The Social Security Check schedule at the end of 2025 is drawing close attention from retirees, disabled workers, and low-income Americans as the final payments of the year align with a new cost-of-living adjustment. According to the Social Security Administration, December’s payment timing will determine which beneficiaries receive their last 2025 benefit—and which will see a higher, COLA-adjusted check before the new year begins.

Last Social Security Check of 2025

| Key Fact | Detail |

|---|---|

| Last 2025 retirement/SSDI payment | December 24, 2025, for most recipients |

| SSI January 2026 payment | Paid early on December 31, 2025 |

| New COLA effective | January 2026 benefits |

| Official Website | Social Security Administration |

When the Last Social Security Check of 2025 Is Paid

For the majority of beneficiaries, the final Social Security Check of 2025 will arrive in late December, following the program’s long-standing payment calendar. Retirement, survivor, and Social Security Disability Insurance (SSDI) benefits are distributed on Wednesdays, with the specific date determined by the recipient’s birth date.

According to the Social Security Administration (SSA), beneficiaries born between the 21st and 31st of any month will receive their December payment on Wednesday, December 24, 2025. That deposit represents the last regular Social Security payment for the year.

Recipients with earlier birth dates will receive their final 2025 check earlier in the month—December 10 or December 17—depending on eligibility. The staggered system is designed to manage payment volume and ensure timely deposits across more than 70 million beneficiaries.

The SSA publishes its official payment calendar annually, a practice intended to provide certainty and reduce confusion, especially during months affected by federal holidays.

Why SSI Recipients Follow a Different Schedule

Supplemental Security Income (SSI) recipients face a distinct Social Security Check timeline because SSI operates under separate statutory rules. Unlike retirement or disability benefits, SSI payments are typically issued on the first day of each month.

When that date falls on a weekend or federal holiday, the SSA issues payments early. In 2026, January 1 falls on a federal holiday, prompting the agency to release January SSI benefits on December 31, 2025.

This scheduling quirk often leads to confusion. Some recipients mistakenly believe they are receiving an extra payment, but the SSA emphasizes that this is not the case.

“This is not a bonus or additional benefit,” the agency explains in its public guidance. “It is an advance payment to ensure beneficiaries receive their funds without delay.”

As a result, SSI recipients will receive two payments in December 2025—one on December 1 for December benefits and another on December 31 for January—but no SSI payment will be issued in January itself.

How the Social Security Check COLA Increase Factors In

The upcoming Social Security Check cost-of-living adjustment, commonly referred to as COLA, is applied to benefits payable beginning in January 2026. The adjustment is designed to protect beneficiaries from inflation by increasing payments in line with rising consumer prices.

The SSA calculates COLA using data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), published by the Bureau of Labor Statistics. The index tracks changes in the cost of goods such as food, housing, transportation, and medical care.

Under federal law:

- Retirement and SSDI beneficiaries will see higher payments starting with their January 2026 checks, paid later that month.

- SSI recipients whose January benefit is paid early on December 31, 2025, will see the COLA increase reflected immediately.

Economists note that while early COLA-adjusted payments may feel significant, they do not change the total amount received over the year.

“This is essentially a calendar effect,” said a senior retirement policy analyst at a Washington-based think tank. “The purchasing power adjustment is real, but the timing can create the illusion of extra income.”

Historical Context: Why COLA Timing Matters

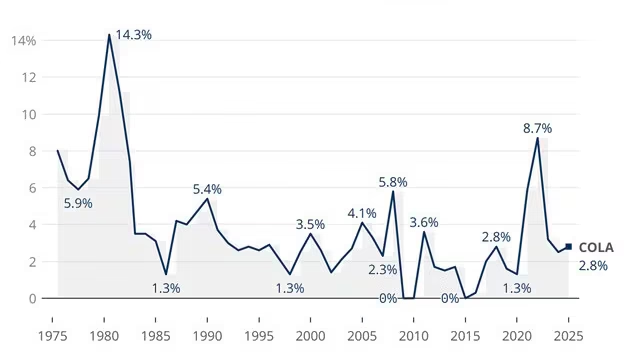

The Social Security Check COLA has varied widely over the years, reflecting broader economic trends. In periods of high inflation, such as the early 1980s and the early 2020s, COLA increases were among the largest on record. In contrast, some years—including 2010, 2011, and 2016—saw no COLA at all.

Advocacy groups for seniors argue that even sizable adjustments often fail to keep pace with the real expenses faced by older Americans, particularly healthcare and housing costs. Medical inflation, in particular, tends to outpace the CPI-W index used to calculate COLA.

“The COLA helps, but it doesn’t fully close the gap,” said a spokesperson for a national senior advocacy organization. “Understanding exactly when and how each Social Security Check changes is critical for household planning.”

Budgeting Implications for Beneficiaries

The December payment structure can pose challenges, especially for households that rely heavily or exclusively on a monthly Social Security Check. Financial planners caution that receiving two SSI payments in December can disrupt monthly budgeting if recipients are not prepared.

“This is one of the most common budgeting pitfalls,” said a certified financial planner who works with retirees and disabled clients. “People see two deposits in December and assume January will look the same. It won’t.”

Experts recommend that SSI recipients treat the December 31 payment as January income and set aside funds accordingly. Failure to plan can leave households short on essentials in January, a month that often brings higher heating and utility costs.

Impact on Direct Deposit and Paper Checks

Most beneficiaries receive their Social Security Check via direct deposit, which typically posts electronically on the scheduled payment date. However, a small number of recipients still receive paper checks, which may arrive by mail several days later.

The SSA advises all beneficiaries to verify deposit dates through official channels, such as their “my Social Security” online account. The agency also warns against misinformation circulating online, particularly on social media platforms that frequently misinterpret early payments as bonuses.

Fraud Risks and Seasonal Scams

The end of the year is also a peak period for scams targeting Social Security beneficiaries. Federal officials warn that fraudsters often exploit confusion around COLA increases and payment timing.

Common scams include:

- Fake notices claiming a beneficiary must “verify” information to receive a higher Social Security Check

- Phone calls impersonating SSA officials

- Emails or texts promising bonus payments tied to COLA increases

The SSA stresses that it does not contact beneficiaries by phone or email to demand personal information or immediate payment.

Tax Refunds Still Going Out in 15 States — Check If Your State Is on the List

What Comes Next

Looking ahead, the SSA will begin issuing official COLA notices to beneficiaries in December, detailing the new monthly benefit amounts effective January 2026. These notices are available by mail and through secure online accounts.

The agency encourages recipients to review those notices carefully and to contact the SSA directly with any discrepancies. As inflation trends evolve, the Social Security Check COLA will remain a focal point in broader debates about retirement security and the program’s long-term sustainability.

For now, beneficiaries are urged to focus on understanding payment timing and planning accordingly as the final Social Security Check of 2025 arrives.

FAQs About Last Social Security Check of 2025

Does receiving two payments in December mean extra money?

No. The second SSI payment in December is an advance for January.

Will retirement benefits be paid early like SSI?

No. Retirement and SSDI benefits follow the Wednesday payment schedule.

When does the Social Security Check COLA officially begin?

The COLA applies to benefits payable starting in January 2026.

Do I need to apply to receive the COLA increase?

No. COLA adjustments are automatic.