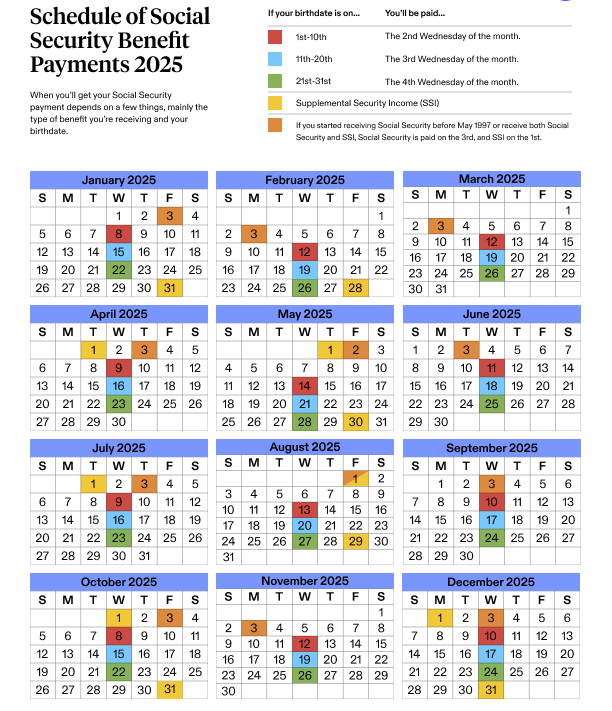

The Next Social Security Check for millions of Americans will follow the 2025 payment calendar confirmed by the Social Security Administration (SSA). The agency continues to base distribution dates on birth dates, enrollment history, and eligibility for Supplemental Security Income (SSI). Federal officials say the long-standing staggered system helps maintain operational reliability as the SSA processes payments for more than 70 million people nationwide.

Next Social Security Check

| Key Fact | Detail / Statistic |

|---|---|

| Total beneficiaries in 2024–25 | About 72 million Americans receive Social Security |

| Primary payment rule | Benefits issued on 2nd, 3rd, or 4th Wednesday based on birth date |

| SSI payment structure | Paid on the 1st unless date falls on weekend/holiday |

| Official Website | Social Security Administration |

The SSA continues to encourage beneficiaries to stay informed through official communication channels and avoid relying on unofficial social media posts for payment information. With steady demand for digital tools and rising enrollment, federal officials anticipate more online service enhancements in the coming years, though the core payment structure is expected to remain consistent.

How the SSA Determines Each Next Social Security Check Date

The Social Security Administration continues to use a monthly staggered payment system introduced in the late 1990s. The system spreads payments over three Wednesdays to reduce strain on payment-processing networks and ensure that banks can deposit funds on a predictable cycle. SSA officials say the system adds stability for beneficiaries and reduces the risk of delays during peak processing periods.

Birthdate Determines Most Monthly Payment Dates

Most beneficiaries who applied after May 1997 follow this schedule:

- Birthdays 1st–10th → Paid second Wednesday

- Birthdays 11th–20th → Paid third Wednesday

- Birthdays 21st–31st → Paid fourth Wednesday

SSA spokesman Mark Hinkle has said in previous statements that the structure “allows the agency to distribute funds efficiently while maintaining predictable timelines for beneficiaries.”

Real-world examples help illustrate how the system works:

- Maria, a retired teacher born on January 14, receives her benefit on the third Wednesday of each month in 2025.

- John, a disabled veteran born on October 5, receives SSDI on the second Wednesday.

These examples show how simple rules guide the dates for millions of households.

Special Rules for Early Enrollees and SSI Recipients

Individuals Receiving Benefits Before May 1997

People who began receiving Social Security benefits before May 1997 continue to follow the third-of-the-month rule. This includes many long-time retirees and surviving spouses. Payments shift earlier when the 3rd falls on a weekend or federal holiday.

Dr. Alicia Munnell, director of the Center for Retirement Research at Boston College, explains: “The SSA preserved these early rules to avoid disrupting older beneficiaries who enrolled before the staggered system was created.”

How SSI Payments Work in the 2025 Calendar

Supplemental Security Income follows a separate schedule. SSI payments typically arrive on the 1st of each month, but when the date conflicts with a weekend or holiday, payments shift earlier.

For example:

If January 1, 2025 falls on a holiday, SSI payments may be delivered on December 31, 2024.

Families with limited income and resources often rely on this program, and predictable payment timing remains essential for budgeting.

How Social Security Payments Interact With Bank Processing

Banks and credit unions post SSA deposits as soon as they receive the payment file, usually at midnight local time. Some institutions release funds earlier through early-deposit programs.

Financial analyst Caroline Chen of the Urban Institute notes that “deposit timing varies by bank, but SSA’s transmission schedule does not change.” She warns beneficiaries that early deposits are a bank policy—not an SSA guarantee.

Comparing the 2025 Payment Schedule to Previous Years

The 2025 calendar includes several months where federal holidays advance payment dates. While the staggered structure remains unchanged, certain parts of the calendar shift:

- In 2025, February contains fewer scheduling conflicts than 2024.

- June and November include federal holidays that may require payment adjustments.

- December 2025 may trigger early SSI payments for January 2026.

These differences matter for beneficiaries who schedule bill payments around their deposits.

Understanding COLA and What It Means for 2025 Payments

The cost-of-living adjustment (COLA) is tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers, calculated by the U.S. Bureau of Labor Statistics. Each October, SSA announces the upcoming year’s COLA.

Economists note that the 2025 COLA will reflect inflation patterns from late 2023 through mid-2024. Although forecasts vary, analysts expect the adjustment to remain moderate compared with high increases in 2022 and 2023.

“COLA remains a critical component for retirees whose expenses grow faster than typical inflation,” said James Carter, a senior researcher at the Brookings Institution.

Any COLA increase automatically applies to January 2025 payments.

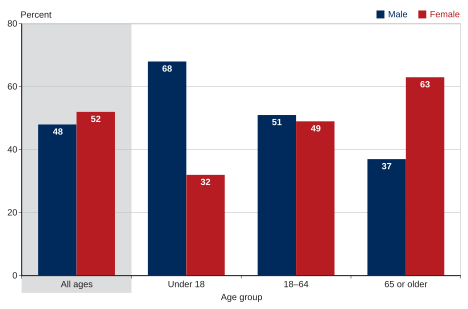

How the Payment Calendar Affects Different Groups

Retired Workers

Retirees make up over 75% of Social Security recipients. Many rely on the exact deposit date for housing, medication, and transportation expenses.

SSDI Beneficiaries

Workers receiving disability benefits follow the same Wednesday schedule unless they fall under early-enrollment rules.

Survivors and Children

Survivor benefits for widows, widowers, and dependent children use the same birthdate-based system.

SSI Households

SSI recipients—many of whom have disabilities or extremely low income—depend heavily on consistent payment timing.

Dual-Entitlement Beneficiaries

Individuals receiving both SSI and Social Security typically receive:

- SSI on the 1st, and

- Social Security on the 3rd.

This dual structure can help families spread expenses across the month.

Detecting and Avoiding Social Security Scams

The SSA and the Federal Trade Commission warn that fraud spikes around payment days. Scammers may impersonate SSA employees and claim that payments are suspended or accounts compromised.

Officials emphasize:

- SSA never demands payment via gift cards, cryptocurrency, or wire transfer.

- The agency never threatens arrest.

- Beneficiaries should report suspicious calls to the SSA Office of the Inspector General.

“Fraud prevention is essential because scammers target older adults who depend on these funds,” said Lisa Kim, policy director at the National Council on Aging.

How Beneficiaries Can Prepare Financially

Financial advisers recommend several steps:

- Review the 2025 payment calendar in advance.

- Set digital banking alerts for deposit notifications.

- Build a small buffer for holiday shifts in November, December, and January.

- Track spending and automatic withdrawals that coincide with benefit days.

- Use a mySocialSecurity account to verify upcoming payment dates.

These steps help stabilize monthly budgeting and avoid overdrafts.

How to Confirm Your Specific Next Social Security Check Date

SSA encourages beneficiaries to:

- Create or sign in to their mySocialSecurity account.

- Go to “Benefits & Payments.”

- Review the official “Next Payment” date listed in their profile.

For those without internet access, SSA recommends contacting the national helpline or local offices. Payment date discrepancies may indicate identity theft or changes in account information.

The 3 Final Social Security Changes Are Here — And One May Hit Your Wallet Hardest

Looking Ahead: What Could Change in 2026?

While the staggered payment system is expected to remain unchanged, policymakers continue debating reforms such as:

- Modernization of SSA IT infrastructure

- Improvements to online claim processing

- Budget proposals affecting staffing levels

- Long-term Social Security solvency projections

Experts say that while 2026 changes remain uncertain, the payment calendar is unlikely to undergo structural revision.

“Stability is essential for a system that supports millions of retirees and vulnerable households,” said retirement expert Dr. Paula Monroe of Georgetown University.