The New York Baby Benefit, a one-time $1,800 payment for each newborn in low-income families, was officially launched by Governor Kathy Hochul in November 2025. The initiative aims to help parents manage the high costs of early childcare and essentials, forming a cornerstone of New York’s ongoing effort to combat child poverty and strengthen economic stability for working families.

$1800 ‘BABY Benefit’

| Key Fact | Detail |

|---|---|

| Payment Amount | $1,800 one-time payment per eligible child |

| Eligibility | Families enrolled in public assistance (SNAP, TANF, Medicaid) |

| Payment Delivery | Automatic for most eligible households; checks or deposits in 2026 |

| Policy Objective | Reduce early-childhood poverty and support parents with infant-related costs |

A Statewide Investment in New Families

The New York Baby Benefit represents one of the most direct cash support policies in the state’s recent history. Funded through the Fiscal Year 2026 budget, the program provides a one-time $1,800 allowance for each eligible newborn or newly adopted child.

Governor Hochul described it as “a lifeline for parents facing the most expensive period of their child’s early life.” She emphasized that the policy is designed to “give every baby in New York a stronger, healthier start, regardless of zip code or income.”

The program is part of a broader family support package that also includes expanded child tax credits, universal school meals, and childcare funding increases.

Who Qualifies for $1800 ‘BABY Benefit’ and How It Works

Eligibility Criteria

The benefit is available to families who meet the following conditions:

- Residency: Must be legal residents of New York State.

- Public Assistance Enrollment: Must be enrolled in at least one state-supported program such as SNAP (Supplemental Nutrition Assistance Program), TANF (Temporary Assistance for Needy Families), or Medicaid at the time of the child’s birth or adoption.

- Childbirth or Adoption Date: The baby must be born or legally adopted during the state’s fiscal year 2025–2026 period, which runs from July 1, 2025, to June 30, 2026.

Application and Distribution

Most qualifying families will receive the payment automatically based on existing benefit records held by the Office of Temporary and Disability Assistance (OTDA). Families not identified automatically will be able to apply directly through OTDA by submitting:

- Proof of residency

- Proof of the child’s birth or adoption

- Documentation showing current enrollment in a qualifying public program

Payments will be distributed as direct deposits or mailed checks beginning in early 2026. The benefit is non-recurring, meaning it is a one-time payment, not a monthly or annual allowance.

A Broader Strategy Against Child Poverty

Economic Rationale

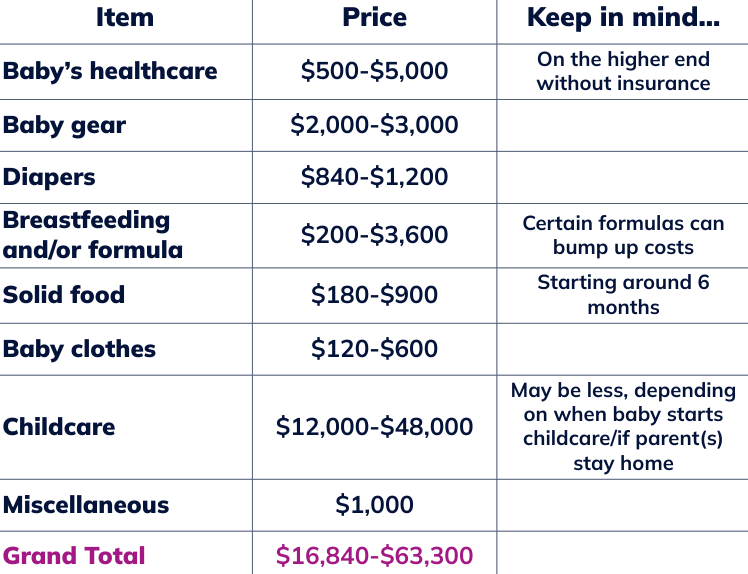

The first year of a baby’s life can cost U.S. families between $15,000 and $20,000, depending on housing, medical, and childcare expenses. For low-income households, these costs can consume nearly half of annual income.

Economists argue that early financial stress has ripple effects: it can increase health complications, reduce parental employment stability, and affect children’s long-term outcomes.

Dr. Elena Torres, a family policy researcher at Columbia University, said, “Early investments like the Baby Benefit are small in size but large in impact. They reduce stress during the most critical developmental stage of a child’s life.”

Complementary Family Programs

The Baby Benefit is only one part of New York’s expanding family assistance framework. Other measures in the same budget include:

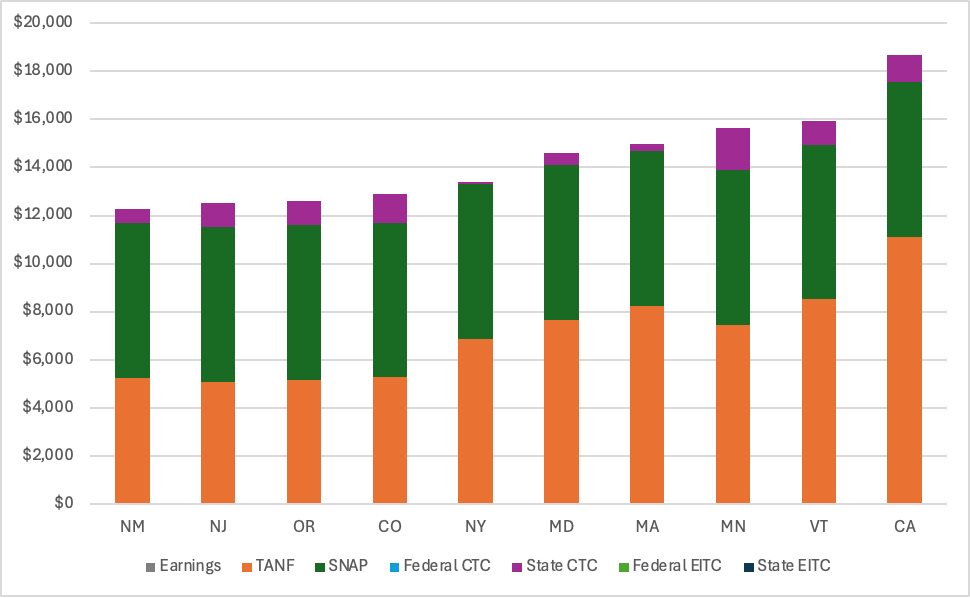

- Child Tax Credit Expansion: Families with children under 4 now qualify for up to $1,000 per child, with a reduced $500 credit for children aged 4 to 16.

- Childcare Access Expansion: Over $2 billion has been allocated to expand childcare subsidies, build new childcare facilities, and support home-based providers.

- Maternal and Infant Health Grants: Approximately $9 million has been reserved for postpartum care programs, infant nutrition support, and behavioral health services for new parents.

- Universal School Meals: The state has extended free breakfast and lunch to more public schools, reducing household costs for low-income families.

These combined initiatives reflect what analysts call a “whole-family approach” to social support — addressing multiple financial pressures at once rather than in isolation.

How the Money Can Be Used

The $1,800 Baby Benefit is unrestricted, meaning families can choose how best to spend the funds. The most common uses are expected to include:

- Baby essentials: Diapers, formula, clothing, strollers, and car seats.

- Medical expenses: Prenatal or postpartum care, hospital fees, and follow-up appointments.

- Housing and utilities: Rent or energy bills during parental leave periods.

- Childcare or temporary help: Paying for babysitting or short-term childcare to help new parents return to work.

Unlike traditional welfare programs, there are no spending restrictions. Policymakers intentionally structured it as a flexible cash benefit to give parents autonomy and reduce administrative complexity.

Expert Analysis and Policy Perspectives

Support and Rationale

Supporters say the Baby Benefit aligns with a growing national shift toward direct cash transfers as an efficient way to fight poverty. Evidence from pilot programs in California, Minnesota, and Washington, D.C. suggests that unrestricted payments improve infant health outcomes, reduce food insecurity, and help parents return to work sooner.

According to policy analysts, programs like the Baby Benefit avoid the bureaucratic hurdles of traditional welfare and allow parents to prioritize their own most urgent needs.

Criticisms and Challenges

Not all lawmakers agree. Fiscal conservatives argue that one-time benefits do little to address long-term economic challenges.

State Senator Robert Ortt, a Republican leader, said in a recent interview, “We all want to help families, but these one-off payments risk becoming symbolic rather than structural. Without sustained funding, we’re just applying a temporary patch.”

Others have raised logistical concerns, such as ensuring accurate eligibility identification, preventing fraud, and maintaining funding during future budget cycles.

How New York Compares Nationally

New York joins a small but growing group of states experimenting with direct family benefits. For example:

- California’s Baby Bonds program sets aside public funds for children born into low-income families, accessible when they reach adulthood.

- Minnesota’s Working Families Credit offers refundable tax credits for parents with young children.

- Washington, D.C. provides early childhood payments and subsidized childcare for low-income parents.

Internationally, similar policies — like child allowances in Canada or family grants in Sweden — have demonstrated long-term benefits for child health and education outcomes. While New York’s payment is modest compared to these international examples, experts consider it an important step toward a stronger social safety net in the U.S.

Projected Impact

The state budget allocates approximately $8.5 million for the program’s first year. Based on that figure, officials estimate around 4,700 families will receive the benefit in the initial rollout phase.

Economists caution that while the $1,800 payment won’t eliminate poverty, it can meaningfully reduce acute stress. Studies show that even small, unconditional cash transfers improve nutrition, healthcare compliance, and infant safety outcomes.

Dr. Monique Harris, an economist at the University at Albany, commented that “targeted cash programs have some of the highest cost-benefit ratios of any social policy. Every dollar spent early can save multiple dollars later in education and health expenditures.”

How Families Can Prepare

Families expecting a child in the coming year can take several steps to ensure they receive the benefit without delay:

- Confirm Program Enrollment: Make sure SNAP, TANF, or Medicaid information is current and active.

- Keep Records Updated: Update addresses, phone numbers, and direct-deposit details with OTDA.

- Maintain Documentation: Keep certified birth certificates or adoption documents.

- Check for Official Notices: Monitor OTDA announcements through mail or online portals.

- Plan Financially: Identify the most urgent needs where the payment can have immediate impact — such as rent, medical bills, or baby supplies.

OTDA is expected to release further details on the application process by spring 2026.

Challenges Ahead

While the Baby Benefit has been widely welcomed, experts caution that its success will depend on smooth implementation. Challenges may include:

- Administrative delays in verifying eligibility or distributing payments.

- Awareness gaps, especially among immigrant and rural populations.

- Limited funding for outreach or translation services.

- One-time design, which means families will need other support once the payment is used.

Advocates hope the program will pave the way for more consistent, multi-year family allowances.

A Step Toward a Broader Vision

The launch of the New York Baby Benefit is not an isolated measure but part of a long-term rethinking of family policy in the state. By coupling direct payments with tax credits, childcare funding, and health programs, New York aims to create a foundation where economic security begins at birth.

Governor Hochul said during the announcement, “This isn’t just about money. It’s about giving families the stability to raise healthy, thriving children — and giving every child, from day one, a fair chance.”

The state plans to review data from the first year of implementation to determine whether the program will be expanded or made permanent in future budgets.

FAQ About New York’s $1800 ‘BABY Benefit’

Who qualifies for the Baby Benefit?

Low-income New York families enrolled in public assistance programs with a newborn or newly adopted child between July 2025 and June 2026.

Do families need to apply?

Most payments will be automatic for current public assistance recipients. Others may apply through OTDA once the application portal opens.

When will payments begin?

Payments are expected to start in early 2026 after administrative systems are finalized.

Is the payment taxable?

The benefit is expected to be non-taxable, similar to other state family assistance payments.