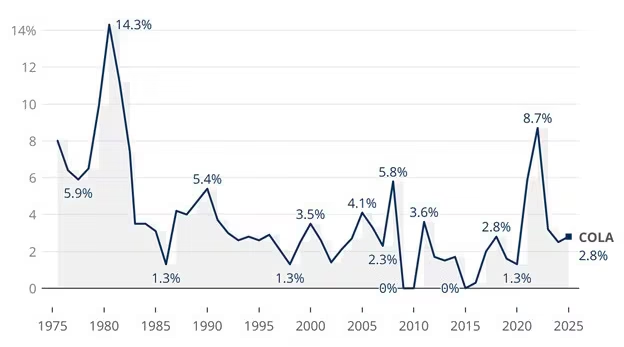

Starting in January 2026, millions of Americans receiving Social Security retirement, disability, and survivor benefits are scheduled to receive a cost-of-living adjustment (COLA) of approximately 2.8%. While this adjustment increases the gross benefit, many recipients may see only a modest change in their take-home pay due to rising health-care premiums and other mandatory deductions.

Millions Could Lose the 2026 Social Security Raise

| Key Fact | Detail / Statistic |

|---|---|

| Projected COLA | 2.8% increase on monthly benefits |

| Average monthly benefit | Approximately $2,000 for retired workers |

| Estimated dollar raise | Around $50–$56 per month for the average recipient |

| Projected Medicare Part B premium increase | From ~$185 to ~$206.50 per month |

| Effective net increase | $30–$35 per month after premiums |

| Official Website | Social Security Administration |

Why the 2026 Social Security Raise Matters

What the raise is and how it is calculated

The COLA adjustment is designed to maintain the purchasing power of Social Security benefits in the face of inflation. The Social Security Administration calculates the increase using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) for July through September of the preceding year.

The 2.8% projected raise reflects moderate inflation trends. For the average monthly benefit of approximately $2,000, this translates to roughly $50–$56 extra per month. While this nominal increase seems significant, deductions such as Medicare premiums and taxes can substantially reduce the net benefit.

Why many beneficiaries might not see the full increase

Several factors can erode the impact of the COLA:

- Medicare Part B Premiums: Premiums are automatically deducted from Social Security checks. The standard premium is expected to rise by about $21–$22 in 2026, reducing the net benefit increase.

- Other Health-Care Costs: Deductibles and supplemental insurance premiums also rise annually. For Medicare Part B, the deductible is projected to increase by $30–$35, which further reduces the effective gain.

- Mismatch Between CPI-W and Retiree Expenses: Older Americans often spend disproportionately on healthcare, housing, and energy. The CPI-W may not fully reflect these costs, meaning the COLA may not keep pace with actual expenses.

- Timing Issues: The COLA is applied in January, but many expenses, such as energy and rental increases, may rise earlier, leaving retirees temporarily behind on costs.

In practical terms, a $54 gross raise could be reduced to approximately $33–$35 after premium and deductible increases.

Context: Broader Economic and Policy Considerations

Inflation trends and their effect on retirees

Although general inflation has stabilized compared to the prior two years, retirees frequently experience higher-than-average cost increases. Medical care, housing, and utilities tend to rise faster than general inflation, which means the COLA may not fully preserve purchasing power.

Rising healthcare costs

Healthcare remains the largest expense for older Americans. In addition to the Part B premium, other costs such as prescription drugs, supplemental insurance, and long-term care insurance are increasing. For higher-income retirees, Income-Related Monthly Adjustment Amounts (IRMAA) can add several hundred dollars to monthly premiums, further reducing net benefits.

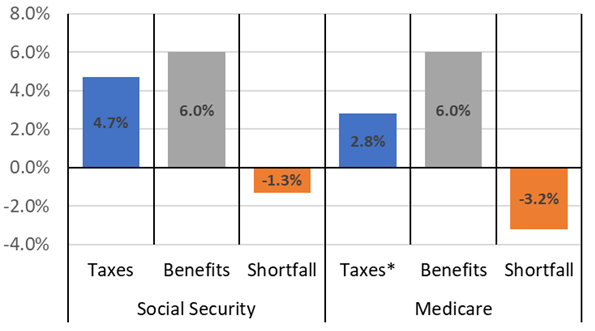

Program sustainability

The Social Security trust funds face long-term financial pressures. Reports from the Social Security Trustees have projected that, under current law, the trust funds may not be able to pay full benefits beyond the mid-2030s. This looming solvency issue underscores the importance of careful fiscal planning and may influence future COLA calculations and benefit formulas.

What It Means for Beneficiaries

Typical retirees

A retiree receiving the average benefit (~$2,000/month) could see the following:

- Gross benefit after COLA: ~$2,056

- Medicare Part B premium increase: ~$21.50

- Net take-home increase: ~$34

Lower-income beneficiaries

For retirees receiving smaller benefits (~$850–$1,000/month), the premium increase may largely offset the COLA. Some could see a net gain of less than $5, highlighting the vulnerability of lower-income retirees to cost increases.

Higher-income beneficiaries

Retirees subject to IRMAA surcharges may see their net benefit increase only modestly, even if the gross benefit rises by 2.8%. In some cases, the net gain may be negligible after accounting for additional premiums.

Steps Beneficiaries Should Take

- Review SSA Notices: The official COLA is announced in October, and notices sent in November/December detail gross benefits and deductions.

- Evaluate Medicare Coverage: Open Enrollment (October–December) is an opportunity to review Part B and supplemental insurance plans.

- Budget Conservatively: Assume that the net raise will be smaller than the headline COLA.

- Monitor Other Expenses: Housing, transportation, and utility costs can also impact disposable income.

- Consider Long-Term Planning: Delaying Social Security benefits, saving strategically, or supplementing income can help mitigate reduced purchasing power.

Scenario Analysis

| Scenario | Current Benefit | COLA 2.8% | Part B & Deductions | Net Benefit Change |

|---|---|---|---|---|

| Average Beneficiary | $2,000 | +$56 | -$22 | +$34 |

| Lower-Income | $850 | +$24 | -$21 | +$3 |

| Higher-Income (IRMAA) | $3,200 | +$90 | -$50 | +$40 |

These scenarios illustrate how deductions and surcharges impact net income differently for beneficiaries across the income spectrum.

Coverage Gaps: What the COLA Does Not Address

The COLA only adjusts for general inflation, but key costs for older Americans frequently rise faster:

- Healthcare premiums and out-of-pocket expenses

- Housing and rental costs

- Transportation and energy expenses

As a result, even with a nominal increase, many retirees may experience declining real purchasing power.

Policy and Political Implications

Calls for Reform

Advocacy groups have recommended shifting the COLA calculation from CPI-W to CPI-E (Consumer Price Index for the Elderly), which weights medical and housing costs more heavily. Such a change could increase the COLA for retirees but would raise federal expenditures and impact trust fund projections.

Long-term solvency

The looming funding gap in the Social Security program highlights the need for structural reforms, including potential adjustments to the benefit formula, payroll tax rates, or eligibility ages.

Social Impact

Social Security provides critical income for millions of Americans. For about one-third of seniors, it represents the majority of their income, and for one in ten, it accounts for 90% or more. Small or nonexistent net raises can force difficult financial trade-offs, including reducing spending on essentials or depleting savings.

Inside the $5251 Social Security Club — Who Qualifies and the Three Smart Moves That Get You Closer

Looking Ahead

While the 2026 Social Security raise offers a modest nominal boost, rising Medicare premiums and other deductions mean that many recipients will see only a small increase in take-home pay. Retirees, policymakers, and advocacy groups continue to debate whether the current COLA methodology adequately addresses the real costs faced by older Americans.

The coming years will test the sustainability of Social Security and the effectiveness of annual adjustments in preserving retirees’ standard of living.