The $5000 Energy Rebate, a central component of the federal government’s climate and energy strategy, is entering its final phase as the program approaches a December 31, 2025 cutoff. Federal agencies warn that this may be the Last Chance to Claim the incentive before the Program Closing Soon notices take effect nationwide.

$5000 Energy Rebate

| Key Fact | Detail |

|---|---|

| Maximum Rebate | Up to $5,000 for approved efficiency improvements |

| Deadline | Scheduled to end Dec. 31, 2025 |

| Eligible Upgrades | Heat pumps, insulation, HVAC, solar installations |

| Expected Consumer Savings | 20–40% reduction in household energy costs |

Why the $5000 Energy Rebate Matters Now

The rebate program, established under the Inflation Reduction Act of 2022, was designed to reduce household energy consumption and accelerate the transition to cleaner residential technologies. According to the U.S. Department of Energy (DOE), qualifying improvements can lower utility bills, boost home comfort, and reduce greenhouse gas emissions.

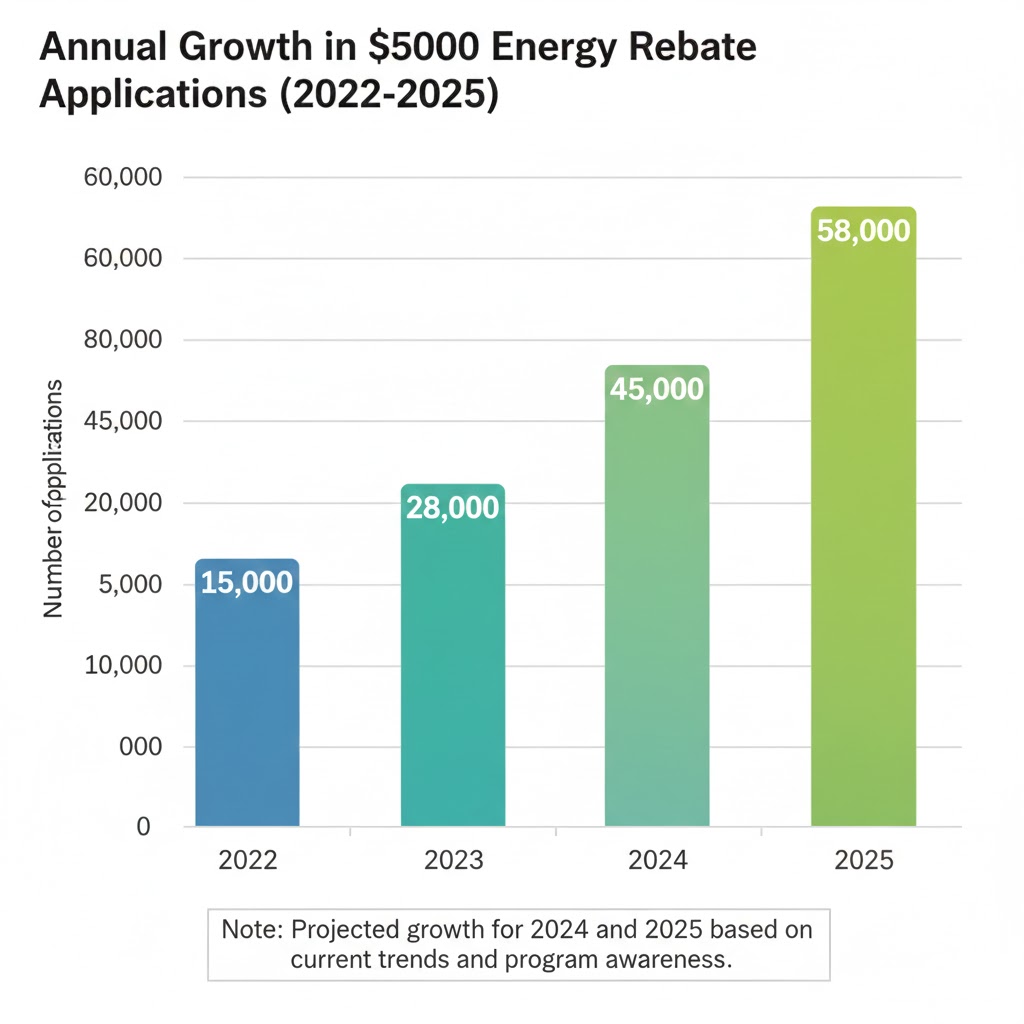

The approaching expiration date has prompted a nationwide increase in applications. “The final two years of any federal energy incentive program typically see the highest participation,” said Dr. Martin Feldman, an energy policy specialist at the Brookings Institution. “Homeowners respond quickly when an incentive is set to sunset.”

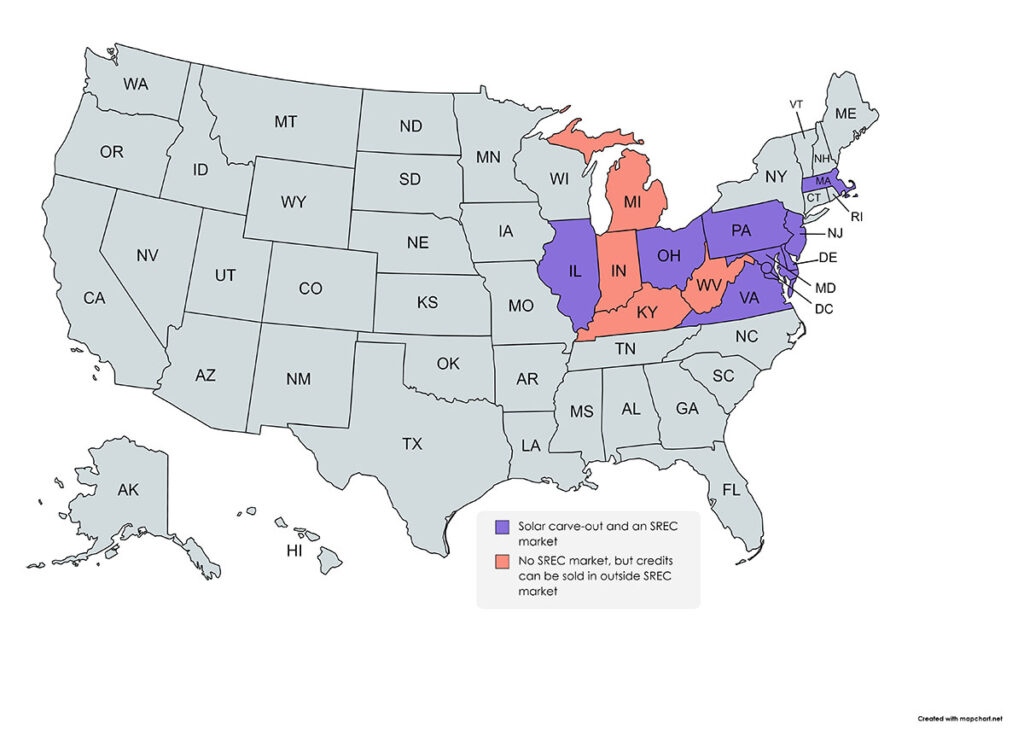

State-by-State Differences in $5000 Energy Rebate Availability

While the program is federal, the distribution of funds occurs through state-level energy offices. This has resulted in notable variations:

States with Additional Rebates

- California, New York, and Massachusetts offer supplemental incentives on top of the federal rebate.

- Some states provide income-based bonus rebates for low- and moderate-income households.

States Still Scaling Up

- Wyoming, Montana, and Arkansas have slower administrative rollouts, according to DOE implementation reports.

- Contractors in these states report fewer certified installers and longer wait times.

“States differ widely in their capacity and policy priorities,” said Elaine Morris, senior analyst at the National Renewable Energy Laboratory (NREL). “That means the homeowner experience is not uniform.”

Case Study: A Homeowner’s Experience

To understand the rebate’s real-world impact, consider the experience of Timothy Alvarez, a homeowner in Columbus, Ohio, who replaced his aging furnace with a high-efficiency heat pump.

- Upfront cost: $13,000

- Rebate received: $4,500

- Annual energy savings: Approximately $1,100

- Installation time: Three weeks after contractor approval

“It was a straightforward process, but the key was getting quotes early,” Alvarez said. “By the time I applied, contractors were already booking months out.”

A Narrow Window Before the Program Closing Soon

The Congressional Research Service confirms that the rebate requires completed installations, not just scheduled work, by the 2025 deadline. Delays in contractor scheduling could jeopardize eligibility.

“High demand near the deadline will stretch installation resources thin,” said Jennifer Graham, Deputy Assistant Secretary for Energy Efficiency at DOE. “We strongly recommend homeowners start the process by early 2025 at the latest.”

Eligible Improvements Under the $5000 Energy Rebate

Heat Pumps

The DOE identifies heat pumps as the most cost-effective upgrade, offering substantial emissions reductions. They also qualify for layered incentives in most states.

Solar Installations

Although the rebate applies to certain solar technologies, homeowners may also qualify for the separate Residential Clean Energy Credit, which offers a 30% tax credit.

HVAC and Insulation Upgrades

High-efficiency air conditioners, ductwork improvements, attic insulation, and modern thermal windows qualify in most states.

Combined Incentives

IRS guidelines confirm that homeowners may stack the rebate with federal tax credits if requirements are met.

Industry Response and Supply Chain Issues

Contractors, manufacturers, and energy suppliers say demand has surged 40–60 percent since the program launched.

“We’ve seen the strongest interest in heat pumps,” said Michael Zheng, vice president at a national HVAC installation firm. “The challenge is ensuring we have enough certified technicians.”

Solar installers report similar pressure. “Residential solar inquiries have doubled,” said Hannah Lopez, spokesperson for a major national solar provider. “Customers want to use the rebate while it’s still available.”

Supply chain strains remain a concern. The DOE says some states may face equipment shortages by mid-2025 if demand continues at current rates.

Environmental and Economic Impacts

A study by the American Council for an Energy-Efficient Economy estimates the rebate could reduce national residential energy-related emissions by as much as 4 percent annually if fully utilized.

Environmental Benefits

- Lower fossil fuel use

- Reduced carbon emissions

- Improved air quality

Economic Benefits

- Reduced household utility bills

- Increased demand for green jobs

- Growth in domestic clean-tech manufacturing

The Environmental Protection Agency (EPA) reports that residential buildings account for roughly 20 percent of U.S. greenhouse gas emissions, underscoring the significance of the rebate’s impact.

Historical Context: Past U.S. Energy Incentives

The U.S. government has introduced multiple home energy incentive programs over the past two decades, including:

- 2009 Home Energy “Cash for Caulkers” Program

- 2010 Home Star Energy Efficiency Program

- 2018 Federal Efficiency Credit Expansion

Participation in the current rebate is higher than in past programs due to a broader range of qualifying technologies and stronger public awareness.

Expert Analysis: Will the Program Be Extended?

Policymakers disagree on the future of the incentive.

Some lawmakers argue that extending the rebate will accelerate national emissions reductions. Others contend that federal spending on home energy programs should be reduced.

“There is real uncertainty,” said Laura Cho, policy analyst at the Center for Strategic and International Studies (CSIS). “Homeowners should not assume an extension is guaranteed.”

Common Challenges Homeowners Face

Contractor Shortages

High demand has created long wait times in certain regions.

Confusion About Credits vs. Rebates

Many homeowners misunderstand the difference between upfront rebates and after-tax credits.

Document Requirements

State programs often require detailed paperwork, including model numbers, efficiency ratings, and installation documentation.

Financing Gaps

Some improvements require large upfront payments, even with rebates.

Step-by-Step Guide to Applying Before the Deadline

- Check eligibility on your state’s energy office website.

- Request multiple contractor quotes for approved technologies.

- Verify equipment meets DOE and IRS standards.

- Schedule installation early, ideally months before 2025 ends.

- Save all documentation, including receipts and contractor certifications.

- Submit rebate application within the specified timeframe.

State-level guidance varies, but most programs accept digital submissions.

Potential Consequences if the Program Ends

If the program expires in 2025 without renewal:

- Homeowners could lose access to up to $5,000 in federal rebates

- Solar and heat pump installation costs may rise due to lower demand

- Domestic manufacturing may slow

- Emissions reduction goals could be harder to meet

Energy economists warn that the program’s expiration could have “significant long-term implications for residential energy trends.”

Final Note

As the $5000 Energy Rebate enters its final eligibility period, federal agencies continue encouraging homeowners to act early. Whether Congress extends the program remains uncertain, but experts agree that homeowners should not delay.