The U.S. government has released updated projections for the Social Security $5251 monthly check, outlining the earnings, age requirements, and policy factors needed to qualify for the highest possible retirement benefit. The figure reflects increases tied to inflation and national wage trends, according to new estimates from the Social Security Administration (SSA). The updates come as policymakers face growing public concern about retirement security and the long-term stability of the program.

$5251 Monthly Social Security Check

| Key Fact | Detail / Statistic |

|---|---|

| Projected 2026 maximum benefit | $5251 per month at age 70 |

| Required earnings | Must hit the maximum taxable wage for at least 35 years |

| Boost from delayed filing | Up to 24% more income by waiting until age 70 |

| Percentage of workers who qualify | Fewer than 6% |

| Official Website | SSA.gov |

Why the Maximum Benefit Is Set to Rise

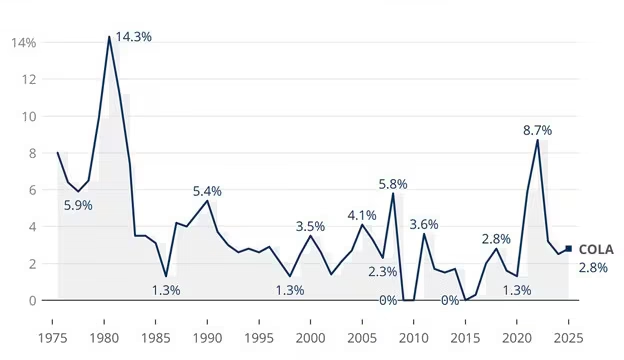

The SSA’s projected Social Security maximum benefit of $5251 for 2026 is driven by increases in the national average wage index, which affects the calculation of primary insurance amounts (PIA). Wage growth and cost-of-living adjustments both directly influence the maximum payment available to retirees who delay filing until age 70.

“Rising wages have a direct and measurable effect on future Social Security benefits,” said Stephen Goss, chief actuary at the SSA. “These adjustments ensure the program remains aligned with economic reality.”

A 2024 report from the Bureau of Labor Statistics (BLS) noted that real wages have climbed for higher-earning Americans, contributing to the expansion of the taxable maximum and, consequently, the highest possible benefit.

Exact Requirements to Receive the $5251 Monthly Social Security Check

To qualify for the projected maximum payment in 2026, workers must meet three primary conditions related to earnings, longevity in the workforce, and retirement timing.

1. A 35-Year Record at the Maximum Taxable Earnings Cap

Social Security uses a worker’s 35 highest-earning years to determine their benefit. To receive the maximum payout, a person must hit or exceed the maximum taxable wage base every year for 35 years.

The taxable maximum changes annually:

- 2024: $168,600

- 2025 (projected): ~$176,000

- 2026 (projected): ~$184,500

Only a small share of Americans ever reach this level.

An analysis by the National Bureau of Economic Research (NBER) shows that “persistent top earners”—mostly professionals in finance, medicine, corporate leadership, and technology—are most likely to meet the requirement.

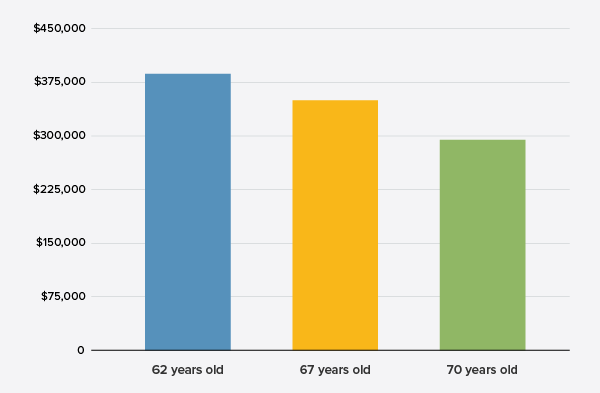

2. Filing at Age 70 to Maximize Delayed Retirement Credits

Filing at age 70 increases monthly income by up to 24% compared with filing at full retirement age (67), according to the SSA. These delayed retirement credits were created to reward workers who remain in the workforce longer or delay accessing Social Security.

“Waiting until 70 remains one of the strongest levers for maximizing retirement income,” said Alicia Munnell, director of the Center for Retirement Research at Boston College.

3. A Lifetime of Consistent, High-Wage Employment

Workers must have a stable, uninterrupted earnings history. Periods of unemployment, caregiving breaks, part-time work, or income dips can reduce the benefit calculation.

According to the Urban Institute, income volatility has risen since the early 2000s, making it increasingly difficult for workers to maintain a high-earning trajectory for decades.

Historical Context: How Today’s Maximum Compares to Previous Decades

Adjusted for inflation, Social Security’s maximum benefit has grown significantly. In 1990, the highest available benefit at age 70 would equal roughly $2,800 in today’s dollars.

A comparison of maximum benefits:

- 1990: ~$1,200 ($2,800 in 2024 dollars)

- 2000: ~$1,700 ($2,940 in 2024 dollars)

- 2010: ~$2,300 ($3,200 in 2024 dollars)

- 2026 (projected): $5,251

Experts attribute this long-term increase to wage growth and structural adjustments in national income patterns.

Why Only a Small Percentage of Workers Qualify

Most workers fall short of the top benefit due to wage limitations, inconsistent employment, or early retirement filings.

The Pew Research Center reports that fewer than 6% of American workers earn the maximum taxable amount in any given year. The percentage drops further when evaluating workers who sustain that level for 35 consecutive years.

“Most Americans depend heavily on Social Security, but only a sliver will ever see the maximum monthly check,” said Andrew Biggs, a senior fellow at the American Enterprise Institute.

Impact of the Maximum Benefit on Broader Retirement Planning

Financial planners say the figure attracts attention, but warn it can create unrealistic expectations.

A study by the Employee Benefit Research Institute (EBRI) found that 40% of workers overestimate how much Social Security will provide. The average monthly retirement benefit in 2024 was about $2,100, far below the top tier.

“Workers should plan for Social Security to replace only part of their income,” said Linda Stone, a retirement fellow at the American Academy of Actuaries. “Even a $5,000 benefit is not enough to fully secure retirement for many households.”

How the Maximum Benefit Shapes Retirement Inequality

Retirement specialists say the maximum benefit highlights broader economic inequality.

Research from Georgetown University’s Center for Retirement Initiatives notes that workers earning at or above the taxable maximum already tend to have:

- Better employer-sponsored retirement plans

- More consistent access to health insurance

- Greater discretionary savings

- Longer life expectancies

This combination gives high earners both a greater likelihood of qualifying for the maximum benefit and more years of payouts, widening retirement gaps over time.

Comparing U.S. Benefits to Other Countries

According to the Organisation for Economic Co-operation and Development (OECD):

- The U.S. replacement rate (percentage of pre-retirement income replaced by public pensions) is around 50% for average earners.

- In contrast:

- Germany: ~53%

- Canada: ~40%

- France: ~74%

- Italy: ~78%

The U.S. system depends more heavily on private savings, while other nations rely more on government pensions.

Debate Over the Long-Term Sustainability of Social Security

While the maximum benefit continues to rise, lawmakers remain divided over the program’s long-term financial stability.

The Social Security Trustees Report warns that the trust fund supporting retirement benefits may face shortfalls beginning in 2033 unless Congress intervenes. Possible solutions include:

- Raising payroll taxes

- Increasing or eliminating the taxable maximum

- Modifying benefit formulas

- Gradually raising the full retirement age

Members of Congress remain split along partisan lines, though several bipartisan proposals aim to extend funding without cutting existing benefits.

Public Reaction and Worker Concerns

Public interest in Social Security continues to rise as more Americans approach retirement age. In surveys by the AARP, 78% of respondents said they are concerned about outliving their savings, and 68% worry Social Security will not keep pace with inflation.

The National Committee to Preserve Social Security and Medicare stated that the updated benefit projections “provide helpful transparency for workers, especially younger Americans who are planning for long-term financial security.”

But others argue the focus on the maximum benefit distracts from more pressing concerns.

“The average beneficiary is far removed from these top-tier payments,” said Nancy Altman, president of Social Security Works. “The central issue is ensuring Social Security remains adequate for the middle class.”

New Proposal Could Add $200 a Month to Social Security — Here’s What’s in the Bill

Looking Ahead

The SSA will release final 2026 benefit numbers in late 2025 after reviewing updated wage index data. Early projections suggest the taxable maximum and benefit levels will continue rising, reflecting broader economic trends.

Analysts say these figures offer a valuable benchmark for workers, even as debates continue over the future of retirement security in the United States.

FAQ About $5251 Monthly Social Security Check

Can anyone qualify for the maximum benefit?

Only workers with 35 years of earnings at or above the taxable maximum who wait until age 70 to file.

Is the $5251 number final?

No. It is an SSA projection based on wage growth. Final numbers may differ.

What is the average Social Security benefit?

About $2,100 per month as of 2024, according to the SSA.

Does filing early reduce benefits permanently?

Yes. Filing at 62 can reduce benefits by up to 30%.