The United States is preparing for a significant Medicare rate shock in 2026 as federal officials confirm sharp increases in monthly premiums, deductibles, and cost-sharing requirements. The Centers for Medicare & Medicaid Services (CMS) announced that standard Part B premiums will rise nearly 10 percent next year. The changes are expected to affect more than 65 million beneficiaries and could pressure retirees who expect only modest Social Security cost-of-living adjustments.

Medicare Rate Shock for 2026

| Key Fact | Detail |

|---|---|

| Standard Part B premium 2026 | $202.90 per month |

| 2025 → 2026 increase | $17.90 (+9.7%) |

| Part A hospital deductible | $1,736 per benefit period |

| Expected Social Security COLA | About 2.8% |

| IRMAA surcharges | Up to $487/month for highest tier |

| Official Website | CMS.gov |

Rising Costs and the Scope of the 2026 Medicare Rate Shock

Federal officials expect Medicare premiums 2026 to rise across multiple components of the program. CMS said the standard Part B premium will increase from $185.00 in 2025 to $202.90 in 2026, one of the largest year-over-year jumps in recent memory.

Part B covers outpatient services, physician visits, durable medical equipment, and certain preventive screenings. Officials said the 2026 increase reflects higher spending on outpatient care, expanded coverage of new treatments, and program integrity requirements.

The annual Part B deductible will also increase to $283, up from $257 in 2025. CMS said these updates are tied to statutory formulas and the program’s expected spending trajectory.

Historical Context of Medicare Rate Increase: A Decade of Steady Increases

Medicare premiums have trended upward for more than a decade. According to a review of CMS historical data:

- In 2015, the standard Part B premium was $104.90.

- By 2020, it had risen to $144.60.

- In 2022, it spiked to $170.10 due to projected drug costs, which were later revised.

The 2026 jump continues this long-term pattern.

“Medicare is facing the challenges of an aging population, new medical technologies, and higher utilization,” said Dr. Alicia Holt, a senior researcher at the Kaiser Family Foundation (KFF). “These pressures show up in premiums.”

Impact on Retiree Budgets

Many older Americans live on fixed incomes, and health care is one of their largest expenses. The Social Security COLA for 2026 is expected to be about 2.8 percent — considerably smaller than the 9.7 percent jump in Part B premiums.

“Any time Medicare premiums rise faster than Social Security benefits, retirees lose real purchasing power,” said Dr. Karen Davenport, a health policy expert at Georgetown University’s McCourt School of Public Policy.

A report from the nonpartisan Senior Citizens League found that older adults have lost significant buying power over the past two decades due to rising medical expenses.

Human Impact: Retirees Face Difficult Trade-Offs

Though names are anonymized for privacy, the experiences of many seniors illustrate the broad financial impact.

Mary, 74, a retired librarian in Ohio, said she is concerned that her monthly expenses will surpass her Social Security increase. “I already worry about prescription costs,” she said. “Another $18 a month may not sound like much, but it matters.”

James, 68, a retired veteran in Florida, said he plans to review alternative Medicare Advantage plans. “I’ve stayed with Original Medicare for years, but these increases push me to reevaluate.”

Advocates say these stories are common. “Seniors are already navigating rising housing and food costs,” noted Bill Sweeney, senior vice president at AARP. “Higher Medicare premiums amplify the pressure.”

Higher-Income Americans Face Additional IRMAA Surcharges

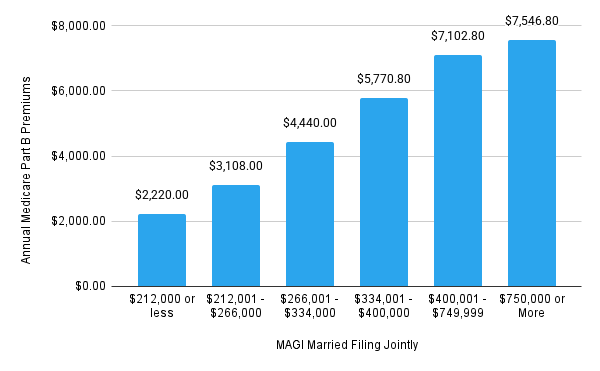

People with higher incomes will pay more under Income-Related Monthly Adjustment Amounts (IRMAA). These surcharges apply to individuals earning more than $103,000 and couples earning more than $206,000, based on tax returns from two years prior.

For 2026, IRMAA for Part B may range from $81.20 up to more than $480 per month, depending on income bracket. Part D drug plan surcharges will also increase.

“IRMAA is designed to ensure wealthier beneficiaries pay a greater share of program costs,” said CMS Deputy Administrator Jonathan Blum. “These adjustments help maintain Medicare’s financial stability.”

Changes to Part A: Hospital Care Costs Also Rising

Medicare Part A, which covers inpatient hospital care, will also see cost increases:

- The 2026 inpatient hospital deductible will rise to $1,736, up $60 from 2025.

- Daily coinsurance for long hospital stays will climb to $434 for days 61–90.

- Skilled nursing facility coinsurance will rise to $217 per day for days 21–100.

These increases reflect higher provider costs and updated Medicare payment rules.

Why Medicare Costs Are Rising Now

Several forces are driving the 2026 premium increases:

1. Expensive New Drugs and Therapies

Gene therapies, cancer immunotherapies, and biologics have pushed Medicare spending upward.

2. Higher Health-Care Utilization

More beneficiaries are receiving outpatient services, including specialty care.

3. Demographic Pressures

More than 11,000 Americans turn 65 every day, expanding Medicare enrollment.

4. Inflation in the Health Sector

Although overall inflation has cooled, medical inflation remains elevated in key areas.

A recent Congressional Budget Office (CBO) report projected steady growth in Medicare spending over the next decade.

Policy Debate: Lawmakers Respond

Reactions on Capitol Hill have been mixed.

Senator Ron Wyden (D-Ore.), chair of the Senate Finance Committee, said he is reviewing the increases and pointed to ongoing efforts to reduce drug costs through Medicare price negotiations.

Senator Mike Crapo (R-Idaho), the committee’s ranking member, argued the increases highlight “structural weaknesses” in Medicare financing and called for broader reforms.

Think tanks are also weighing in.

The Brookings Institution emphasized the need to improve care coordination and reduce unnecessary spending.

Meanwhile, the Heritage Foundation argued that greater private-sector participation could lower long-term costs.

Comparisons With Private Insurance

Medicare premium increases, while significant, mirror broader trends in the U.S. health-care system.

According to data from the Kaiser Family Foundation:

- Employer-sponsored health insurance premiums rose 7 percent in 2023.

- Private plan deductibles also increased.

“Medicare is not operating in a vacuum,” said Dr. Holt of KFF. “Health-care costs are rising across the board.”

What Beneficiaries Can Do Now

Experts recommend that seniors take several steps to prepare:

1. Review coverage during open enrollment

The annual enrollment window runs from October 15 to December 7.

2. Compare Medicare Advantage plans

Advantage plans offer varying premiums and out-of-pocket limits.

3. Reevaluate prescription drug coverage

Drug plans change formularies annually.

4. Consider Medigap plans

Medigap can help cover deductibles and coinsurance.

“Beneficiaries should not assume last year’s plan remains the best fit,” said David Lipsky, a counselor with the State Health Insurance Assistance Program (SHIP).

Next Social Security Check: Full 2025 Payout Schedule- When Will You Get Yours?

Looking Ahead

The 2026 Medicare increases mark another year of rising health-care costs for older Americans. CMS is expected to release additional projections in the spring, including forecasts for enrollment growth and future spending. Advocates say they will monitor the effects of the increases on access to care, especially for beneficiaries with limited incomes.

“Retirees are resilient, but these trends are concerning,” said Sweeney of AARP. “We need sustainable solutions that protect Medicare today and for future generations.”