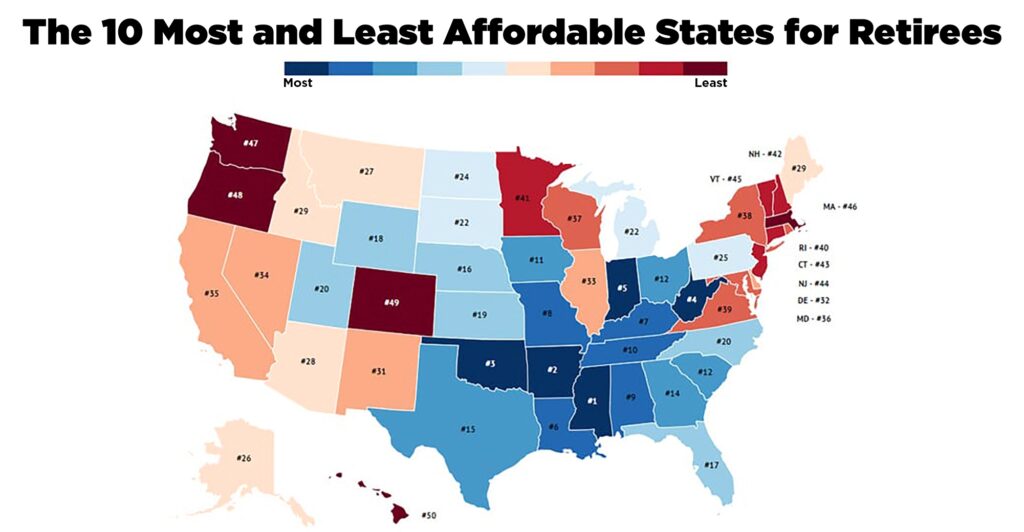

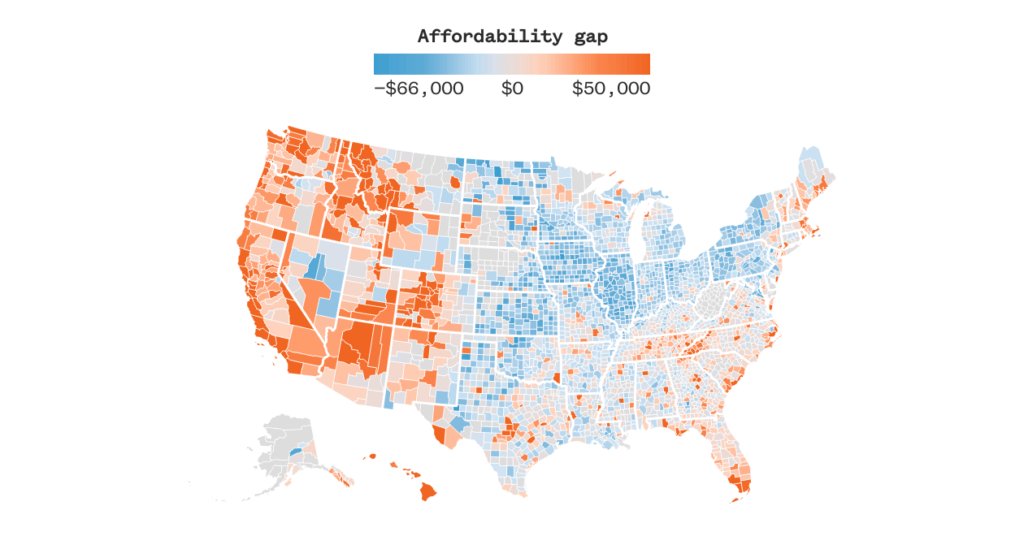

A new Social Security map from Realtor.com shows that only 10 U.S. states provide retirees enough Social Security income to cover basic living costs without a mortgage, while 40 states leave them short by hundreds or even thousands of dollars each year. The findings underscore rising concerns about retirement affordability as property taxes, insurance premiums, and energy costs outpace federal benefit increases.

Social Security Map Splits Retirees

| Key Fact | Detail |

|---|---|

| States where retirees can cover basic costs | 10 |

| Largest annual deficit | Vermont (approx. –$8,088) |

| Main cost driver | Housing-related expenses without mortgage |

| Average 2025 retired-worker benefit | $1,907 per month |

| Official Website | Social Security Administration |

How the Social Security Map Was Developed

Realtor.com created the Social Security map by comparing the average Social Security benefit for retired workers with the estimated cost of living for homeowners who have paid off their mortgages. According to the Social Security Administration (SSA), the average retired-worker benefit reached $1,907 per month in early 2025.

The analysis focuses on non-mortgage housing costs, including property taxes, utilities, homeowner’s insurance, and routine maintenance—categories that often rise more quickly than general inflation.

“Even without a mortgage, housing remains the largest line item for most retirees,” said Danielle Hale, chief economist at Realtor.com, in remarks to USA Today. “In many markets, housing-related bills have grown faster than Social Security benefits.”

Where Retirees Break Even — The Ten Surplus States

The map shows that 10 states offer surpluses—meaning average Social Security benefits exceed estimated retiree expenses. These states tend to share lower housing costs, modest property taxes, and relatively stable insurance markets.

The surplus states include:

- Delaware

- Indiana

- Arizona

- Utah

- South Carolina

- West Virginia

- Alabama

- Nevada

- Tennessee

- Michigan

However, the margins are narrow. Surpluses range from roughly $132 in Michigan to $1,764 in Delaware, leaving retirees with little room for unexpected bills.

A Thin Financial Cushion

Experts warn that even the most affordable states do not guarantee financial stability.

“A surplus of a thousand dollars or less per year is not a safety net,” said Dr. Maria Lopez, a senior researcher at the National Institute on Aging. “One medical emergency or home repair can erase the entire cushion.”

The Forty States Where Social Security Falls Short

In 40 states, retirees face annual deficits, with shortfalls of up to $8,000 per year. States with the largest deficits often have high property taxes, elevated utility costs, and rapid increases in home insurance premiums.

Highest Shortfall States

Among the highest-deficit states:

- Vermont: approx. –$8,088

- New Jersey: approx. –$7,512

- Massachusetts: approx. –$7,345

- New York: approx. –$7,248

- New Hampshire: approx. –$6,564

These states are concentrated in the Northeast, where aging housing stock and high energy prices add additional pressure.

What Regional Economic Differences Reveal

The Social Security map reflects deep regional divides:

The Northeast

Marked by high property taxes, strong state regulations, older homes, and high energy costs. Insurance and utility inflation are particularly steep.

The South

More affordable on average, though insurance markets in coastal areas have become unstable due to climate-related risk.

The West

Mixed affordability—states like Arizona and Nevada fare well, while California, Oregon, and Washington show significant retiree deficits.

The Midwest

More balanced overall, with several states near break-even due to lower housing costs and moderate taxes.

Rising Costs Outpacing Social Security Growth

The 2024 cost-of-living adjustment (COLA) delivered a 3.2% increase, following an 8.7% adjustment in 2023. But several key expenses for retirees have outpaced these increases:

- Home insurance premiums up 18–25% in many states

- Electricity rates up 12% nationwide over two years

- Property taxes rising faster than inflation in 32 states

- Home maintenance costs increasing due to labor shortages

“We are seeing structural inflation in categories that retirees cannot avoid,” said Dr. Leonard Pierce, an economist with Boston College’s Center for Retirement Research.

Social Security Solvency and the Federal Policy Debate

The Social Security map arrives amid renewed debate about long-term program funding. According to the Congressional Budget Office (CBO), the program’s trust fund is projected to become insolvent in the early-to-mid 2030s.

If Congress takes no action, benefits could be reduced by around 20%, a change economists say would deepen affordability challenges nationwide.

Lawmakers are considering several policy options:

- Raising or eliminating the Social Security payroll tax cap

- Increasing the retirement age

- Adjusting benefit formulas

- Creating supplemental income supports for low-income seniors

Each proposal carries political tradeoffs.

“The map highlights the consequences of inaction,” said Rachel Monroe, a senior analyst at the Brookings Institution. “Retirees already struggle to cover essentials in most states. A benefit cut would broaden that hardship dramatically.”

Demographic Pressures Intensifying the Challenge

The U.S. population is aging rapidly. According to the Census Bureau, Americans over 65 now represent nearly 17% of the population, up from 13% in 2010. The older population is projected to reach 21% by 2035.

Worker-to-Beneficiary Ratio Shrinking

Social Security’s funding depends on payroll taxes from current workers.

In 1960, there were 5.1 workers for every retiree.

Today, there are just 2.8, and that number continues to fall.

This demographic shift places additional pressure on program finances and intensifies debates surrounding benefit adequacy.

How Financial Planners Interpret the Map

Retirement planners say the Social Security map is a useful, though limited, tool for assessing affordability.

“It’s a baseline—not a full financial plan,” said Alan Chen, a certified financial planner and partner at Evergreen Advisory Group. “Retirees should consider health care costs, savings, taxes, and regional price variability.”

Key recommendations from planners include:

- Relocating within-state to lower-tax or lower-cost counties

- Using senior property tax exemptions where available

- Considering downsizing to reduce maintenance and utility expenses

- Reviewing supplemental insurance options to avoid large medical bills

Real-World Scenarios Illustrate the Data

While the report does not include individual case studies, demographic patterns reveal common experiences:

Fixed-Income Strain in High-Cost States

Retirees in Massachusetts, Vermont, and New Jersey often allocate large portions of their fixed income to property taxes alone, leaving limited funds for medical expenses or food.

Budget Stability in Lower-Cost Regions

States like Alabama or West Virginia offer stability through lower tax burdens and reduced insurance costs, giving retirees more predictable annual expenses.

Climate Risk Affects Affordability

In Florida, Louisiana, and parts of Texas, home insurance premiums have increased sharply due to storm risk, neutralizing the advantage of relatively low state taxes.

4 New Social Security Rules Hit in January — And They Could Cost You Thousands if You’re Not Ready.

What Comes Next for Retirees Nationwide

Experts expect affordability gaps to widen due to inflation in sectors essential to seniors.

“We will need a combination of federal reform, state-level tax adjustments, and local housing policy to address these pressures,” said Dr. Samuel Nguyen, professor of public policy at the University of Minnesota.

FAQ About Social Security Map Splits Retirees

Does the Social Security map include renters?

No. Renters typically face much higher costs and would experience larger deficits.

Will Social Security benefits keep up with inflation?

Benefits adjust annually, but experts say adjustments often lag behind real-world retiree expenses.

Can retirees reduce property tax burdens?

Many states offer senior exemptions or tax freezes, though eligibility varies.

Is relocation an effective strategy?

Relocation may help, but housing and insurance markets should be evaluated carefully.