxable at the state level. Federal tax implications vary; residents may consult a tax professional.

What if I moved this year?

Payments are mailed to the address on your 2023 tax return. Residents who moved may experience delays.

Can non-filers participate?

No. Only individuals who filed a 2023 state return are eligible.