The 2026 Medicare price hikes will absorb a significant share of next year’s Social Security cost-of-living adjustment, limiting the real income gains retirees will see in January. The Centers for Medicare & Medicaid Services (CMS) announced that the standard Medicare Part B premium will increase to $202.90 per month, while the Social Security Administration (SSA) confirmed a 2.8% COLA. Together, these changes mean many retirees will see only a modest rise in their take-home benefits.

Medicare Price Hikes for 2026

| Key Fact | Details |

|---|---|

| Standard Medicare Part B Premium (2026) | $202.90, up $17.90 (+9.7%) from 2025 |

| Annual Social Security COLA (2026) | 2.8%, average monthly increase of ~$56 |

| Part B Annual Deductible | $283 in 2026, up from $257 |

| Part A Inpatient Deductible | $1,736 in 2026, up $60 |

| Net Effect on Average Retiree | Roughly one-third of COLA absorbed by Medicare premium hike |

The Medicare price hikes scheduled for 2026 reflect broader economic and demographic forces that continue to reshape the U.S. health-care system. While Social Security’s 2.8% COLA offers some relief, many retirees will see only a modest increase in their monthly income. Analysts warn that the pressures driving these cost increases are unlikely to ease soon, leaving older Americans facing ongoing challenges as they balance fixed incomes with rising medical expenses.

Understanding the 2026 Medicare Price Hikes

The 2026 Medicare price hikes are driven by rising health-care utilization, broader medical inflation, and updated projections for outpatient services. In announcing the new rates, CMS said the increase reflects higher expected expenditures for hospital services, physician visits, diagnostic imaging, and durable medical equipment.

What Is Medicare Part B and Why It Matters

Medicare Part B covers outpatient care, physician services, preventive screenings, medical equipment, and some home-based care. Because Part B premiums are deducted directly from Social Security checks, any increase in the premium reduces the net amount retirees receive each month.

For most beneficiaries, this deduction represents their largest monthly health-care expense outside prescription drug coverage.

What the Premium Increase Means for Retirees

The 9.7% premium increase is one of the steepest in recent years. While the Social Security COLA provides a modest benefit boost, the rising Medicare premium significantly reduces its impact.

Example: The Average Retiree

- Current average Social Security benefit: ~$2,015/month

- 2026 COLA increase (2.8%): +$56/month

- Part B premium increase: –$17.90/month

- Resulting net gain: roughly $38/month

Economists note that this amount is unlikely to keep pace with rising prices for food, housing, and medical services.

“The COLA aims to offset inflation, but health-care inflation is often much higher,” said Dr. Laura Mitchell, a senior policy analyst at the nonpartisan Center for Retirement Research at Boston College. “Retirees feel this gap every year, and 2026 will be no exception.”

The Social Security COLA: Why 2.8% Feels Underwhelming

The 2.8% adjustment matches broader inflation trends but fails to fully account for expenses that disproportionately affect older adults.

Why the COLA Is Not Keeping Pace

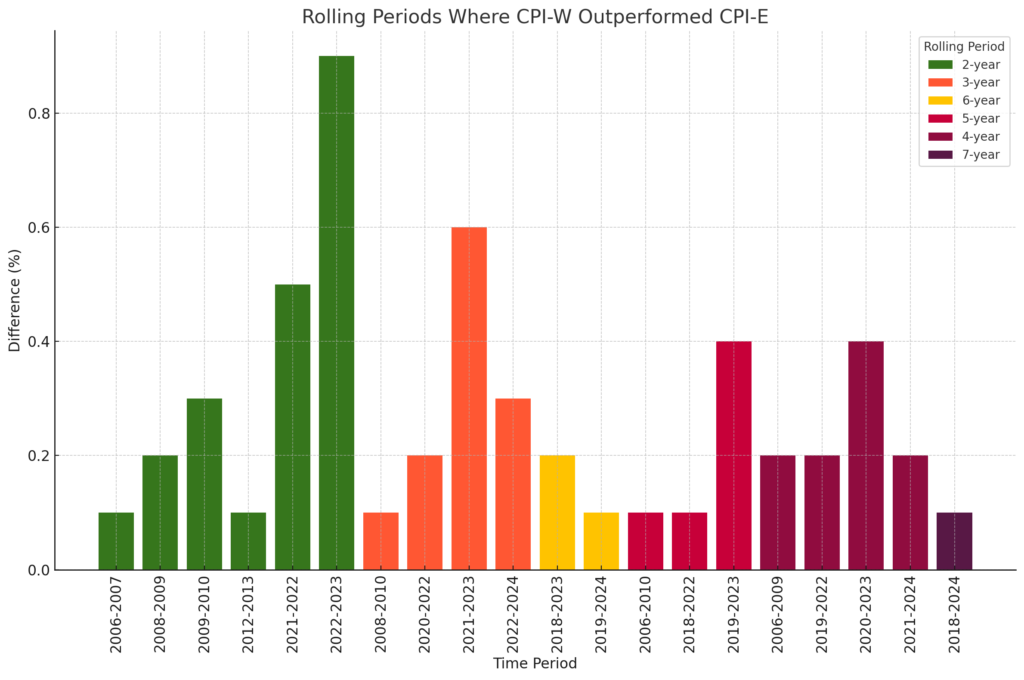

The COLA is calculated using the CPI-W, an inflation index based on spending by working Americans—not retirees.

Organizations such as AARP and the National Committee to Preserve Social Security and Medicare argue that the CPI-W underestimates inflation for seniors, who spend more on medical care and housing.

According to AARP’s latest analysis:

“The 2.8% COLA does not reflect the true cost increases experienced by older Americans, who face far higher medical and prescription drug expenses than younger households.”

Why Medicare Costs Are Rising Faster Than Inflation

Health-care economists cite several reasons for the persistent rise in Medicare costs:

1. Higher Use of Outpatient Services

Increases in outpatient surgeries, preventive screenings, and diagnostic tests drive much of Part B spending growth.

2. Pharmaceutical Price Pressures

Though the Inflation Reduction Act gives Medicare new authority to negotiate drug prices, most negotiated savings begin after 2026.

3. Population Aging

More than 11,000 Americans turn 65 every day, expanding Medicare enrollment and increasing demand for services.

The U.S. Census Bureau projects that adults aged 65+ will outnumber children by 2034.

4. Healthcare Workforce Shortages

Shortages of nurses, primary care doctors, and geriatric specialists increase labor costs, which are reflected in Medicare reimbursement rates.

Economist Dr. Marcus Leary from the Brookings Institution noted, “Medicare is absorbing the full cost of demographic and economic pressures. The 2026 increase is not surprising—it is part of a long-term trend.”

Who Will Be Hit the Hardest by Medicare Price Hikes for 2026?

The impact of the 2026 Medicare price hikes will vary based on income, Social Security benefit level, and health-care needs.

Low-Benefit Recipients

Those with very small Social Security checks may qualify for the “hold harmless” rule, which prevents net benefit reductions. However, these beneficiaries often have no real increase at all.

Middle-Income Retirees

This group experiences the greatest squeeze because:

- They are not fully protected by hold harmless

- They do not qualify for Medicaid or Medicare Savings Programs

- They spend a larger share of income on health care

Higher-Income Beneficiaries (IRMAA Surcharges)

Individual filers with incomes above $103,000, or joint filers above $206,000, will pay an Income-Related Monthly Adjustment Amount (IRMAA).

Top-tier Part B premiums are set to reach $649.20 per month in 2026 for the highest income bracket.

Political and Policy Implications

Medicare and Social Security are likely to be major political issues in 2026.

Budgetary Pressure on the Federal Government

The Medicare Hospital Insurance Trust Fund is projected to face financial challenges by 2031 according to the Medicare Trustees Report, raising concerns about future premium increases.

Congressional Debates Ahead

Lawmakers remain divided on how to shore up both Medicare and Social Security:

- Some lawmakers propose raising payroll taxes.

- Others suggest raising the Medicare eligibility age.

- Some aim to expand drug price negotiations to more medications.

As Sen. Maggie Hassan (D-NH) said during recent hearings,

“Rising health-care costs are squeezing older Americans, and we cannot allow premiums to continue increasing faster than benefits.”

Republican lawmakers have emphasized cost containment and the need for structural reforms to extend Medicare’s long-term solvency.

Historical Context: How 2026 Compares to Previous Years

The 2026 Part B premium increase is notable but not unprecedented.

Looking Back a Decade

- In 2015: Premium was $104.90

- In 2020: Premium was $144.60

- In 2026: Premium will be $202.90

This represents a 94% increase over 11 years—far outpacing the growth of Social Security benefits over the same period.

Practical Steps Retirees Can Take

Experts recommend several strategies to help retirees manage rising costs:

1. Review Medicare Advantage (Part C) Plans

Some plans offer lower premiums or out-of-pocket caps, though benefits vary widely.

2. Evaluate Medigap (Supplemental) Coverage

For beneficiaries who prefer Original Medicare, Medigap can offset coinsurance and deductibles.

3. Assess Drug Coverage Annually

Part D formularies change each year; seniors are advised to review coverage during open enrollment.

4. Seek Financial Assistance Programs

Low-income retirees may qualify for:

- Medicare Savings Programs

- Prescription Assistance Programs

- Medicaid in some states

5. Revisit Budgets and Savings Drawdowns

Financial planners suggest adjusting withdrawal strategies from retirement accounts to compensate for rising medical costs.

Medicare’s 2026 Changes: How New Rules Will Affect Social Security for Different Retiree Groups

Looking Ahead

Most analysts expect Medicare premiums to continue rising in the years ahead. The Inflation Reduction Act may moderate prescription drug costs, but broader health-care inflation remains a challenge.

As Tricia Neuman, Executive Director of the KFF Program on Medicare Policy, observed:

“Unless health-care inflation slows substantially, retirees will continue to face annual pressure on their real incomes—even when Social Security benefits rise.”