The Social Security Divide is widening as Americans born after 1960 confront a full retirement age of 67, a significant shift shaped by decades-old legislation and rising strain on the U.S. Social Security system. The change affects how millions plan their financial futures and has renewed national debate over benefit adequacy, demographic pressure, and long-term program stability.

New Social Security

| Key Fact | Detail / Statistic |

|---|---|

| Retirement age shift | Full retirement age increased from 65 to 67 for people born in 1960 or later |

| Demographic pressure | U.S. ratio of workers to retirees fell from 5:1 in 1960 to under 3:1 today |

| Fiscal forecast | Social Security trust funds projected to deplete by 2033 without reforms |

| Official Website | Social Security Administration |

What Is Driving the Social Security Divide?

The term Social Security Divide refers to the growing gap between older Americans who could claim full benefits at 65 or 66, and younger workers—specifically Americans born after 1960 who face a lifetime lock-in at 67 under current law. The full retirement age change was established by the Social Security Amendments of 1983, a bipartisan measure aimed at stabilizing the system during a period of financial strain.

According to the Social Security Administration (SSA), the increase was designed to reflect longer life expectancy trends and a shrinking ratio of workers contributing to the system. “The program was never intended to remain static,” said Dr. Diane Whitfield, a retirement policy expert at the Brookings Institution, noting that the demographic profile of the country has changed dramatically since the 1930s.

Why Americans Born After 1960 Face a Lifetime Lock-In at 67

The phrase Americans Born After 1960 Face a Lifetime Lock-In at 67 describes how legislative changes permanently set a higher full retirement age for this cohort. While early benefits remain available at 62, retirees who claim before 67 face significant lifetime reductions—up to 30 percent, according to SSA benefit calculators.

A Structural Shift Decades in the Making

The Congressional Budget Office (CBO) reports that retirees are living longer while birth rates have fallen, placing pressure on Social Security’s pay-as-you-go structure. As a result, lawmakers in 1983 advanced a phased increase in the full retirement age, culminating in the current 67-year requirement for the 1960 and later birth group.

Economist Dr. Alan Ramirez from the University of Michigan said the gap between older and younger retirees reflects “a long-term recalibration rather than an abrupt change,” but emphasized that it nonetheless reshapes expectations for tens of millions of workers.

Economic and Social Impacts of the Age 67 Threshold

The rise to 67 has created differing retirement realities across generations. Older workers may lack the health or financial stability to continue working longer, while others, particularly in physically demanding jobs, face heightened hardship.

A 2024 Government Accountability Office (GAO) analysis found that nearly 40 percent of workers aged 62–66 have jobs requiring frequent physical exertion, making delayed retirement more difficult. Meanwhile, higher-income professionals are statistically more likely to work past 65 and benefit from delayed retirement credits.

Financial Consequences for Future Retirees

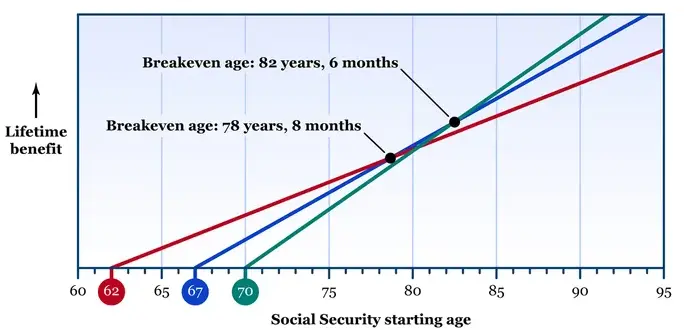

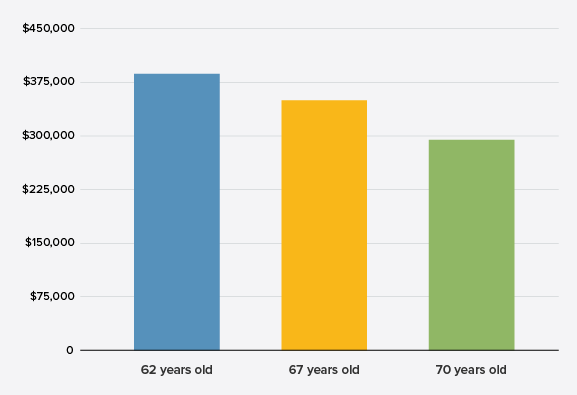

Claiming benefits at 62 results in a permanent monthly reduction. For example, a worker expecting $1,500 per month at full retirement age would receive roughly $1,050 if claiming five years early.

“People underestimate how early claiming shapes lifetime earnings,” said Barbara Ng, policy director at the National Institute on Retirement Security (NIRS). “The Social Security Divide is partly a financial literacy divide.”

A Longer Look Back: How Retirement Norms Have Shifted

Social Security was signed into law in 1935 when the average American lived to just 61. Today, average life expectancy is nearly 79, according to the Centers for Disease Control and Prevention (CDC). Although longevity gains have slowed in recent decades, Americans are still living far longer in retirement than earlier generations.

Work Has Changed—But Not Equally

Experts say rising longevity alone does not justify pushing retirement later. Many workers in service and labor-intensive fields have not experienced the same life expectancy gains as professionals. Research from the National Academy of Sciences shows a widening longevity gap between high-income and low-income Americans, with differences exceeding a decade in some cases.

“That inequality has serious consequences,” said Dr. Lena Rodriguez, a labor economist at Harvard University. “Raising the retirement age impacts different groups very differently.”

How the Social Security Divide Affects Different Demographic Groups

The shift to 67 is not felt evenly across the population. Several groups face sharper impacts than others.

Lower-Income Workers

Workers in lower wage brackets often claim benefits earlier due to job strain, unemployment, or poor health. As a result, they experience larger benefit reductions.

Women

Women, who statistically live longer and take more career breaks for caregiving, may rely more heavily on Social Security. The higher retirement age may require them to work longer to secure adequate benefits.

Minority Communities

Studies from the Urban Institute indicate that Black and Hispanic Americans are more likely to have physically demanding jobs, experience health complications earlier, and face less job security in late-middle age.

Rural Americans

Rural workers often have limited access to later-life employment opportunities or retraining programs.

What Reform Proposals Are on the Table?

Lawmakers and policy experts are debating several proposals to address the divide and the system’s long-term funding gap.

Raising the Payroll Tax Cap

Proposals include increasing or removing the cap on taxable earnings. Analysts say this would primarily affect higher earners.

Adjusting Benefits

Think tanks such as the Center on Budget and Policy Priorities (CBPP) suggest targeted increases for low-income workers combined with modest reductions for high-income retirees.

Further Raising the Full Retirement Age

Some policymakers advocate raising the full retirement age to 68 or 69. Critics argue such moves would exacerbate the existing Social Security Divide and disproportionately burden workers in physically demanding jobs.

Creating a Minimum Benefit

Some experts argue for a baseline benefit guaranteeing that no retiree falls below the poverty line.

Immigration Reform as an Economic Tool

Expanding legal immigration, analysts say, could bolster the worker-to-retiree ratio.

Looking Ahead: The Future of U.S. Retirement Policy

The divide over Social Security’s future reflects deeper questions about economic fairness, demographic change, and government responsibility. Lawmakers from both parties acknowledge the need for reform, but no consensus has emerged.

Retirement policy scholar Dr. Helena Porter from Stanford University said, “The central challenge is balancing fiscal sustainability with equity across generations. That tension defines the Social Security Divide.”

For now, Americans born after 1960 face a lifetime lock-in at 67, shaping their retirement planning in ways previous generations did not have to consider.

FAQ About New Social Security

Why did the retirement age increase to 67?

The increase stemmed from the 1983 Social Security Amendments, passed to address funding concerns as Americans began living longer and the worker-to-retiree ratio shrank.

Can people still claim Social Security before 67?

Yes. Early retirement is available at 62, but benefits are permanently reduced.

Will the retirement age rise again?

Some lawmakers propose raising it further, but such proposals face strong debate and public resistance.