The U.S. federal government has confirmed a 2.8 percent increase in the military retiree COLA 2026, raising monthly payments for retired service members beginning in December 2025. The adjustment, based on inflation data released by the Department of Labor, aims to protect the long-term purchasing power of retirees and their families as living costs continue to rise across key sectors of the economy.

Military Retirees in 2026

| Key Fact | Detail |

|---|---|

| 2026 COLA Rate | 2.8% increase for most retirees |

| Effective Date | First checks arrive Dec. 2025–Jan. 2026 |

| Impact on SBP | Survivor Benefit Plan annuities also increase |

| Exception | REDUX retirees receive 1% less until age 62 |

| Inflation Basis | CPI-W data from Q3 2025 |

DFAS and the Social Security Administration will continue releasing updated guidance as the effective date approaches. While the 2.8 percent increase reflects moderating inflation, analysts say retirees should still prepare for potential cost pressures in housing, healthcare, and energy in the coming year.

Why the 2026 COLA Adjustment Matters for Retired Service Members

The federal COLA adjustment ensures that military retirement pay keeps pace with inflation, which continues to affect food, housing, transportation, and healthcare costs. According to the Department of Labor, price growth during the third quarter of 2025 exceeded forecasts, leading to a COLA rate slightly above the long-term historical average of 2.4 percent.

In a public statement, the Defense Finance and Accounting Service (DFAS) said the updated rate will “maintain financial stability for military retirees and their families in a period of ongoing economic uncertainty.”

Broader economic forces

Inflation pressures remain elevated due to rising housing demand, higher energy costs, and global supply chain disruptions. Economists at the Brookings Institution note that federal COLA adjustments remain one of the most reliable tools for shielding fixed-income households from inflation shocks.

How Much Monthly Pay Will Rise in 2026

The 2.8 percent increase will affect retirees differently based on rank, years of service, and retirement system. Under the new rate:

- A retiree receiving $1,860 per month (approximate High-3 average) will gain about $52 monthly.

- A retiree receiving $3,200 per month will see an increase of nearly $90.

- Senior officers and enlisted leaders with pensions above $4,000 per month may see increases exceeding $110.

Financial planners emphasize that even moderate COLA adjustments can significantly increase long-term lifetime earnings, especially for retirees drawing 30–40 years of pension payments.

Impact on SBP beneficiaries

Most Survivor Benefit Plan (SBP) recipients will receive proportional increases. According to DFAS, COLA is “critical for stability among surviving spouses, particularly those dependent on fixed annuity income.”

REDUX retirees

Members who chose the REDUX retirement option after receiving the Career Status Bonus continue to receive a reduced COLA—1 percent lower than the full rate—until age 62. At that point, their base pay is reset to its full value.

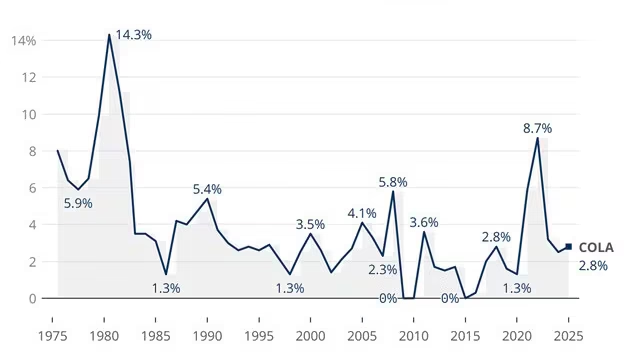

Historical Context: How the 2026 Increase Compares

The 2.8 percent increase for the military retiree COLA 2026 is lower than the 2022 and 2023 adjustments, which reached 5.9 percent and 8.7 percent amid record-high inflation. However, it remains above the levels seen in the mid-2010s, when COLA rates were frequently below 2 percent.

According to data compiled by the Social Security Administration, COLA rates have averaged:

- 2.4% over the past 20 years

- 1.7% over the past 10 years

- 3.2% since 2020, reflecting elevated inflation

Expert perspective

Dr. Elena Martin, an economist at Georgetown University, said the 2026 figure “signals a gradual easing of price pressures but confirms that inflation remains embedded in key sectors, especially housing and healthcare.”

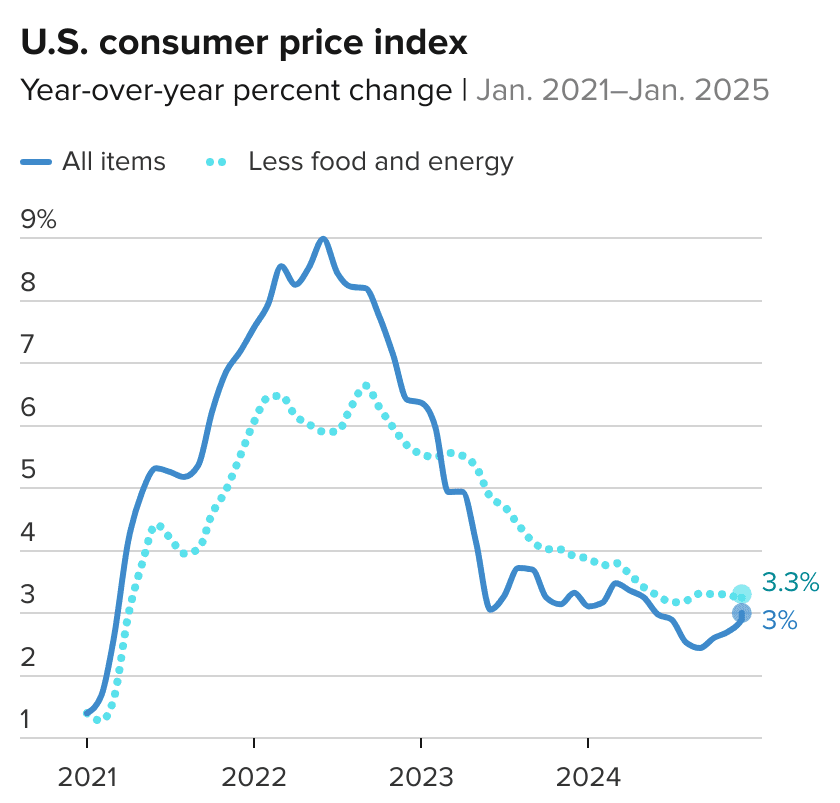

How COLA Is Calculated and Why It Changes Each Year

The Cost-of-Living Adjustment is mandated by federal law and linked to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index measures the price movement of goods and services purchased by working households.

Key factors influencing the 2026 rate

According to the Department of Labor:

- Housing costs rose more than 4 percent during the CPI-W evaluation period.

- Medical care services experienced persistent cost increases.

- Energy prices, including electricity and gasoline, fluctuated but remained elevated.

- Food-at-home prices stabilized but remain higher than pre-pandemic levels.

Economists note that COLA formulas protect retirees from inflation but do not increase benefits in years when prices fall — ensuring consistency in federal spending and policy.

Comparison With Social Security COLA and VA Benefits

Military COLA typically matches the Social Security COLA to ensure equitable adjustments across federal benefit programs. For 2026, the Social Security Administration also confirmed a 2.8 percent increase.

Impact on VA disability

According to the Department of Veterans Affairs, disability compensation rates will rise by the same percentage. The VA said this “creates uniformity in veterans benefits and prevents divergence between disability payments and military retirement pay.”

Financial planners’ guidance

Experts recommend that retirees review how the COLA adjustment interacts with:

- State taxes on military retirement

- Tricare premiums

- Survivor Benefit Plan costs

- Long-term financial planning and required minimum distributions (RMDs)

Household Budget Effects for Retirees

The average retired military household faces higher expenses in healthcare, housing, and transportation than the general population, according to research from the Rand Corporation. As a result, even modest increases in income can offset rising out-of-pocket costs.

Healthcare pressure

A study from the Kaiser Family Foundation found that national healthcare inflation continues to outpace overall inflation. For retirees enrolled in Tricare, costs remain comparatively stable, but prescription and specialty care expenses have risen.

Housing and utilities

Energy prices in several regions increased through 2025 due to fuel supply constraints, according to the U.S. Energy Information Administration. These increases directly impact fixed-income households, especially those with older homes requiring more heating or cooling.

Federal Budget Impact and Policy Debate

The COLA adjustment also carries implications for federal spending. According to the Congressional Budget Office (CBO), every 1 percent increase in military retirement COLA raises federal outlays by approximately $800 million annually.

Some lawmakers have proposed modernizing the COLA formula to account for retiree-specific spending patterns, particularly in healthcare. Others warn against changes that could reduce long-term retiree compensation, arguing that military personnel earned these benefits through decades of service.

In testimony before the House Armed Services Committee, retired Army Gen. Michael Langford argued that “predictable and adequate COLA increases are essential for sustaining military retention and honoring commitments made to service members.”

December $2000 Payout Guide: What the IRS Says About Who Will Receive It

What Retirees Should Expect Over the Next Year

DFAS will publish updated military retirement pay tables in late 2025. Retirees are encouraged to review their MyPay accounts for final calculations. Financial advisors recommend verifying tax withholdings and reviewing beneficiary designations ahead of the December 2025 payment cycle.

Potential future adjustments

Economists predict moderate inflation in 2026 and 2027, suggesting that future COLA increases may remain between 2 and 3 percent barring unexpected economic disruptions.

As policymakers continue monitoring inflation and federal spending, retirees can expect continued emphasis on maintaining the value of earned benefits in a changing economic environment.

FAQs About Military Retirees in 2026

What is the COLA increase for 2026?

The government has confirmed a 2.8 percent adjustment.

When do the increases appear?

Payments reflecting the increase will arrive late December 2025 or early January 2026.

Do SBP annuities increase as well?

Yes. SBP beneficiaries receive the same percentage adjustment.

Are REDUX retirees affected differently?

Yes. They receive 1 percent below the full COLA until age 62.

Does the adjustment affect disability benefits?

Yes. VA disability compensation increases by the same percentage.