January 2026 Social Security payment dates will arrive on an adjusted schedule due to the New Year’s Day federal holiday, with some recipients receiving benefits earlier than usual, according to the Social Security Administration. The timing affects more than 71 million Americans who rely on retirement, disability, survivor, or Supplemental Security Income benefits to cover monthly expenses.

January 2026 Social Security Payment Dates

| Key Fact | Detail |

|---|---|

| SSI January payment | Paid Dec. 31, 2025 |

| Earliest Social Security payment | Jan. 2, 2026 |

| Wednesday payment groups | Jan. 14, 21, and 28 |

| Official Website | Social Security Administration |

Looking ahead, the Social Security Administration says it will continue publishing annual payment schedules to provide predictability for beneficiaries. Any future changes to payment timing or benefit administration will be communicated through official SSA notices and public statements.

How the January 2026 Social Security Payment Dates Are Determined

The Social Security Administration (SSA) pays benefits on a staggered schedule that depends on both the type of benefit received and, for most beneficiaries, their date of birth.

For individuals who began receiving retirement, survivor, or Social Security Disability Insurance (SSDI) benefits after May 1997, payments are issued on one of three Wednesdays each month. The specific Wednesday corresponds to the beneficiary’s birth date range, a system designed to distribute payments evenly throughout the month.

Those who started receiving benefits before May 1997 generally receive their Social Security payments on the third day of each month, unless that date falls on a weekend or federal holiday. In such cases, payments are issued on the prior business day.

According to the SSA, this structure helps ensure reliable processing while minimizing delays caused by banking and federal payment systems.

“Social Security payment dates are established annually and published in advance so beneficiaries can plan accordingly,” the agency states in its official payment calendar.

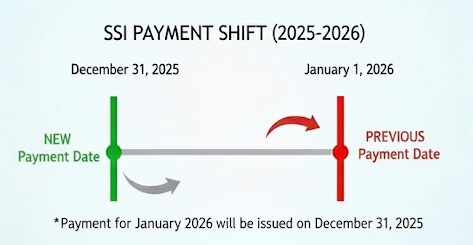

Supplemental Security Income Payments Arrive Early

Recipients of Supplemental Security Income (SSI) will experience the most visible change in January 2026.

Because January 1 is a federal holiday, SSI payments normally scheduled for that date will instead be issued on Wednesday, December 31, 2025, according to the SSA. This adjustment follows standard federal payment rules and occurs several times each year.

SSI is a needs-based program that supports older adults, blind individuals, and people with disabilities who have limited income and resources. Unlike Social Security retirement or disability benefits, SSI payments are always scheduled for the first day of the month.

Financial planners often caution that early SSI payments can create budgeting challenges, as recipients may not receive another SSI payment for more than four weeks.

“An early payment does not mean an extra payment,” the SSA emphasizes. “It is simply the regularly scheduled benefit delivered ahead of time.”

January 2026 Social Security Payment Dates by Birth Date

For the majority of Social Security beneficiaries, January payments will follow the standard Wednesday distribution schedule.

- Born between the 1st and 10th: Wednesday, January 14, 2026

- Born between the 11th and 20th: Wednesday, January 21, 2026

- Born between the 21st and 31st: Wednesday, January 28, 2026

These dates apply to recipients of retirement, survivor, and SSDI benefits who began receiving payments after May 1997.

Beneficiaries who receive both SSI and Social Security—often referred to as “dual beneficiaries”—typically receive their Social Security payment on the third day of the month. For January 2026, that payment will be issued on Friday, January 2, since January 3 falls on a weekend.

Who Is Most Affected by January 2026 Social Security Payment Timing

The January payment schedule is particularly important for lower-income households, which may rely heavily on Social Security or SSI as their primary source of income.

According to SSA data, Social Security benefits account for at least half of income for about half of all beneficiaries. For roughly one in four retirees, Social Security provides 90 percent or more of total income.

Early or shifted payments can affect rent schedules, utility payments, and medical expenses. Advocacy organizations often encourage beneficiaries to review payment calendars carefully at the end of each year.

Why Federal Holidays Matter for Benefit Payments

Federal law requires the Treasury Department and the SSA to issue payments only on business days. When a scheduled payment date falls on a weekend or federal holiday, benefits are paid on the preceding business day.

This policy affects not only Social Security and SSI, but also other federal benefits such as veterans’ payments and federal pensions.

As a result, some months feature irregular payment patterns. For SSI recipients, this can mean receiving two payments in one calendar month and none in the following month, even though the total annual benefit remains unchanged.

Cost-of-Living Adjustments Reflected in January Payments

January payments also mark the first month in which beneficiaries receive the annual cost-of-living adjustment (COLA).

The COLA is calculated using inflation data from the Consumer Price Index for Urban Wage Earners and Clerical Workers. The SSA announces the adjustment each October, with the increase applied to benefits beginning in January.

The adjustment is intended to help benefits keep pace with rising costs for essentials such as food, housing, and healthcare. However, economists note that individual expenses may rise faster or slower than the official inflation measure.

Once applied, the COLA remains in effect for the entire calendar year and is automatically included in monthly payments.

How Payments Are Delivered: Direct Deposit vs. Paper Checks

Most Social Security and SSI recipients receive benefits through direct deposit, either to a bank account or through the Direct Express debit card program.

The SSA strongly encourages electronic payments, citing increased reliability and reduced risk of lost or delayed checks. Paper checks are still issued in limited circumstances but may be more vulnerable to holiday-related mail delays.

“Direct deposit is the safest and fastest way to receive benefits,” the SSA advises. “Funds are available immediately on the payment date.”

IRS Approves $1390 Relief Deposits — Check Who Qualifies and When Payments Go Out

What Beneficiaries Should Do Now

The SSA recommends that beneficiaries take several steps to prepare for January’s adjusted schedule:

- Review the official SSA payment calendar

- Confirm direct deposit or Direct Express information

- Plan budgets carefully if receiving SSI early

- Monitor bank accounts on scheduled payment dates

Beneficiaries can view personalized payment information by creating or accessing a “my Social Security” account on the SSA’s website.

“Understanding when your payment will arrive can help prevent unnecessary concern and improve financial planning,” the agency said.

FAQs About January 2026 Social Security Payment Dates

Does an early SSI payment mean extra money?

No. An early payment replaces the regular January benefit. The total annual amount remains the same.

Will everyone receive Social Security on the same day in January 2026?

No. Payment dates vary based on birth date, benefit type, and when benefits began.

What should I do if my payment does not arrive?

The SSA advises waiting three business days before contacting the agency, as banking delays can occur around holidays.

Can payment dates change after they are announced?

Changes are rare and usually occur only due to unexpected federal closures or emergencies.