Thousands of New Yorkers may soon receive a one-time New York $1800 payment under a new state initiative aimed at easing financial pressures for low-income families. But eligibility for the benefit — part of the state’s “BABY Benefit” program — is narrowly limited to residents receiving public assistance who recently had or adopted a baby, according to the New York State Office of Temporary and Disability Assistance (OTDA).

The announcement comes as the state winds down its broader inflation refund checks, which distributed smaller one-time payments to millions of taxpayers earlier this year.

$1800 Relief Payment

| Key Fact | Detail | Source |

|---|---|---|

| Maximum payment | $1800 (one-time “BABY Benefit”) | New York OTDA |

| Eligibility | Parents on public assistance with a newborn | EN AS |

| Broader refunds | $150–$400 “Inflation Refund Checks” mailed automatically | NY Dept. of Taxation and Finance |

| Residency rule | Must be a full-year New York resident | NY DTF |

A New Phase of Financial Relief

The New York $1800 payment is part of the Fiscal Year 2026 state budget, approved by the legislature earlier this year. It establishes a one-time benefit for qualifying families to help cover the immediate expenses associated with newborn care, including food, clothing, diapers, and health costs.

Governor Kathy Hochul described the initiative as a “targeted investment in families who need it most,” emphasizing that the program is intended to complement — not replace — other social assistance efforts.

“This program recognizes that the costs of welcoming a child can be overwhelming,” Hochul said during an October press conference. “We’re ensuring that every child born in New York has the support they deserve from day one.”

Eligibility and Distribution

Under OTDA guidelines, the BABY Benefit is available to parents who meet three main conditions:

- They are currently enrolled in a public-assistance program, such as the Family Assistance or Safety Net programs.

- They gave birth to or adopted a child within the program’s designated period.

- They are New York residents at the time of birth and payment issuance.

Qualified families will receive the $1,800 automatically through existing benefit payment channels, meaning no separate application is necessary. State officials expect initial payments to begin before the end of 2025.

Dr. Helen Carter, a social policy economist at Columbia University, said the approach represents a deliberate shift in how the state deploys fiscal aid. “New York has moved from broad, inflation-era relief to narrowly targeted transfers,” she said. “That’s consistent with a post-pandemic focus on budget sustainability.”

End of the Inflation Refund Checks

While the new benefit focuses on low-income households, New York’s broader inflation refund check program — launched earlier this year — is coming to an end.

The Department of Taxation and Finance (DTF) distributed payments between $150 and $400 to residents who filed 2023 tax returns. Eligibility was based on income and filing status: single filers earning up to $150,000 received smaller checks, while married couples filing jointly could receive up to $400.

The refunds were meant to offset lingering price pressures from the inflation surge of 2022–2024. According to the DTF, nearly eight million residents qualified statewide. Checks were mailed automatically, with no repayment obligations.

“Inflation relief was always meant to be temporary,” said Mark D’Angelo, senior policy analyst at the Rockefeller Institute of Government. “What we’re seeing now is a transition from universal relief to strategic support — particularly for families facing the highest costs.”

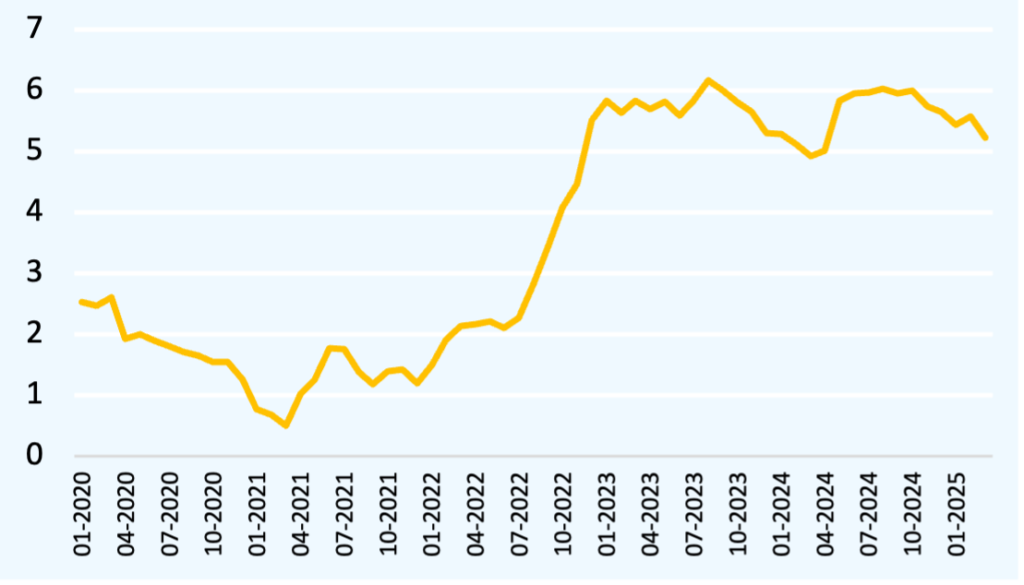

The Economic Context: Inflation and Cost of Living in New York

New York’s inflation rate peaked at 8.2% in mid-2022, among the highest in the Northeast, before gradually declining to about 3.4% by mid-2025, according to U.S. Bureau of Labor Statistics (BLS) data. However, prices for essentials — particularly rent, childcare, and groceries — have continued to climb faster than the national average.

In New York City, the median rent rose by nearly 14% between 2021 and 2025, while childcare costs increased by more than 20%, according to a report from the Community Service Society of New York.

For many families living on fixed incomes, even modest price increases have outpaced wage growth.

“Families that depend on assistance programs are still struggling to meet basic needs,” said Marina López, a program director at the nonprofit Families Forward NY. “An $1,800 benefit can mean the difference between stability and crisis during a child’s first year.”

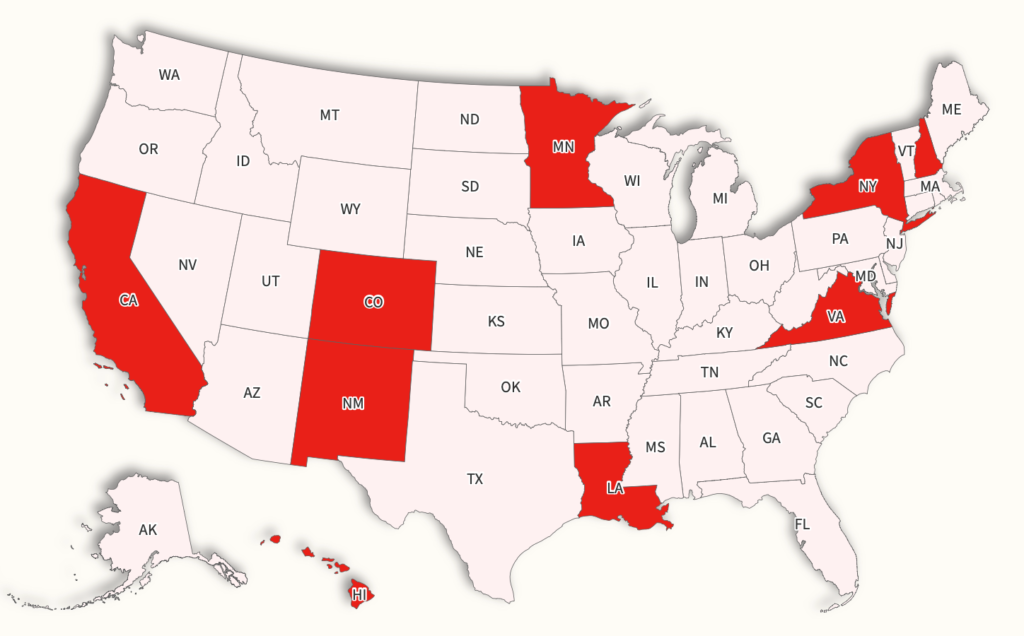

Comparisons with Other States

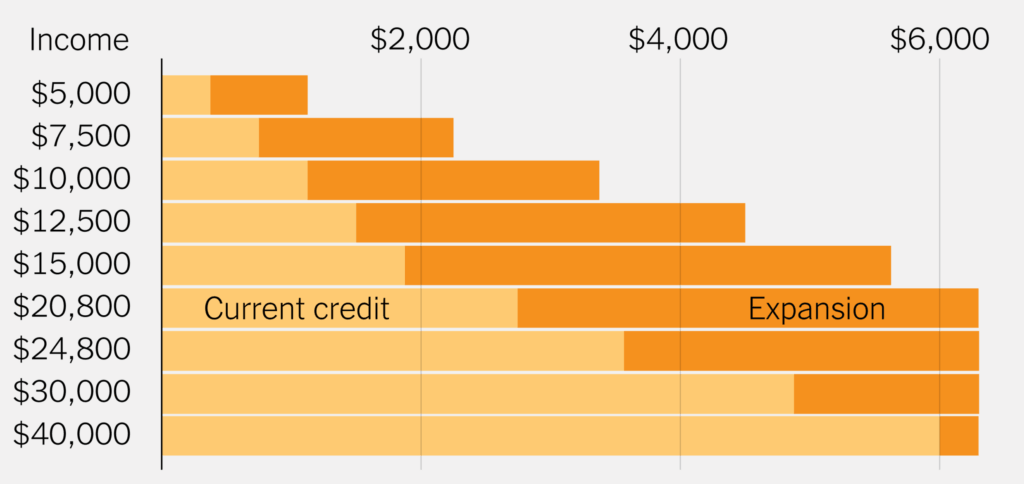

New York is not alone in offering targeted payments amid post-inflation recovery. Several states have rolled out similar initiatives, though the amounts and conditions vary widely:

- California: Offers a “Newborn Supplement” of $1,000 for families receiving Temporary Assistance for Needy Families (TANF).

- Illinois: Provides a $500 Child Benefit to low-income parents, disbursed through the state’s Earned Income Tax Credit program.

- Minnesota: Offers a $1,200 Child Tax Rebate for dependents under 17, including newborns.

Economists say these programs reflect a national recalibration of fiscal aid. “States are acknowledging that while inflation has eased, affordability challenges remain persistent,” said Dr. Priya Menon, senior researcher at the Brookings Institution. “Targeted family support is both socially and economically defensible.”

New York’s BABY Benefit, she noted, is among the most generous per-child state-level payments currently active in the United States.

Fiscal Pressures and Policy Outlook

New York’s 2026 budget faced a projected $4.3 billion shortfall, driven by slower tax revenue growth and higher spending on housing, healthcare, and migrant support programs.

State budget officials said the BABY Benefit was structured to fit within existing allocations rather than create a new recurring obligation.

“This is a one-time appropriation, not a permanent entitlement,” said Elena Martinez, deputy director of the New York Division of the Budget. “It delivers targeted support while keeping our long-term fiscal goals intact.”

Analysts note that while targeted programs can be efficient, they also raise concerns about coverage gaps.

“Many struggling families earn just above the eligibility threshold,” said Dr. Carter of Columbia. “They face similar challenges but receive no assistance. Policymakers will need to revisit the balance between inclusivity and budget discipline.”

Impact on Families

For eligible families, the $1,800 benefit represents significant relief.

According to OTDA estimates, the cost of basic newborn supplies — including diapers, clothing, a crib, formula, and medical co-pays — exceeds $2,500 in a baby’s first three months.

Brooklyn resident Janelle Thomas, who recently gave birth to her first child, said even small payments make a difference. “Diapers alone cost over $100 a month,” she said. “Knowing the state recognizes that struggle means a lot.”

Advocacy groups, however, argue that short-term aid must be paired with longer-term reforms.

“The payment is welcome, but New York families need sustainable solutions — affordable childcare, stable housing, and paid family leave,” said Rodríguez of Families Forward NY.

Looking Ahead

The Office of Temporary and Disability Assistance will begin distributing payments later this year.

Eligible families are advised to verify their contact details through OTDA or local social-service offices to ensure timely receipt.

For other residents, the conclusion of the inflation refund checks marks the end of broad-based cash relief in New York.

Economists expect future aid programs to focus more narrowly on specific demographics — such as young families, seniors, and renters.

As of late October, OTDA confirmed that funds have been fully appropriated and disbursement systems tested.

“This program is on schedule,” an agency spokesperson said. “Payments will begin before the end of the year.”