A rare calendar shift in the Social Security payment schedule has alarmed millions of Americans this November, as many Supplemental Security Income (SSI) recipients discover that no deposit will arrive this month. The gap is not the result of a funding cut or delay, but a quirk of the 2025 calendar that has created real-world strain for vulnerable beneficiaries who rely on the payments to meet essential expenses.

Massive Payment Gap Revealed

| Key Fact | Detail | Explanation |

|---|---|---|

| SSI payment advanced to Oct 31 | November 1 falls on a Saturday | SSA issues payments on the previous business day when the 1st falls on a weekend. |

| No SSI deposit in November | Next payment scheduled for Dec 1 | Creates an apparent “gap” between Oct 31 and Dec 1. |

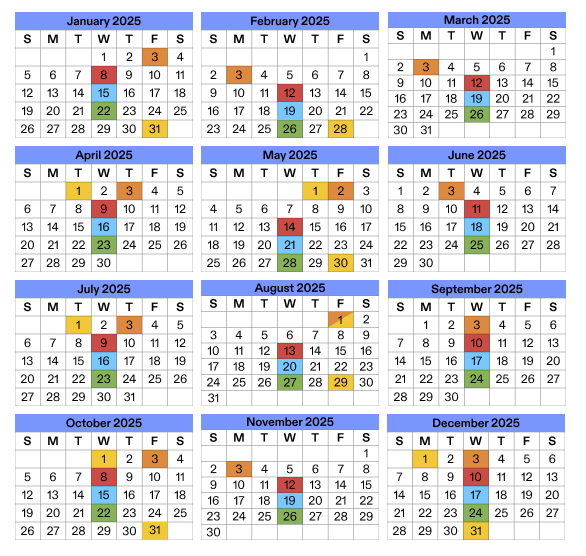

| Regular Social Security (Retirement, Disability, Survivor) payments unaffected | Paid Nov 3, 12, 19, 26 | Based on standard Wednesday schedule tied to beneficiaries’ birthdays. |

| Programs unaffected by shutdown | SSA benefits are mandatory expenditures | Payments continue regardless of congressional funding negotiations. |

Understanding the Shift

The Social Security Administration (SSA) issues payments to more than 71 million Americans each month through two major programs: the Social Security Retirement, Survivor, and Disability Insurance (RSDI) program, and the Supplemental Security Income (SSI) program.

Ordinarily, SSI payments are distributed on the first day of each month. However, when that date falls on a weekend or federal holiday, the payment is released on the preceding business day. Because November 1 lands on a Saturday this year, the SSA sent the November payment on Friday, October 31.

While the payment reached recipients as planned, the adjustment leaves no deposit within the calendar month of November. The next scheduled payment, labeled for December, will arrive on Monday, December 1.

Regular Social Security Payments Proceed as Usual

Recipients of retirement, disability, or survivor benefits will continue to receive funds on their usual dates in November:

- November 3: For individuals who began receiving benefits before May 1997 or who also receive SSI.

- November 12: For beneficiaries whose birthdays fall between the 1st and 10th.

- November 19: For birthdays between the 11th and 20th.

- November 26: For birthdays between the 21st and 31st.

This staggered schedule, established in 1997 to distribute payments more evenly across the month, remains unchanged.

Why the “Gap” Feels Like a Crisis

For millions of low-income Americans, the SSI payment represents their only reliable income. Many budget carefully around the expectation of receiving one deposit each month.

Because the November benefit was paid at the end of October, recipients now face a five-week stretch before their next payment. The issue is logistical rather than legislative, but its impact is significant.

Dr. Laura Mendoza, an economist specializing in social policy, explains: “From a technical standpoint, no payment was skipped. But psychologically and financially, that long gap can feel like a missed month of income.”

Beneficiaries often schedule rent, groceries, utilities, and medical co-pays around predictable deposit dates. When payments shift unexpectedly, even by a few days, many face overdrafts, late fees, or unpaid bills.

Living Paycheck to Paycheck

According to SSA data, roughly 7.4 million Americans currently receive SSI benefits. Most have limited savings or additional income. For these households, even short disruptions in cash flow can create instability.

“You can’t tell your landlord or your pharmacy that the check came early,” said Anita Vasquez, director of community programs at a senior advocacy organization. “People plan their lives around the idea that money arrives in November. When it doesn’t, they panic.”

Local assistance groups report a rise in calls from confused recipients asking why their checks have “stopped.” Financial counselors emphasize that the October 31 deposit should be treated as the November payment and stretched over the longer interval until December.

A Policy Rule, Not a Funding Problem

The SSA’s payment timing rule has existed for decades. When the first day of a month is not a standard banking day, the agency advances the payment. This ensures beneficiaries never receive late funds, but it can create apparent “gaps” like this one.

Crucially, the agency confirms that no benefits were reduced or delayed. Both Social Security and SSI programs are mandatory spending items, meaning they continue even during a government shutdown. While other federal operations may pause, benefit disbursements rely on trust-fund mechanisms that remain active.

“These payments are protected by law,” said an SSA official speaking on background. “Recipients will receive every dollar they are owed, exactly as scheduled.”

Inflation and the Cost of Living

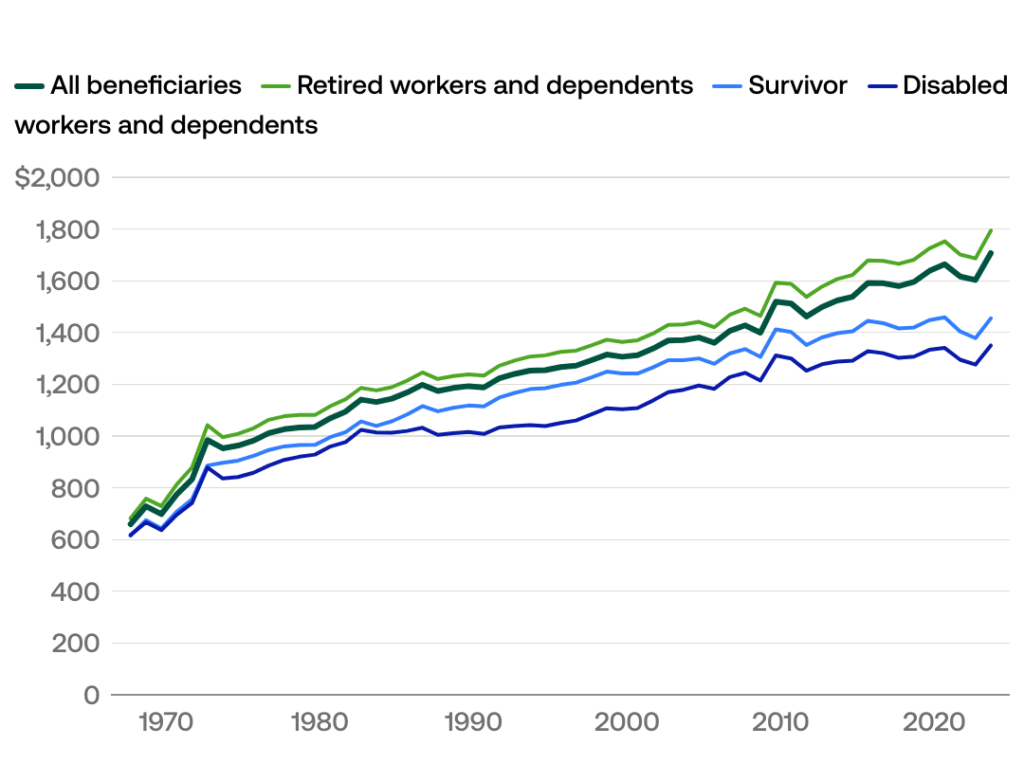

This year’s Cost-of-Living Adjustment (COLA) raised benefits by 3.2 percent, matching inflation trends recorded in mid-2024. The average Social Security retirement benefit now stands at approximately $1,910 per month, while the federal maximum SSI payment is $943 for individuals and $1,415 for couples.

Despite these increases, rising prices for housing, food, and healthcare continue to erode purchasing power. Many fixed-income households report difficulty keeping pace with essentials.

Professor Michael Tanner, a public-policy scholar, noted: “Even small disruptions or timing shifts hit harder when budgets are already stretched thin. It’s not about losing money — it’s about running out of it sooner.”

Transition to Digital Payments

Nearly all Social Security and SSI payments are now made through direct deposit or prepaid Direct Express debit cards. The federal government phased out paper checks to improve security and reduce fraud.

While electronic delivery speeds up processing, it also assumes recipients have stable banking arrangements. Advocates warn that those without permanent housing, internet access, or up-to-date bank information may struggle to track early deposits.

Recipients are urged to verify their direct-deposit details through their “my Social Security” online account or by calling the SSA’s national helpline. Anyone who has not received a deposit three business days after their scheduled date should contact the agency directly.

Communication Challenges

Although the SSA posts its full payment calendar each year, many beneficiaries remain unaware of how weekends and holidays affect distribution dates. Some rely on printed notices or word-of-mouth rather than online resources.

“Most people don’t read the fine print,” said Ruth Chen, a retired case manager. “They expect a deposit each month. When they don’t see it, they think something’s wrong — especially during a shutdown or political uncertainty.”

Advocacy groups have called for improved communication, suggesting text alerts, email reminders, and clearer statements in advance of schedule shifts. Such measures could help prevent confusion and financial stress in future months.

Historical Perspective

Similar timing gaps have occurred in previous years. When New Year’s Day, Independence Day, or the first of any month lands on a weekend, the same “advance-then-skip” pattern repeats.

In 2023 and 2024, for example, SSI recipients also received two payments in certain months and none in others. Each time, the early payment was counted for the upcoming month.

While the SSA consistently explains this policy, the public response remains one of surprise. The issue underscores how small administrative details can have disproportionate effects on everyday lives.

Practical Guidance for Beneficiaries

1. Confirm your payment type.

Check whether you receive SSI, Social Security, or both. Payment timing depends on which program applies.

2. Verify your deposit date.

Use your “my Social Security” account or bank app to ensure funds arrived on October 31. That payment represents your November benefit.

3. Plan ahead.

Budget for a five-week gap between deposits. Prioritize essential expenses and avoid scheduling automatic withdrawals before funds are available.

4. Contact SSA if necessary.

If no deposit appears within three business days of your expected date, call 1-800-772-1213 (TTY 1-800-325-0778). Be prepared to verify your identity.

5. Seek local support.

Community action agencies, senior centers, and faith-based charities often provide emergency assistance or short-term grants for rent and utilities.

Expert Commentary

Dr. Lauren Boyd, senior policy analyst: “This is a textbook example of how a minor procedural change can cause major anxiety. For households already stretched, predictability is everything.”

Prof. Michael Tanner, economist: “The underlying rule makes sense administratively — pay early rather than late. But communication hasn’t caught up. Transparency would help people plan rather than panic.”

Anita Vasquez, social-service director: “The policy works on paper, but real people feel the strain. A simple SMS alert could make the difference between confusion and clarity.”

Experts largely agree that while the current system ensures punctuality, it may benefit from modernization — such as automated alerts or calendar integrations reminding beneficiaries of date shifts.

Broader Economic Context

The payment-gap story reflects broader concerns about financial vulnerability in the United States. Nearly 40 percent of households report they would struggle to cover an unexpected $400 expense. For SSI recipients, who often live near or below the poverty line, any disruption in cash flow amplifies that fragility.

Economists warn that as cost pressures persist, policymakers may need to consider reforms that stabilize income timing, enhance outreach, and strengthen automatic budgeting tools.

“Predictable income is central to financial security,” said Dr. Boyd. “When predictability falters — even for technical reasons — trust in the system can erode.”

Looking Ahead

The SSA will release its 2026 payment calendar in early December. Analysts expect similar adjustments whenever the first of a month falls on a weekend or federal holiday. The agency has indicated plans to expand online resources explaining these shifts and to pilot optional text notifications.

Advocates also urge Congress to invest in outreach and financial-literacy programs for older and disabled adults. Simple awareness, they argue, can prevent unnecessary hardship.

“The benefit amount isn’t changing,” Vasquez said. “But understanding when it arrives — and planning around that — is just as important as the payment itself.”