New Jersey is preparing to issue Year-End Refunds to hundreds of thousands of taxpayers as part of a statewide effort to ease property tax burdens and expand financial assistance for older adults. The payments reflect recent upgrades to the state’s relief system, which officials say will streamline applications, enhance accuracy, and help New Jersey Residents maintain stability amid rising living costs.

New Jersey Residents Could See Year-End Refunds

| Key Fact | Detail/Statistic |

|---|---|

| Maximum benefit | Up to $1,750 for homeowners; renters may receive up to $450 |

| Senior advantage | Consolidated PAS-1 form for multiple programs |

| State goal | Reduce property tax pressure for seniors and low-income households |

Why Year-End Refunds Are Being Distributed Now

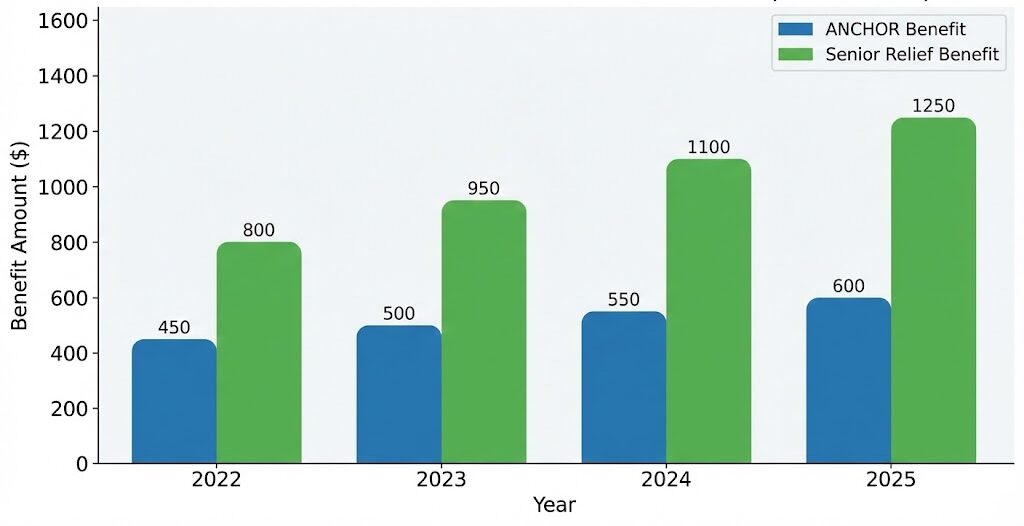

New Jersey’s Year-End Refunds stem from the ANCHOR tax relief program and several senior-focused initiatives designed to offset the state’s historically high property taxes. These refunds arrive as part of a multi-year plan to modernize the relief system, improve processing efficiency, and broaden access for residents who previously struggled to navigate complex requirements.

The New Jersey Department of the Treasury said the timing reflects improvements to the payment infrastructure, including automated eligibility checks and upgraded cross-agency data verification. These enhancements reduce manual reviews, significantly shortening processing times.

Policy analysts say the timing also aligns with the state’s fiscal calendar. Surpluses from stronger-than-expected tax revenues have allowed lawmakers to expand relief without cutting other essential services.

Understanding New Jersey’s Property Tax Landscape

New Jersey consistently ranks among the states with the highest property taxes in the nation, according to annual studies by tax policy organizations. The average property tax bill exceeds $9,000 per year in many counties, creating long-term affordability challenges for both homeowners and renters.

Several structural factors contribute to high taxes:

- Heavy reliance on local property taxes to fund schools, emergency services, and municipal operations.

- Limited federal and state offsetting programs, making local governments dependent on direct revenues.

- Long-term demographic shifts, including a growing senior population and declining school-age populations in some regions.

Experts at the Rutgers University Bloustein School of Planning and Public Policy note that New Jersey’s tax system has historically lacked alignment between state-level policies and resident-level affordability, making relief programs critical to preventing displacement.

Who Is Eligible for Year-End Refunds

Eligibility depends on income, homeownership status, age, and long-term residency requirements.

Eligibility for Homeowners

Homeowners qualify if:

- The property was their principal residence on October 1 of the tax year.

- Household income falls below $250,000.

Refunds vary by income bracket, with those in lower tiers receiving higher amounts.

Eligibility for Renters

Renters may qualify if:

- They lived in a rented home subject to property taxes.

- Household income did not exceed $150,000.

Refunds for renters generally range from $150 to $450.

A Treasury official said, “Our system now cross-references tax and residency records automatically, which reduces application errors and ensures eligible households are more accurately identified.”

Extra Support for Seniors: New Consolidated PAS-1 Form

To simplify bureaucracy, New Jersey introduced the PAS-1, a single form covering:

- ANCHOR tax relief

- Senior Freeze (Property Tax Reimbursement)

- Stay NJ property tax cut program

The consolidation was widely praised by senior advocacy groups. Previously, seniors needed to complete separate applications for each program, repeating documentation.

According to Governor Phil Murphy, the PAS-1 form is intended to “increase accessibility for older adults and remove long-standing administrative hurdles.”

Historical Context: New Jersey’s Troubled Relief System

New Jersey has attempted multiple tax relief reforms over the last two decades:

- Homestead Benefit Program introduced in the early 2000s

- Senior Freeze expanded during the Christie administration

- ANCHOR launched in 2022 to replace older systems

- Stay NJ approved in 2023 as a long-term affordability plan

Each program addressed specific gaps, but overlapping eligibility rules left many seniors confused.

Dr. Lena Ortiz of Rutgers said, “The PAS-1 reform represents the state’s first serious attempt to unify relief channels and ease the paperwork burden that historically discouraged participation.”

How New Jersey Year-End Refunds Will Be Delivered

Most Year-End Refunds will be issued through:

- Direct deposit, if banking information is on file

- Paper checks, mailed to a verified address

- Treasury-issued prepaid cards, in limited cases for residents without bank accounts

The Treasury has urged residents to update address and banking information to avoid misdirected payments.

First-time senior applicants may face additional verification steps, but the state expects most payments to be completed by late December.

What Seniors Should Know About Stay NJ

Though not fully active until 2026 or later, Stay NJ is designed to reduce property taxes for seniors by up to 50 percent.

Key features include:

- Annual property tax credits applied directly to bills

- Income-based eligibility thresholds

- Coordination with local tax boards to avoid municipal shortfalls

Experts believe Stay NJ could become one of the most generous senior tax relief programs in the country once operational.

However, the long-term cost remains a source of debate. Several municipal officials have urged lawmakers to develop safeguards ensuring that towns are reimbursed on schedule.

Economic Implications of the Expanded Refunds

Economists say tax relief programs can boost local economies in several ways:

- Increased consumer spending: Payments arriving near the holiday season may lift retail activity.

- Housing market stability: Seniors remaining in their homes helps prevent sudden market fluctuations.

- Reduced reliance on public assistance: Lower property taxes decrease financial strain on older adults living on fixed incomes.

A recent analysis by the New Jersey Policy Perspective (NJPP) suggests that struggling homeowners may benefit most, though the full impact will depend on long-term funding commitments.

Technology Improvements Behind the New System

The Treasury Department modernized its processing tools to handle high application volumes. Upgrades include:

- Automated data matching with tax filings

- Fraud detection algorithms

- Real-time claim tracking for residents

- Digitized verification for senior documentation

Treasury officials say these improvements have reduced manual errors by more than 30 percent compared to previous years.

Local Governments Respond

New Jersey municipalities have expressed cautious optimism.

Mayors in counties such as Bergen, Middlesex, and Burlington say residents regularly raise concerns about housing affordability. Many local leaders hope state-level relief will ease pressure on community assistance programs.

Yet some warn that delays in state reimbursements could strain municipal budgets. They argue that consistent state funding is vital for long-term stability.

December SSI & Social Security Guide: Check Updated Dates, Extra Checks, and the New 2026 COLA

What Residents Should Do Next

The Treasury recommends that New Jersey Residents:

- Visit the state’s online portal to check eligibility

- Review refund status using their unique taxpayer ID

- Monitor mail for PAS-1 instructions

- Keep all tax-related documents for at least three years

- Contact the state hotline for clarification on senior benefits

Financial advisors also suggest that seniors consult with tax professionals to ensure they maximize available benefits.

Looking Ahead

New Jersey lawmakers continue to debate how future budgets will support expanded senior relief programs. Analysts say the success of this year’s refund cycle will influence long-term policy decisions and determine whether additional adjustments are needed to improve accessibility.

As the state prepares for its next fiscal planning phase, residents and advocacy groups are expected to push for further reforms to stabilize property tax burdens and enhance financial support for vulnerable populations.