Navigating the minimum financial requirement to study in Germany in 2026 can feel like the first big test of your German university journey. You’ve aced your exams, polished your application, and dreamt of life in a vibrant German city. Now, you’re faced with a crucial step: proving you can financially support yourself. Don’t worry, this guide is here to demystify the process. We’ll break down exactly what you need, how it works, and how you can confidently clear this hurdle on your path to studying in Germany.

minimum financial requirement to study in Germany in 2026

| Key Fact | Detail & Estimated Figures |

| Proof of Funds Amount | Currently €11,208 per year (€934/month). This amount is subject to change for 2026. German Federal Foreign Office |

| Primary Method | A Blocked Account (Sperrkonto) is the most common way to provide proof of funds. |

| What It Covers | This amount is the minimum estimated to cover accommodation, food, and personal expenses for one year. |

| Key Alternatives | Full scholarships or a formal Declaration of Commitment (Verpflichtungserklärung) can be accepted. Study in Germany |

Meeting the financial requirement is a critical step, but it is entirely manageable with proper planning. Think of it as the foundation you’re laying for an incredible educational adventure. By understanding the process, starting early, and budgeting realistically, you are setting yourself up for success. You’ve got this!

What Exactly is “Proof of Financial Resources”?

The German government wants to ensure that international students can focus on their studies without facing financial hardship. This is why, as part of your German student visa application, you must provide a Proof of Financial Resources (Finanzierungsnachweis).

Essentially, you need to show the German authorities that you have enough money to cover your living expenses for your first year of study. It’s Germany’s way of welcoming you while making sure you have a secure and stable start to your new academic life. The most straightforward and widely accepted method for this is the blocked account.

The Blocked Account (Sperrkonto): Your Key to Financial Proof

Think of a blocked account, or Sperrkonto, as a financial safety net. It’s a special type of bank account where you deposit the total required amount upfront. Once you arrive in Germany, the bank releases a fixed monthly sum to you. This system guarantees that you have a steady income to cover your expenses throughout the year.

How Much Money Do I Need for a Blocked Account in 2026?

This is the million-dollar—or rather, the eleven-thousand-euro—question.

As of 2025, the required amount is €11,208 for one year. This breaks down to €934 per month. However, the German government periodically adjusts this figure to account for inflation and the rising cost of living.

For your 2026 application, you should anticipate a potential slight increase. It is absolutely crucial to check the official website of the German embassy or consulate in your home country for the exact, up-to-date amount as you prepare your application. This figure is non-negotiable, so always rely on the official source.

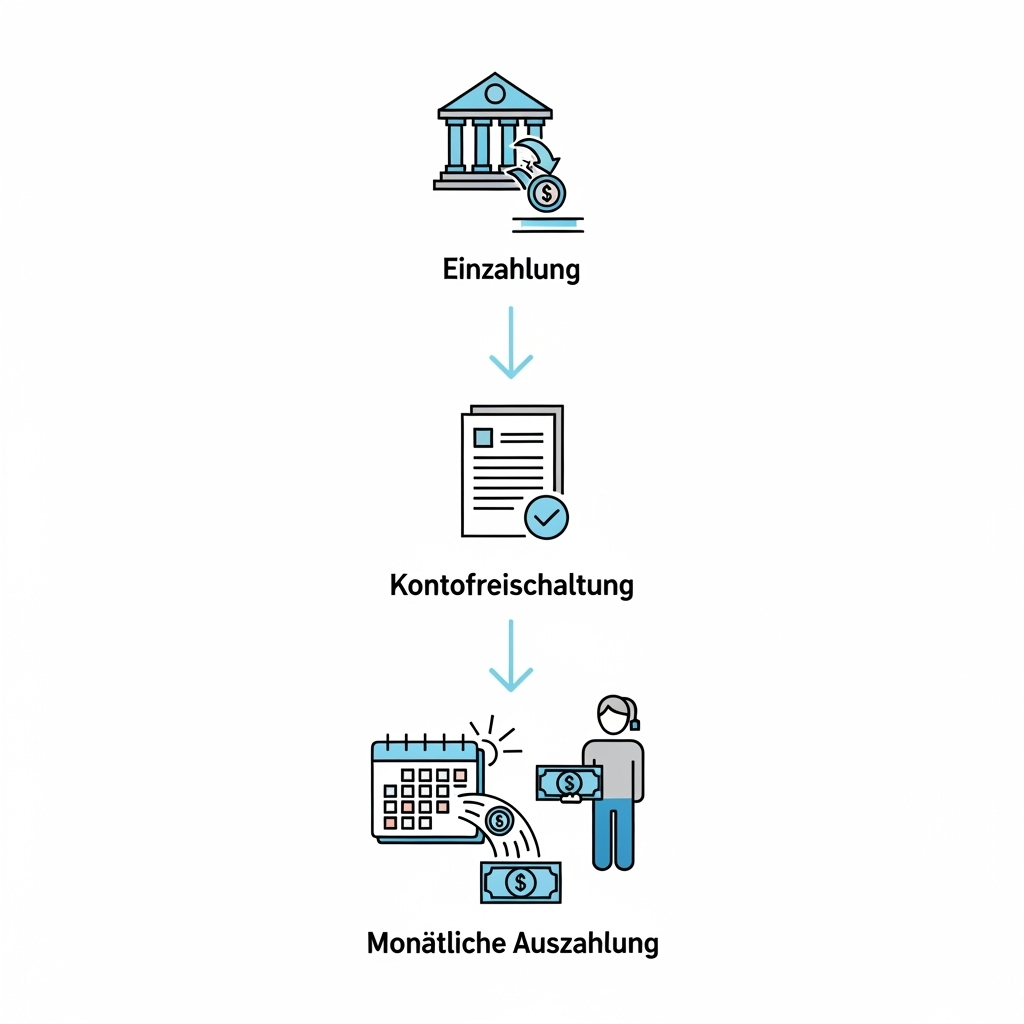

How Does a Blocked Account Actually Work?

The process is simpler than it sounds. It’s like setting up a pre-paid allowance for yourself.

- Open an Account: You open a blocked account with an approved provider from your home country.

- Deposit the Funds: You transfer the full required amount (e.g., €11,208 or the updated 2026 figure) into this account.

- Get Confirmation: The provider sends you a confirmation document. This is the official proof you will submit with your visa application.

- Arrive in Germany: Once you’ve settled in, you’ll open a regular German bank account (a Girokonto).

- Receive Monthly Payouts: The blocked account provider will then transfer your monthly allowance (€934 or the updated amount) into your regular bank account each month.

Where Can I Open a Blocked Account?

Several private companies offer blocked account services that are officially recognized by the German Federal Foreign Office. Popular and trusted providers include Fintiba, Expatrio, and Coracle.6 When choosing a provider, ensure they are approved by the German authorities to avoid any issues with your visa application.

Are There Alternatives to the Blocked Account?

Yes, while the blocked account is the most common route, it isn’t the only one. Depending on your situation, you might be able to use one of these alternatives as your German student visa proof of funds.

Winning a Scholarship

If you have secured a full scholarship from a recognized German provider, such as the German Academic Exchange Service (DAAD), this can serve as your proof of funds.7 The scholarship award letter must clearly state that the amount is sufficient to cover all your living expenses.

A Declaration of Commitment (Verpflichtungserklärung)

A Declaration of Commitment is a formal document where a person residing in Germany (a sponsor) legally commits to covering all your expenses. Your sponsor must have sufficient income and will need to complete this process at their local Foreigners’ Authority (Ausländerbehörde) in Germany.

Proof of Parental Income

In some cases, your parents can submit notarized documents showing their income and financial assets are sufficient to support you. However, the acceptance of this method can vary significantly between different German embassies. I’ve seen students run into delays with this, so it’s vital to confirm with your local German consulate if this is an accepted form of proof.

Beyond the Minimum: Budgeting for the Real Cost of Living in Germany

The blocked account Germany amount is a calculated national average. It’s a baseline, not a luxury budget. In my experience advising students, understanding the real-world cost of living in Germany for students is key to a stress-free experience. The €934 monthly allowance can be quite tight in major cities like Munich or Berlin but more comfortable in smaller university towns like Greifswald or Jena.

Here’s a look at a more realistic monthly budget:

- Rent (including utilities): €350 – €600+ (This is your biggest variable!)

- Health Insurance: ~€120 (Mandatory for all students)

- Groceries & Food: €170 – €200

- Semester Contribution: €20 – €50 (This is the average monthly cost of the fee paid each semester, which often includes a public transport ticket)

- Phone & Internet: €30

- Leisure & Personal Expenses: €100+

As you can see, the total can easily approach or exceed the €934 monthly payout. Planning ahead and having some extra savings is always a wise idea.

Your Action Plan: A Step-by-Step Timeline

- 6 Months Before Application: Start researching. Check your local German embassy’s website for the expected minimum financial requirement to study in Germany in 2026. Explore scholarships and other alternatives.

- 3-4 Months Before: If using a blocked account, choose your provider. Begin the application process, as it can take some time for verification.

- 2-3 Months Before: Transfer the full amount into your blocked account. International bank transfers can take several days, so don’t leave this to the last minute.

- 1-2 Months Before: You will receive the official blocked account confirmation. Keep this document safe—it’s essential for your visa appointment.

A Guide to the BPP University £1.4M+ Law Scholarship Fund 2025 Batch

FAQs

Q1:Can I use the money in my blocked account for other things?

The money is yours to live on. The monthly payout is transferred to your regular German bank account, and you can use it for your rent, food, transport, and other living expenses as you see fit.

Q2:What happens to my money if my visa application is rejected?

If your visa is unfortunately rejected, you can close the blocked account. The provider will require official proof of the visa rejection from the German embassy, after which they will return the full amount to you (minus any service fees).

Q3:Can I work part-time to supplement my income?

Yes, as an international student, you are generally allowed to work for up to 120 full days or 240 half days per year. Many students work part-time to cover extra costs, gain work experience, and improve their German skills.

Q4:Is the blocked account amount different for major cities like Munich?

No, the minimum required amount for the blocked account is a federal standard and is the same regardless of which German city you plan to study in. However, your actual living costs will be significantly higher in cities like Munich or Hamburg, so you should budget for more.